By Morten Jerven

Until the 2000s, economists deplored the stagnant incomes, slow growth and uncertain development that marred Africa. As a result, they spent much of their time elaborating on the historical roots of these problems. So, with African economies growing for more than a decade now, and fuelling a counter-narrative of ‘Africa rising’, what do the analysts do now? Morten Jerven thinks they need to explain the development that has taken place and explore its future prospects.

Until the 2000s, economists deplored the stagnant incomes, slow growth and uncertain development that marred Africa. As a result, they spent much of their time elaborating on the historical roots of these problems. So, with African economies growing for more than a decade now, and fuelling a counter-narrative of ‘Africa rising’, what do the analysts do now? Morten Jerven thinks they need to explain the development that has taken place and explore its future prospects.

Until the late 2000s, the economic development performance of postcolonial Africa was summarised as a failure of economic growth. Accordingly, since the 1990s academic literature sought to determine which factors could explain slow growth. In addition, alleged failure and permanent stagnation cohered well with GDP per capita distribution of income in Africa, providing the impetus for an economic and political science literature that investigated the historical causes of low income persistence in African economies. However, African economies have been growing for more than a decade, fuelling the counter-narrative of ‘Africa rising’. This information changes the questions that should be asked when looking at African economies. There is now a need to focus on explaining the growth that has taken place in Africa and explore its future prospects.

Different vantage points may provide very different views of the past. After a decade or more of growth on the African continent, it is perhaps easier to recall that many (if not most) African economies were growing from the 1950s into the 1970s. If it is accepted that growth revived in Africa in the early 1990s, then viewing the decade of decline from the 1980s to the 1990s as representative of African growth characteristics becomes untenable. The empirical growth literature has focused on explaining something that was actually a very distinct period in the history of African economies, a period (the 1980s and 1990s) that is sometimes referred to as ‘the lost decades’. Ultimately, however, the reason to unearth what the determinants of African growth were in the past and present is not just to get the historical analysis right but also to have something to say about what matters for future growth.

