By: Elizabeth Chen

Introduction

China’s leadership has signaled the country’s dedication towards pursuing self-sufficiency in “core technologies“ including integrated circuits. During the Fifth Plenum last fall, the Chinese Communist Party (CCP) reinforced its belief in innovation being the core driver of China’s continuing development and pursuing a high-tech transformation of the manufacturing sector. The impetus for this structural transformation of the economy was first established in the 2006 Medium and Long Term Plan for Science and Technology and emphasized in the 13th Five Year Plan (2016-2020). The 14th Five Year Plan (FYP) (2021-2025), unveiled on March 5 during the annual legislative Two Sessions meetings, described technology innovation as a matter of national security, not just economic development, for the first time. This represents the increasing perception that technology is a battleground for competition with the West, following U.S. actions against Chinese companies such as ZTE, Huawei and Bytedance, which began in 2018 and escalated last year.

During his presentation of the annual Government Work Report to the National People’s Congress, Premier Li Keqiang (李克强) targeted integrated circuits as one of seven technology areas that will require “major breakthroughs in core technologies” (Gov.cn, March 5). And although the 14th FYP did not include an explicit benchmark for annual GDP growth, Li committed to growing China’s spending on research and development (R&D) at 7 percent per year during the 14th FYP, with basic research expenditures at the central level to increase by 10.6 percent (China Money Network, March 9).[1] China’s three previous FYPs targeted R&D spending at 2 percent, 2.2 percent, and 2.5 percent of GDP during the 11th, 12th, and 13th FYPs respectively, although it consistently fell short of reaching these goals.[2]

Following the close of the Two Sessions, the CCP’s top theoretical journal Qiushi (求是) published a previously unreleased 2018 speech by Chinese President and CCP General Secretary Xi Jinping (习近平) on state reforms aimed at achieving indigenous innovation capacity, titled “Strive to Become the World’s Primary Center for Science and High Ground for Innovation” (努力成为世界主要科学中心和创新高地, nuli chengwei shijie zhuyao kexue zhongxin he chuangxin gaodi). While the speech showed the 14th FYP’s prioritization of indigenous innovation (自主创新, zizhu chuangxin) to be in line with previous Xi-driven strategies to promote technological development, it also bluntly stated that there were “significant problems urgently in need of solutions” in China’s science and technology sector. In particular, Xi highlighted persistent shortcomings in basic research, saying, “We lack major original achievements. We have weak low-level basic technology and basic industrial capabilities,” and that “Our situation in which key and core technologies are controlled by others, has not fundamentally changed.” Xi also highlighted continuing deficiencies in developing talent and said that “China’s S&T administrative structure still fails to fully meet the requirements for building a world S&T superpower” (DigiChina, March 18; Qiushi, March 15). Xi’s comments show the continuing difficulties that plague China’s efforts to become an advanced industrial economy, which are encapsulated by the problems facing China’s development of an indigenous semiconductor industry.

Chinese Semiconductors After Made in China 2025

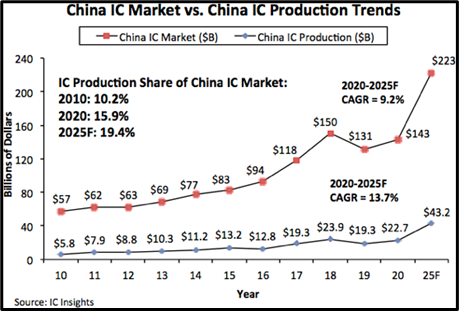

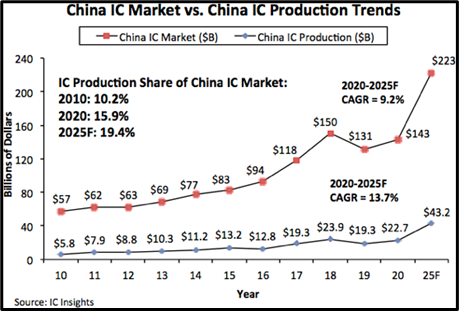

Integrated circuits (IC)—often referred to interchangeably as semiconductors—power the supercomputers that control global finance markets and cutting-edge defense systems and underpin many of today’s strategically important emerging technologies such as artificial intelligence, 5G, autonomous drones, and surveillance networks. China has been the largest state consumer of ICs since 2005, but Chinese companies have long been under-represented in domestic IC production. It is thus important to distinguish between the wider IC market in China—which includes so-called “fabless” foreign semiconductor companies such as Qualcomm, Intel, SK Hynix, Samsung, and Taiwan Semiconductor Manufacturing Corporation (TSMC) that manufacture within China—and indigenous semiconductor production. In 2020, about one-third of the total global IC market was made in China. But only 15.9 percent of China’s IC market (representing 5.9 percent of the global IC market) was manufactured by indigenous producers (IC Insights, January 6). China’s growing demand for IC products is also likely to compound this problem as it increasingly outpaces the indigenous producer’s ability to supply (SCMP, May 22, 2020).

