DIANE HARRIS

The signs of financial gloom are seemingly everywhere. Inflation is now at its highest point in more than 40 years. Stocks officially fell into a bear market in June, dropping more than 20 percent from their peak in January. Bonds and cryptocurrency are bleeding red ink too, with Bitcoin losing over half of its value so far this year. And, as if all that weren't bad enough, economists are now warning in increasingly heated language about the rising risk of recession—a three-syllable term with four-letter-word implications.

By one common but unofficial definition of recession—two consecutive quarters of economic contraction—the downturn may already be upon us. Newly released government data shows the economy shrank by about an estimated annual rate of 0.9 percent percent during the three-month period that ended on June 30, following a 1.6 percent drop in GDP in the first quarter. But it is up to academics at the National Bureau of Economic Research, a private nonprofit group, to officially determine if the U.S. is in a recession, which it defines as a significant decline in economic activity that's spread across the economy and lasts more than a few months.

Predictions about if and when that official recession will arrive are all over the place. A recent paper by Federal Reserve economist Michael Kiley suggests there's a greater than 50 percent chance of a downturn between now and March. Meanwhile, Goldman Sachs and Morgan Stanley peg the probability of recession within a year at 30 percent, Deloitte forecasters put the likelihood at just 15 percent and BlackRock simply predicts "real economic pain" ahead as the Fed continues to raise interest rates (there have been three hikes already this year) in an effort to combat inflation.

"The biggest elephant in the room for investors, market experts and everyday individuals is the level of uncertainty about the future," says Lindsey Bell, chief markets and money strategist at Ally Invest. "It is clear parts of the economy are slowing and serious headwinds are present for both the market and the consumer. What is uncertain is which way we break from here. It is causing a lot of anxiety for everyone."

In fact, many people already feel like their personal economy is in the dumpster or could land there soon, whether an official recession is coming or not. In June, the University of Michigan's index of consumer sentiment hit the lowest level in its 70-year history and it has remained near those record lows ever since. Nearly six in 10 Americans in a recent BMO Harris Bank survey said that inflation was adversely affecting their finances and 42 percent said they are struggling to remain where they are financially, according to a Monmouth University poll in early July—an 18-point increase in just one year. And if recession does hit, a new MagnifyMoney survey found, more than two-thirds of Americans don't feel prepared.

GET THE BEST OF NEWSWEEK VIA EMAIL

Fortunately, there are steps you can take to reverse that sentiment—to ease the strain inflation is putting on your budget, protect your savings and your livelihood in case that feared recession hits and dampen the stress of money worries. Says financial planner Stephanie McCullough, founder of Sofia Financial, "The antidote to anxiety is action."

You just need to be sure they're the right actions. Here's what financial experts advise now.

Soothe Your Pain Points

For most Americans, the immediate squeeze they feel is from dramatically higher prices on everything from gas and food to rent, new homes and cars, not the threat of a possible recession that could be six or more months away. At an annualized rate of 9.1 percent, inflation is now at its highest point since 1981, and the basics have risen even more sharply: Gas prices, even with recent declines, are still up more than 40 percent over the past year; electricity is up 13.7 percent; groceries, 12.2 percent.

Small wonder then that nearly half of consumers in the University of Michigan survey blame inflation for eroding their standard of living. And 54 percent of the respondents in the Monmouth University poll cited inflation, gas prices and everyday bills like groceries as their family's biggest worry right now, crushing concerns over abortion and reproductive rights, guns, crime and climate change, despite the record heat wave sweeping much of the U.S. and Europe.

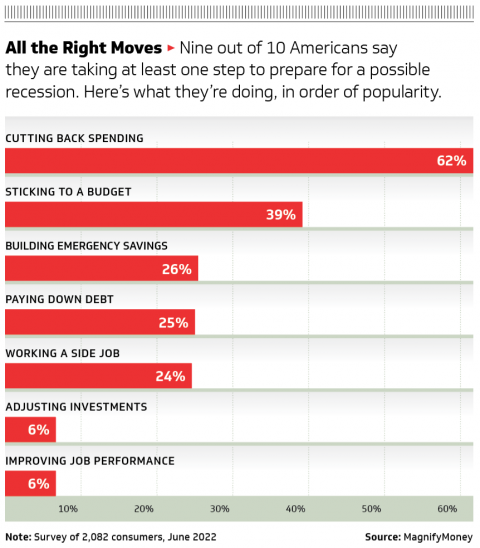

What to do? Some 62 percent of Americans say they're cutting back on spending, according to MagnifyMoney—by far, the most popular step consumers are taking to prepare for recession and helpful in curbing your personal inflation rate too. That's smart, but there's a lot more you can do to lower your cost of living in these inflationary times.

