Dr. Markus Jaeger

The financial sanctions imposed on Russia by Washington and its allies have put Beijing on notice. In the event of a military conflict over Taiwan, China now knows what to expect from the United States. Beijing will therefore accelerate efforts to promote the renminbi as an international currency and reduce its dependence on the dollar. But the greenback will remain the dominant international currency and will continue to provide Washington with significant geo-economic power.

True, China’s far greater economic weight compared to Russia will make some American allies more hesitant to support US financial sanctions in the event of a military clash. But the implicit or explicit threat of US secondary sanctions should help persuade them to support American policies, even if the economic costs of doing so will be considerable. Should the US Navy impose a blockade on Chinese seaborne trade, financial and currency sanctions will become less meaningful, as they derive their effectiveness largely, if not exclusively, from restricting a country’s international trade.

China is the world’s second-largest economy. It is the world’s largest trading nation and the largest trading partner of a hundred-odd countries. It is the world’s third-largest creditor, and it is a major lender to developing economies. China also happens to be America’s second largest international creditor. And yet China remains highly dependent on the dollar and access to America’s financial system in terms of international trade and finance. Having watched Washington’s decisive response to Russia’s invasion of Ukraine, Beijing will double down on efforts to reduce its dependence on the dollar.

Beijing Is Keen to Reduce Dollar-Dependence

Beijing is seeking to reduce its dependence on the US-dominated international economic regime and financial networks by slowly laying the foundation of an alternative, more Sino-centric system. China has created an Asian Infrastructure Investment Bank, initiated the Belt Road Initiative, has become an important source of international foreign direct investment, is experimenting with a digital e-yuan, and has even set up a renminbi-based interbank payments system. It has also taken a pro-active approach to promoting the renminbi as an international currency by having it included in the IMF’s special drawing rights currency basket and by offering renminbi swap lines to other countries.

Taken together, these initiatives amount to a deliberate strategy to enhance the international role of the renminbi and reduce China’s dependence on the dollar. Given that international financial and trade relations are two sides of the same coin, China is also seeking to reduce it its dependence on international trade in general and on trade with the United States in particular, as reflected in its ‘dual circulation’ and Made in China 2025 policies. China’s concerns are also reflected in its market access policies, including the recent agreement on the Regional Comprehensive Economic Partnership (RCEP) and its application to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). Both are aimed at diversifying trade away from the United States and at creating more Sino-centric regional trade relations. In the wake of the US-Chinese trade war and US and allied sanctions against Russia, Beijing is going to intensify efforts to build a parallel, more Sino-centric economic regime to reduce its vulnerability to third-party geo-economic coercion.

Reforms in China Are Difficult and Costly

Despite all these efforts, China has made only very limited progress in terms of challenging the dominance of the dollar. Concerns about the rule of law, about Beijing’s willingness to allow market forces greater rein, and about geopolitical risk combine to curtail the attractiveness of the renminbi as an international currency. A closed capital account, a managed exchange rate, underdeveloped financial markets, and a vulnerable banking system also remain major impediments. The reforms required to successfully promote the renminbi would effectively bring about the demise of China’s long-standing economic development model. With policymakers struggling to rebalance the economy and make economic growth more sustainable, renminbi-promoting reforms would increase the risk of economic and financial instability at a very inopportune moment. Hence, necessary reforms are not going to happen, at least not anytime soon.

Combined with its relative greater relative trade dependence on the United States, China’s dependence on the dollar will continue to make Beijing vulnerable to American geo-financial coercion. Beijing’s best ‘play’ is to grow its economy and thereby reduce its relative trade dependence while increasing the relative dependence of the United States (and its allies). This would make it increasingly costly for Washington to resort to financial and currency sanctions against China. It would also diminish the power of US secondary sanctions, as third parties, including US allies, would become more willing to incur America’s wrath in order to maintain amicable economic relations with China.

