Ben Longstaff

1. Federated learning

In 2018 it was approximated that 2.5 exabytes (2,500,000,000 GB) of new data was created daily. 90% of all the data online was created in the last two years.

The solution to this is a new field of Machine Learning called Federated Learning. Instead of sending the data to the algorithm you send the algorithm to the data. You may have already experienced the benefits of Federated Learning without realizing it. When you type a message on your phone, you get three options for what the next word might be. These recommendations are generated by a Machine Learning model. Privacy laws stop Apple and Google from sending your private messages to their learning algorithms. Instead they use Federate Learning to train the model on your phone.

The benefit of user privacy comes at the cost of running the algorithm on the device. Federated learning lends itself to applications where privacy is a concern.

Medicine

Regulations on how medical data is stored and used aim to keep patients data safe. These regulations make it almost impossible to get data out of hospitals. I think we will see custom hardware on medical devices around 2023. Sending the algorithm to the hardware will bypass the regulatory compliance issues. This will unlock huge amounts of value that is currently trapped by regulations and red tape.

2. Deepfakes

Photoshop made us question the legitimacy of the photos we see online. Deepfakes is going to do the same for video. This Deepfake of Bill Hader with Tom Cruise is my favourite so far.

US senators have expressed concerns about the impact of Deepfakes on the 2020 elections to Facebook executives. I predict that we will see Deepfakes effect the 2020 presidential elections. This will resurface the publisher vs platform debate for social media companies. Registries of authentic digital assets from publishers will be created to combat fake news. By 2024 social media platforms will be required to verify content as authentic.

In many parts of the world revenge porn is illegal. Deepfake revenge porn will be much harder to prosecute as the origin will be difficult to prove. Media platforms will be treaded as publishers once the families of politicians become victims.

3. Nationalism

Globalisation was great for consumers and big businesses but not so good for employees and small businesses.

Local economies of scale result in value creation.

Global economies of scale result in value extraction.

Free trade agreements and consumer demand for cheap products created a race to the bottom, local economies of scale couldn’t compete with mega corporations. The rise of nationalism around the world is a backlash to globalisation’s effect on small business.

Right now the world is on fire

The list below is active protests.

In France the yellow vest protests where sparked by fuel prices. They have been going for 1 year, 1 month and 12 days and counting.

The Hong Kong protests have been going for 204 days.

Protests in Lebanon have been going for two months calling for the resignation of the current Prime Minister.

Iraq has had 511 deaths and 21,000 injuries in the 2 months, 3 weeks and 2 days of protests in response to unemployment, low wages and corruption.

5% of Chile’s population took part in a protest sparked by an increase in public transport fees, the protests are 77 days in and still going.

Farmers in the Netherlands have been protesting for 90 days in response to new legislation on nitrogen emissions.

Haiti has had ongoing protests for 1 year, 5 months and 12 days in response to increased fuel prices.

Colombia has had 38 days of protests sparked by rumours of pension cuts.

40,000 farmers on tractors blocked Berlin to protest changes to agriculture policy.

Iran is 45 days into protests sparked by increases in fuel prices

Algeria is 317 days into protests again the current regime

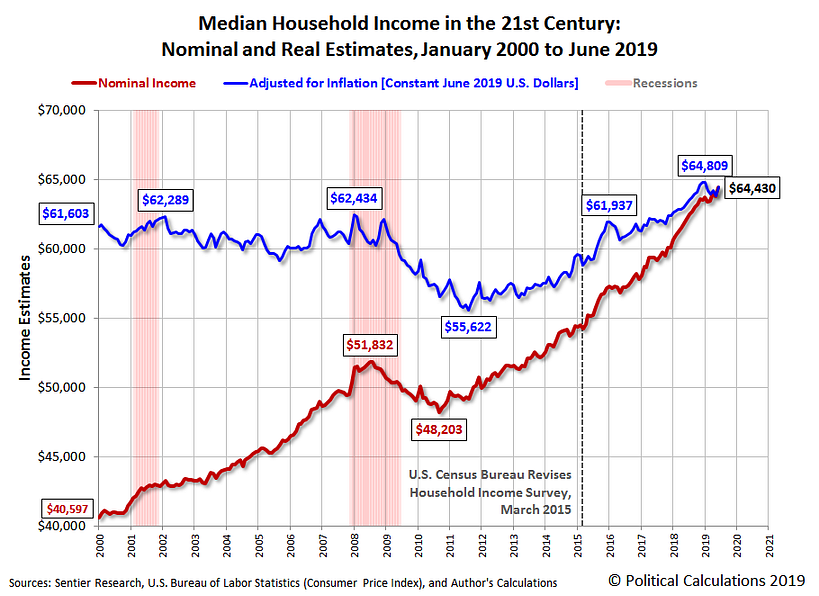

America is the shining beacon for capitalism. Things haven’t improved much for the average American once you adjust for inflation.

