“The announcement this week that China has invited Australia to send a team of medical research scientists and public health experts to Wuhan to help document the origins of the Covid-19 pandemic is being widely welcomed. The Aussies will join scientists from Oxford and Cambridge Universities, already working on site with their colleagues from Tsinghua University and other top Chinese scientific institutions, to sequence the latest mutations of the virus… The move is a follow-up to the joint program announced earlier this month to fully combine American and Chinese programs for vaccine research and production.

“The announcement this week that China has invited Australia to send a team of medical research scientists and public health experts to Wuhan to help document the origins of the Covid-19 pandemic is being widely welcomed. The Aussies will join scientists from Oxford and Cambridge Universities, already working on site with their colleagues from Tsinghua University and other top Chinese scientific institutions, to sequence the latest mutations of the virus… The move is a follow-up to the joint program announced earlier this month to fully combine American and Chinese programs for vaccine research and production.

“In related news, U.S. President Biden announced that all charges against Huawei, China’s leading international company, will be dropped in exchange for a pledge of full technology sharing. Huawei CFO Meng Wanzhou was welcomed in New York to ring the opening bell as Huawei shares began trading on Nasdaq, surging more than 15% in the first day on news of a major 5G order from Vodafone in the UK.

“Simultaneously, Beijing’s decision to fully rescind the new security laws for Hong Kong helped boost the Hang Sent index by 22%, and brought applause from financial markets everywhere. New polls showed public approval of China soaring in Europe and the United States. China’s pending elevation to membership in the G7 has met with universal support from world leaders. Xi Jinping is seen as a shoo-in for the Nobel Peace Prize.…” [fade to grey]

*The Counterfactual News Network

(How different it all might have been.)

Beijing’s Double Strategy

Back in the real world, China is trying to master two games at the same time. On the one hand, they are learning how to be a geopolitical superpower. On the other, they are building a modern economic and financial system. These are both huge decades-long projects, running in parallel. The strategies obviously interact, and not always happily. In particular, the economic game-plan is vulnerable to inept political moves.

For several decades, starting with the reforms led by Deng Xiaoping in the 1980s and 1990s, Beijing’s foreign policy was careful. This facilitated China’s tremendous economic growth. Encouraged, the West engaged, and made China its (junior) partner in a vast global division of labor — China as “workshop of the world” and all that – and channeled large scale trade and investment into China. Ten years ago most American leaders were inclined to support China’s emergence as a new “major player” – even an incipient superpower, a rival in some ways, but an unthreatening one. It was assumed that economics would prevail over traditional ideological differences. Lion would lay down with lamb, under the aegis of Free Trade. Liberal democracy and free market doctrines would spread a self-reinforcing prosperity. “They” would become like “us.” History would truly end.

This quiescence is what has come to an end under Xi Jinping. With the new CEO’s accession to power in 2012, the tone began to change. Xi began to experiment with a more active approach to the geopolitical game, seeming to ignore the nuances of the more fragile economic game. Signs of economic dysfunction began slowly to accumulate.

At first, these seemed (from the American perspective) remote, internal to China — like the Chinese stock market disturbances of 2015 (American investors couldn’t play there anyway); obscure in significance, like the recurrent mentions of “capital flight” (whatever that means exactly); or “symbolic”/pointless-seeming stunts like building artificial islands to claim some empty stretches of saltwater (which didn’t seem to have any economic implications beyond a few dubious oil-patch prospects – and the world has plenty of oil…).

But it was a trend, and a style. In the past few years, Chinese miscalculations have become more frequent, more obvious, and more serious. These have ranged from the clumsy handling of the Huawei affair to the disproportionate counter-attacks aimed at Australia (including evidently an all-out cyber-war) after the Aussies presumed to request an audit of the Covid-19 matter. Then there was the inexplicable decision to pick a border fight with India, which will probably cost China an enormous loss of economic opportunity (in the country that will soon have world’s largest population of rising consumers).

But the crowning blunder of the Xi Jinping era is the move against Hong Kong.

The Hong Kong Fallout

Beijing’s looming emasculation of Hong Kong’s legal and economic system is the headline misjudgment of the year, maybe of the decade. It is an egregious human rights offense, which will unite the West against China. In the U.S. it has even brought Republicans and Democrats together, in unanimity against the Chinese takeover. Public opinion is hardening.

