Prof Hari Bansh Jha

Background

All countries, big or small, promote investment as it plays a crucial role in capital formation and in increasing production, generating employment opportunities and boosting exports. Foreign investment is required when the domestic investment proves inadequate in meeting the requirements. In Nepal, a number of policies have been formulated to attract foreign investment. To promote the industries to be set up in the Special Economic Zone (SEZ), the SEZ Act was passed in 2016. It offers various incentives to the industries on the use of domestic raw materials as well as on the imports of raw materials from outside. Industries to be established in the SEZ were required to export up to 75 percent of their products to other countries.

All countries, big or small, promote investment as it plays a crucial role in capital formation and in increasing production, generating employment opportunities and boosting exports. Foreign investment is required when the domestic investment proves inadequate in meeting the requirements. In Nepal, a number of policies have been formulated to attract foreign investment. To promote the industries to be set up in the Special Economic Zone (SEZ), the SEZ Act was passed in 2016. It offers various incentives to the industries on the use of domestic raw materials as well as on the imports of raw materials from outside. Industries to be established in the SEZ were required to export up to 75 percent of their products to other countries.

Nepal is in dire need of Foreign Direct Investment (FDI) as it envisions graduating from a low-income country to a low-middle country by 2030. Therefore, the present government seems to have adopted "Look North" policy to benefit from the Chinese development. Accordingly, the government of Nepal signed a Memorandum of Understanding on the framework agreement on Belt and Road Initiative (BRI) with China in Kathmandu just two days before the Belt and Road Summit began in Beijing on May 14, 2017, and ten days before the military exercise with China, with a view to attract investment from north.

To support Nepal under the framework of BRI, President Xi Jinping of China said, "China stands ready to strengthen cooperation with Nepal in infrastructure connectivity, post-disaster reconstruction, trade and investment under the framework of the BRI." 1 In certain quarters, hopes are that Nepal would benefit from BRI projects in some of these sectors. But it is not well understood why there was no serious debate in Nepal about geo-economic and security implications of joining BRI club and the costs that the country might have to pay which is so vital to the future for this country.

Now that the Chinese President Xi Jinping is himself visiting Nepal on his return trip to Beijing from India on October 12, expectations are quite high that some crucial agreements will be signed between the two countries to promote further investment from China to Nepal under the umbrella of BRI.

What is BRI?

The BRI, what is also called 21st-century Silk Road, was initiated by China in 2013. It is a combination of "belt" of overland corridors and road of maritime shipping lanes. So far, it has covered over 60 countries in Asia, Africa and Europe, which amounts to almost half of the global population and a quarter of global GDP. The total project cost of BRI is estimated at $ 1 trillion and it will take decades to complete it. Estimates are that the Chinese companies have already made investments worth over $ 210 billion in BRI projects2 mostly in poor Asian countries.

Aimed at improving connectivity from China to different countries of Asia, Africa and Europe, the multi-billion BRI could foster regional cooperation in such crucial areas as trade, investment and finance. Therefore, some European countries such as Italy, the United Kingdom, Germany and France have positive feelings about BRI. Rather Italy and Hungary have turned into major terminal hubs for BRI. It was under BRI that the first Silk Road Train reached London from China in 2017.3 Between Asia and Europe, a new connectivity is now developed under BRI through the construction of motorway from the Yellow Sea off eastern China to the Russian port of St Petersburg as an alternative overland trade route. The lorries will now take only 10 days to cover this distance of 5,248 miles via Kazakhstan when earlier it took 45 days to cover this distance by sea.

Strategic Side of BRI

The BRI is often termed as a tool of economic imperialism as it provides unqualified leverage to China over such countries that are smaller and poorer. Also, it is perceived as a strategy to expand military presence in the Belt and Road counties. The case in point is Djibouti where the Chinese made the military base. Most of the ports and transport infrastructures built under BRI are in use for both commercial and military purposes. Therefore, Jonathan Hillman, Director of the Reconnecting project at the Centre for Strategic and International Studies made a revelation in Washington that the BRI is "...more than roads, railways and other hard infrastructure... It is also a vehicle for China to write new rules, establish institutions that reflect Chinese interests, and reshape 'soft' infrastructure." 4 It is because of BRI that most of the global choke points have been experiencing pressure from BRI.