People are scared and want their leaders to protect their jobs from foreign competition.

My prediction is that the UK will leave the EU, followed by France then Germany. At which point the EU will dissolve. Citizens will pressure their leaders for protection against free trade.

China will continue to eat the world, slowly but methodically. This will feed the rise of nationalism around the world.

I think that China and Russia will seperate from the internet and establish their own DNS. The splinternet will take form in response to nationalism.

4. eSport and entertainment

eSports will become a bigger industry than most regular sports.

“we are basketball, we are the NBA, we are ESPN a little bit” — Netflix Explained eSports

In traditional sports you might hear briefly from the team captain after the game. In eSports the whole team is streaming regularly. This makes the storyline in eSports easier to access for viewers. Game companies are continually tweak the rules of the game to make it more entertaining.

The extent to which the industry has matured is not obvious in mainstream media yet. The change is coming, just follow the money

Wimbledon singles winner prize $3M USD

Fortnite world cup finals winner prize $3M USD

Make no mistake, eSports is big business.

Streaming and Content Creation

The top 4 cable companies in the US have 80% of the cable tv market. Cable companies have been able to dictate to content producers what they did with their content. It’s hard for content producers to walk away from a multi year contract that guarantees profitability.

Many content distributors have become content producers to justify being a subscription. This has lead to Netflix, Hulu, Youtube and Amazon original series.

“We compete with (and lose to) Fortnite more than HBO,” — Netflix shareholder letter

This trend will continue and result is less cookie cutter content.

Storylines — Don’t tell me how to consume my content

In 2013 Netflix released the entire season of House of Cards at once. No need to reintroduce plot points or characters, writers can assume you are up to date. Not having to catch the viewer up each episode opened up room for more complex story lines. Marvel took this further with cross movie character development.

At the moment we consume stories through the story arc that is available. The next evolution will be to recut series so that you can rewatch it through the story arc of each character. Imagine watching Game of Thrones recut to only show the series from Tyrion Lannister’s perspective.

Deep fakes may take fan fiction to a new level. Letting fans contribute to the universe of their favourite franchise.

Fan Engagement

Twitch streamers are the buskers of eSports. Twitter is a way for celebrities to interact with their fans. It is difficult for fans to get the attention of celebrities though.

Interactions on Twitter are often delayed. Twitch offers real time interaction with this new breed of celebrity.

Streamers are selling access to being apart of their community. Watching a stream is a lot like going to a club. You can spend the evening with people ignoring you, or if you want to be a VIP, digital bottle service is available.

I suspect that there will be a glass ceiling to subscribers on Twitch. More people in the stream means less interaction with the celebrity.

5. Blockchain and Bitcoin

Blockchain is a feature, trust is the benefit.

There is a lot of talk about DeFi (Decentralized Finance) being the thing that brings blockchain mainstream. Key management is still hard. I believe adoption of blockchain will mostly occur behind the scenes in enterprise supply chains.

Retrofitting existing processes to be backed by blockchain is hard. It requires buy in from multiple stake holders and getting trusted data from offchain to be onchain.

Decentralised apps will continue to get adoption in gambling, gaming and trading. Key management, custody and recovery need to be solved for mainstream adoption.

Not your keys, not your crypto

Speculation

Every 210,000 blocks in Bitcoin the mining reward is cut in half, this is called the halvening. Mid 2020 the third halvening will occur, a lot of people are predicting it will cause another bull run. John McAfee is super confident about this. I hope they are right.

As a currency Bitcoin failed, as a store of value it succeeded.

6. Self driving cars

Adoption will be slow due to regulations, eventually capitalism will win out.

Transportation costs will go towards zero.

Netscape provided the platform for Amazon, Google, and Facebook, fleets of self driving cars will become a new platform to build on. When the cost of delivery goes to zero it will open up new business models that don’t make sense today, things like:

Mobile food preparation, so your pizza finishes cooking as it arrives.

Predictive shipping, sending products out before the orders come in.

Mobile offices for working commutes.

Home showrooms for the “do it for me generation”, making returns as convenient as delivery.

On demand access to low utilisation items.

Just in time manufacturing principles will give rise to just in time consumption.

7. Welfare

Countries like Australia will have their welfare system become strained. The number of people needing support is increasing faster than the number of people paying tax to provide that support.