Use Hacks to Save ▸ Creative workarounds for the everyday expenses that have shot up the most can save you hundreds, often thousands, of dollars a year.

Take gas, for instance. Use a gas-station tracker such as GasBuddy to identify the lowest prices at the pump in your area; AAA and GPS services like Waze and Google Maps have gas trackers on their apps as well. Cutting down on aggressive driving—rapid acceleration, high cruising speed and braking sharply—can cut gas consumption and costs by a third or more, according to real-world tests by Edmunds.com last year. Paying in cash or, alternatively, with a rewards credit card from a gas chain you typically frequent can also save a lot of money. If you're a Costco member, for instance, you'll get 4 percent back on the price of already cheaper-than-average gas from its stations via Citi's Costco Anywhere Visa, though you'll probably have to contend with long lines to fill up.

Grocery prices got you down? At the supermarket, favor your inner vegan: Fruit and vegetable prices are "only" up around 8 percent over the past year, vs. about 12 percent for meat, poultry, fish and eggs and 13.5 percent for dairy products.

Get a Little Payback ▸ As long as you can pay your balance in full every month, cash-back rewards cards can be a smart way to retrieve some of the extra money you're spending due to inflation. A top pick is Blue Cash Preferred from American Express, which gives you 6 percent back on groceries, up to $6,000 a year (1 percent after that), 6 percent on streaming services and 3 percent on gas. The card has a $95 annual fee but a typical family might save $400 a year on groceries and gas alone, calculates senior industry analyst Ted Rossman of Bankrate.com.

Among no-fee cards, Wells Fargo Active Cash and Citi Double Cash offer a flat 2 percent back on everything you charge. Rossman also recommends using shopping portals for extra savings: Cardholders often get an extra 3 to 5 percent back via Shop Through Chase, he says, and third-party portals like Rakuten can offer good discounts too.

Pay Off the Plastic ▸ The Fed's recent and likely future rate hikes, while key to its inflation-fighting strategy, are making carrying credit card debt even more expensive, which puts an extra strain on households already struggling to keep up with inflation. According to LendingTree, the average rate on cards accruing interest was 16.65 percent in the first quarter of the year and the average on new offers is 20.82 percent, the highest rate since it began tracking new-offer rates in 2018.

To pay off high-interest debt faster, LendingTree chief credit analyst Matt Schulz recommends transferring any balances you have—roughly four in 10 Americans don't pay off their bill in full every month—to a balance transfer card with a long zero-percent interest period (at least 15 months) and reasonable fees (3 percent of the amount you're transferring or less). Among the best offers currently: Wells Fargo Reflect, which has an interest-free period up to 21 months and Citi Double Cash, up to 18 months.

You better move fast, though. As interest rates continue to rise, Schulz believes balance transfer offers will start to shrivel up. "It will get harder for banks to justify these deals, leading to shorter zero-percent introductory periods and higher transfer fees," he says.

Stay in the Game

Stocks recorded their worst first six months of a year since 1970 in 2022. July has been no picnic either—a roller coaster of big ups and downs that has left many investors feeling a little nauseous and anxious about what comes next.

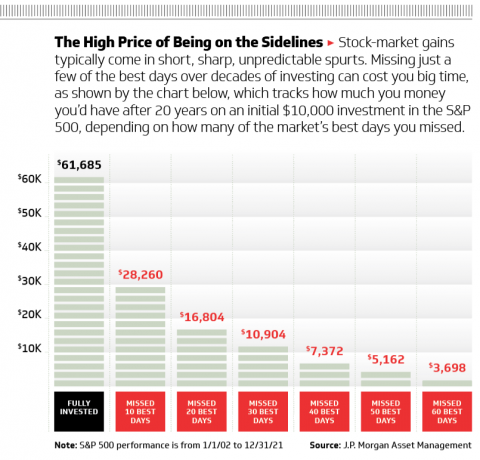

Tempted to get off the ride? Don't do it. The history of the market shows that gains tend to come in short, sharp, unpredictable spurts, and the biggest advances frequently come within days of the worst declines. Missing just a few of those great days over decades of investing can cost you dearly, according to an analysis of stock market performance from 2002 to the start of 2022 by J.P. Morgan Asset Management. Missing stocks' 10 best days over that 20-year period cut returns by more than half, while missing the 40 best days—out of a total of 5,000 or so trading days—resulted in actually losing money.

