By Christina Lin

In this publication, Christina Lin argues that the United Arab Emirates (UAE) is becoming increasingly prominent in China’s strategic calculus and it’s One Belt, One Road (OBOR) strategy. Lin specifically highlights 1) the role Dubai now plays as an important financial and trading hub for Beijing; 2) Abu Dhabi's growing significance as an oil supplier for China; and 3) the mounting convergence of the UAE with Egypt and China on security matters, particularly against violent jihadism.

In this publication, Christina Lin argues that the United Arab Emirates (UAE) is becoming increasingly prominent in China’s strategic calculus and it’s One Belt, One Road (OBOR) strategy. Lin specifically highlights 1) the role Dubai now plays as an important financial and trading hub for Beijing; 2) Abu Dhabi's growing significance as an oil supplier for China; and 3) the mounting convergence of the UAE with Egypt and China on security matters, particularly against violent jihadism.

This article was originally published by the Institute for Strategic, Political, Security and Economic Consultancy (ISPSW) in April 2017.

In recent years, there has been much focus on China’s budding ties with large Arab countries such as Egypt and Saudi Arabia in the Middle East. However, among the Arab Gulf states, the smaller United Arab Emirates (UAE) is quietly gaining stature in Beijing’s strategic calculus and its One Belt, One Road (OBOR) strategy.

For Beijing, the UAE is not simply an end market, but a powerful hub that supports Chinese commerce across key emerging markets on China’s OBOR. Located on the Persian Gulf, Dubai—the most populous city in the UAE and second-largest emirate after Abu Dhabi—is strategically located at the heart of several new trade corridors1 such as the SAMEA (South Asia Middle East, Africa) and CHIMEA (China, India, Middle East, Africa) corridors. Dubai handles nearly 80% of UAE’s overall trade, and some 60% of China’s total exports to the UAE are re-exported to Africa and Europe, principally via the Jebel Ali port, the ninth-busiest container terminal port in the world.

For Beijing, the UAE is not simply an end market, but a powerful hub that supports Chinese commerce across key emerging markets on China’s OBOR. Located on the Persian Gulf, Dubai—the most populous city in the UAE and second-largest emirate after Abu Dhabi—is strategically located at the heart of several new trade corridors1 such as the SAMEA (South Asia Middle East, Africa) and CHIMEA (China, India, Middle East, Africa) corridors. Dubai handles nearly 80% of UAE’s overall trade, and some 60% of China’s total exports to the UAE are re-exported to Africa and Europe, principally via the Jebel Ali port, the ninth-busiest container terminal port in the world.

In 2014, bilateral trade was US$54.8 billion and expected to increase to US$80 billion by 2018, according to Hakel Wen2 from the China Foreign Trade Centre. UAE is also playing a key role in the internationalization of Chinese renminbi, with Emirates NBD becoming the first bank in the Middle East and North Africa to issue a yuan “dim sum”3 bond in 2012.

Despite having a population of only 9.3 million, UAE hosts more than 300,000 Chinese nationals among which 200,000 are residents in Dubai, in addition to 4,200 Chinese companies, 356 trade agencies, and more than 2,500 registered Chinese trade labels.

While Dubai serves as an important financial and trade hub for Beijing, Opec member Abu Dhabi4 is also gaining prominence as an oil supplier. Endowed with 98 billion barrels of proven oil reserves, western energy companies such as ExxonMobil, Total, BP and Royal Dutch Shell have been dominant players in the UAE concession system.

However, China became a new player in 2014 when China National Petroleum Corp secured the rights to produce and export oil from Abu Dhabi, and in February 2017 Beijing added a 12% stake (CNPC 8%, CEFC 4%) in Abu Dhabi National Oil Co (Adnoc)5 onshore concession to its portfolio.

On the security front, the Emirates also shares Egypt and China’s concerns regarding the threat of Salafi jihadism destabilizing the Eastern Mediterranean/Red Sea region.

In 2014, without informing Washington, UAE joined Egypt in Libya to bomb the Muslim Brotherhood-led Libya Dawn militias backed by Qatar6, Turkey and Sudan.

