by Jonas Crews and Charles S. Gascon

The coal industry has experienced a significant decline over the past decade. This descent has been driven predominantly by the advent of cheap natural gas, along with policies to promote cleaner, more sustainable sources of energy. While the industry’s overall decline has been a more recent phenomenon, labor productivity in U.S. coal production has increased steadily for over three decades as firms move toward complete automation of the mining process. From January 1985 to May 2017, the amount of coal produced by the average mine worker increased 224 percent.

The coal industry has experienced a significant decline over the past decade. This descent has been driven predominantly by the advent of cheap natural gas, along with policies to promote cleaner, more sustainable sources of energy. While the industry’s overall decline has been a more recent phenomenon, labor productivity in U.S. coal production has increased steadily for over three decades as firms move toward complete automation of the mining process. From January 1985 to May 2017, the amount of coal produced by the average mine worker increased 224 percent.

The outlook for coal, which once was the dominant fuel for electricity generation, is waning. This article analyzes the coal industry both nationally and within our region (the states that make up the Eighth Federal Reserve District[1]) and ponders its future as a source of both electricity and jobs.

Coal serves two main purposes in the global economy: It can be burned to create electricity, or it can be used to produce steel. In 2016, the U.S. electricity sector’s coal consumption was equal to 93 percent of domestic coal production.

The National Scene

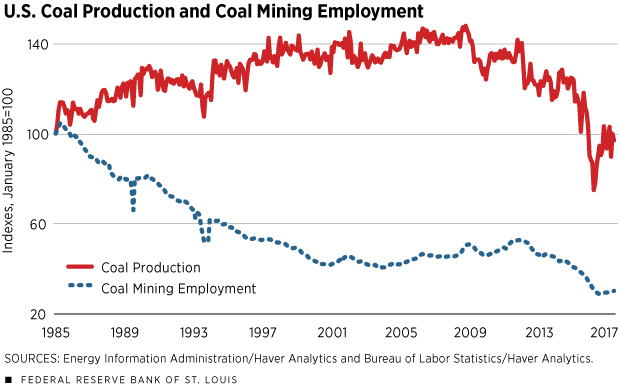

After a modest, consistent rise in coal production over the past few decades, U.S. coal production started to decline in 2009. (See Figure 1.) By the end of 2016, annual production had fallen 38 percent from its 2008 peak. Figure 1 also shows the steady decline in mining employment, going as far back as at least 1985, when data became available.

The drop in production is a response to plummeting coal prices, driven largely by rising international supply and declining domestic demand. The increased global supply has come from multiple countries, particularly Australia, China and India; they have boosted their mining of coal over the past decade. The U.S. share of world coal production has dropped from 18 percent in 2004 to 11 percent in 2014. Meanwhile, the decline in U.S. coal demand is a product of reduced electricity demand and increased competition from other energy sources.

Figure 1

Coal’s largest competitor in energy production is natural gas, which saw its supply skyrocket and price plummet with the now-ubiquitous use of hydraulic fracturing to extract natural gas in the U.S. The price of natural gas fell from an average of $7 per million British thermal units in 2007 to an average of $3 in the first five months of 2017.[2]

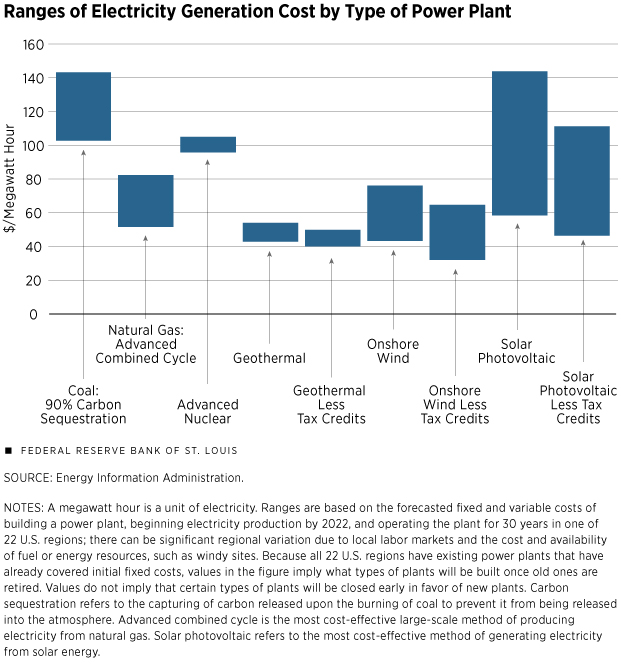

According to a cost-benefit analysis by the U.S. Energy Information Administration (EIA), upcoming advanced natural gas power plants - called advanced combined cycle plants - will reduce electricity production costs in supplied regions by 8 percent compared with a scenario in which the plants are not built. Meanwhile, the EIA estimates a negative return on investment for a “clean coal" plant built anywhere in the U.S.[3] On average, the EIA estimates a new “clean coal" plant would more than double electricity production costs over the alternative of not building.[4]

Natural gas’s price advantage has resulted in coal-fired electricity plants across the country being shut down or retooled for natural gas-fired energy production. In 2016, for the first time in U.S. history, natural gas surpassed coal as the top electricity creator. For comparison, in 2000, natural gas produced only a third of the electricity that coal produced in the U.S.

