By: Elizabeth Chen

Introduction

Amid the coldest winter recorded since 1966, provinces across the People’s Republic of China (PRC) struggled with the worst electrical blackouts seen in nearly a decade (OilPrice, January 8). More than a dozen cities across Zhejiang, Hunan, Jiangxi, Shaanxi, Inner Mongolia, and Guangdong provinces imposed limits on off-peak electricity usage in early December, affecting city infrastructure and factory production. Analysts expect power shortages to persist through at least mid-February (SCMP, December 23, 2020). Officials have repeatedly assured the public that residential heating would not be affected and that China’s electrical supply remained “stable” and “sufficient,” even as energy spot prices continued to rise into the new year.

In one concerning sign, coal power plants outside of Beijing restarted production at the end of the year to supply the city’s increased winter heating demands after being put into reserve in 2017. China’s capital had previously been “coal-free” for three years (Twitter, December 29, 2020). During an executive meeting of the State Council on January 8, Chinese Vice Premier Li Keqiang signaled the central government’s prioritization of energy security, declaring, “we must give priority to ensuring the people’s safety and warmth through the winter, and intensify efforts to ensure energy security and stability” (State Council, January 9).

The proximate causes for China’s electricity shortages differed across provinces. Overall, coal production stoppages and reduced imports combined with higher-than-usual industrial production and seasonal heating needs contributed to restrict the domestic coal supply and send prices skyrocketing (Caixin, December 28, 2020). Coal usually fuels more than half of China’s electricity production; this winter, China’s coal shortages have put increased pressure on its oil and natural gas supplies as well (OilPrice, January 7). A lack of adequate national gas storage facilities has failed to keep up with demand even as an increasing number of users are planned to transfer their heating needs from coal to gas in order to meet decarbonization goals set under the 13th Five Year Plan (2016-2020) (Yicai, December 24, 2020). In summary, a combination of factors have contributed to stretch China’s energy supply this winter, resulting in historic power shortages causing widespread concern. This has come just as the country has tried to establish itself as a “self-reliant” global powerhouse and undermined its narrative of successfully recovering from the ongoing COVID-19 pandemic.

A Variety of Causes

Higher Industrial Output, Seasonal Heating, and Equipment Failures

In November, China reported a startlingly high export growth of 21 percent compared to the previous year, capping off six months of continuous export growth as domestic industrial production benefited from coronavirus lockdowns elsewhere in the world (SCMP, December 7, 2020). The industry group China Electricity Council (CEC) predicted that China’s total electricity consumption would increase by 2-3 percent in 2020 even after accounting for the impact of shutdowns earlier in the year (CEC, November 11, 2020). This growth demonstrates the remarkable energy requirements necessitated by Chinese economy recovery from COVID-19, which has been spurred by government investments in so-called “new infrastructure” (新型基础, xinxing jichu) and industry (World Resources Institute, September 10, 2020). International energy analysts have observed that the recovery so far has been more “brown” than “green” and could set back national goals for becoming a carbon-neutral state by 2060.[1]

The early onset of an unusually cold winter also contributed to boost energy consumption at the end of the year, with the energy consulting group Wood Mackenzie estimating that China’s demand for thermal coal was 12 percent higher year-on-year in December (AFR, January 6). Throughout December, representatives from the National Development and Reform Commission (NDRC) repeatedly attributed the winter surge in electricity demand to the severe cold weather and high industrial growth (Xinhua: December 16, 2020; December 21, 2020).

Power shortages in southern provinces such as Hunan and Jiangxi followed record high year-on-year monthly industrial output increases of 7.4 and 7.9 percent, respectively, which overloaded local grid capacities. In Hunan, supply was also constricted by the recent shut down of two coal power plants which suffered equipment failures (The Paper, December 21, 2020). Production by hydropower plants was impacted by summer flooding and winter icing, further restricting the province’s electricity supply (China Brief, July 29, 2020; Straits Times, December 24, 2020). In Guangdong province, equipment failures at local power plants reportedly affected electricity and water supplies, forcing factories in major industrial cities such as Shenzhen, Zhuhai and Dongguan to scale back production (RFA, December 21, 2020; Power Magazine, December 24, 2020).

In Zhejiang province, power rationing in early December was imposed due to artificial constraints. Multiple city governments instructed public departments to limit electricity use in order to meet annual carbon emissions targets aimed at limiting energy use and improving energy efficiency (Sixth Tone, December 15, 2020). Following rebuke from the central government, provincial authorities walked back restrictions on power usage. A spokesperson from the NDRC took pains to underscore the correction, saying, “There is no shortage of power supply in Zhejiang” (Caixin, December 28, 2020).

Mining Production Shortages and Systemic National Supply Problems

Although China has announced ambitious goals to become a carbon-neutral country by 2060, it currently relies on coal for the majority of its energy consumption (China Power, August 26, 2020). A renewed focus on the need to ensure energy security amid increasing global tensions (most notably with Australia) will likely also drive China to increase its reliance on coal in the near term (see [1]; IEA, June 2020).