Commenting on the BRI, Admiral Harry Harris, Commander of the US Pacific Command stated that it was “…much more than just an economic engine that China is undertaking…it is a concerted, strategic endeavor by China to gain a foothold and displace the United States and our allies and partners in the region.” China could influence the shipping routes in the Strait of Hormuz, in the Gulf of Aden, the Suez Canal and also in Panama Canal through such activities.5 The Strait of Malacca is also under pressure from BRI. India is concerned for the way the China Pakistan Economic Corridor (CPEC), a part of BRI, overlooked its interests and is made to pass through Pak Occupied Kashmir. These are some of the factors that made India, the United States and many other countries to openly oppose BRI.

Debt Trap Diplomacy

The Washington, D.C. based think tank, the Centre for Global Development, has identified 68 countries as potential borrowers of funds under BRI. These countries are likely to face the risk of debt distress once they receive infrastructure financing. In particular, the Maldives, one of India’s neighbours along with Djibouti, which has provided a military base to China are at the risk of debt distress. At times, China used this ‘debt-trap diplomacy’ to get strategic concessions from the Belt and Road countries in all such areas as related to territorial disputes in the South China Sea and in silencing the voice of countries about human rights violations. In the case of Tajikistan, China wrote off undisclosed debt by this country in exchange for 1,158 sq km of disputed territory.

Importantly, Christine Lagards of the International Monetary Fund asked China to be cautious in financing unsustainable projects, especially in those countries which were already overburdened with debt. The debt burden of such countries could further aggravate if they received funds under BRI for the development of infrastructure as their limited resources would be largely spent in debt service. This could further create an imbalance in their balance of payments.6 In Pakistan, certain sections of the society have openly started criticizing the China Pakistan Economic Corridor (CPEC), a part of BRI. They have a perception that it is a ploy to colonize them. But Beijing views that BRI project has not saddled Pakistan with debt as it has created 70,000 jobs in the market and also that it stepped up economic growth of the country by one to two percent. But not being satisfied with Beijing’s claim, the US Secretary of State Mike Prompeo has asked International Monetary Fund (IMF) not to make any funding to Pakistan as that could be used for paying off Chinese lenders to bail it out of its economic crisis.7

Immediately after coming to power, Prime Minister Imran Khan rung alarm bell about the debt crisis in Pakistan. It was thought that his government could review all BRI contracts as "the deals were badly negotiated, too expensive or overly favoured China."8 Accordingly, the $8.2 billion rail project that aimed at revamping colonial-era rail line from the Arabian Sea faced rough weather. This mega project could have linked Karachi with Peshawar. It is to be noted that in 2017 Pakistan had cancelled Chinese funding for $14 billion mega-dam projects in the Himalayas on account of the cost concerns.9 Furthermore, Malaysian government outrightly cancelled Chinese-funded $20 billion East Coast Rail Link (ECRL), the largest ticket project in the entire BRI.10 Sierra Leone terminated a $400-million scheme for the Chinese-built Mamamah International Airport for the reason that it was "too costly" and "uneconomical." Agreement for the construction of this project had been made with Beijing at the initiative of Ernest Bai Koroma, Sierra Leone's previous president. After he lost the elections, the new president Julius Maada Bio terminated this agreement. About this agreement, Bio stated that "most of the Chinese infrastructructural projects in Sierra Leone are a sham with no economic and development benefits to the people."11

In 2018 alone, eight Belt and Road countries, including Djibouti, Kyrgyzstan, Laos, the Maldives, Mongolia, Montenegro, Pakistan and Tajikistan, expressed their inability to repay their loans as they faced a serious economic crisis due to the debt distress. These countries owe over half of their total foreign debt to China.12 The new governments formed in Sri Lanka, Malaysia and Maldives are concerned about the Chinese deals made by the previous governments. Unable to repay the Belt and Road loan, Sri Lanka in 2017 handed over Hambantota deep-sea port to China for 99-year. US Vice President Mike Pence feared if this port could become a forward military base for Beijing's blue-water navy.13 However, the Sri Lankan government has rejected such US claims.

