Arvind Gupta

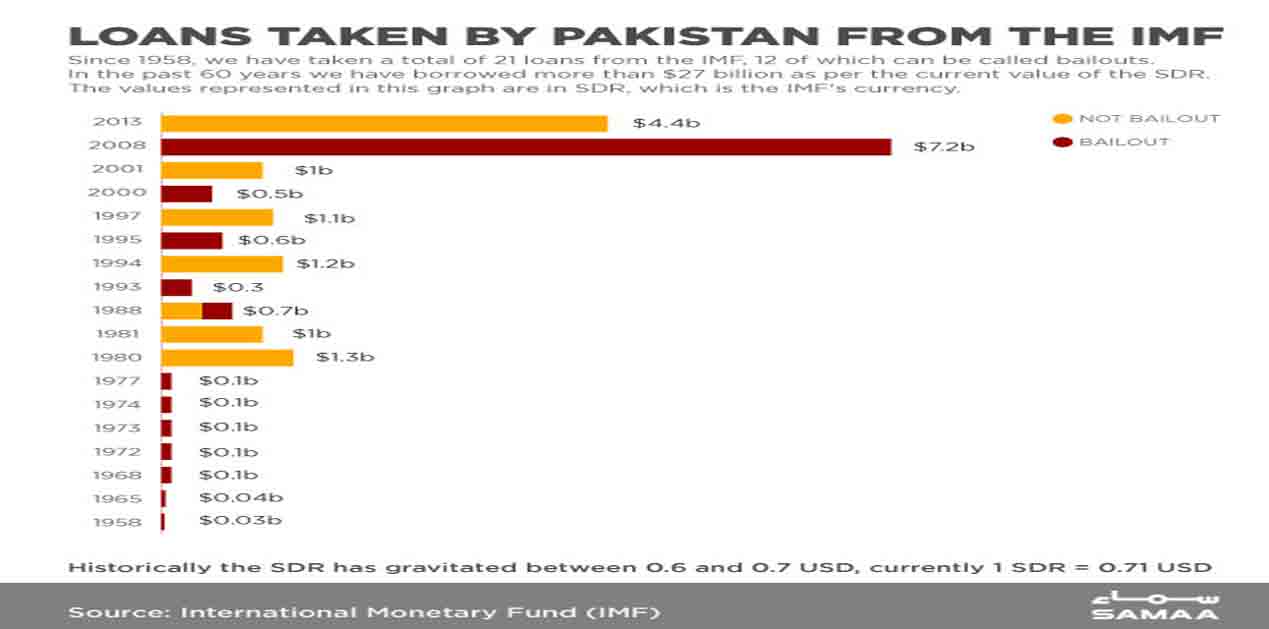

The IMF and the government of Pakistan have agreed on a structural adjustment program of USD 6 billion for three years to stabilise Pakistan’s crisis ridden economy. This will be the 13th such IMF package since 1988. The agreement was reached after months of tough negotiations. The International Monetary Fund (IMF) board is expected to approve the loan agreement in July 2019.

The IMF and the government of Pakistan have agreed on a structural adjustment program of USD 6 billion for three years to stabilise Pakistan’s crisis ridden economy. This will be the 13th such IMF package since 1988. The agreement was reached after months of tough negotiations. The International Monetary Fund (IMF) board is expected to approve the loan agreement in July 2019.

According to some Pakistani economists, the structural adjustment program is focused on stabilisation and not growth. Under the conditionalities agreed, the government will have to take measures to reduce its current account and budget deficits by increasing tax collection, hiking the prices of utilities and letting the rupee float. As an advance action, the Oil and Gas Regulatory Authority (OGRA) of Pakistan has announced a 47 percent increase in the gas prices and recommended a 205 percent hike by 1st July. The Pakistan government has been regularly raising the gas prices since it came to power.