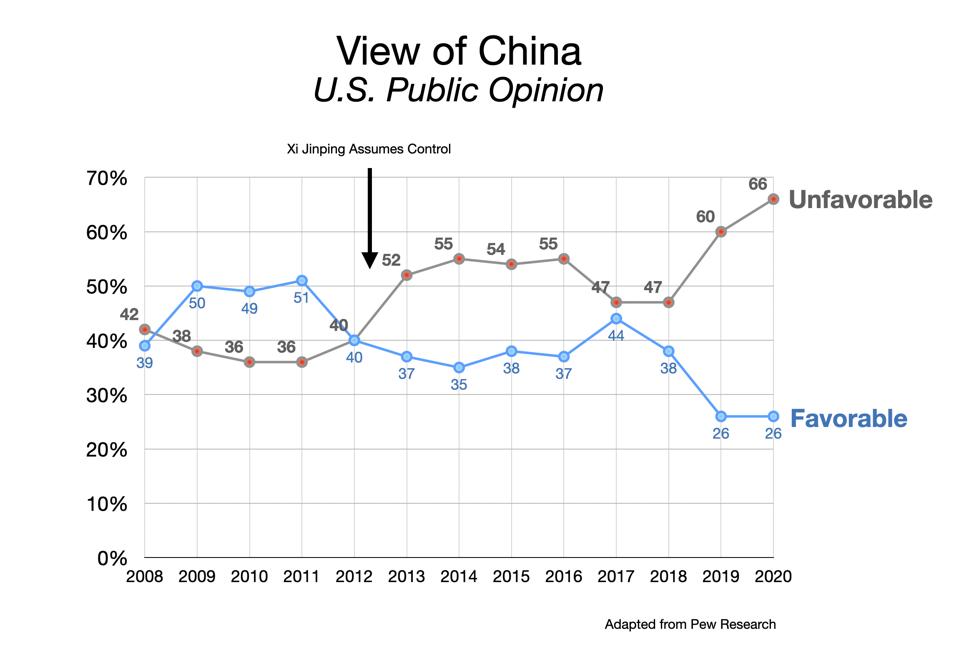

Public Attitudes towards China CHART BY AUTHOR

Majorities in major Western countries now see China as a “malign force in the world.” (Only 3% of Britons, 4% of Germans and 5% of the French and Americans identified China as a force for good. Xi’s personal ratings have gone to 71% “No Confidence” – 21 points more to the negative in recent months.)

The Real Damage is Financial

The political costs for China are alarming. It is likely that Xi doesn’t care much about Western public opinion. He should.

But it is the financial consequences of the Hong Kong move that are the most damaging – to China – now, and over the long term.

Start with the fact that today Hong Kong is the world’s Number 3 global financial center (after New York and London). This status in itself is an asset of incalculable value, which no city in the European Union can claim. Financial pre-eminence takes centuries to achieve. It is based on network-effects like market depth and liquidity. People want to trade where the most other people trade, and the best prices obtain. People want to trade with people they know, and through institutions they can trust. And almost everything in finance rests on long-accumulated habits of trust, confidence in the fairness of the system, the security of contracts, and the predictable behavior of one’s counterparties. Trust cannot simply be mandated by public officials as part of the five-year plan. Xi’s strategic blunder will kill this trust, and impair this priceless Hong Kong asset, swiftly and irreparably.

Hong Kong is Critical to the Status of the Chinese Currency

Hong Kong manages over 70% of the international trade volume in Chinese currency – which makes it the cornerstone for any plan to elevate the yuan to true hard-currency/reserve-currency status, competitive with the Dollar or the Euro. China cannot succeed at either the geopolitical or the economic game without eventually establishing a strong currency. It is a strategic imperative. But so far it has been a struggle:

“China’s years-long ambition of internationalizing the yuan has progressed slowly, with only 2 percent of all global transactions conducted in Chinese currency.”

In fact, the program is slipping backwards, as underscored in a report by Citi from 2018:

“The currency has a diminishing presence offshore, is used less as a medium in which to denominate debt contracts, and its role as a medium for settling trade contracts has fallen… International bond issuance in renminbi has declined since the end of 2014: from around $25 billion per quarter to less than $8 billion recently. This coincides with a decline in the renminbi’s use as a settlement currency for China’s international trade: having settled almost 30% of China’s trade in late 2015, only 13% of China’s trade is now settled in renminbi.”

China dearly wants to position its currency as an alternative to the dollar. Cutting off the Hong Kong channel will put an end to these ambitions. The dismantling of the Hong Kong financial system will likely drive down the value of the yuan and threaten the Hong Kong dollar with inanition, if not extinction.

Hong Kong is the U.S. Dollar Pipeline to Mainland China

As to the dollar…

Quite aside from this “prestige” goal of displacing the greenback, the takeover of Hong Kong will have a damaging effect on China’s own financial operations, which are still deeply dependent on dollar financing. Hong Kong is the key channel for funneling dollars into and out of mainland China.