While natural gas’s supplanting of coal has been primarily market-driven, government-sponsored research, tax credits and environmental protections have resulted in two more coal competitors. Wind and solar technologies, while not necessarily cost-effective for the U.S. as a whole, are more cost-effective than coal in some areas of the country even without any government support.

Figure 2 shows the per-unit-of-electricity cost associated with building various types of U.S. power plants and operating them for 30 years.

Figure 2

Long-term Outlook for Coal

Coal’s electricity-related problems do not seem to be short-term. In its 2017 Annual Energy Outlook, the EIA explained that the move away from coal-fired electricity production will likely continue.[5] According to EIA’s base scenario, electricity production from renewable resources will surpass that from coal by 2030. We expect to see continued labor productivity gains in coal production, which will further reduce employment in the industry.

Although coal companies have needed to file for bankruptcy and to restructure in the past few years, there are two areas worthy of optimism: demand for coal used in steel production and demand for rare-earth elements that can be extracted from coal.[6] Coal needs to have certain characteristics to be used in steel production, and such coal is bought at a premium over coal used for electricity. High demand for steel in China and other developing countries has resulted in a large premium over the past several years.

Mining coal for rare earth elements is a more recent phenomenon. Both policymakers and private corporations have shown interest in such mining as a future for the coal industry, and the U.S. Department of Energy has allocated $7 million toward research on the economic viability. The process is expected to involve extracting coal from existing mines and removing the carbon from the coal in order to obtain any rare metals within. Such metals are expected to be in high demand for the foreseeable future, due to their use in cell phones, laptops and many other electronics.

The District’s Coal Industry

Coal has a very significant presence in the Eighth District. St. Louis is home to two of the largest coal producers in the world: Peabody Energy Inc. and Arch Coal Inc.

The District also consumes a lot of coal: Illinois, Indiana, Kentucky and Missouri were among the top six consuming states in 2015.

District coal production is dominated by mines in the Illinois Basin, which covers most of Illinois, the southwestern portion of Indiana, the western portion of Kentucky, and small sections of Missouri and Tennessee. Illinois Basin coal is moderately efficient in regard to electricity production, but it also produces the most sulfur dioxide - one of the major pollutants released when coal is burned - of any coal from major U.S. mining areas.

Because there are higher-quality substitutes elsewhere in the U.S., some coal-fired power plants, including those in the District, look elsewhere for coal. This has resulted in the basin’s coal selling at a lower price than other coals with similar energy efficiency. Thus, in an industry already struggling with low prices, coal mines found in this basin face even tighter margins.

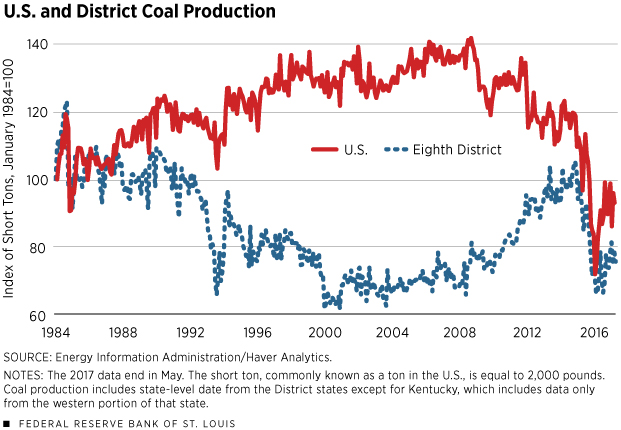

Although there is pessimism about the future of the District’s coal industry, Figure 3shows that production has rebounded over the past few months. The District’s major coal producing areas have all climbed modestly from their early-2016 troughs. Data on District mining employment are sparse, but trends in available data have generally followed the national trend of reduced labor intensity.

Figure 3

Looking Forward

The U.S. energy sector has been turned on its head over the past two decades. Developments in fracking have led to natural gas’s unseating coal in electricity production. U.S. oil production has almost doubled, wind and solar are now the cheapest producers of electricity in some areas of the U.S. even before tax credits, and ethanol refinement has changed both energy and corn markets. At the same time, significant moves in energy efficiency have mitigated the growth in U.S. electricity demand. This scenario was anticipated by very few.[7]

If new trends in electricity production continue, coal power plants may eventually become obsolete. But if the energy sector has taught us anything, it’s that we can’t rely on trends. New technologies are constantly reshaping our existing industries, and the coal industry could be no different.

No comments:

Post a Comment