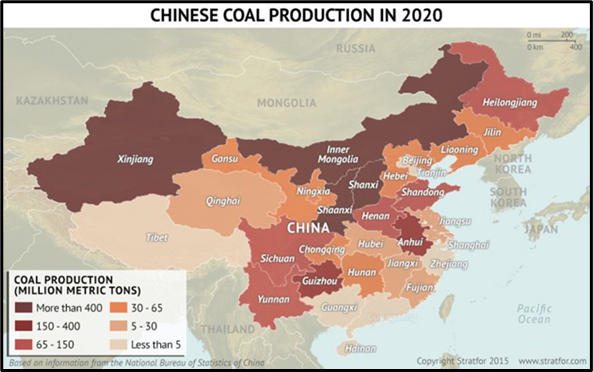

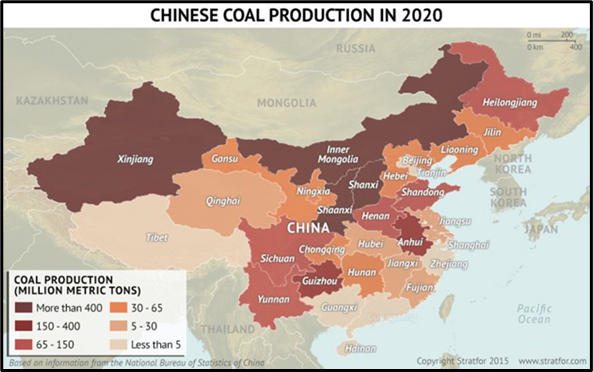

Domestic coal mines had their operations impacted by the pandemic and were ill-equipped to deal with the surge in energy demand (Yicai, December 15, 2020). Chinese media reported that some mines hit their annual production caps by the end of October, even as demand for coal continued to rise (Futures Daily, December 24, 2020). Following a series of high-profile mining accidents and anti-corruption probes, national authorities moved to tighten scrutiny over local mining operations and slowed down production (Bloomberg, December 10, 2020; SCMP, December 23, 2020). After the NDRC’s intervention to lift national targets for coal production in December, daily output of coal reportedly rose by 16 percent over the year’s average production levels (SCMP, January 5).[2] The map shows relative densities of coal production across China’s provinces, based on extrapolation from 2015 data (Image source: Stratfor).

The map shows relative densities of coal production across China’s provinces, based on extrapolation from 2015 data (Image source: Stratfor).

The map shows relative densities of coal production across China’s provinces, based on extrapolation from 2015 data (Image source: Stratfor).

The map shows relative densities of coal production across China’s provinces, based on extrapolation from 2015 data (Image source: Stratfor).While China’s coal industry typically suffers from an overcapacity problem, its eastern and southern industrial base is comparatively undersupplied. The major coal-producing western provinces of Shanxi, Shaanxi, and Inner Mongolia should have been able to produce enough to avoid power shortages nationwide. But the aforementioned supply shortages this year were compounded by China’s underdeveloped national electricity transmission systems (Philip Andrews-Speed, December 24, 2020).

Impact of Australian Coal Bans

In November, China reportedly banned Australian coal imports after months of informal import quota restrictions, affecting more than $540 million in coal shipments stuck off the coast of China since October (Sydney Morning Herald, December 14, 2020). While foreign media reports have frequently tied China’s ban on Australian coal to ongoing bilateral tensions, Bloomberg has reported that China’s restrictions on coal imports could also have been due to domestic lobbying.[3] Officials from less developed western provinces such as Shanxi, Shaanxi, Inner Mongolia and Xinjiang have long argued that China’s domestic coal industry plays a “foundational role” in building energy security and stabilizing power supplies. Their views have gained support as China has grown increasingly isolated this past year.

In combination with continuing coal export restrictions from Mongolia due to Covid-19, the Australian ban caused Chinese coal imports to fall by almost 50 percent in November, representing a seven-month decline (China Brief, November 12, 2020; Caixin, December 15, 2020). Chinese officials have repeatedly denied the impact of the Australian bans on the winter power outages, and analysts have observed that Australian coal in previous years made up less than 7 percent of China’s domestic coal supply—and so should have little bearing on the current shortages (Global Times, December 16, 2020; SCMP, December 23, 2020). But it is difficult to believe that there is no connection between the two (News.com.au, January 10).

Conclusion

A white paper titled “Energy in China’s New Era” published on December 21 underscored China’s continued prioritization of “developing high-quality energy in the new era” and deepening the green reform of China’s energy system (SCIO, December 21, 2020). But even as the central government has moved forward with the February launch of a long-awaited emissions trading scheme (ETS) to curb carbon production, it is still grappling with the basic tasks of ensuring energy security (SP Global, January 6) and keeping spot prices for coal, oil, and gas down.

In response to the December power shortages, the NDRC increased coal and gas production quotas, while the NEA ordered state power grids to optimize operating procedures and increase supply (Gov.cn, January 8; China Daily, December 19, 2020). The NDRC also reportedly gave power plants approval to import coal “without clearance restrictions (except for Australia)” in mid-December in an apparent bid to stabilize prices (Twitter, December 12, 2020; SCMP, December 16, 2020). Given that China’s power consumption growth is expected to hit a three-year high in 2021, China’s leadership will struggle to prioritize the stabilization of electricity supplies for industrial production and heating amid an unusually severe winter, and its efforts are likely to come into direct conflict with competing political priorities to reduce foreign energy dependence while simultaneously achieving ambitious decarbonization goals (SX Coal, December 22, 2020).

Elizabeth Chen is the editor of China Brief. For any comments, queries, or submissions, feel free to reach out to her at: cbeditor@jamestown.org.

No comments:

Post a Comment