The moral of the story, as the old New York Lottery slogan said: You gotta be in it to win it. But there are steps you can take to protect yourself from the worst losses while positioning yourself for solid gains when the market eventually recovers—you don't have to simply ride the wave.

Fix Your Mix ▸ With stocks, bonds and crypto all down sharply this year, there's been almost no place for investors to hide. That doesn't mean, though, that the basic advice to diversify your investments among different kind of assets—the old don't-put-all-you-eggs-in-one-basket approach—no longer holds true. "The S&P 500 was down 20 percent through June 30, but a diversified portfolio holding different types of stocks and bonds was only down 14.6 percent," McCullough says. "Down 14 percent sucks, but it's better than down 20. It means diversification is actually working."

How to Stay Sane In a Crazy Market

The secret is knowing the role each asset plays in your investment account, and adjusting the percentage you hold of each one to reflect your personal appetite for risk and how much time you have before you'll need this money. Bell suggests thinking about the various investment classes this way: "Stocks are for long-term appreciation, bonds are for stabilization and crypto is for fun money or long-shot bets. Each can have a place."

In general, the younger you are, the greater the percentage of higher-risk, potentially higher-return investments you want to hold in your account. One rough rule of thumb is to subtract your age from 120 or 110 to land on an appropriate percentage for stocks—if you're, say, 40, you'd keep 70 to 80 percent of your investment money in stocks, and most or all of the rest in bonds. Or you can invest through a target date fund, which gives you a pre-mixed portfolio of stocks, bonds and other assets based on the year you're likely to retire. As you get closer to your "target date," the fund automatically shifts more of your money into more stable investments.

Act Your Age ▸ Time is, in fact, the greatest asset younger investors have, which is why financial advisors urge them to try to find a way to increase contributions to their 401(k) plans now. Bump up the percentage you're putting in at least to the maximum your company will match and a little beyond that if you can. "If you're early in your career, these down markets are your friend, they're the opportunity to put more money to work, to buy more shares for the same amount of money as when things were higher," says Christine Benz, director of personal finance at Morningstar, in a video discussing bear-market strategies on the company's YouTube channel. "They're really beneficial for you even though it might not feel like it at the time."

For older investors who are within five years or so of retirement or who have already left the workforce, the goal should instead be to avoid tapping retirement accounts for as long as possible or to minimize withdrawals. That buys time for your investments to recover from their recent thrashing. Maybe you delay leaving your job for another year beyond your intended quit date, or do some freelance work or take a part-time job to supplement your income so you don't need to tap as much from savings.

Look for Small Wins ▸ One of the best investment deals lately: government-issued inflation-protected savings bonds, or I-bonds. The bonds are guaranteed to pay 9.62 percent interest for the first six months, and the rate is adjusted twice a year to keep up with inflation—a sweet proposition at a time when most other assets are losing money. Says Bell, "It's hard to find other investments that can help fight against inflation to this extent."

Still, there are caveats. You can't redeem the bonds for at least a year and if you cash in before five years, you'll forfeit three months' interest. You can only buy $10,000 worth ($20,000 for a married couple) and you need to purchase the bonds through the government's TreasuryDirect website, a sometimes cumbersome and time-consuming process.

Pump up Your Savings

A possible recession is the very definition of a financial emergency, yet with the high price of everything these days, it's tough to find extra cash to put aside for that proverbial rainy day—let alone save enough to cover at least six months of living expenses, as financial advisors recommend.

Still, it's important to try to tuck away whatever you can. Nearly 60 percent of adults surveyed by Bankrate last month said they were concerned about the amount they have in emergency savings, a 10-point rise from last year, and one in four has no emergency fund at all. You're going to need that cushion if the job market starts to soften and your income takes a hit or you're laid off. "Even one month of expenses saved is better than nothing," says Chris Browning, host of the Popcorn Finance podcast.

Here's how to get started.