All the figures below are either from the Australian Tax Office or Australian Bureau of Statistics.

13,123,478 people paid tax in 2007–2008

13,508,101 people paid tax in 2015–2016

So an extra 384,623 people paid tax, but, the population increased by 2,783,435 over the same time period.

Put another way Australia’s tax paying population increased by 2.93% while the overall population increased by 13.24%.

Australia has a program called Newstart to help unemployed people while they are looking for work. The government is often criticised due to Newstart not receiving a meaningful increase since the 90s.

In 2009 there were 443,918 people on Newstart

In 2014 there were 695,907 people on Newstart

Put another way the number of people on Newstart has increased by 56% over a 5 year period. As the population grows but industry doesn’t keep pace this is going to make it harder to balance the budget each year.

This is the trend that keeps me awake at night.

8. Cashless and Sovereign Currencies

The International Monetary Fund published an article titled “Cashing In: How to Make Negative Interest Rates Work”

In a cashless world, there would be no lower bound on interest rates. A central bank could reduce the policy rate from, say, 2 percent to minus 4 percent to counter a severe recession. The interest rate cut would transmit to bank deposits, loans, and bonds. Without cash, depositors would have to pay the negative interest rate to keep their money with the bank, making consumption and investment more attractive. This would jolt lending, boost demand, and stimulate the economy.

When cash is available, however, cutting rates significantly into negative territory becomes impossible. Cash has the same purchasing power as bank deposits, but at zero nominal interest. Moreover, it can be obtained in unlimited quantities in exchange for bank money. Therefore, instead of paying negative interest, one can simply hold cash at zero interest. Cash is a free option on zero interest, and acts as an interest rate floor. — International Monetary Fund

Japan, Sweden, Denmark, Switzerland and the European Central Bank all currently have negative interest rates.

Neobanks

This new breed of online only banks will eat traditional banks for breakfast when competing for young customers. Older customers will still want the security and comfort that comes with being able to walk into a branch and talk with a person face to face.

Sovereign Currencies vs Corporate Currencies

The following central banks are actively working on sovereign digital currencies.

Bank of Thailand

Bank of the Marshall Islands

Central Bank of Curacao and Sint Maarten

Central Bank of the Bahamas

Central Bank of the Republic of Turkey

Central Bank of Iran

Central Bank of Tunisia

Central Bank of Uruguay

Central Bank of Venezuela

Central Bank of West African States — Senegal

Eastern Caribbean Central Bank

European Central Bank

Monetary Authority of Singapore

National Bank of Cambodia

People’s Bank of China

Saudi Arabian Monetary Authority

Sveriges Riksbank

United Arab Emirates Central Bank

Traditionally regulators have limited what industries banks have been able to expand into. Banks have an unfair advantage, they can see who a business’s best customers are. Corporate currencies have the potential to do the same.

Stable coins are going to do weird things to privacy once people start building meta data layers about the address owners.

Libra is the first corporate currency to worry governments due to the distribution channels of its members. Libra would initially be backed by a basket of fiat currencies, however the governance is controlled by a group of corporations. What stops Libra from decoupling from fiat in the same way the US dollar decoupled from gold?

Challenging Sovereignty

The challenge to sovereignty will be proportionate to the utility offered and the rate of adoption. At the moment most nation states have a central bank that operates under its jurisdiction, the central bank sets the monetary policy.

If Libra operates at scale it could affect the ability of a nation state to regulate its economy. The decision makers may not operate under the jurisdiction of the nation state.

Bitcoin is like gold, its a store of value because its supply is finite and everyone agrees it has value.

Ethereum is like oil, its value is derived through people using it executing smart contracts.

Other tokens are like taxi medallions that give people a right to do work.

None of these projects affect a nation states ability to control their economy. Crypto as a whole has maybe reached 50 million people to date. Facebook has a direct channel to 2 billion people. For this reason I think that the US government will slow the development of Libra.

9. Search Reimagined — Where I hope to be in 2029

I believe search needs to be reimagined.

Better results come from better data and more of it. But do you really want a for profit company to have all your data? I don’t.

Federated Learning is going to provide the tools to unlock the value in our local data. Instead of getting the top 10 search results back from Google, your local data will get augmented with the top 10,000 realtime results. The aggregated results will then be reordered based on your personal data. Your browsing history and transaction data will be used to train the reranking algorithms.

We live in a state of anxiety without a path to financial independence. The path to creating wealth from last century no longer applies.

The path to reimagining search begins with helping people to understand their money. The first step starts with delivering insights into the stories that data can tell.

No comments:

Post a Comment