Africa’s growth reconsidered

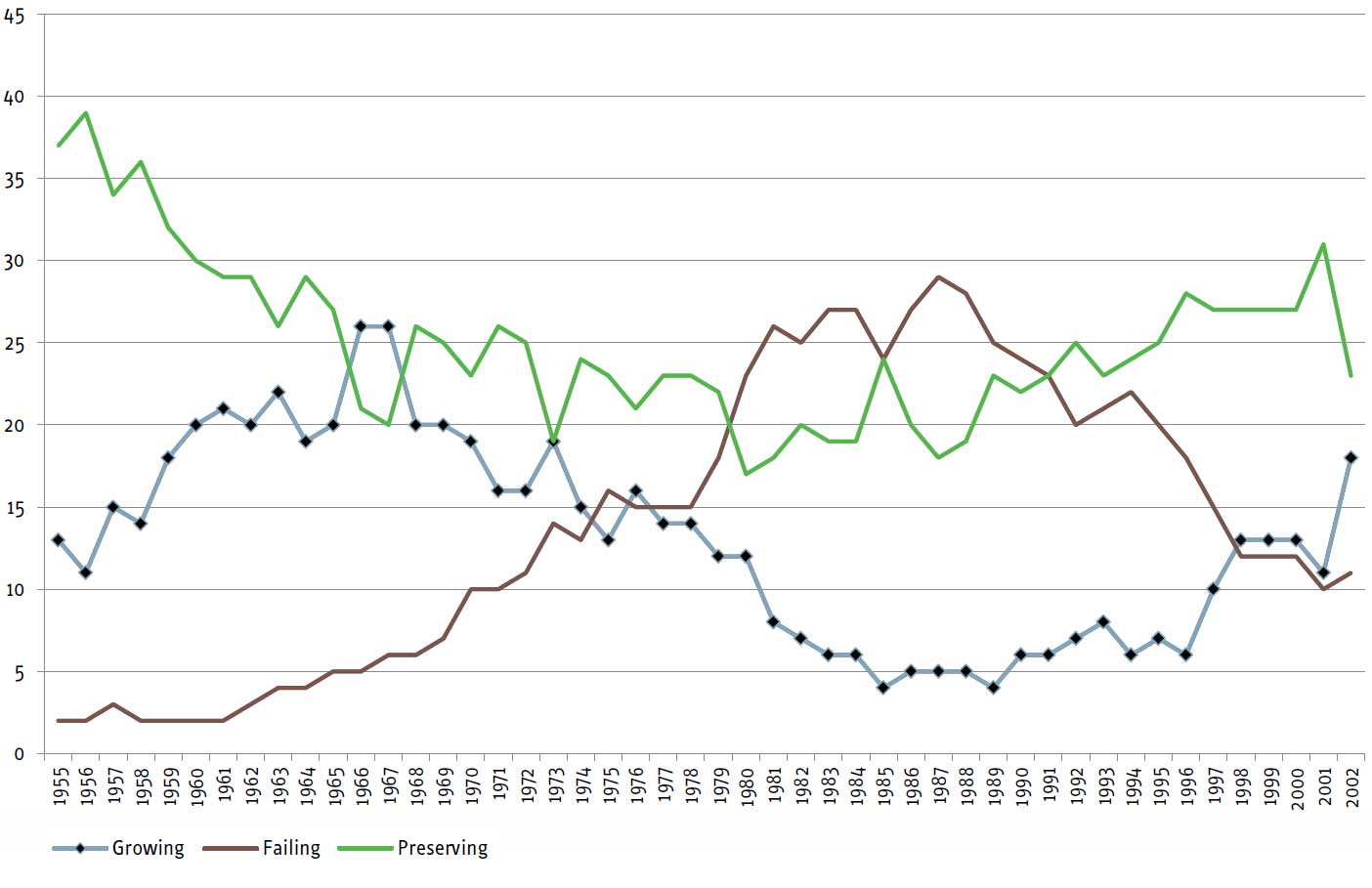

What generalisations can be made about African growth episodes between 1950 and today? Using the Maddison dataset, which contains GDP per capita data for all African economies from 1950 until 2009, patterns can be discerned in periods of sustained growth. Different methods can and have been used to identify and define periods of sustained growth or growth accelerations. In this case, an economy is classified as ‘growing’ if the nine-year moving averages of GDP per capita growth are 3% or higher. This is quite a strict criterion: according to the Maddison dataset, the average annual growth in GDP per capita in the world over the same period was just 2%. An economy is classified as ‘failing’ when the nine-year moving average of real GDP per capita growth is less than 0% – evidence of an overall and lasting deterioration in income per capita. Economies that neither grew nor failed were classified as ‘preserving’.

Figure 1: African economies 1950–2006

Source: Morten Jerven (2010)

Many countries experienced high growth towards the end of the colonial period. When most African economies regained their independence, sustained growth in Africa became more prevalent: in 1967- 1968, half of Africa’s economies were in the middle of a decade of sustained rapid growth. This trend was reversed at the beginning of the 1970s. After the second oil price shock in 1979-1981, only a handful of countries achieved sustained growth in the 1980s. Until recently, the improvement was very slight. But in 1998, 25% of African economies began experiencing sustained growth again.

It is the phenomenon of failed growth that has received far more attention in economic literature on African development. Until the 1980s, however, that was the exception in Africa. From 1950 to the 1960s, only Benin, Tanzania, and Morocco experienced sustained periods of stagnation and negative growth. In the 1960s, Chad and the Central African Republic also stagnated. This group of poor performers was joined by Senegal, Niger, and Somalia in the late 1960s and the early 1970s. (Tanzania and Morocco improved during this period, though.) A sudden spike in the list of poor performers occurred in the late 1970s. Thereafter, in the 1980s and early 1990s, growth failure became the rule rather than the exception. A number of economies were growing in a modest fashion, making slow progress. These were classified as preserving, aptly complementing the overall picture.

