Corey Lee Bell, Elena Collinson, and Xunpeng Shi

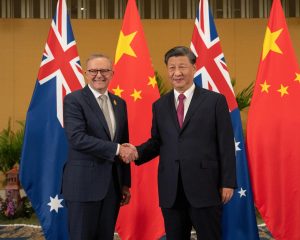

The meeting between Australian Prime Minister Anthony Albanese and China’s President Xi Jinping on the sidelines of the G-20 summit in Bali on November 15 indicates an easing of tensions between Canberra and Beijing.

The breakthrough talks – the first between leaders of the two countries in five years – was also attended by Chinese Foreign Minister Wang Yi, the director of the General Office of the Chinese Communist Party, Ding Xuexiang, and He Lifeng, a Politburo member and minister in charge of the National Development and Reform Commission. The high-powered meeting comes after a prolonged trough in the relationship, propelled by a number of significant irritants, including geopolitical tensions and China’s trade punishment of Australia.

The meeting had been anticipated by observers, having come on the back of an unscheduled phone call on November 8 between Australian Foreign Minister Penny Wong and her Chinese counterpart Wang, a meeting on the same day between Opposition Leader Peter Dutton and China’s ambassador to Australia, and warmer rhetoric out of Beijing on some fronts since Labor’s federal election victory in May. Yet, with the absence of notable progress on core issues of contention between Australia and China, the flurry of diplomatic activity over those eight days was also somewhat sudden.

A perusal of the official account of the meeting on China’s Ministry of Foreign Affairs website perhaps offers some hints as to what is underpinning the turnaround. It was mentioned, albeit vaguely, that Australia had “shown a willingness to improve and develop the bilateral relationship,” and that the two nations have “highly complementary economic structures.” The statement also encouraged cooperation in trade and climate action, and expressed China’s “hope that Australia will provide a favorable business environment for Chinese firms that invest or operate in Australia.”

Yet to understand why Beijing is reaching out now, it might also be useful to peer across the Pacific – not in the direction of the United States, but rather Canada. Recent developments there are likely having an impact on an increasingly critical economic component of the Australia-China relationship: Australia’s lithium exports.

Lithium and “the New Oil Rush”

Earlier this month, the Canadian government directed three Chinese companies – Sinomine (Hong Kong) Rare Metals Resources Co., Ltd., Chengze International Limited, and Zangge Mining Investment (Chengdu) Co., Ltd. – to divest from companies that operate lithium mines in Canada: Power Metals Corp., Lithium Chile Inc., and Ultra Lithium Inc., respectively.

In a statement justifying the decision, Canada’s Minister of Innovation, Science, and Industry François-Philippe Champagne said, “While Canada continues to welcome foreign direct investment, we will act decisively when investments threaten our national security and our critical minerals supply chains.” The national and economic security imperative was further pressed home by his statement that the government would proactively help Canadian businesses “identify and find partnerships that will serve in the best interest of Canadian businesses, workers, and the economy.

Canada is a minor player in the global lithium supply chain. Yet the significance of this move is that a developed Western democracy has invoked national and economic security imperatives to block legal, and largely market-driven Chinese investments in this commodity. This is more so significant because lithium is an increasingly critical commodity for the low-carbon future – particularly for China.

Among other things, lithium is a key ingredient for building batteries for electric vehicles (EVs). This is a rapidly growing market, with Boston Consulting Group recently forecasting that EVs will account for one-fifth of global light vehicle sales by 2025, and 59 percent by 2035. Such is the significance of this shift that Tesla’s Elon Musk has called lithium batteries “the new oil.” This resonates with what the International Energy Agency (IEA) has described as an ongoing “shift from a fuel-intensive to a material-intensive energy system.”

China currently dominates the EV battery market. It contributes 56 percent of global supply, with one company, CATL, accounting for roughly one-third of the global share. China’s lithium-ion battery manufacturing capacity is expected in 2024 to almost double the 2000 figure and reach nearly 600 gigawatt hours.