How important is this?

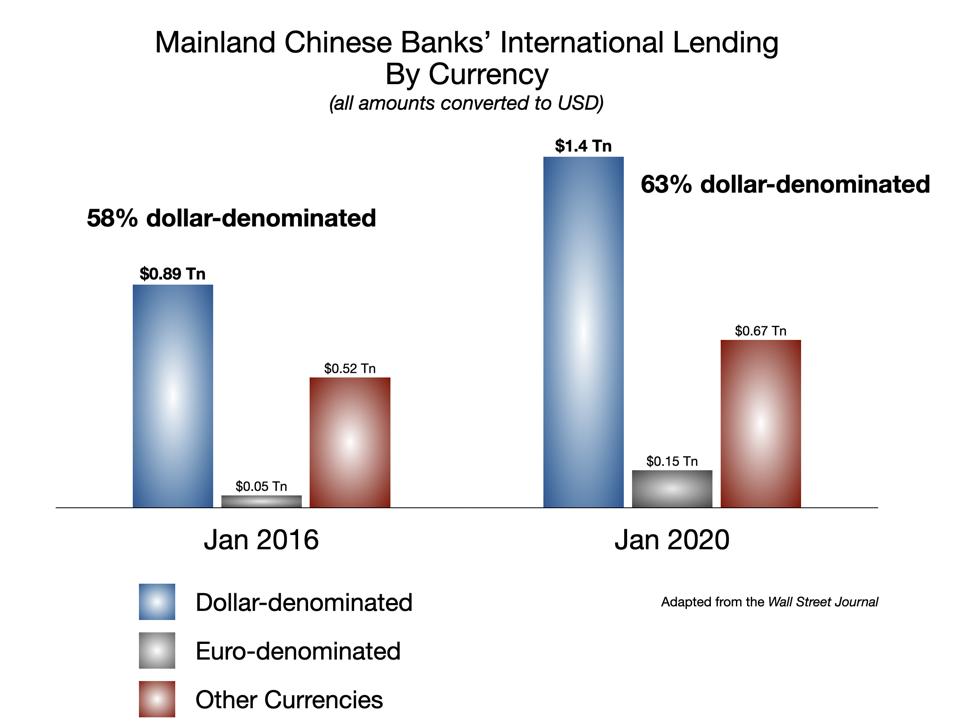

Mainland banks’ international lending is largely denominated in dollars, and passes through Hong Kong, which has been described as “China’s lifeline.”

“China’s banks do much of their international business, mostly conducted in U.S. dollars, from Hong Kong. With Shanghai [the mainland’s market financial center] inside China’s walled garden of capital controls, there is no obvious replacement….”

China Banks' Int'l Lending by Currency Denomination CHART BY AUTHOR

Hong Kong Facilitates Financing for China’s Belt and Road Initiative

Even Xi Jinping’s flagship “Belt and Road” Initiative (BRI), designed to project China’s political and economic influence externally, runs on dollars. Embarrassing, but unavoidable. The Citi report states:

“Since the renminbi is not a fully functioning global currency, the BRI largely requires dollar-denominated financial resources to fulfill its objectives: it is significant that the major financing announcements made to kick-start the BRI in 2014 — recapitalizations of the China Development Bank, China Export-Import Bank, as well as new capital for Silk Road Fund, the AIIB, and the New Development Bank — were all made in dollars. And since China lacks a [reliable] supply of dollars, it therefore lacks [the] capacity to meet its goals….”

“The declining use of the Renminbi as a financing currency for China’s trade is a constraint for BRI.”

The U.S. dollars that BRI needs come in mostly through Hong Kong. BRI needs a functional Hong Kong market.

The Hong Kong Autonomy Act

The takeover will lead to sanctions by the U.S. that will cut off this flow.

“The primacy of the dollar and the pivotal role of the U.S. banking system mean China’s banks could be instantly hobbled in the event of U.S. sanctions. … Introducing the Hong Kong Autonomy Act this week, Sen. Patrick J. Toomey (R-Pa.), a member of the Banking Committee, explicitly said he crafted legislation that holds leverage over Chinese banks and hence Beijing…. The Chinese economy “for the foreseeable future will be dependent on U.S. dollar transactions,” Toomey said. “So I think these sanctions we’ve proposed are likely to be very, very powerful for a very long time.”

The Act passed both the House and Senate unanimously.

Hong Kong and Dollar-Denominated Corporate Debt

It is not just the banks that are vulnerable to the loss of the Hong Kong channel. Chinese companies need dollars to operate, to finance their own growth, to support their exports, to finance their customers’ purchases. They issue a lot of dollar-denominated bonds. Managing and refinancing this debt requires continued access to the dollar market, which has been the purview of the Hong Kong financial center. Things are already tight.