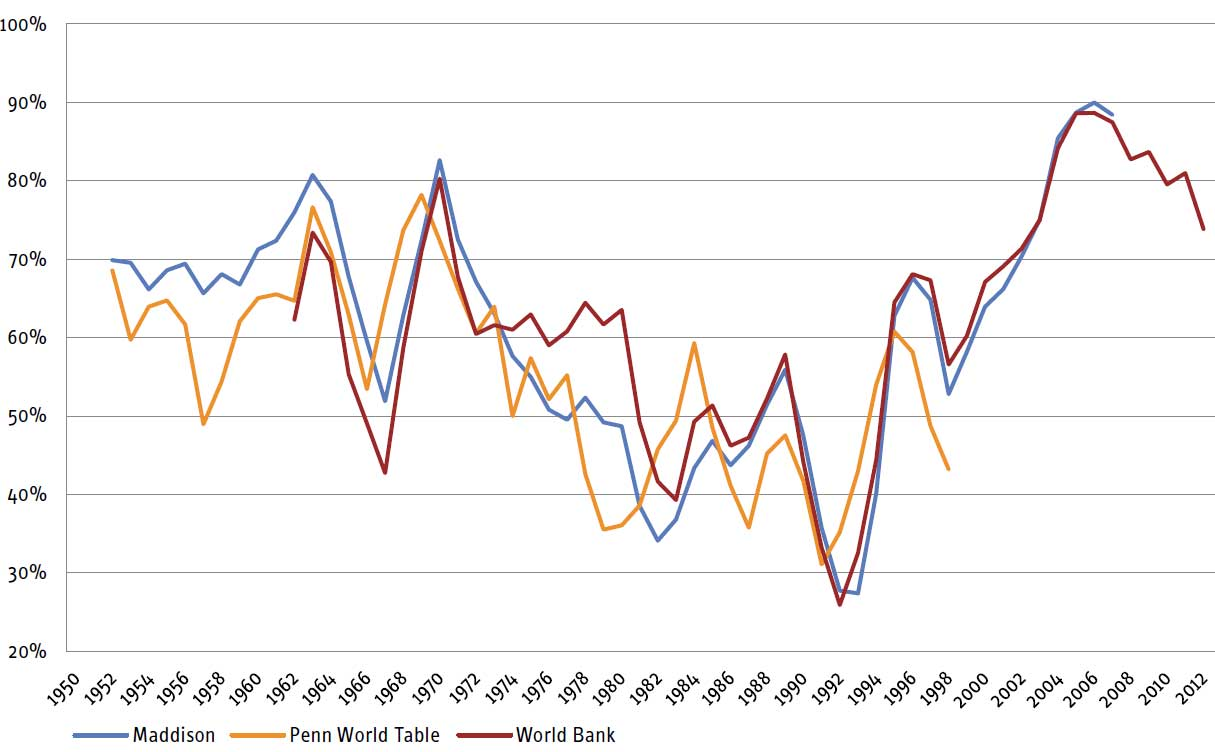

Figure 2 uses data on real economic total GDP growth and records how many countries grew faster than 3%. Instead of counting the absolute number of countries, it examines the share of the continent’s population living in a country where the economy is growing faster than 3%. Figure 2 shows that most of the time the majority of the African population lived in the economies that were growing until the mid-1970s (or 1980s, according to World Bank data). The highest point in the first half of the period was in 1970, when fourfifths of the population were+ in growing economies. This figure dropped to only one-fourth in 1992. In 2006, growth reached a higher proportion of the population in Africa than had been previously observed.

While earlier literature emphasised a ‘governance shortfall’ as a major source of slow growth in Africa, the recent return to growth may indicate that the ‘governance shortfall’ (or at least its importance in the short and medium term) has been overstated. If it is overstated or misstated – or ‘institutions’ are just not measured accurately – the basic determinants of growth can still be looked at. These are labour, capital, and technology. Growth happens when these factors of production are available at a cost that gives the producer a comparative advantage in local or international markets. It has been widely noted and accepted that Africa has been a high-cost location because of physical constraints: namely, the basic constraints in wages, human capital, capital investment, technological change, and transport costs that were significant during the past 50 years – some of which have not changed fundamentally over time.

Figure 2: African population living in economies that grew faster than 3% (three-year moving average)

Maddison: 52 countries covered (1951-2008); Ethiopia and Eritria are combined as a single observation.

Penn World Table: 9 (1951-54); 11 (1955); 13 (1956-59); 16 (1960); 41 (1961); 42 (1962-64); 43 (1965-70); 48 (1970-99).

World Bank: 32 (1961-64); 31 (1965); 33 (1966); 35 (1967); 36 (1968-70); 38 (1971-76); 39 (1977-80); 44 (1981); 45 (1982); 46 (1983-86); 47 (1987); 48 (1988-89); 49 (1990-93); 50 (1999); 51 (2000); 52 (2001-2008); 53 (2009-2013).

History has shown that African countries are particularly vulnerable to economic downturns. In times of economic depression, political instability and inefficiency have proven particularly harmful for economic growth. All economies have been hit by external shocks in the past, but African economies were hit harder and took longer to recover.

Will African economies be better equipped to handle economic downturns in the future than they were in the past? Recent institutional reforms have removed some of the opportunities for destructive rentseeking and corruption. Some evidence from other countries indicates that states and societies consolidate over time; thus, there may be reasons to expect less political turbulence in the future. Today, African economies have more diversified partnerships with other members of the world economy, but they are still just as dependent on trade and capital flows as they were in the past (if not more so).

What are the macro-economic prospects for Africa? Will the recent rates of economic growth and the continent’s trend of poverty reduction continue? Will Africa experience a period of rapid economic development similar to that seen in other regions over the past 50 years? These are arguably some of the most important current questions for those who are interested in the future prospects for improving the living standards of the world’s poorest. Sustained improvement of living standards in Africa depends crucially on the prospects of economic growth in the region: how this can be achieved depends on the lessons which can be drawn from the continent’s past to predict its future. Will the recent rapid growth sustained since the mid-1990s continue, or is the continent likely to witness a growth collapse as experienced in the period between 1975 and 1995?