After five years of the introduction of BRI, the number of disputes between China and Chinese companies on the one side and the governments/parties in the participating countries on the other has grown enormously. The number of arbitrations between parties from participating countries increased from 70 in 2016 to 124 in 2017. Also, the number of arbitrations between Chinese companies and parties involved in BRI stepped up from mere 12 in 2016 to 38 in 2017.14 No doubt, the Chinese have made a provision for courts in Beijing on the model of Dubai International Financial Centre Courts and the International Commercial Court in Singapore to settle disputes related to BRI projects. But it is feared that such courts will hardly be independent and so they might go in favour of Chinese firms.15

Areas Specified under BRI Projects in Nepal

During his visit to Nepal, Shu Ya, founder of One Belt One Road (OBOR) International Trade and Investment Platform, identified such areas of cooperation for investment purposes in Nepal as infrastructure development, commercial farming, energy, tourism, international trade and investment sectors.16 Under BRI, a proposal for concessional funding had been submitted to Ministry of Finance to provide a concessional loan to Nepal upto $ 1 billion at 3 percent rate of interest.17 However, not much was known about the funding modality of the BRI projects. On its part, Nepal government identified the list of 35 projects to be undertaken under BRI, which covers a wide-ranging area, including infrastructure development, energy, construction of integrated check posts, free trade area, and irrigation. Given below is the list of some of these projects:

List of BRI floated Projects

1.0 View Tower in Negarkot

2.0 Upgradation of Rasuwagadhi-Kathmandu road

3.0 Korala-Pokhara road

4.0 Kimathanka-Hile road construction

5.0 Handicraft village in Humla, Simikot

6.0 Exhibition centres in all seven provinces

7.0 Multifunctional lab at Rasuwagdhi border point

8.0 Free trade area in Betrawati of Nuwakot and Panchkhal, Kavre

9.0 Construction of six ICPs in Pulang-Yari(Humla), Liji Nechung (Mustang),

Jilong-Rasuwa,Jangmu-Kodari,Reu-Olangchungola and Chentang-Kimathanka

10.0 Karnali corridor (Jamunaha-Hilsa)

11.0 Gandaki corridor (Belhaiya-Korala)

12.0 Thori-Kerung corridor

13.0 Kodari-Birgunj corridor

14.0 Koshi corridor (Rani-Kimathanka)

15.0 Bhittamod-Lamabagar-Lapcha corridor

16.0 Mahadevkhola rainwater harvesting project

17.0 Groundwater possibility in Kathmandu at Chandragiri

18.0 Galchi-Rasuwagadhi-Kerung400 KV transmission line

19.0 New city at Bheriganga, Surkhet

20.0 Kathmandu Outer Ring Road

21.0 Sunkoshi Marin diversion multi-purpose project

22.0 Mid-Tarai lift irrigation project

23.0 Lift irrigation project in Panchkhal, Kavre

24.0 Araniko Highway disaster and climate change project

(Source: Kathmandu Post, October 10, 2018)

As per the agreement made between the Investment Board of Government of Nepal and China's Huaxin, there will be an investment of $130 mn in the cement plant in Nepal, which is expected to produce 3,000 tonnes of cement each day. Besides, a 164 MW hydropower plant will be set up at Kaligandaki Gorge on the build-own-operate-transfer model. Apart from this, a 40 MW hydropower plant would be set up at Siuri Nyadi on a different model. Additionally, the 600 MW hydropower project is likely to be set up at Marsyangdi Cascade and another 75MW plant at Trishuli Galchhi. A Memorandum of understanding has also been signed between the two countries for the construction of Eastern Tarai Irrigation System around the Biring, Kamala and Kankai rivers. A highland food part is also envisaged at the cost of $46 mn to supply fruits and vegetables.18

The concerned ministries of Nepal have been asked to work on the financial and investment models of these projects. Estimates are that these projects would cost the US $10 billion to Nepal.19 The Chinese have opened a Commercial Counselor Office in Kathmandu to facilitate the work on Chinese funded projects in Nepal.