“China Inc. now faces a shortage of dollars. Chinese companies are looking at $120 billion of debt repayments this year on their U.S. dollar denominated debt. Real estate developers and industrial companies make up three-quarters of the outstanding $233 billion of junk-rated bonds. There’s another $563 billion of higher-rated debt. The question isn’t just whether they’ll be able to pay their debt. It’s worth wondering how they can access the needed dollars — and at what cost.”

Hong Kong & “FDI”

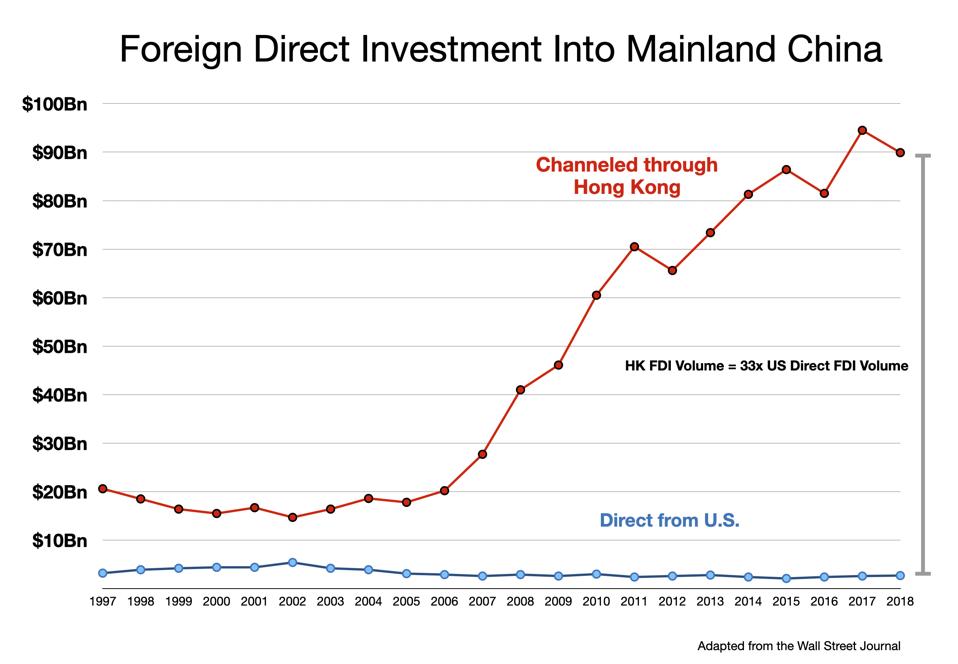

Hong Kong is the gateway for foreign investment coming into China:

“The city remains central to China’s economy [this article was written in 2019, before the move against Hong Kong]. It is its main interface with global capital markets, the conduit for most foreign direct investment in China….Around 60% of foreign direct investment into China flows through Hong Kong… “

“Investors like funneling cash into China through Hong Kong because the city’s legal and regulatory system—combined with the substantial Hong Kong footprint of wealthy Chinese and Chinese companies—means investors have real recourse in the event of disputes. Singapore and Shanghai simply can’t offer the same combination of rule of law, open capital account, stable currency…”

“If investors conclude Hong Kong is no longer a reliable base for jumping into China, foreign investment into the nation as a whole may take a substantial, permanent hit.”

FDI: US Direct vs Through Hong Kong Channel CHART BY AUTHOR

Overall, 65% of inbound FDI and 61% of outbound FDI go through the Hong Kong channel.

Hong Kong Dominates the IPO Market for Chinese Companies

Chinese companies have raised over $350 Bn in Initial Public Offerings (IPO’s) in Hong Kong since 1997– about the same amount that Chinese companies have raised in all other major exchanges combined – and about half as much as all the IPO funding raised on the New York Stock Exchange. Hong Kong has been a vital part of China’s entrepreneurial economy.

Hong Kong as a Preferred Asian Hub for Western Financial Firms

Hong Kong is a preferred seat for Western financial firms doing business with China. This too is threatened by the crackdown and looming restrictions on the press and free expression.

Finance runs on information. Without access to high quality financial, political, and economic information, and without the freedom to publish and exchange uncensored opinions, forecasts, analyses and recommendations, a financial market cannot function. Hong Kong has built its financial status on (among other things) a free press. The city is the regional hub for many Western news organizations, including CNN, Bloomberg, and the Financial Times. China’s repressive move compromises the quality of the information available to investors and markets in Hong Kong. Beijing has already expelled reporters from the Times, the Wall Street Journal and the Washington Post, and has extended the ban to include Hong Kong. Censorship is intensifying. The New York Times has decided to shift its Asian operations to Korea. Others are “reassessing” and likely to follow. Even the Hong Kong Free Press has said it will probably exit Hong Kong.

