BY DAN CANCIAN

Some of the world's richest men reportedly paid no income tax at all in various years over the last decade, according to a trove of data that has been leaked to ProPublica.

On Tuesday, the website said it had obtained a "vast cache" of information from the Internal Revenue Service—the revenue service of the U.S. Federal government, which is responsible for collecting taxes—which showed multibillionaires like Jeff Bezos, Elon Musk, George Soros, Michael Bloomberg and Warren Buffett paid little income tax compared to their enormous wealth.

At times, they paid none at all.

ProPublica said it planned to disclose further details over the coming weeks, but the revelation contained in the initial report appear already very significant.

According to the leaked data, Bezos paid no income tax at all in 2007 and 2011. The Amazon founder and CEO is currently ranked by Bloomberg and Forbes as the richest man in the world, ahead of Musk, the CEO of Tesla. Like Bezos, Musk is alleged not to have paid any income tax in 2018, while billionaire investor George Soros reportedly did not pay any federal income tax at all for three consecutive years.

Business magnate Carl Icahn, who briefly served as special economic adviser on financial regulation to President Donald Trump in 2017, allegedly did not pay federal income tax twice in the last 15 years, while former New York City mayor Michael Bloomberg and Berkshire Hathaway CEO Warren Buffett also avoid contribution to the IRS at least once.

"I continue to believe that the tax code should be changed substantially," Buffett wrote in a statement to ProPublica.

"I hope that the earned-income tax credit is increased substantially and additionally believe that huge dynastic wealth is not desirable for our society."

A spokesman for Soros, meanwhile, told ProPublica that the billionaire had lost money on his investments from 2016 to 2018 and so did not owe federal income tax for those years.

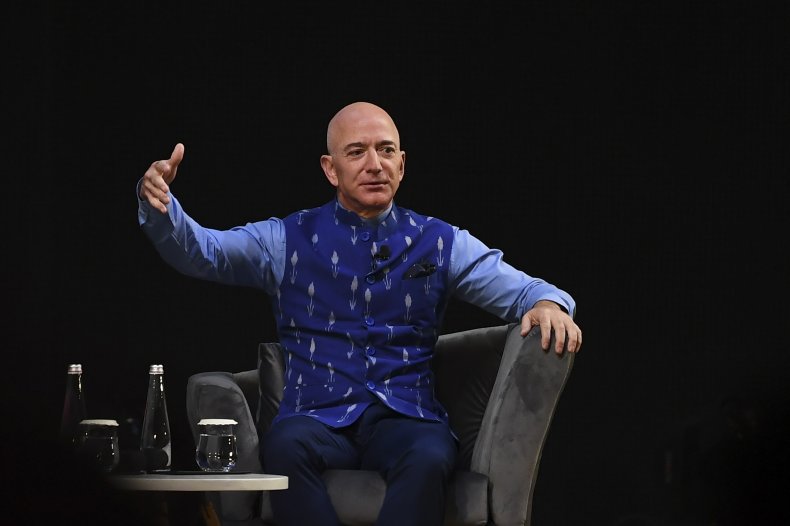

CEO of Amazon Jeff Bezos addresses the Amazon's annual Smbhav event in New Delhi on January 15, 2020. Bezos, whose worth has been estimated at more than $110 billion, is officially in India for a meeting of business leaders in New Delhi.SAJJAD HUSSAIN/AFP/GETTY IMAGES

CEO of Amazon Jeff Bezos addresses the Amazon's annual Smbhav event in New Delhi on January 15, 2020. Bezos, whose worth has been estimated at more than $110 billion, is officially in India for a meeting of business leaders in New Delhi.SAJJAD HUSSAIN/AFP/GETTY IMAGESThe list also includes media mogul Rupert Murdoch, Microsoft co-founder Bill Gates and Facebook founder Mark Zuckerberg.

Using data collected by Forbes, ProPublica calculated the combined wealth of the 25 richest Americans soared by $401 billion from 2014 to 2018. Over the four-year period, however, the 25 billionaires paid only a combined $13.6 billion in income tax. In true tax term, that amounts to 3.4 percent.

By contrast, over the same period, the median American household income has stood at around $70,000 with 14 percent paid in federal taxes.

The FBI and tax authorities are both investigating the leak, which a White House spokesperson described as "illegal".

After the release of the report, Democratic Senator Elizabeth Warren called taxing the wealth of the richest Americans—not just their income.

"Our tax system is rigged for billionaires who don't make their fortunes through income, like working families do," Warren tweeted.

"The evidence is abundantly clear: it is time for a #WealthTax in America to make the ultra-rich finally pay their fair share."

President Joe Biden has vowed to increase taxes on the richest Americans, as part of his plans to address financial inequality and raise funds for his infrastructure program.

Biden has proposed to raise the top tax rate to 39.6 percent for people earning $400,000 a year or more in taxable income, which are estimated to be fewer than two percent of U.S. households.

Currently, the top tax rate that workers pay on salaries and wages stands at 37 percent.

No comments:

Post a Comment