This, however, may not be enough, with China also set on becoming a global leader in the EV sector itself, which it has seeded with targeted subsidies, investment, and infrastructure for over a decade. This year China will already pass the Made in China 2025 pledge of EV vehicles making up 20 percent of domestic automobile sales, and 80 percent of these will likely come from domestic producers. EV sales in China are expected to reach 6 million units in 2022, more than the rest of the world combined, and roughly equal to the entire global volume of sales in 2021. It has also recently been forecast that China will export up to 800,000 EV units to Europe by 2025.

While lithium prices have recently reached record highs, lithium-ion battery prices per kilowatt hour are 30 times cheaper than in the early 1990s, making it likely to remain the go-to source of EV power in China and elsewhere in the medium term. Forecasts put the lithium chemical supply for 2022 at 636,000 megatonnes, an increase of well over 50 percent from the 2020 figure (408,000), while Australia’s Department of Industry forecasts that production will hit 821,000 tonnes by 2024. However, this is still not keeping up with demand, which is forecast to run at 641,000 across 2022, and “grow by about seven times between 2020 and 2030.” Some predictions have European demand alone rising a whopping 6,000 percent by 2050.

The likelihood of intensifying competition for this vital commodity is prompting Western countries such as Canada to securitize lithium supply chains – a trend that has only intensified in the wake of the energy insecurity caused by Russia’s invasion of Ukraine in February. In 2020, the European Union, as with Canada, added lithium to its list of strategic minerals, while then-U.S. President Donald Trump went so far as to announce a “national emergency” concerning the nation’s reliance on countries such as China for its supplies of “critical minerals,” including lithium.

In May, current U.S. President Joe Biden announced a $3 billion investment aimed at boosting the supply of lithium, and in mid-October the White House released a statement pledging to “develop enough lithium to supply over 2 million electric vehicles annually.” It invoked the Defense Production Act “to secure American production of critical materials for electric vehicle and stationary storage batteries,” and “put the U.S. on a path to long-term competitiveness in the global battery value chain.”

While China still faces regular supply shortages, it is, in a sense, still ahead of the game on the “securing supply” front, having acquired controlling or substantial stakes in companies with mining rights in critical supply regions. This includes South America’s “lithium triangle” (Argentina, Bolivia, and Chile), via deals such as the Sichuan-based Tianqi Lithium’s 23 percent stake in Chile’s SQM, and Chengze International Limited’s aforementioned stakes in Lithium Chile, which recently scored an agreement with Monumental Minerals Corporation to exploit the 5,200-hectare Laguna Blanca property.

However, it is clear that Western powers are now acting on growing concerns about China’s dominance in supply chains. Canada’s divestment move, which could at least theoretically impact China’s stake in projects such as the Laguna Blanca operation, and the United States’ recent efforts to deny China access to advanced chip technologies, are raising fears in China that intensifying geostrategic and geoeconomic rivalries could prompt Washington and its allies to use security-linked legislation to block China’s access to the 21st century’s “new oil.” This would be of particular concern to Beijing because China’s external lithium supplies mainly come from a country that is arguably the United States strongest geostrategic ally: Australia.

Australia-China Lithium Trade

Australia has the fifth-largest reserves of lithium in the world. However, with one of the most advanced mining sectors in the world, it is a dominant player in global production, contributing about 60 percent of the global supply. About 90 percent of what Australia produces it exports to China. Chinese companies also have important stakes in key Australian mines, including Tianqi Lithium, which leads a joint venture in Greenbushes – by far the largest lithium producer in the world – and Ganfeng Lithium, which has stakes in Australia’s next two largest lithium mines.

Lithium exports and investments, and their significance in the context of the Australia-China relationship, have also recently come into the spotlight.

In 2019, Lithium Australia joined forces with China’s DLG Battery to form the battery manufacturing subsidiary Soluna Australia Pty Ltd, which turned a profit within only one year of operation. A Forbes article in March 2021 stated that the growing volume of export and investment deals in lithium could “signal an end” to the China’s trade punishment of Australia.

On November 9, coinciding with Foreign Minister Wong and Opposition Leader Dutton’s discussions with Chinese officials, West Australia’s Premier Mark McGowan met with representatives of Chinese state-owned entities and Chinese private investors, including Tianqi and CITIC, in a closed door meeting that was “expected to broach the sensitive subject of Australia and other Western nations accelerating efforts to develop non-Chinese supply chains for critical and battery minerals vital to electrification of the economy and in military applications.” In the lead-up to the meeting, McGowan noted that China “accounts for more than half of WA’s total goods exports” and that “China will continue to be a part of” the state’s “place as a world leader in the critical minerals that will underpin global decarbonization.” He further emphasized that there were “hundreds of thousands of WA jobs dependent on the relationship.”