Put Saving on Autopilot ▸ Don't wait until the end of the month to see how much cash you have left to put into emergency savings (hint: there probably won't be any). Instead, take it off the top, designating a set amount to go into your emergency savings account every time you get paid via direct deposit (most employers allow you to split your paycheck between two or more accounts) via a bank, brokerage or money-management app like Qapital. Qapital also has a few quirky preset rules you can use to add a few extra dollars to your account every time, say, you go to the gym or buy coffee from your favorite java joint.

Most people find they automatically adjust their spending to the amount they have available in their checking or money market account. But if you find yourself falling short and unable to pay your regular monthly bills, you can simply lower the amount you've designated to go into emergency savings or suspend contributions until you're flush again.

Earn a Little Extra ▸ One silver lining to the recent interest rate hikes by the Fed: Yields on savings accounts are finally climbing out of the basement level of the past few years.

Still, don't settle for whatever rate your bank is offering to pay on your emergency stash. While the average yield on FDIC-insured savings and money market accounts is still a barely there 0.1 percent, according to Bankrate, you can earn 10 to 15 times that amount or more by shopping around. Among the institutions recently offering highly competitive rates on savings accounts, with minimum balance requirements of $1 or less to earn top payouts, Bankrate reports: New York Community Bank's My Banking Direct, yielding 2.02 percent; CIT Bank, 1.65 percent; and SoFi, 1.5 percent.

Take Some Credit ▸ If you've owned your home for a while, chances are you've built up a fair amount of equity, given the 45 percent average rise in housing prices over the past three years. Taking out a home equity line of credit that you can tap as needed if times get tough can be a good backup to your emergency fund, especially if saving enough to cover the recommended six months of living expenses is out of reach.

The time to secure the line is now, before a recession hits; once the economy goes south, banks become more reluctant to approve loans or may limit how much you can borrow. And if you are laid off or your income drops, the chances that you'll be rejected for a HELOC skyrocket, no much how much equity you have.

Warm Up Your Network

Right now, the job market is still a very bright spot in an otherwise gloomy economy, with historically low unemployment and open positions outstripping the number of workers available to fill them. But jobs are a lagging economic indicator; an uptick in unemployment is typically one of the last developments to presage a downturn, so don't get too comfortable.

AnnElizabeth Konkel, a senior economist at Indeed Hiring Lab, sees mixed signals in the labor market—indications of ongoing strength as well as "signs of temperance." On the plus side, employer demand for workers form her vantage post at Indeed remains robust, with job postings on the site recently at 54 percent above their pre-pandemic level. Meanwhile, payrolls have grown by an average of 400,000 jobs a month over the past three months and nominal wage growth remains strong.

On the negative side, Konkel notes, there have been a variety of announcements lately about layoffs and hiring freezes—Tesla, Coinbase, J.P. Morgan Chase and Netflix among them—particularly in the tech sector. The biggest outstanding question, in Konkel's view and that of many other economists, is whether the Federal Reserve can manage a soft landing. "Tightening of monetary policy [to fight inflation] is like threading a needle," she notes. "How the Federal Reserve proceeds will impact what we see in the labor market."

There is, of course, nothing you can do about the Fed, which this week raised interest rates by an unusually large three-quarters of a percentage point, its fourth increase of the year so far—and signaled that the move is unlikely to be its last rate hike of the year. But you can take steps to make your current job more secure and position yourself to find new work quickly if a recession develops and your income takes a hit or your position is eliminated.

"Hiring still occurs in down markets," says career coach Caroline Ceniza-Levine, founder of the Dream Career Club. "People who leave need to be replaced, new projects need to be staffed."

Reach Out and Touch Someone ▸ Still working remotely or only venturing into the office on rare occasions? Make an effort to interact more with colleagues in real life, both at work and socially, if appropriate. Says Ceniza-Levine, "Face time is important because it adds another dimension to relationship-building."

If going back to a physical work setting isn't feasible because you live in a different location or have health-safety concerns, make an extra effort to build relationships in other ways with your boss, colleagues and senior leaders. This means more frequent reporting on your work results and the status of your projects, and might include social Zooms so you can have friendly interactions. "People want to like who they work with," says Ceniza-Levine. "Likability matters when companies make decisions on who to keep during a layoff."

Focus on Measurable Results ▸ Companies will use bad news about the economy to gain back the advantage they lost during the Great Resignation, says Ceniza-Levine, who believes employers may soon start to negotiate harder on salary and raises and be pickier about who they hire and retain because they think they can be.

