by Brad W. Setser

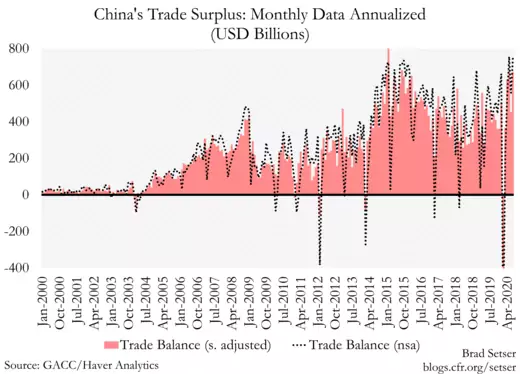

On an annualized basis, China’s trade surplus in July was around $700 billion. That’s big.

In a typical year, July is one of those months where seasonality neither increases nor reduces China’s surplus in a predictable way (the seasonal lows are in early q1, the peak is in q4). China’s goods surplus in July was up something like $20b y/y (over $200b at an annualized rate), which if sustained implies a significant rise in China's trade and current account surplus.*

But amid all the disruption to global trade from the unprecedented COVID-19 shock, China is emerging as a special case. Its strong export performance stands out all the more amid a generalized fall in global trade.

The euro area data shows that China’s exports to Europe are way up. And the Chinese data shows a big increase in Chinese exports to the United States in July as well (which likely will be confirmed when the U.S. data for July comes out).

One easy forecast at the start of the COVID-19 crisis was that the fall in global trade should reduce trade imbalances.

That is just math. If export and imports both fall by say 15 percent, countries that previously exported a lot will see bigger dollar falls in their exports than in their imports, and see their surplus shrink (and vice versa). Think about the impact of COVID-19 on trade in services. An awful lot of services trade is travel (for vacations, for education, and for business). With less travel, those countries that previously had large deficits in travel and tourism are running smaller deficits (China is the best example here) and those countries that relied on tourism for foreign exchange are generally suffering big falls in exports.

That easy forecast has basically played out for Europe. The euro area previously ran a large surplus in goods trade. With less trade, that surplus has fallen, even though Europe benefits from lower oil prices.

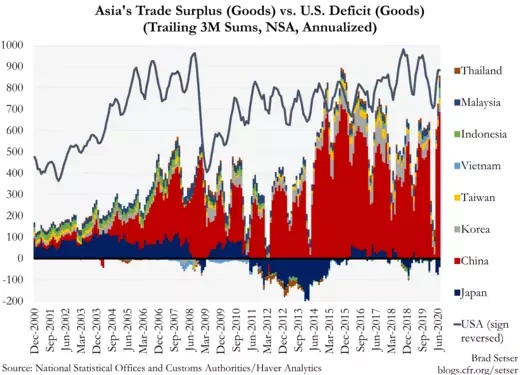

But it hasn’t played out for the United States. As Matt Klein has noted, U.S. exports are down more than imports, pushing the U.S. (non-petrol) deficit up.

Nor has it played out for China.

China’s exports have been resilient—they haven’t fallen (y/y) even though overall trade has fallen, so China’s market share of global trade is going up. But they haven’t shown superlative growth either.

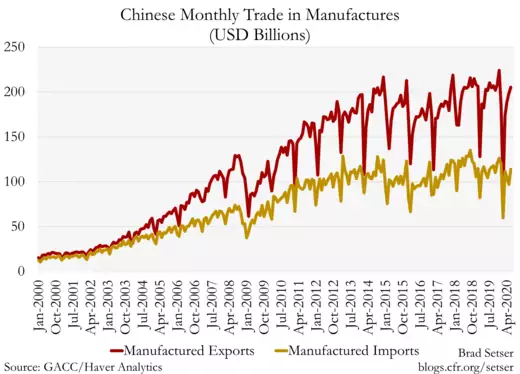

What matters in a sense is that China’s exports have held up better than its imports. That is true even if you net out commodity trade and leave out services trade—the manufacturing surplus in q2 2020 was bigger than in q2 2019. And with commodity prices down, China’s overall (goods) surplus is thus up a lot. China has provided credit and tax breaks to keep firms up and running, but it continues to be reluctant to stimulate consumption directly (see the FT's amazing Big Read on this).

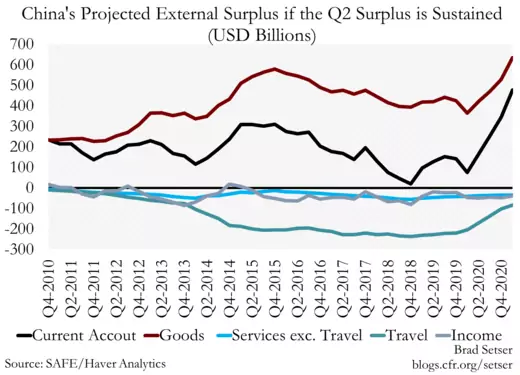

And with reduced outflows from tourism, the rise in the goods surplus is driving a big increase in China's current account surplus. There is something interesting happening on the financial side too, with large inflows into China's government bond market from investors looking for a bit of carry (that includes some central banks, reserve managers need income too). Twin surplus may be back.**

The recent uptick in the surplus is so big that it is bound to attract notice eventually. If China’s q2 balance of payments surplus is sustained for the full year (and the July data suggests it will be), China’s overall surplus will easily top $300 billion this year. On a trailing four quarter basis it will top $400 billion early next year (when q1 2020 falls out of the data). The IMF’s External Sector Report was basically out of date by the time it was published, as the IMF didn’t anticipate that China’s surplus would rise like this.

Now you can argue that the fall in commodity prices and reduction in travel just exposed a large pre-existing Chinese surplus in manufactures. And you can argue that the jump in q2 won’t last—as it reflects special COVID-19 related circumstances (though the CNY’s depreciation over the last five years is also no doubt a bit of a factor). But the fact remains that of every dollar China received on its goods exports, it now is only spending around 75 cents on imported goods. And if you just look at manufactures, for every dollar China receives it spends only about 50 cents on imports. If you export over $2 trillion of manufactures that starts to matter.***

I have come to realize over time that the both the popular and the elite debate over China tends to lag what’s in the data. Trump was talking about going after China for manipulation well after China had stopped intervening to hold its currency down (it may be back in the market, but at this stage all I have is circumstantial evidence…but that’s for another blog). Folks (at the IMF and a lot of big banks) were talking about how China was heading toward a current account deficit for several quarters after it was clear that China had hit an inflection point and its surplus was rising again. And it will take some time for the current data to sink in and for elite debate to recognize that big trade surpluses are once again in Asia…

* To an extent this is a predictable consequence of lower oil prices, as higher oil invariably reduces China’s surplus. But a lower oil import bill cannot explain the strength of euro area imports from China—or the July strength in Chinese exports to the United States.

** China’s July goods surplus was $60b, its services deficits should be modest. The services deficit in June was around $10 billion (down $10 billion y/y) and July should be similar. China attracted $20b in bond inflows in July—so absent absolutely massive private financial outflows (circa $70b a month, or close to $1 trillion at an annualized pace) China's state should be building up financial assets..

*** I have done this analysis in the trade space, not in the savings and investment space. But the reasons for the rise in China’s surplus in savings and investment terms are straightforward. China’s stimulus has been relatively modest, and much more focused on keeping producers alive than on supporting domestic consumption. China thus is drawing to a degree off the demand that the large stimulus programs enacted in the United States and Europe have created, while doing a relatively modest stimulus program of its own. And yes, this should be a matter of global concern.

No comments:

Post a Comment