The 14 May 2019 drone attack on two oil pumping stations in Saudi Arabia, allegedly carried out by Iranian-supported Houthi forces in Yemen, was a sophisticated operation. Coming at a time of increased tensions in the region, and notwithstanding Iranian denials, the attack represents a carefully calibrated response to the tightening of oil sanctions against Iran and the US Trump administration’s policy of “maximum pressure” on Tehran.

The 14 May 2019 drone attack on two oil pumping stations in Saudi Arabia, allegedly carried out by Iranian-supported Houthi forces in Yemen, was a sophisticated operation. Coming at a time of increased tensions in the region, and notwithstanding Iranian denials, the attack represents a carefully calibrated response to the tightening of oil sanctions against Iran and the US Trump administration’s policy of “maximum pressure” on Tehran.

The attacks were preceded three days earlier by acts of sabotage against ships in the United Arab Emirates (UAE) oil port of Fujairah. Taken together, these attacks against oil export infrastructure of the leading Gulf state members of the anti-Iran bloc are a signal that the collective ability of Saudi Arabia, the UAE and other Gulf countries to replace Iranian oil is not assured.

The attack in Saudi Arabia caused minor damage to only one of the pumping stations, according to the Saudi Ministry of Energy,[1] resulting in a temporary and precautionary shutdown of the pipeline for evaluation. On the day of the drone attacks, a television station operated by Houthi forces in Yemen reportedly claimed the rebels had conducted drone attacks on Saudi installations, without specifying the exact time or targets of the attacks.[2]

In prior attacks on Saudi Arabia, Houthi rebels have used Qasef-1 drones, copies of Iran’s Ababil-2 drone that are allegedly produced in Iran despite Houthi claims of local production.[3] The Qasef-1 was used to conduct the May 2018 attack on Saudi Arabia’s Abha International Airport.[4] The one runway airport services flights to Egypt and Saudi Arabia’s Gulf neighbours and is located approximately 100 km from the Saudi–Yemen border. The two pumping stations hit almost exactly a year later are located over 700 km from Saudi’s border with Yemen.

This most recent attack therefore represents a considerable upgrade in the sophistication of the Houthi’s drone capabilities, suggesting the use of the 1,400 km range UAV-X drone reported to be in their possession.[5]

In contrast to large oil storage tanks, the pumping stations that were attacked are relatively small targets. More difficult to hit, especially over such long distances, and not inflicting spectacular damage for the effort, the deliberate targeting of the pumping stations that supply the Saudi Petroline pipeline was specifically tailored to threaten the kingdom’s export outlets without providing a pretext for a major escalation.