Back to the future

There are some systematic guidelines for how to think about the different scenarios for economic growth in Africa. Scholarship on economic development in the late 1990s and early 2000 was pessimistic on the prospects for African growth, but these evaluations were very much shaped by the dismal record in the 1980s. If the positive experiences from the 1960s, and more recently since the 1990s, are taken into consideration together with long term trends in human and social development, the picture is much more favourable.

The primary drivers of economic growth in the past were linked first of all to the demand for African minerals and agricultural products in world markets. Economic policy and political governance has played an important role, too. By and large, the evidence indicates that problems of policy and governance have been overcome during times of favourable external conditions, but have proved very detrimental during times of depressed market conditions. Finally, the fundamentals of economic growth matter; increases in production and productivity result from a combination of labour, capital and technology.

It is rather obvious that future growth will depend on a multitude of variables, and therefore accurate projections are of course unfeasible. However, it is beyond doubt that the world markets, the local political conditions and the costs of factors of production in the domestic economy will pay a key role in determining future growth trajectories. To predict the growth of the world economy is a tall order: the best guess is that the markets will continue to fluctuate as they have done in the past. But this will not only mean more of the same for Africa. How African economies are integrated in the world economy has changed. In particular the rise of Asia has altered and diversified the pattern of geographical dependency for many African economies, giving cause to think that continued external market dependence will not result in as volatile conditions as it has done in the past. Evidence from other countries, particularly Latin America, has shown that states and societies consolidate over time, and thus there may be reasons to expect less political turbulence in the future.

Changing factors and equations

In the past, labour in Africa (particularly in sub-Saharan Africa) has been relatively scarce and therefore expensive – and, adding to that, levels of human capital (health and education) have been relatively low compared to other regions. Moreover, Africa has had a shortage of capital, and has nevertheless received less international capital flows than other regions. Finally, technology is crucial: technological change has been dominated either by capital intensive technologies aimed at substituting labour – which have reaped high benefits in areas where the cost of labour is relatively high, such as Europe and North America. Alternatively the production techniques that have been developed are geared towards taking advantage of a high supply of labour and low wages – a path which Asian economies have successfully adapted to. In sum, the technological innovations of the 20th century have not been suitable for, and therefore not readily adaptable in African economies.

African economies have had locational disadvantages in the 20th century. While transport costs, also due to technological improvements, have been lowered significantly over the past century, there is still considerable evidence that sub-Saharan Africa (and particularly the landlocked countries) have suffered from the high cost of distance from world markets. Transport and communication technologies have in the past typically relied more on large investments in fixed infrastructures, such as telephone lines and railways. With a low ratio of population to land, these investments have had lower returns in sub- Saharan Africa.

In the agricultural sector, Africa experienced a long lasting boom from the late 19th century until the 1970s in large parts due to the introduction of new seeds. Since the 1970s, African economies have not benefitted from productivity increases (as experienced in Latin America and Asia) associated with the ‘green revolution’, largely because the seeds and extensive cultivation techniques were not suitable for the region. When land is relatively abundant and labour relatively scarce, technologies that involve investment in land, particular in the form of the capitalisation of labour, have much smaller pay-offs than in South Asia, for instance. Again, changing factor ratios in the future will open up new investment opportunities.

The absolute gaps in investments in human capital vis-à-vis the world are smaller in 2010 than they were in 1960. Moreover, while larger cities and higher population densities carry with them substantial policy challenges, they also create economic opportunities. There is already some evidence that African economies are able to benefit from industries that demand a supply of available and affordable labour. Higher population densities both necessitate and enable new technologies and production techniques. As higher demand for land justifies ‘green revolution’ types of investment in Africa, these producers may benefit from more efficient and cheaper means of communication, but large investments in physical infrastructure are required for future expansion and physical transportation of produce.

Historical evidence from Latin America and contemporary evidence from North Africa and the Middle East indicate that distributional conflicts may arrest economic growth. Recent unrest in North African countries, which have higher income per capita than sub-Saharan Africa, furthermore suggest that equity in the political system will matter for the future of political stability in the region. A strengthening of the legitimacy of the political systems and their ability to enact policy are also particularly important to tackle increasing population pressure and land distribution problems, and to oversee the investment of rents from natural resources and returns from agriculture into infrastructure and production capacity in other sectors of the economy. In sum, there is cause for qualified optimism.

About the Author

Morten Jerven is a Professor at Lund University and the Norwegian University of Life Sciences.

No comments:

Post a Comment