IAIN MORRIS

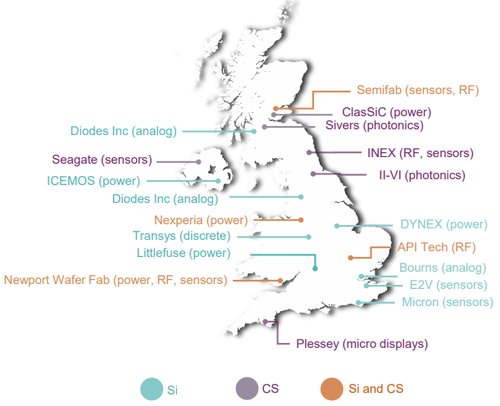

When it comes to chip shops, the UK looks spoilt for choice. Some 19 "fabs" that produce semiconductors of one variety or another are sprinkled across the land, from Glenrothes in Scotland to Plymouth in the southwest.

It is even better served by designers of high-end silicon chips used in the most sophisticated gadgets. "We have the second-highest number of design companies outside the US," says Andy Sellars, the strategic development director at the Compound Semiconductor Applications Catapult, a not-for-profit research and technology association that advises industry and government on semiconductor strategy.

Cambridge-based Arm, which designs processors used in most of the world's smartphones, is perhaps the UK's shiniest semiconductor asset. But other design jewels include Imagination Technologies, XMOS and Graphcore. Based in Bristol, the latter is working on what Sellars describes as the world's most complex microprocessor. "It is an AI microprocessor with 59 billion transistors," he says. "The chip in your phone has about 2 billion, and so this is about 30 times the complexity."

Notes: Si means silicon; CS means compound semiconductor.

(Source: CSA Catapult)

Yet there is a big gap. None of the UK's fabs has the ability to make the most advanced silicon chips needed by the telecom, automotive and other critical sectors. For these, its economy is heavily dependent on Asian manufacturers. What's more, most of the cutting-edge components are produced by a single firm: Taiwan's TSMC. "There is a lot of nervousness that TSMC makes 85% of high-end silicon chips," says Sellars.

The deficiency has become even more glaring after Brexit and recent spats with China. Following its withdrawal from the European Union (EU), the UK is firmly on the outside of an EU scheme to boost semiconductor production, and its relationship with EU authorities is worsening. In the meantime, clashes with China over Huawei and the rights of Hong Kong citizens present a risk because of China's political interest in Taiwan.

Masters of miniaturization

Concern about TSMC's effective monopoly in this market extends far beyond the UK. As a 'foundry,' or contract manufacturer, the Taiwanese company crunches out chips for many of the largest technology and semiconductor firms in the US, including iPhone maker Apple and Nvidia, a designer of graphics chips that is trying to overcome regulatory opposition to a $40 billion takeover of Arm. Even Intel is now outsourcing the production of its most advanced chips to TSMC.

The Taiwanese foundry has led the world in the miniaturization of transistors used in chips. Its state-of-the-art technology uses transistors that each measure just 5 nanometers (nm), or billionths of a meter. No other company is at this level, and only South Korea's Samsung can match TSMC on the 7nm technology used in some 5G network equipment and smartphones. With its 10nm fab, Intel is about two generations behind TSMC, says Roslyn Layton, the co-founder of China Tech Threat, an advisory group.

The growing importance of semiconductors to the global economy makes heavy dependence on one vendor look desperately myopic. Worse still is China's territorial claim to the country where TSMC's semiconductor factories are found. "The fact that China has designs on Taiwan has made everyone very nervous about relying on TSMC for these silicon chips," says Sellars. Arguably, the main US concern about a Chinese takeover of Taiwan is that it would allow China to block TSMC shipments to the West.

It is a frightening prospect for other jurisdictions, too. Regardless of its role in the semiconductor value chain, any technology-driven economy would suffer badly if TSMC were cut off from companies in the West. In telecom, specifically, Ericsson and Nokia, the only large Western makers of 5G network equipment, are probably customers of TSMC, say experts (neither firm discloses the identity of its suppliers).