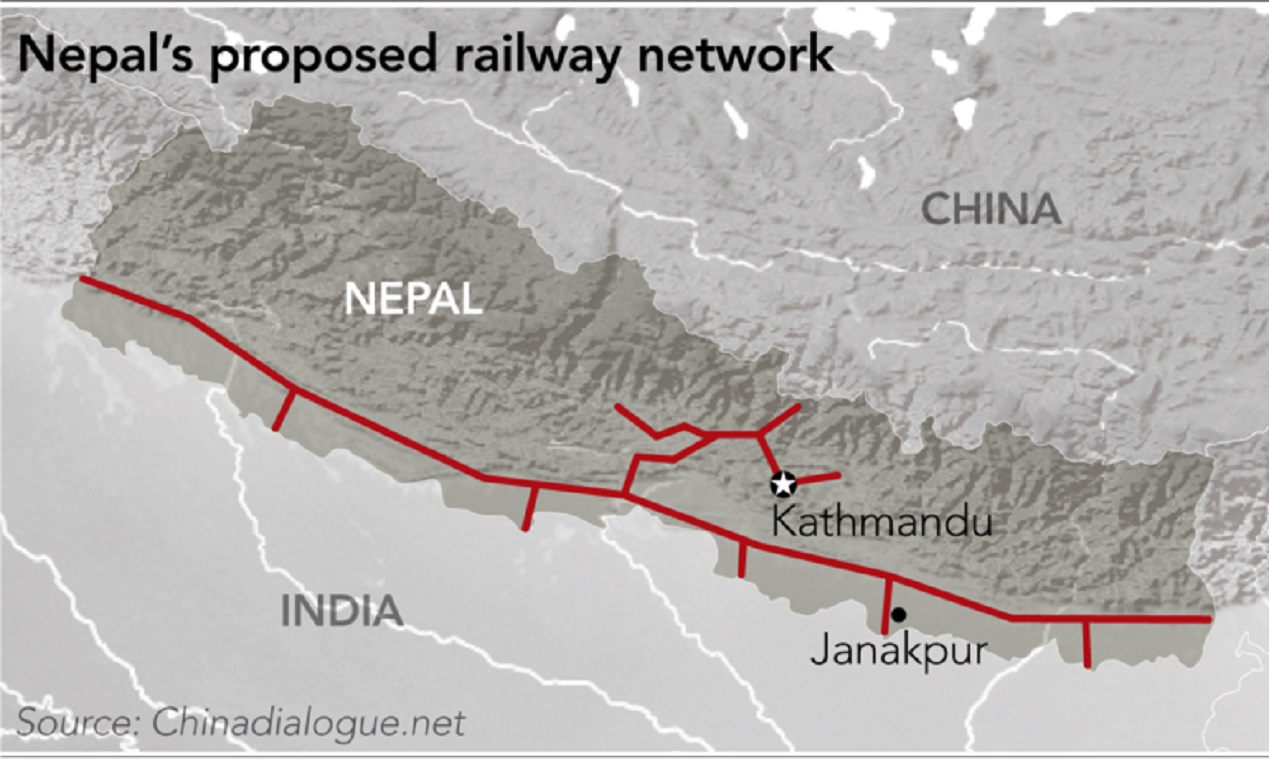

Mega Train Project

A high-level Chinese technical team under Jhang Lee Yang, the deputy administrator of National Railway administration, in cooperation with the Department of Railway (DoRW) of Nepal government conducted a field visit to the proposed 287-kilometre-long Kyirong-Kathmandu-Pokhara-Lumbini Railway Project in Nepal.20 It was during the visit of Nepalese Prime Minister KP Sharma Oli to China in March 2016 that the agreement for the construction of the railway between Nepal and China was signed.

Details on the construction activities and the cost of the project will be known once the detailed project report is completed. In view of the complexities involved in the construction of the project, it might take about nine years to complete it. The total distance of the railway line from Rasuwagadhi to Kathmandu is nearly 72 kilometres.21 Construction work of Rasuwagadhi-Kathmandu-Pokhara-Lumbini railway is likely to begin next year after the completion of the detailed project report.22 Owing to the fact that Nepal is a member of the Asian Infrastructure Investment Bank, getting a loan from China for the construction of this railway might not be that difficult.