China’s pursuit of technological “self-reliance” (自力更生, zili gengsheng) in semiconductors began as early as 1986 with the launch of the “531 Development Plan” and was revitalized in 2014 when the State Council released its “Guideline for the Promotion of the Development of the National Integrated Circuit Industry” (hereafter “Guideline”) and established a $50 billion China National Integrated Circuit Industry Investment Fund to develop the domestic chip supply chain (WTO.org, accessed March 24; Macropolo, September 10, 2019). The Guideline set an ambitious goal for China to become a global leader across all segments of the semiconductor supply chain by 2030. This priority was boosted by the release of the Made in China 2025 (MIC2025, 中国制造, zhongguo zhizao) industrial plan in 2015, which sought to more broadly upgrade China’s manufacturing capability and set a goal for China to indigenously produce 70 percent of its IC market by 2020 (The Diplomat, February 1, 2019). But the implementation of MIC2025 was beset by problems, particularly in the complex IC sector. Although China Daily reported last year that the Chinese IC industry was on track to reach 70 percent self-sufficiency by 2025 (China Daily, August 20, 2020), foreign industry analysts forecast that it would fall far short of its MIC2025 goal and would more likely produce about 19.4 percent of the Chinese IC market in 2025 (IC Insights, January 6). Image: The graph shows the lag between China’s indigenous IC production capability and its overall IC market (Image source: IC Insights).

Image: The graph shows the lag between China’s indigenous IC production capability and its overall IC market (Image source: IC Insights).

Image: The graph shows the lag between China’s indigenous IC production capability and its overall IC market (Image source: IC Insights).

Image: The graph shows the lag between China’s indigenous IC production capability and its overall IC market (Image source: IC Insights).Another indicator of China’s comparative IC weakness is its failure to produce the most advanced chips. Because of the complexity and expense of semiconductor manufacturing equipment (SME), only a few chip makers (or “fabs”) in the world can produce state-of-the-art chips with transistors that measure 5 nanometers (nm). All of these factories are currently located in either the U.S., South Korea, or Taiwan. In comparison, China’s top chipmaker Semiconductor Manufacturing International Corporation (SMIC) is currently manufactures chips with 14nm transistors, and industry analysts estimate that China’s chip manufacturing capability is at least two generations (7-10 years) behind current state-of-the-art levels of production (East Asia Forum, February 22).[3] Demonstrating this gap, China imported $350 billion worth of chips in 2020, marking an increase of 14.6 percent even as total IC output increased by 16.2 percent (SCMP, January 19).

The state’s top-down drive towards IC self-sufficiency also aims to make up gaps in so-called third-generation chip making—an emerging field with no established incumbents—as well as electronic design automation (EDA) tools and chipmaking technologies currently dominated by companies such as Cadence, Synopsis, and ASML Holding (Bloomberg, March 2). Businesses have been quick to capitalize off of the state’s priority to secure an indigenous IC industry—and overflowing funds for development. In 2020 alone, more than 22,000 new semiconductor companies were registered in China and existing platform companies, smartphone makers, and even smart home appliance brands have rolled out semiconductor side businesses (Protocol, March 13).

The Warnings of Hongxin and HiSilicon

Two recent scandals serve as a warning as China’s semiconductor hopefuls forge ahead. The first highlights the vulnerabilities of even China’s strongest technology companies to international supply chain ruptures. After U.S. export controls prevented the Chinese smartphone and telecommunications infrastructure company Huawei from sourcing cutting-edge 7nm Kirin 9000 chips (produced by the Taiwanese TSMC) last fall, Huawei was forced to delay the release of its prestige P50 smart phone series and sell its Honor smart phone brand “to ensure [Honor’s] survival” (The Verge, November 16, 2020). Recent news reports have said that Huawei’s semiconductor branch HiSilicon may have reached an agreement to manufacture modified Kirin chips with Samsung in the near future, but new 5G export restrictions from the U.S. could impact this deal as well (Gizmochina.com, March 20; SCMP, March 12).

The second demonstrates the dangers of the Chinese state’s massive investment in indigenous semiconductor start-ups. Hongxin Semiconductor Manufacturing Corporation (HSMC) shut down abruptly in February following revelations that the once-promising start-up—which had received $18.5 billion in investments from the Wuhan city government—had deceived employees, failed to pay suppliers and grossly exaggerated its technological capacity to secure government support. At one time, HSMC’s founders promised officials that it could produce 90 micron to 7nm chips—a process that would span 13 generations of chip-making and was literally too good to be true (Caixin, February 27). An investigation found that HSMC’s founders—who had no previous semiconductor experience—had leveraged rumors about their high connections to secure large amounts of funding and use that to lure well-established talent from Taiwan, then purchased cutting-edge factory equipment with the aid of more government loans and subsidies. It was in effect a multi-layered con job that adroitly played off of the local government’s desire to develop a localized semiconductor company and failure to ensure the accountability of its easy investments (China Money Network, January 29).  Image: A picture of HSMC factory construction in Wuhan on pause after the company went bankrupt (Image source: Jiemian).

Image: A picture of HSMC factory construction in Wuhan on pause after the company went bankrupt (Image source: Jiemian).

Image: A picture of HSMC factory construction in Wuhan on pause after the company went bankrupt (Image source: Jiemian).

Image: A picture of HSMC factory construction in Wuhan on pause after the company went bankrupt (Image source: Jiemian).Conclusion

These high-profile scandals notwithstanding, China has continued to double down on its drive to secure an indigenous semiconductor capability. In the first two months of 2021, more than 4,350 new semiconductor companies were created (Protocol, March 13). It is likely that Xi’s renewed call to develop a resilient indigenous IC industry will drive even more to enter the market. But as past experience has shown, the process will require talent and time—both of which are currently lacking—and cannot just be achieved by implementing top-down exhortations for progress and massive injections of capital. If China fails to build out a robust regulatory framework to ensure accountability and transparency in its semiconductor buildup, or, failing that, to develop other alternatives to securing its IC supply chains, it is likely that it will see more semiconductor scandals to come.

No comments:

Post a Comment