Hence recent US and European moves to boost semiconductor production in their own backyards. The US had already extracted a commitment from TSMC last year to build a new foundry in Arizona. Then, last week, Intel unveiled plans to spend $20 billion on setting up its own foundry business in the same US state.

That came days after Europe had announced its ambition to increase its share of semiconductor production from 10% to 20% of the world's total by 2030. While Europe has given little indication of the how, Intel's plans might align with its interests. "I expect that we will be ready to announce our next phase of expansions in the US, Europe and other global locations within the year," said Pat Gelsinger, Intel's new CEO, in his recent statement.

Chip choices

But this all leaves an independent UK potentially exposed. Sellars, who has been in talks with the government, says three approaches are now being considered. The first is the status quo of relying on the free market while continuing to highlight the UK's design credentials. "Clearly, if TSMC closes down you are in trouble and don't have access," says Sellars. "And then you can't make your cars, so that is a bit risky."

One alternative is to have a strategic partnership with a company like Intel. That could mean inviting the US firm to build one of its international foundries in the UK, something Sellars thinks would be a "great idea." Otherwise, the UK could make an upfront promise to purchase a minimum amount of capacity at Intel's Arizona or future European plant for a contractual fee.

This could also entail some risk, however. Just weeks after Brexit became official, relations between the UK and the EU are at an all-time low over shipments of coronavirus vaccines. In short, the EU has accused the UK of hoarding vaccines intended for Europe and threatened to block UK-bound vaccine exports in retaliation. It is not hard to envisage similar blockades and wrangling over semiconductors in the event of a shortage.

For reasons of supply and demand, that is exactly the situation the world currently faces. Surging take-up of laptops, tablets and mobile phones has coincided with a water shortage at TSMC, crippling its production process. The automotive industry has paid the price, according to Sellars. "TSMC is prioritizing where the money is and that is in mobile phones and not in cars," he says. "As a result, America is laying off people in the automotive industry."

Silicon production at one of TSMC's facilities in Taiwan.

Option three for the UK would be a full-blown investment in high-end silicon fabs and "sovereign capability," says Sellars. Yet this would be a daunting task at the best of times. GlobalFoundries, the only major US foundry, gave up trying to compete on transistor size a few years ago because of the investment demands, says Layton. Today, it concentrates on the 22nm to 90nm range.

Earl Lum, a semiconductor expert with EJL Wireless Research, is similarly dubious that Europe or the UK would be able to compete in this high-end market. "Who is going to pay $40 billion to $50 billion a year to create a foundry that is equivalent to TSMC for Europe?" he told Light Reading. "You would want a place with a lot of land that is pretty cheap, and the other problem is how you are going to train people to work in a wafer fab."

Sellars broadly agrees. "It is not just the money," he says. "One of the pieces of equipment costs $100 million but you need to have people who have commissioned and bought these before and the environment it goes into needs to be clean. You need extreme expertise." Importing that from elsewhere might be a remedy, he thinks.

Even so, the UK currently has a more interventionist government than it has seen for about 40 or 50 years. "We had successes and failures and then in the 1980s decided we weren't doing that again," says Sellars. "It was about picking winners and we were never very good at it, but as a result of that some of these big strategic things don't reside here."

Government interventionism is already apparent in the telecom sector, where last year's decision to ban Huawei from 5G has prompted head-scratching about the lack of homegrown alternatives. Authorities have set up a telecom taskforce to explore options for diversifying the market that sells to operators such as BT, O2, Three and Vodafone.

Efforts are bound to meet with charges of protectionism and unwelcome state interference. And as it emerges from the coronavirus pandemic, the UK is lumbered with a national debt of £2.1 trillion ($2.9 trillion) and has little room for any fiscal mistakes. A big bet on semiconductors could be a smart move in such an uncertain world, but it could also backfire badly.

No comments:

Post a Comment