The Challenge of Investment and the Concerns

Though the Chinese team of experts found the Chinese railway project in Nepal feasible, it is likely to prove most challenging even for China that has a reputation of masterminding railway engineering. Serious doubts have been expressed about the implementation of this railway project. This is mainly due to the difficult terrains of the regions through which the railway line will pass. It would be most difficult to traverse the highly inclined Syaphrubesi-Kerung section of the project.23 Also, it will be difficult to run the railway in this stretch, especially in the winter season when there is snowfall. The snow- resistant railway track is the most expensive and it will not be that easy for a poor country like Nepal to afford it. It is also feared that the Nepalese side would not be able to clear frost areas and acquire lands needed for the railway lines. Over and above, the repair and maintenance work of the project might not be that easy if there is any serious damage to the structures.

Yet, it does not mean that some of the concerns expressed in regard to the construction of the railway line are insurmountable. China does have experience in meeting such challenges in Tibet and there is no reason why it cannot apply it in Nepal. But then each of such activities has certain costs. If these factors are considered, the Chinese railway project is likely to be “too costly.” The railway project under BRI is expected to cost Nepal around $8 billion, 24 which is nearly one-third of the country's total GDP. A poor country like Nepal would find it too difficult to repay the debt with interest rate. Several types of research conducted on BRI suggest that the grant component in the BRI loan is minimal. In Pakistan's CPEC case, the grant element in loans was only 4 percent and the rest 96 percent was loans provided by the Chinese commercial banks on a higher interest rate.25

Even if the costliest railway project is completed, what is that Nepal could gain from it? Experts believe that the railway will not be able to reduce even Nepal’s bourgeoning trade deficit with China. In 2017, Nepal imported goods worth $966.96 million, while its exports to that country formed merely $17.85 million in 2017.26 Prospects for Nepal to make exports to China through this railway seem to be bleak considering the fact that there are very little surplus products in the country to export. Nevertheless, the strategic importance of the Chinese railway in Nepal cannot be overlooked, which gives China easy access to reach the Indian border. To the great disadvantage of India, the debt crisis in its neighborhood is likely to affect its political cost.27

Prospect for the development of tourism through the railway is there, but this will be possible only if Tibet is made open for the outside world. The question is whether China will allow the tightly-closed Tibet to open for the world. Under the existing situation, China might not be fooling itself by opening Tibet just to get hold over the small Nepalese market. And, given the rivalry between India and China on different fronts, it is unlikely that India would ever be interested to give its huge market in its northern states to the Chinese through this railway. As such, there is too little commercial importance of the railway link for Nepal.

China's Own Limitations

Recent developments have shown that China is experiencing resource crunch to support the BRI projects. Since Chinese renminbi is not yet grown-up as a global currency, it has its own limitations to print and use this currency for financing BRI projects. Most of the BRI projects are dollar-denominated financed rather than renminbi-financed. Because of this dollar constraint for China in financing BRI projects, the only option that China has is to go for co-financings its BRI projects with multilateral institutions like the World Bank, Asian Development, Asian Infrastructure Investment Bank, European Investment Bank and European Bank for Reconstruction and Development. But the negotiations with these institutions will not all go in Chinese favour. It is likely that these institutions would place their own terms and conditions in implementing BRI projects, which could forbid China to make a preference for contractors in any particular country.28 Thus, the dollar crunch for China might affect the implementation of major BRI projects including those in Nepal.

Environmental Concerns

Another important dimension of BRI is its insensitivity towards environment. Professor William Laurance of James Cok University in Australia opines that there are countless examples in which the Chinese firms working mostly in the developing countries are least bothered about environmental issues.29 Under the BRI, China plans to build 7,000 infrastructure projects until the mid of the current century in BRI countries in Asia, Africa and Europe that could develop links between the sea and the land. Yet, such projects are believed to pose “riskiest environmental” threat ever undertaken by mankind. In Nepal, too, the Worldwide Fund for Nature (WWF) has warned that the BRI project could negatively threaten the existence of 265 species such as antelopes, tigers and giant pandas. Also, that could overlap with 1,739 designated bird areas, apart from biodiversity hotspots.