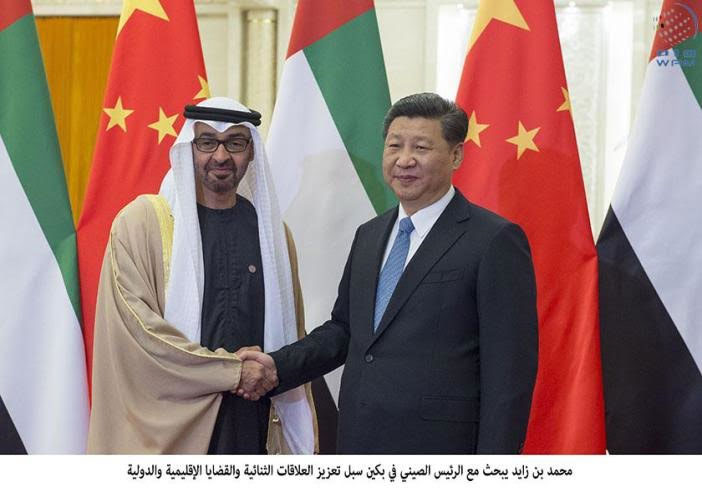

This incident underscored the split within the Gulf Cooperation Council and regional rivalry between actors that support the spread of Salafism/Muslim Brotherhood and others who see them as a threat to traditional states in the Middle East. Abu Dhabi’s Crown Prince Mohhamed bin Zayad for one sees Qatar as “part7 of the Muslim Brotherhood” and a threat to UAE’s longer-term political and economic order, and is increasingly frustrated with Riyadh’s current overtures to the Brotherhood as well.

In this regard, UAE is finding sympathetic ears with Egypt’s President Sisi and seems slowly aligning with Cairo, Moscow and Beijing in the emerging Mideast security arc8 to combat Takfiri terrorism. Nonetheless, while the Emirati-Qatari rivalry continues to play out in Libya, in Syria and Yemen the UAE was on the same side as Riyadh and Doha, although Abu Dhabi is increasingly forging its own independent and multi-vector path.

In June 2016, it left9 the widely condemned10 Saudi-led/US backed11coalition that is accused of war crimes12 and the main cause of a humanitarian13 disaster in Yemen, and focused on battling Al Qaeda14and ISIS that were gaining power from the Saudi intervention.

It is also emerging as a formidable regional military power which the Pentagon has nicknamed “Little Sparta”.15 Currently UAE houses an US airbase in Al-Dhafra outside of Abu Dhabi, and has built up its military capabilities and training over the years. Its armed forces train as often and intensely as the US military, and in Afghan campaigns, Australia and UAE were the only non-Nato nations allowed to fly air support missions to protect coalition ground forces.

According to the Stockholm International Peace Research Institute, in 2015 the UAE had the 14th16 highest military expenditures of any countries in the world—ahead of Israel at 15th place—and is also the world’s third-largest17 arms importer. While its arsenal consists mainly of US weapons, it is now looking east for other options.

In February, eight Chinese companies were featured in Abu Dhabi’s 13th International Defense Exhibition and Conference (IDEX2017)18 while a Chinese naval task force visited Port Zayed19 around the same time, in a sign of warming ties. In Yemen, the UAE is already using China’s Wing Loong drones in its campaign against al Qaeda, and recently purchased the CH-4 drones20 similar to US MQ-1 Predator.

With Abu Dhabi being a main commercial hub between Asia and Europe/Africa and China as the largest trading nation in the world, both have shared interests in combating al Qaeda groups that threaten shipping21 in the Suez Canal and Red Sea. As such there seems to be further prospect for counter-terror and security cooperation between China, Egypt and now “Little Sparta” in the region.

Notes

1 Zongyuan (Zoe) Liu, “Rising Chinese Waves in the UAE”, Middle East Institute, August 5, 2015, http://www.mei.edu/content/map/rising-chinese-waves-uae

3 Dania Saadi, “UAE financial ties with China were years in the making”, The National, January 11, 2015, http://www.thenational.ae/business/economy/uae-financial-ties-with-china-were-years-in-the-making

4 “Abu Dahbi to join OPEC”, MEES Weekly, https://mees.com/opec-history/1967/09/29/abu-dhabi-to-join-opec-2/

5 Anthony Dipaola and Mahmoud Habboush, “China Wins Big With Stakes in $22 Billion Abu Dhabi Oil Deal”, Bloomberg, February 19, 2017, https://www.bloomberg.com/news/articles/2017-02-19/abu-dhabi-awards-china-s-cnpc-stake-in-main-onshore-oil-deposits