Social media companies and Internet providers will go next. Facebook, Microsoft and Google are beginning to pull back. Virtual Private Networks (VPNs) — which allow Chinese individuals free access to the outside world — are suspending operations.

“The VPN providers said they felt it was safer to close down their servers and avoid routing online traffic to Hong Kong.”

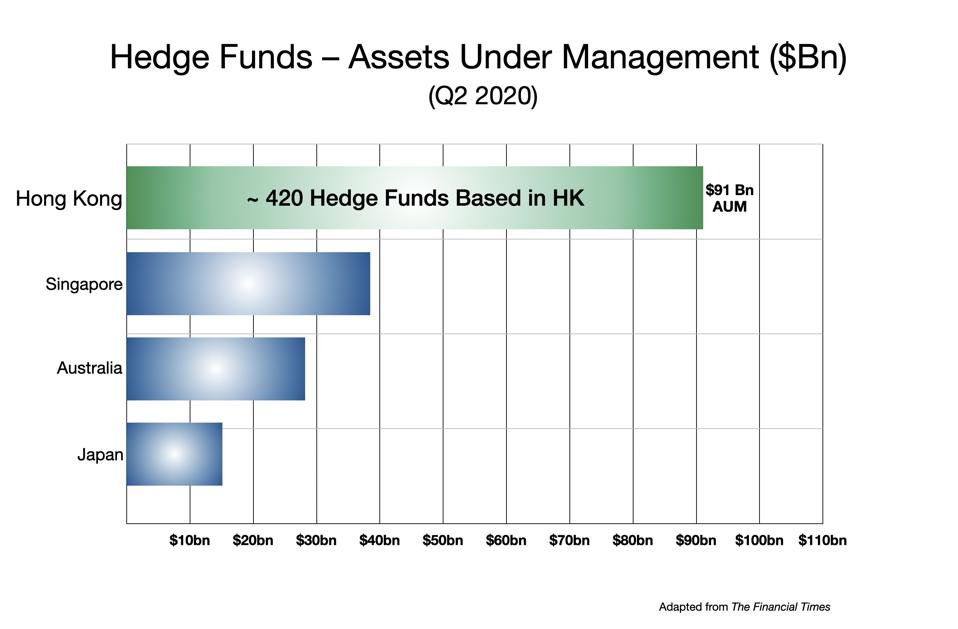

The loss of free information flow will drive investors out. Hong Kong is the center for the hedge fund industry in Asia, with more assets under management than Singapore, Japan and Australia combined. Many of these firms are now planning to decamp to Tokyo or Singapore.

“We rely on objective information, objective reporting,” one fund manager said, adding that if Hong Kong’s free press were to be cowed by the new law, “propaganda comes into play in investment decisions…”

As another fund manager put it, “Hong Kong as we know it is dead… The hedge fund community will move on…”

Hedge Funds in Hong Kong vs Other Asian Centers CHART BY AUTHOR

Hedge funds are the jackrabbits of the financial world, light on their feet and ready to move quickly. The big banks and asset managers are watching closely. “Increasingly these concerns are seeping into business decisions,” said one experienced investor. “What is just a trickle could become a flood of capital out of Hong Kong.”

(In fact, almost 30% of Hong Kong business leaders polled say they are already planning to relocate their businesses out of the territory, and almost 40% are thinking about leaving personally.)

Xi’s Hong Kong move is a financial disaster for China. If the country really were a corporation (“China Inc.”), the lengthening list of the CEO’s unforced strategic errors might now prompt the Board of Directors to consider a change. Xi Jinping has shown himself to be a genius at consolidating power inside the corrupt party system in China. But he doesn’t seem to know how to get what he wants internationally – respect, enduring influence, parity. He seems in particular not to have a grasp of how the financial system works, and has terribly misjudged the consequences of clamping down on Hong Kong.

It’s a pity, because it won’t be reversible, even after Xi departs. Many of China’s other recent missteps could potentially be rectified. The dispute with Australia could be settled with adept diplomacy. India, with diplomacy and some largesse. Huawei could be saved with a change of tone, a few conciliatory promises from the company and the government, and perhaps some “firewalls” to seal off the company from the state security apparatus. But once the financial magic of Hong Kong — built up over two centuries – is gone, it will never return. Look for it instead in Singapore, perhaps.

No comments:

Post a Comment