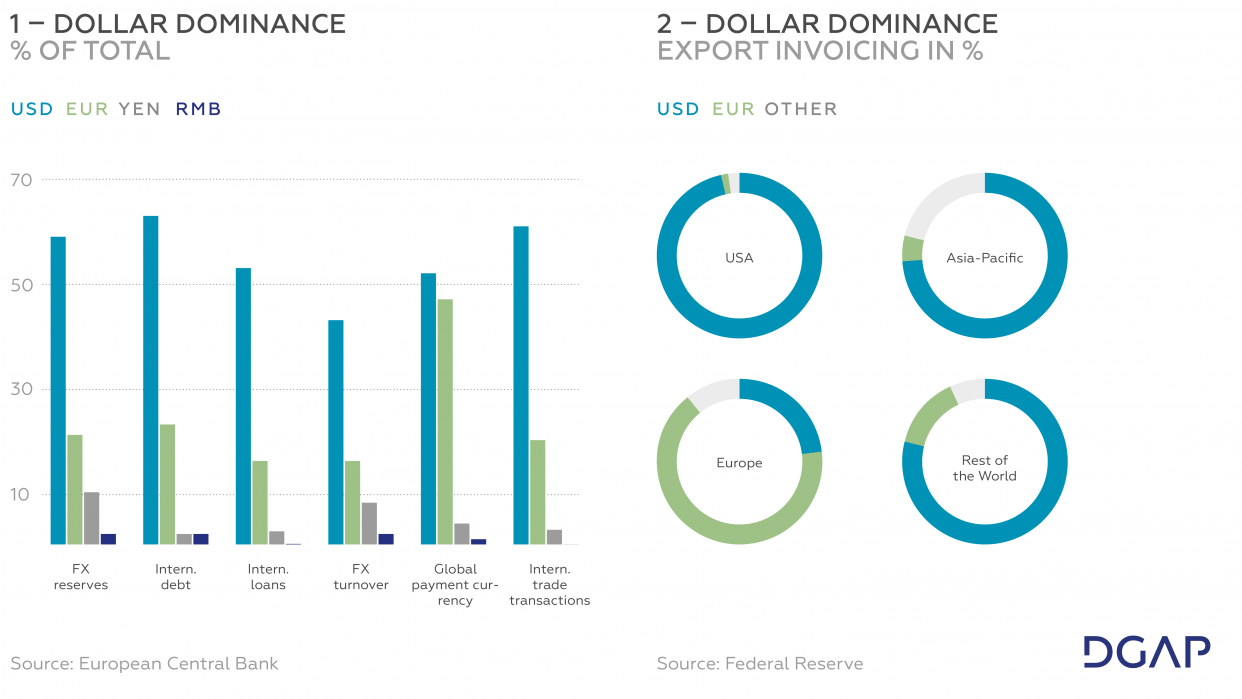

America’s Power Is Robust

For the time being, US currency and financial power remains robust. Nothing reflects the importance of the dollar (as a medium of exchange) more than the fact that 80 percent of international trade (defined as trade involving neither the United States nor the euro area) is denominated in dollars. A stunning 90 percent of the time, it is on one side or the other of foreign-exchange transactions compared with a mere 30 percent and four percent in the case of the euro and the renminbi, respectively. If one wants, for example, to convert Turkish lira into Chinese renminbi, one typically needs to trade via the dollar.

What underpins US financial power? Amongst other things, the need of companies, banks, and central banks across the world to hold liquid dollar assets to engage in international trade and financial transactions. For this, they typically depend on ready access to the US financial system. Moreover, US financial markets are the deepest and most liquid in the world, in addition to being very open and sophisticated. The unmatched opportunities they provide to investing and raising funds make foreigners not just interested in but also highly dependent on maintaining access to the US financial system. Currency and financial power are two sides of the same coin.

The need to hold dollar liquidity to engage in international transactions makes countries vulnerable to asset freezes and other financial restrictions, as Russia just found out. Ironically, it is America’s international liabilities that give it power, and it is China’s financial claims on the United States that make it vulnerable. China is officially the second-largest foreign holder of US government debt to the tune of more than one trillion dollars. Freezing Chinese assets and excluding China from US financial markets would make it much more difficult, if not necessarily impossible, for China to engage in international trade and financial transactions.

Holding international financial claims on a geopolitical competitor is risky. (The Soviet Union used to keep its dollars in the London offshore Eurodollar markets.) But while China may be wary of holding US assets and relying on the dollar, in practice it has no viable alternative. True, the dollar’s importance as a reserve currency has recently declined somewhat. But it is telling that this has not benefitted its two major actual or potential competitors: the euro and the renminbi.

Although the demise of the dollar as the dominant international reserve currency has been foretold many times, its dominance has endured. As it stands, the dollar will remain the dominant international currency for the foreseeable future, first and foremost due to a lack of viable alternatives. As such, it will provide Washington with considerable financial and currency power vis-à-vis other countries. American currency and financial power will remain effective in terms of its ability to impose significant economic costs on sanctioned parties. Whether it is also efficacious in terms of deterring or compelling them is, of course, another issue altogether. But Beijing has been put on notice.

No comments:

Post a Comment