Federal Student Aid, an Office of the U.S. Dept. of Education, helps make a college education possible for every dedicated mind by providing more than $150 billion each year in grants, loans, & work-study funds. For more info, visit StudentAid.gov.

While you are focused on completing your college applications, don’t forget to fill out the FAFSA form! The FAFSA is the Free Application for Federal Student Aid form, and you should fill it out now if you plan to go to school between July 1, 2019, and June 30, 2020!

Just make sure you don’t make one of these common mistakes:

1. Not Completing the FAFSA Form

We hear all kinds of reasons: “The FAFSA form is too hard.” “It takes too long to complete.” “I’ll never qualify anyway, so why does it matter?” It does matter. For one, contrary to popular belief, there is no income “cut-off” when it comes to federal student aid. The FAFSA form is not just the application for “free money” such as the Federal Pell Grant, it’s also the application for Federal Work-Study funds and federal student loans. In addition, why would you say no to grants or scholarships from other organizations? Many states, schools, and scholarship organizations require a complete FAFSA form in order to provide aid to students. If you don’t complete the FAFSA form, you could lose out on thousands of dollars to help you pay for college.It doesn’t take too much time to complete, and now there’s the option to fill out the FAFSA form on your phone or tablet with the new myStudentAid mobile app!

2. Not Filing the FAFSA Form by the Deadline

You should fill out the FAFSA form as soon as possible, but you should DEFINITELY fill it out before your earliest FAFSA deadline. States and schools set their own deadlines, some of which are very early. To be sure you’re being considered for the maximum amount of financial aid, fill out your FAFSA form—and any other financial aid applications required by your state or school—before the earliest deadline.

3. Not Getting an FSA ID Before Filling Out the FAFSA Form

An FSA ID is a username and password that you use to log in to certain U.S. Department of Education websites, including fafsa.gov. You AND your parent (if you’re considered a dependent student) will each need your own, separate FSA ID if you both want to sign your FAFSA form online. It’s important to get an FSA ID before filling out the FAFSA form. Why? Well, because when you register for an FSA ID, you may need to wait up to three days before you can use it to sign your FAFSA form electronically. DO NOT share your FSA ID with anyone! Doing so could cause problems or delays with your financial aid. Don’t wait! Create an FSA ID now: StudentAid.gov/fsaid.

Also when you log in to fafsa.gov using your FSA ID, some of your personal information (name, Social Security number, date of birth, etc.) will be automatically loaded into your application. This will prevent you from running into a common error that occurs when your verified FSA ID information doesn’t match the information on your FAFSA form. You won’t have to enter your FSA ID again to transfer your information from the IRS or to sign your FAFSA form electronically.