India’s Efforts to Counter China’s Infra Push

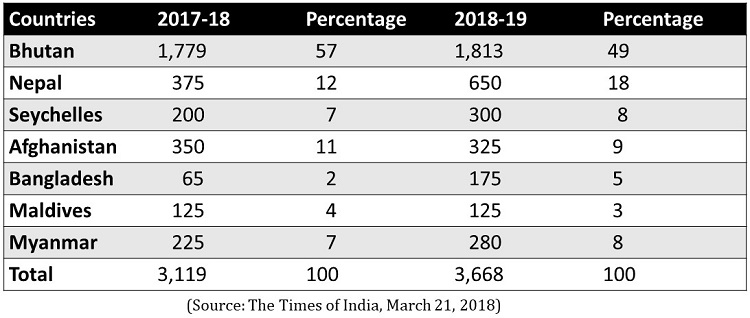

India has increased Nepal’s share in its financial aid by 73 percent from IRs. 375 crore in 2017-18 to 650 crore for the year 2018-19.30 As the following table indicates, Nepal’s share in India’s total financial aid was 12 percent in 2017-18, which stepped up to 18 percent in 2018-19. India increased aid to Nepal to counter China’s vigorous effort to build up infrastructure projects in its neighbourhood. In this regard, India’s parliamentary committee’s report clearly spelt out, “China is making serious headway in infrastructure projects in our neighbourhood. Specifying the strategy devised to counter increasing Chinese presence in our backyard, the government is committed to advancing its development partnership with [Bhutan and] Nepal, as per their priorities.”31

Table No 1: India’s Aid to Nepal

Interestingly, India took initiative for the connecting Raxaul-Kathmandu through the railway only after Nepal made an agreement with China for the construction of the railway. In fact, India hurried up for railway construction in Nepal to check the growing influence of China in Nepal.32 The Indian government has accorded priority to the construction of Raxaul-Kathmandu railway line which is estimated to cover the distance of 113 kilometres.33

The Way Forward

After six years of implementation of projects under the BRI, disputes have gradually started cropping up. It is likely that the problems on this front might aggravate in the years to come. It is also embarrassing for Beijing that some of the BRI countries have terminated their contracts with China; while the others are reassessing costs of the projects. Such developments are more common in those participating countries where there have been changes of governments. Therefore, Chinese assurance that it does not have any geopolitical goals has not proved convincing to the world community. The way it is exhibiting assertiveness in the South Asian Sea and other parts of Asian region has not been able to prove that it is benign power. It has not been able to build the level confidence that is necessary with its neighbours and global community.

Through the BRI, Beijing wants to emerge as one of the vital powers of the world. In this effort, the best bet for China is the underdeveloped parts of the world, particularly in Asia and Africa. These countries are easily trapped as they don't have such access to loans from alternative sources. Several BRI countries have taken heavy loans from China and Chinese companies as it is delivered to them rapidly without any hassles. It is a different matter that they realize the implications of heavy loans when the time comes for repayment. Some of the BRI countries are in the process of turning into satellite colony of China after they became victims of the debt trap. To get out of this trap, some of the BRI countries have made a demand for fresh loans from multilateral financial institutions. But these institutions are careful to see that its funds are not used by the debt-trapped countries to pay the loans of the BRI projects. It is at this stage that China leaves the BRI countries in a helpless situation.

In view of the experience of poor and low-income BRI countries, it appears that Nepal would fail to deal with China to pay the BRI loans as the conditions attached to it is difficult to meet. It is feared if the country would plunge into the debt trap as other countries because the scope to get adequate returns from the loans are bleak. BRI is, in fact, more important to China as it eyes on using Nepal merely as a transit country to flood its manufactured goods to the huge Indian market. Only time will show the extent to which another vital power, India and the West, could emerge as alternative source of BRI funding.

Chinese projects are not merely confined to the hills and the Himalayan region, but also to the Terai region which happens to be a sensitive zone in Nepal-India affairs. It is obvious that especially those projects that touch the Indian border through the different corridor might have strategic implications.

There is a lack of transparency in BRI projects at the global level. In Nepal too, it is not yet known if the projects under BRI would be launched as investment projects serving the rules and regulations of the government of Nepal or they would be launched through loans with certain conditions attached by China or its financial institutions. It might not be much of hesitation for a poor country like Nepal to accept projects under BRI if they come in investment form. But certainly, the country needs to be cautious if such projects come through the loans. As such, broader debates need to be invited on BRI financing modality before any negotiation for its implementation takes place.

No comments:

Post a Comment