By Xuepeng Liu and Huimin Shi*

The trade war between China and the US has lasted for almost a year and has recently escalated. In many industries, US–China trade had declined. At the same time, the two countries’ trade with certain third countries/regions have increased. Some of the products diverted to third countries might actually be made in China or the US. For example, in a recent Bloomberg.com news report, Chau and Boudreau (2019) show that Vietnamese exports to the US surged in 2019 and some of the products such as plywood are actually made in China, but shipped to the US with ‘Made in Vietnam’ labels. Earlier discussions on antidumping duty evasion have appeared in news or government investigation reports, but they only investigated a few products or offered mostly anecdotal evidence. In a recent econometric study, we provide a more systematic econometric analysis of the rerouting behaviours of Chinese firms to evade US antidumping duties (Liu and Shi 2019).

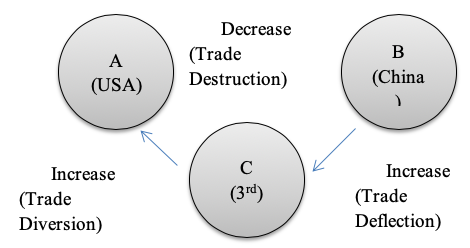

Figure 1 The impact of temporary trade protection measures on trade flows

The impact of antidumping on trade flows and trade rerouting

Previous studies have investigated how temporary trade protection measures, such as antidumping and countervailing duties, affect trade flows. We use Figure 1 to illustrate the numerous effects of antidumping duties on trade flows. When country A imposes antidumping duties on the products from country B, the first effect is ‘trade destruction’ – that is, a decrease in country A’s imports of the targeted products from country B. Prusa (2001), among others, found the US antidumping investigations led to exporters of other countries ceasing to export to the US. Lu et al. (2013) confirmed the exports-dampening effect of US antidumping against China. The second effect is a trade diversion effect – that is, an increase in country A’s imports from third countries C other than B. This has been investigated by Konings et al. (2001), Durling and Prusa (2006), and Romalis (2007) with mixed evidence. The third effect is an increase in country B’s exports to some third countries C (or a trade deflection effect). The evidence on trade deflection is mixed too. Bown and Crowley (2006, 2007) confirm the trade deflection effects of US antidumping on Japanese exports. Durling and Prusa (2006) found some weak evidence. Bown and Crowley (2010), however, found no systematic evidence of deflection for China’s exports before joined WTO.

We connect the trade diversion effect to the trade deflection effect and provide evidence that Chinese exporters rerouted products through third countries/regions to evade US antidumping duties during 2002-2006. This kind of rerouting, trans-shipment or re-exporting of services has actually been openly advertised by intermediary firms. For example, one of them specifically describes the process of rerouting circumvention on their website as follows: “(1) we can export those products (made in China) to another country/region (e.g., Malaysia) at little cost to exporters; (2) we will finish customs clearances for cargo in Malaysia, send it to our warehouse, and then pick up and reload them in a new container (booked in Malaysia); and (3) we will find a local factory to provide all the original certificate of origin (C/O) documents from Malaysia and then export the products to your final destinations”.

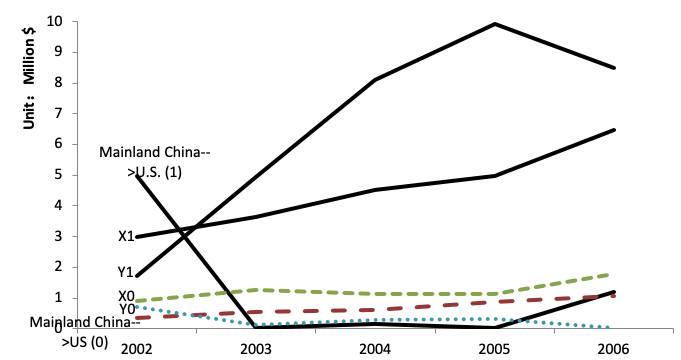

Take a specific case US-AD-1013 as an example. We show in Figure 2 that the exports of saccharin and its salts from mainland China to the US declined sharply after antidumping. At the same time, the exports of these products from mainland China to Korea and Taiwan and the US imports from Korea and Taiwan increased. This pattern does not hold for other similar products not subject to US antidumping duties (the control group).