Yet with geostrategic competition intensifying, and the world order appearing to be in a nascent stage of devolving from liberal internationalism into value-based blocs, China is beginning to see warning flags that Australia could be veering in the direction of Canada and the United States on critical minerals security.

Weeks prior to McGowan’s meeting, Japanese Prime Minister Kishida Fumio visited Western Australia, where he visited mining facilities and signed both a joint declaration on security cooperation and a critical minerals partnership. Earlier this month, Resources Minister Madeline King flagged the need to diversify “supply chains in rare earths and other critical minerals,” and emphasized the “need to be… cognizant of the role Australia’s critical minerals will play in the security of our trusted regional friends and allies.” The latter prompted an immediate rebuke from China’s foreign affairs spokesperson, who said, “No one should use the economy as a political tool or weapon.”

Arguably reflecting such concerns, in mid-2021 an article from China’s state-owned Global Times reported that China was striving to “reduce its reliance on foreign suppliers [of lithium] such as Australia,” and in March of this year Tianqi Lithium’s chairman Jiang Weiping told China’s annual parliamentary session that domestic extraction should be expedited. But while these measures may help reduce reliance on imports over the long term, they are not likely to have a sizable impact on China’s needs in the more immediate, critical transition period, which King has described as “an important moment in history which could dictate the shape of the world that we will live in for the next century.”

In the short term at least, Australian exports remains critical to China’s plans to capitalize on its early gains and consolidate a less assailable leading place in the post-decarbonized energy sector.

Opportunity vs Systemic Power

Beijing’s intense desire to shore up a more stable short-to-medium-term supply of lithium could thus be an important factor motivating its attempt to mend ties with Canberra. Yet to the extent that this is so, the new push to mend ties may also be a product of earnest reflection on how Beijing’s coercive measures towards Canberra, including trade disruptions affecting a raft of Australian exports since 2020, have not only failed, but have coincided with other Pacific middle powers adopting firmer measures to protect their strategic and economic interests at Beijing’s expense.

After Beijing asked Canberra to hold urgent talks on China joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, it was Japan’s ambassador to Australia who, advising against accommodating Beijing, issued the warning that “economic coercion has become a signature modus operandi of a certain major WTO member.” And in a joint press conference during Kishida’s visit to Australia, in which Australia and Japan signed both security and critical mineral supply partnerships, it was Kishida, not Albanese, who explicitly identified China as a source of threats to regional security. Worsening relations with Japan coincided with Tokyo this year introducing an economic security bill, and bestowing leadership of Japan’s new Ministry of Economic Security to Takaichi Sanae, a fierce critic of China and its trade practices.

Canada’s measures against Chinese lithium producers also emerged against the backdrop of fierce public criticism of Chinese interference in Canadian elections, and accusations that Chinese police had established an unauthorized “service center” in Canada. With economic resilience measures targeting China multiplying, Beijing may be belatedly assessing its culpability in prompting democratic middle powers’ growing propensity to compromise free market principles to enhance economic security.

Time will tell whether or not lithium is a key motivating factor behind Beijing’s recent reconciliatory moves. But with the incumbent Australian government far more committed to combating climate change than their predecessor – and to promoting its efforts on this front – Beijing may have chosen an opportune moment.

Australia has shifted 284.8 million tonnes of emissions to China through its trade from 1990 to 2015 – roughly 70 percent of its 2017 emissions. And while the Chinese Low Carbon Emitting Technology (LCET) industries fed by Australia’s lithium exports have been the subject of protectionist policies, Canberra may well be aware that China is unparalleled in its capabilities in LCET scale-up in the time frame needed to limit climate change to below 2 degrees Celsius.

In any event, lithium exports and investments are likely to become a pivotal factor in the Australia-China relationship moving forward. As geostrategic tensions and competition for critical minerals intensify, it may also become the most consequential test-site of how Australia will manage growing conflicts between its expanding alliance obligations and its economic interests.

No comments:

Post a Comment