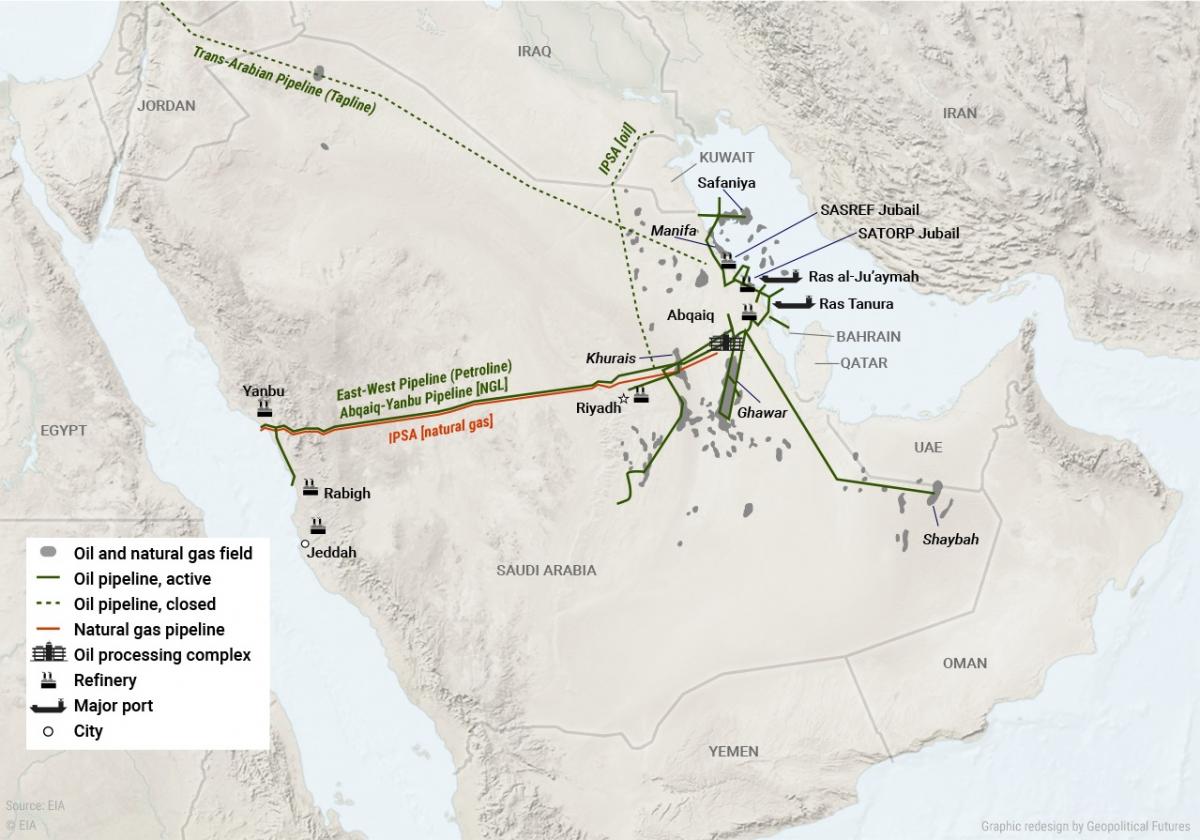

Petroline, also known as the East-West pipeline, transports oil from Saudi Arabia’s oil-producing Eastern province on the Persian Gulf westward a distance of 1,400 km to the oil refineries at Yanbu on Saudi Arabia’s Red Sea coast (see Figure 1).

Figure 1 | Major oil and natural gas infrastructure in Saudi Arabia

Source: “Saudi Arabia’s Oil and Gas Infrastructure”, in Geopolitical Futures, 9 February 2016, https://geopoliticalfutures.com/?p=672.

Located some 300 km northwest of Jeddah, the Yanbu port is a major oil terminal for the kingdom. The maximum capacity of the pipeline is roughly 5 million barrels per day (bpd) and is being expanded to 6.5 million bpd. Currently, Saudi oil exports are hovering just under 7 million bpd,[6] so the expanded Petroline pipeline could theoretically be used to continue Saudi Arabia’s global exports in the event of a disruption in the Persian Gulf and the strategic passageway of the Strait of Hormuz.

The UAE’s Fuajirah port performs a similar function in providing security of export supply routes in the event of conflict in the Persian Gulf. It too was targeted through acts of sabotage on Saudi and Emirati vessels anchored off port.[7] Fujairah is the world’s second largest bunkering (ship refuelling) port and a major oil storage centre, with the UAE seeking to more than double its already large storage capacity by 2022.[8]

Strategically located on the UAE’s eastern coast on the Gulf of Oman, outside the Persian Gulf and its Strait of Hormuz choke point, the Fujairah port provides another critical export outlet. The Abu Dhabi Crude Oil Pipeline (ADCOP) runs from the UAE’s Habshan oil field to Fujairah where it supplies the refinery as well as the export terminal.

The spare production capacity of Saudi Arabia, the UAE and Kuwait are crucial for the success of US’s confrontational policy towards Iran, including most significantly the stringent oil sanctions. This spare capacity can, and has in the past, been used to keep global oil prices stable despite the removal of Iranian oil from the market. However, oil produced by these nations is of no use if it cannot be securely exported. Saudi Arabia’s Petroline pipeline and the UAE’s ADCOP pipeline and Fujairah port are critical back-up supply routes should a conflict break out in the Persian Gulf.

The attacks, therefore, are a message for Riyadh, Abu Dhabi and Washington as the US escalates its crippling economic pressure on Iran, particularly in the wake of the US ending sanctions waivers in early May 2019 for Iran’s largest purchasers of oil.[9] Iran’s economy had already contracted by 3.9 per cent in 2018 and was forecasted to shrink by another 6 per cent in 2019 prior to the announced end of waivers. With general inflation over 50 per cent and rising, and the inflation rate on food at 85 per cent and rising,[10] Iran’s economy is on the verge of entering a death spiral.