6 Jeremy Bender, “Egypt and the United Arab Emirates Bombed Libya, and Qatar Could be a Big Part of the Reason Why”, Business Insider, August 15, 2014, http://www.businessinsider.com/egypt-and-the-united-arab-emirates-bombed-libya-2014-8?IR=T

7 Giorgio Cafiero, Daniel Wagner, “How the Gulf Arab Rivalry Tore Libya Apart”, The National Interest, December 11, 2015, http://nationalinterest.org/feature/how-the-gulf-arab-rivalry-tore-libya-apart-14580

8 Christina Lin, “New Security Arc in the Mideast”, ISPSW/CSS ETH Zurich, December 2016, https://www.ethz.ch/content/specialinterest/gess/cis/center-for-securities-studies/en/services/digital-library/publications/publication.html/ca9265b7-023d-4c4b-83ad-87a75ab659bf

9 “UAE: ‘War is over’ for Emirati troops in Yemen”, Al Jazeera, June 16, 2016, http://www.aljazeera.com/news/2016/06/uae-war-emirati-troops-yemen-160616044956779.html

10 Christina Lin, “US support for Saudi war ‘immoral, and unlawful’”, Asia Times, September 13, 2016, http://www.atimes.com/us-support-for-saudi-war-in-yemen-immoral-and-unlawful/

12 Julian Borger, “US military members could be prosecuted for war crimes in Yemen”, The Guardian, November 3, 2016, https://www.theguardian.com/world/2016/nov/03/us-military-members-war-crimes-yemen

13 Robert Naiman, “Dick Durbin: “Count Me In” for Tying Saudi Arms to Stopping Yemen Famine”, The Huffington Post, March 27, 2017, http://www.huffingtonpost.com/entry/dick-durbin-count-me-in-for-tying-saudi-arms-to_us_58d954e1e4b0f633072b3a79

14 Eleonora Ardemagni, “UAE’s military priorities in Yemen: “Counterterrorism and the South”, Istituto per gli Studidi Politica Internazionale, July 28, 2016,http://www.ispionline.it/it/pubblicazione/uaes-military-priorities-yemen-counterterrorism-and-south-15573

15 Rajiv Chandrasekaran, “In the uAE, the United States has a quiet, potent ally nicknamed “Little Sparta”, The Washington Post, November 9, 2014, https://www.washingtonpost.com/world/national-security/in-the-uae-the-united-states-has-a-quiet-potent-ally-nicknamed-little-sparta/2014/11/08/3fc6a50c-643a-11e4-836c-83bc4f26eb67_story.html?utm_term=.44911e3a1af1

17 “Middle East countries ranked among world’s biggest arms buyers”, Al Arabya, Febuary 21, 2017, https://www.alaraby.co.uk/english/news/2017/2/21/middle-east-countries-ranked-among-worlds-biggest-arms-buyers

18 “Chinese companies join Abu Dhabi International Defense Exhibition”, China Military, February 20, 2017, http://english.chinamil.com.cn/view/2017-02/20/content_7494484.htm

20 Kyle Mizokami, “For the first time, Chinese drones are flying and fighting in the Middle East”, Popular Mechanics, December 22, 2015, http://www.popularmechanics.com/military/weapons/news/a18677/chinese-drones-are-flying-and-fighting-in-the-middle-east/

21 David Barnett, “Al Furqan Brigades claim 2 attack on ships in Suez Canal, threaten more”, The Long War Journal, September 7, 2013, http://www.longwarjournal.org/archives/2013/09/al_furqan_brigades_claim_two_a.php; “COSCO Aia Container ship attacked in Suez Canal”, August 31, 2013, http://gcaptain.com/cosco-asia-containership-attacked/

About the Author

Dr. Christina Lin is a Visiting Research Fellow at the Center for Global Peace and Conflict Studies at the University of California, Irvine and Fellow at the Center for Transatlantic Relations at SAIS-Johns Hopkins University. She is the author of "The New Silk Road: China's Energy Strategy in the Greater Middle East" (The Washington Institute for Near East Policy), and a former director for China policy at the U.S. Department of Defense.

No comments:

Post a Comment