4. Not Using the IRS Data Retrieval Tool (IRS DRT)

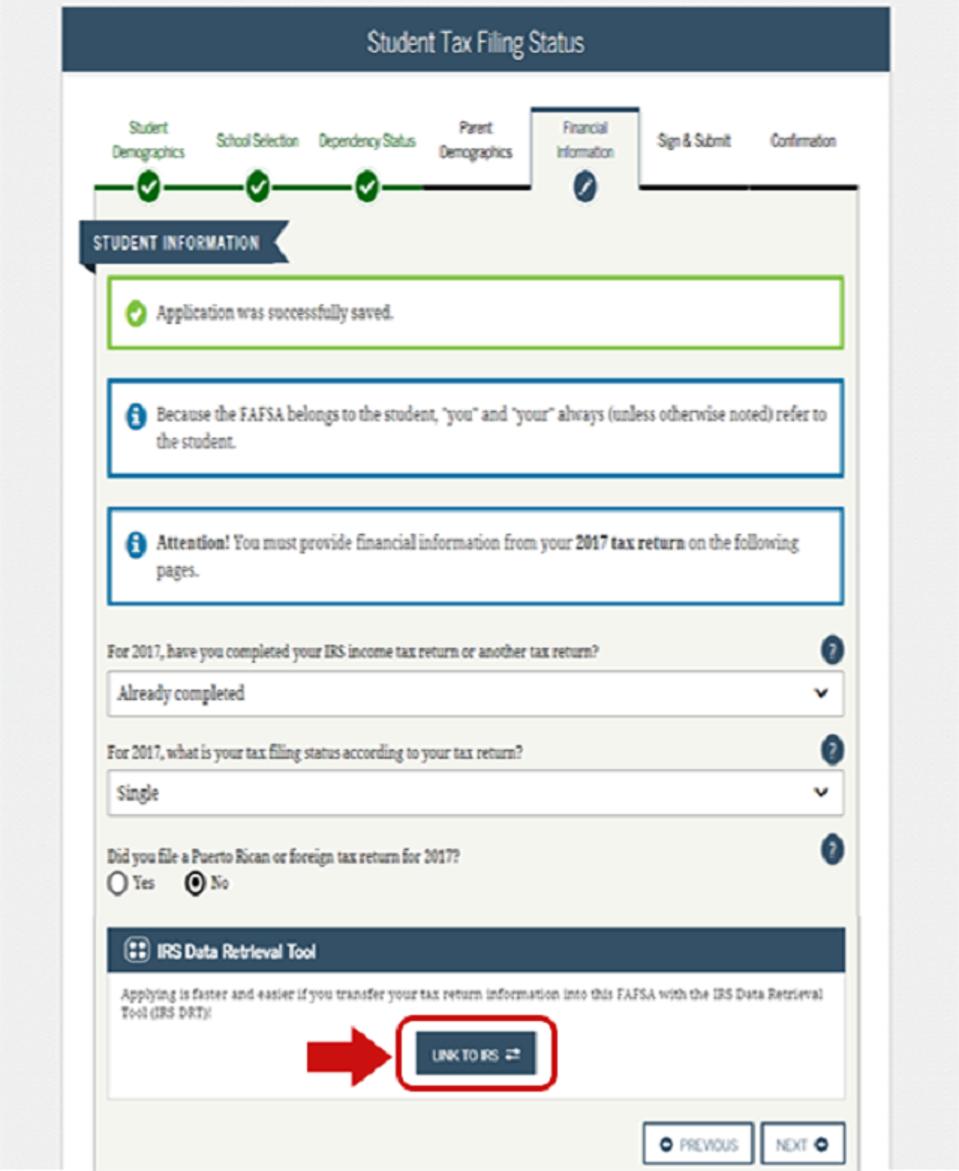

Some applicants find it challenging to enter financial information in the FAFSA form. But, thanks to a partnership with the Internal Revenue Service (IRS), students and parents who are eligible can automatically transfer their necessary 2017 tax information into the 2019–20 FAFSA form using the IRS DRT. It’s the fastest, most accurate way to enter your tax return information into the FAFSA form; if you’re given the option to “LINK TO IRS,” take advantage of it!

Students and parents who are eligible can automatically transfer their necessary 2017 tax information into the 2019–20 FAFSA form using the IRS DRT.COURTESY OF FEDERAL STUDENT AID

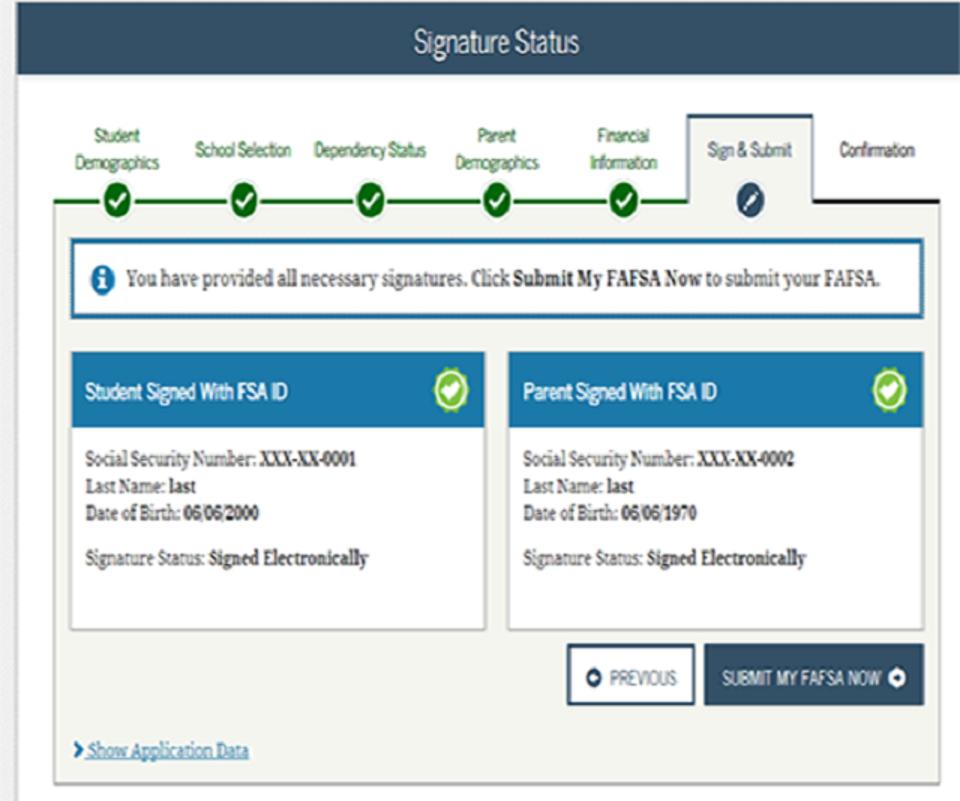

5. Not Signing the FAFSA Form

You can answer every question that’s asked on the FAFSA form, but if you don’t sign and submit it, then you’ve filled it out for nothing. This happens for many reasons—maybe you forgot your FSA ID, or your parent isn’t with you to sign with the parent FSA ID—so your application is left incomplete. Don’t let this happen to you.

If you don’t know your FSA ID, select “Forgot username” and/or “Forgot password.”

If you don’t have an FSA ID, create one.

If you’re not able to sign with your FSA ID, there’s an option to mail a signature page. If you would like confirmation that your FAFSA form has been submitted, you can check your status immediately after you submit your FAFSA form online.

You can answer every question that’s asked on the FAFSA form, but if you don’t sign and submit it, then you’ve filled it out for nothing.COURTESY OF FEDERAL STUDENT AID

So, are you ready to get started? To fill out the FAFSA form, simply:

OR

visit fafsa.gov and fill it out on a computer or mobile device.

You can find more information about the FAFSA and the federal financial aid process at StudentAid.gov/fafsa.

No comments:

Post a Comment