Counter that burgeoning trend by driving home what a valuable employee you are, and back that up in ways that can be quantified. "Make your boss look good," says Ceniza-Levine. "Check in with them to ensure you're working on the projects that matter. Show a positive, can-do attitude."

Kick Your Job Search Into Higher Gear ▸ If you're not working now, double down on your search; you want to get hired before more layoffs occur and candidates flood the market. Add temp and consulting work to your radar, suggests Ceniza-Levine, and be visible with your connections.

Also rekindle old connections where you might have fallen out of touch. Say hello and share what you're seeing in the market. She says, "Don't make every outreach about your job search—that's annoying and makes the outreach transactional."

Instead, make the interaction as much or more about the person you're reaching out to as it is about you. Among Ceniza-Levine's tips: Share leads that might fit the other person; they'll be flattered you thought of them. Make introductions to recruiters, as appropriate; both the recruiter and the person you refer will see you as a connector. And when you do talk about yourself, make the interaction about more than just your job search—share what you're reading, any consulting (even pro bono) that you're doing, ideas you have.

Cultivate Your Inner Zen

It's hard not to be anxious about your finances now, with a constant barrage of news about one or the other worrisome development in the economy and constant reminders of the personal impact of inflation and falling financial markets every time you fill up at the pump, check out at the grocery store or look at the balance on your 401(k).

That mindset, however, is not only bad for your mental health; it can prompt you to make poor decisions about your money, if clear, long-term thinking gets clouded by the emotions of the moment. "When we are emotionally charged we become rationally challenged and we are wired to do everything wrong when it comes to money," says financial psychologist Brad Klontz, author of Mind Over Money: Overcoming the Money Disorders That Threaten Our Financial Health. "Typically our financial situation won't kill us but chronic financial stress can."

Here are some tips for keeping cool when the financial hysteria around you is threatening to heat up.

Adjust Your Point of View ▸ Instead of focusing on what's happening now or could happen in the economy and your own financial life over the next few months, develop a longer-term point of view. Take the stock market's recent swoon, for example. Says Klontz, "If you are a long-term investor you just hit a pothole. If you have a short-term view you just fell off of a cliff."

How do you keep the economic turmoil in perspective? Check the facts. Browning of the Popcorn Finance podcast points out that there have been 12 recessions since 1948. Since the '90s, the typical downturn has lasted less than a year and the period of economic growth that always follows has lasted roughly eight years on average. Not counting 2022, there have been 14 bear markets since 1947 that range anywhere from one month to over a year and a half. But the growth in the stock market that occurs after a bear market is almost always much greater than the drop itself.

For younger people especially, Browning says, "The money that you're investing into a 401(k) won't be needed for decades and then needs to last for decades of retirement. The temporary downturns in the stock market today will have no impact on you in the long run."

Think Through the Worst-Case Scenario ▸ Think of all the bad things that could happen in your life if the economy goes south and how you would handle them, mentally working through possible solutions. If stocks don't bounce back for a few years and you're close to retirement, could you work a year or two longer to delay tapping your savings and give your account more time to bounce back? If you're laid off, how much could you trim your budget? If you can't cut back enough to cover your basic bills, would you have to sell your house and downsize to something smaller or move in temporarily with your parents or in-laws?

Klontz says that rather than heightening your anxiety, this "what-if" exercise helps alleviate it, as you develop a longer-term perspective and are prepared with a workable plan if the bad stuff actually happens. He says, "Typically you will land on a temporary uncomfortable setback but something that is non-life threatening and that you can bounce back from."

Tune Out the Noise ▸ Once you've taken the steps you can to protect yourself from whatever bad economic developments could hurt you, put your blinders on. Shut off CNBC and Fox Business News for a while, take a walk, read a book or stream a comedy to distract yourself the next time the market has a meltdown or the government releases another worrisome stat and avoid checking your 401(k) balance for the next several months at least.

As former stock trader turned "fin-fluencer" Vivian Tu, a.k.a. Your Rich BFF, recently told her 1.6 million followers on TikTok: "You will hurt your own feelings checking your investments right now. Don't do it."

That's sound advice for anyone right now. Focus on what you can do, not on what you can't control. And if a recession doesn't materialize anytime soon, all your preplanning—building your emergency fund and retirement savings, taming your personal inflation rate, shoring up your professional network and developing a long-term perspective—will still serve you and your family well.

No comments:

Post a Comment