Pakistan rupee is already under pressure having hit the low of ₹ 151 per dollar. According to Bloomberg, the currency has dropped more than 20 percent in the past year, making it the “worst performer in a basket of 13 currencies in Asia”. The rupee has been devalued five times last year. Faced with the large twin current-account and budget deficits, the Pakistan central bank raised interest rates by a whopping 475 basis point during the period. The Karachi Stock Exchange has been sliding for the past seven weeks amidst heavy sell offs. This is its worst ever performance in the last 17 years.

Pakistani economy is in dire straits. Pakistan’s GDP is USD 300 billion but its current account deficit is USD 18 billion or about 6 percent of the GDP. Its external debt is USD 100 billion while foreign exchange reserves are about USD 16 billion, sufficient for only six weeks of imports. Pakistan’s imports are at USD 60 billion while its exports are USD 24 billion. Remittances from Pakistanis abroad, about USD 20 billion per year, is the only silver lining. But that is not sufficient for a debt-ridden economy whose debt servicing last year was about USD 9 billion and is expected to reach USD 20 billion by 2024. Imran Khan’s government has got some relief from the Saudi Arabia and from the UAE in terms of deferred payments for the imported oil and the parking of 6 billion with Pakistani banks. But this could not prevent Pakistan from going to the IMF.

One immediate impact of the IMF bailout would be increased inflation on account of the devaluation of the rupee, the rise of the costs of imported raw materials and the hike in the tariffs of power and gas. The government would be hoping that following the IMF bailout agreement, it would be able to get more loans from other donors like the World Bank and the ADB. But that would only increase its debt burden. The IMF conditionalities reportedly include a condition that Pakistan should implement the recommendations of the Financial Action Task Force (FATF) for curbing terror financing and money-laundering. To come out of FATF’s grey list, Pakistan would have to plug the loopholes in its financial system. The ongoing crackdown on terror groups in Pakistan should be seen as a compulsion dictated by the FATF.

The exact conditions of the IMF bailout have not been spelt out. The newly elected chairman of the Finance Committee of the National Assembly, Asad Umar, who, as former Finance Minister, negotiated the bailout package with IMF, has promised to speak out in due course of time on the differences between what he negotiated and what has been agreed with the IMF. This indicates that the conditions agreed and finalised with the IMF may be different from what Pakistan was negotiating earlier.

Improving tax revenues is central to economic reform in Pakistan. Tax to GDP ratio in Pakistan is among the lowest in the world. The government will have to broaden the base of tax collection, remove exemptions and possibly increase tax rates. The World Bank has promised USD 400 million assistance to help out Pakistan in modernizing its outdated taxation system. Tax compliance rate in Pakistan is only about fifty percent. The aim is to raise compliance to 75 percent and improve the tax to GDP ratio to 17 percent by 2024. It is felt that there is enough room for generating higher tax revenues without raising the tax rates. The politics in Pakistan has prevented the previous government to plug the loopholes in taxation. It remains to be seen whether this time around the government will succeed considering that the rich in Pakistan evade taxes by various means.

The government has announced a tax amnesty scheme whereby people holding black money can whiten it by 30 June by paying a tax of 4 percent if they want to keep the whitened money in Pakistan and of 6 percent if they want to keep it abroad. The stated aim of the scheme is not to generate revenue but to document the illegal economy by making people file tax returns. Previous such schemes have faltered. Whether the scheme would succeed remains to be seen as numerous such schemes by earlier governments made no difference to rampant tax evasion in Pakistan.

The Armed Forces would not agree to any reduction in the defence budget. Pakistan has high debt servicing commitments. The cuts in government expenditure would eventually fall on the social sectors. This will hit the poorer sections of the population badly.

In order to increase the tax revenue, Pakistan may resort to increasing the indirect taxes. The rise in the tariffs of power and gas would hit the consumers including Pakistan industry and agriculture. Pakistan’s economy may be hit badly as a result of the hikes in indirect taxes and tariffs. This could lead to protests from a wide cross-section of Boxer’s population.

The bailout does not mean that Pakistan economy is out of the doldrums. It needs serious structural reforms which are likely to prove unpopular as they involve hardships to ordinary citizens and also put constraints on governed spending. The hard part begins now.

No comments:

Post a Comment