Figure 2 Trade rerouting through Korea and Taiwan: The case of US-AD-1013

Notes: “1” in the series label names denotes HS6=292511 (saccharin and its salts) in the treatment group of US-AD-1013 (the three solid lines), while “0” in the label names denotes HS6=292519 (other imides and their derivatives) in the control group of the same case (the three dotted lines). The preliminary and final decision dates of this case are 12/27/2002 and 7/9/2003, respectively. Mainland ChinaUS refers to US imports from mainland China. Y refers to US imports from Korea & Taiwan. X refers to mainland China’s exports to Korea and Taiwan.

Detecting circumvention in the data

Rerouting circumvention has been previously investigated by customs offices and the media. Nita and Zanardi (2013) conducted a comprehensive review of the EU’s anti-circumvention investigations in practice. Our paper is the first attempt to systematically detect the antidumping triggered tariff evasion by covering many products. We carry out a difference-in-difference analysis using China’s monthly export data, the US monthly imports data, and the data from the Global Antidumping Database from 2002 to 2006 (Bown, 2010). The treatment group covers the products subject to antidumping duties, while the control group covers similar products not subject to the duties.

Our identification strategy is based on a positive correlation between China’s exports to a third country (trade deflection) and the US imports from the same third country (trade diversion) for the products subject to the US antidumping duties (treatment group), but not for the other products in the control group. The dataset is constructed based on third countries over time for many HS 6-digit products at the monthly level. Note that trade diversion and deflection may exist even in the absence of trade rerouting. However, as explained in detail in Liu and Shi (2019), the third countries involved in trade diversion and those involved in trade deflection are unlikely to be the same group of countries. Trade diversion or trade deflection alone cannot explain a stronger positive association between a third country’s exports to the US and the imports of the same third country from China – it can be better explained by trade rerouting.

We go further to show that the evidence for rerouting is more pronounced for countries and products with features that could facilitate evasion due to lower transportation and collusion costs. We find that the evidence of rerouting is stronger for third countries/regions that are geographically closer to China and the US and for those countries that have a relatively large ethnic Chinese population who might help exporters from China collude in those third countries to obtain their local certificate of origin (C/O) documents. We also find that less-differentiated products were more likely to be rerouted for evasion purposes because it is usually more difficult to identify the true production origins of these products, which in turn lowers the probability of being detected. All of these are consistent with a rerouting circumvention story.

Alternative stories and other robustness checks

Any preferential trade policies may trigger rerouting. For example, during the final years of the Multifiber Agreement (2001–2005), the US imposed quotas on Chinese apparel but gave African apparel duty- and quota-free access through the African Growth and Opportunity Act (AGOA). Rotunno et al. (2013) showed that the rapid but ephemeral rise of African exports can be explained in part by ethnic-Chinese firms using Africa as a quota-hopping export platform. Our paper shows that their results are robust to the exclusion of textile and clothing products.

Similarly, because a free trade agreement (FTA) favours countries inside the trading bloc over non-members, there is an incentive for countries outside the trading bloc to reroute their products through the member countries of the FTA to enjoy the lower preferential tariff rates. Using product-level data on trade between Canada and the US, Stoyanov (2012) presents evidence of tariff evasion and violation of the rules of origin occurring under the Canada-US FTA. We show that the positive correlation between a third country’s imports from China and their exports to the US is not just driven by trade creation within FTAs. In addition, we show that the results are not driven by the observations with both dependent and independent variables being zeros in the dataset either.

Our findings are also robust regardless of using trade value or trade quantity data. We consider other concurrent antidumping actions against China or third countries as well, possible aggregation bias, and an alternative definition of the control group based on a matching method. These findings provide further support for the evasion hypothesis.

Similar analysis may be carried out in the future to investigate possible rerouting during the ongoing US-China trade war when more recent data are available. In addition, the exporters on both sides may evade tariffs (as shown by Ferrantino et al. 2012, among others), so similar analysis can also be carried out to analyse possible evasion behaviours of US traders.

A final note on welfare implications

A final note on welfare implications is in order here. As Leitzel (2003) puts, “evasive behavior in essence presents an experiment, an alternative way of arranging society.” Although evasion can be illegal, it is actually not straightforward to evaluate its welfare effects. If trade protection measures are erected for legitimate reasons, then the rerouting behaviours will be welfare reducing. If the trade protection measures such as antidumping duties or tariff hikes during trade wars are not economically justified, however, then rerouting behaviours could well be welfare-improving by reducing the welfare loss from the trade war or other temporary protection measures. We do not intend to evaluate the welfare effects of rerouting in this paper.

No comments:

Post a Comment