The desperate situation was made worse by Washington’s announcement, on 8 May 2019, that it would impose sanctions on Iran’s metals industry. Primarily iron, steel, aluminium and copper, these metal exports constitute Iran’s largest revenue source outside its hydrocarbon-related exports, providing 10 per cent of Iran’s export revenue,[11]and are also a major employment sector in the country.

For its part, Tehran has denied that it was involved in either set of attacks, maintaining plausible deniability. Describing the sabotage at Fujairah as “alarming and regrettable”,[12] Iran’s foreign ministry spokesperson warned of the intervention of foreign forces in the Gulf and called for further clarification of what occurred.[13]

The incidents at Fujairah are currently being investigated by the UAE with assistance from Saudi Arabia, the US, Norway[14] and possibly France. While the circumstances surrounding the Fujairah attacks remain murky, Iranian-backed Houthis in Yemen were clearly involved in the attack on Saudi Arabia’s Petroline pipeline. It is unlikely that Iranian-supplied Houthi forces would conduct such an attack without at least tacit permission from Iran’s Revolutionary Guards Quds force.

Ninety per cent of Iran’s oil is exported from its Kharg Island terminal located 25 km off Iran’s Persian Gulf coast and 483 km northwest of the Strait of Hormuz. Saudi Arabia and the UAE’s dependency on the Persian Gulf for their own oil exports traditionally created a degree of mutual deterrence against any party disrupting the security of the shared maritime domain. The creation of Persian Gulf bypass routes by Saudi Arabia and the UAE, however, has removed that mutual deterrence and created a severely asymmetrical vulnerability for Iran’s maritime oil exports.

By striking at oil export infrastructure that bypasses the Persian Gulf without inflicting serious damage, a calibrated message was communicated that these bypass routes are in fact vulnerable to attack and therefore the strategic calculus in Riyadh and Abu Dhabi (as well as in Washington) should again return to the principles of mutual deterrence.

It is doubtful that this warning will be heeded as intended. For its part, Saudi Arabia has reason to believe its pipeline is sufficiently resilient, as Saudi Aramco is amply supplied with spare pipeline parts and maintains the backing of the US. Riyadh is more likely to focus on further augmenting its air defences and Abu Dhabi would probably take a similar approach.

The US strategy of “maximum pressure” is increasing Iranian isolation and leaving Tehran with a diminishing time-frame in which to act. In an apparent departure from the defiant tone emanating from Tehran, Heshmatollah Falahat Pishe, the head of the Iranian parliament’s national security and foreign policy committee issued a public plea on 17 May 2019 for direct dialogue between Iran and the US in Iraq or Qatar.[15]

This suggestion has not been echoed by anyone else in the Iranian government. The day after Falahat Pishe’s appeal, Iranian foreign minister Javad Zarif re-iterated Iran’s desire to avoid a war, emphasising that Iran’s ability to inflict harm on its neighbours would deter Iran’s opponents.[16]

Iran’s emerging asymmetrical vulnerability in the Persian Gulf and Strait of Hormuz, however, is limiting Tehran’s options, shifting the balance of deterrence and creating a dangerous potential for escalation or miscalculation. Iran is facing an economic time-bomb that needs to be defused by easing the effects of the sanctions before a potential economic collapse further diminishes its ability to respond or deter foreign threats.

Yet, it appears that neither the US nor its regional backers are providing Iran with a pursuable exit strategy, prioritising isolation, pressure and sanctions instead. Securitised and zero-sum approaches aimed at bringing about the capitulation of one or another side are maximalist starting positions that cease to be tenable when seeking a negotiated readjustment to the strategic equilibrium in the region.

In this regard, the recent attacks on Saudi Arabia and the UAE represent a deliberate but carefully calibrated message from Tehran to its regional antagonists and their foreign backers. While the message contains an implicit warning as to Iranian capabilities, it may also indicate a willingness in Tehran to consider dialogue that would lead to the establishment of new strategic redlines related to regional security and the economic and energy interests of all states in the Persian Gulf. The message should be heeded, and all efforts directed towards exploring de-escalation, including in the realm of maritime security, trade and energy relations.

If no such effort is launched, then a critical opportunity will have been missed and proxy attacks emanating from both sides could accelerate and increase in their intensity, pushing the region into further instability while empowering radicals and military-first approaches on all sides.

No comments:

Post a Comment