By Nikos Chrysoloras and Birgit Jennen

Germany stuck to its stance that Europe’s economic engine will pull through its current trough without a spending jolt, countering increasingly dire warnings from the International Monetary Fund.

Europe needs to come up with emergency plans, since monetary policy has all but exhausted its arsenal and risks spread, the fund warned.

“Given elevated downside risks, contingency plans should be at the ready for implementation,” the IMF said in its Regional Economic Outlook for Europe. “A synchronized fiscal response” may be necessary, the fund said in the report, highlighting the dangers from trade protectionism, a chaotic Brexit and geopolitics.

The stark warning comes after the latest data showed that the euro-area economy is proving more resilient than anticipated, driven by robust expansion in countries such as France. Still, Germany probably went into a technical recession during the last quarter, and the labor market in the continent’s biggest economy started to deteriorate.

Germany shrugged off those concerns, with Finance Minister Olaf Scholz saying there’s no immediate need for a fiscal stimulus package to pump up the country’s stalled growth machine.

“We have all the abilities to act if there is really a crisis,” Scholz said at Bloomberg’s Future of Finance event in Frankfurt. “But there is not a crisis which we see today and which we do not expect.”

For the IMF, more trouble could lie ahead.

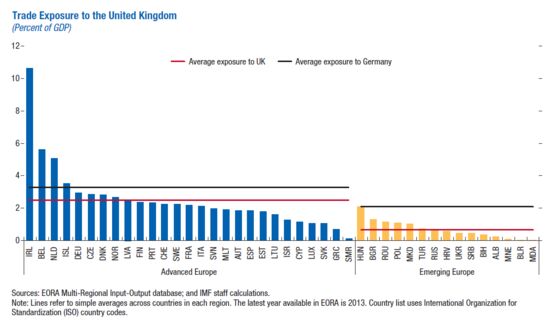

If the U.K. leaves the European Union in January without an orderly withdrawal agreement, the country’s economic output would be 3.5% lower in two years, according to the Fund’s forecast. The EU economy would be 0.5% smaller in that scenario.

Adding to Brexit uncertainty, “the weakness in trade and manufacturing could spread to other sectors -- notably services -- faster and to a greater extent than currently envisaged,” the IMF said. The report also warns about elevated asset prices in several countries -- including in real estate -- which are making banks more vulnerable to shocks, such as abrupt declines in risk appetite and tightening of financial conditions.

The IMF singled out Germany and the Netherlands among the countries which should loosen their purse strings to spur growth. Such “measured fiscal expansion” could have positive spillover effects, halting the slowdown, while at the same time reducing external imbalances.

Such calls have repeatedly fallen on deaf ears in Berlin. Germany already has a “very expansive” fiscal policy but still retains room to maneuver in the event of a genuine economic crisis, Scholz said at Bloomberg’s event on Wednesday.

Even countries with high deficits and debt should consider a “temporarily slower pace of fiscal consolidation or a temporary expansion” if negative scenarios materialize, according to the fund. Meanwhile, governments should consider “debt management options” to take advantage of ultra-low yields to improve their financing requirements in the years ahead.

Despite the side-effects of ultra loose monetary policy on asset prices, the IMF recommends that central banks maintain their accommodative stance to stem the slowdown. The report is the latest to hand ammunition to the European Central Bank, which is battling a persistent backlash against its renewed stimulus measures.

No comments:

Post a Comment