Jeremy Mark and Dexter Tiff Roberts

Introduction

In August 2022, the US Congress passed the CHIPS and Science Act, a law that approves subsidies and tax breaks to help jump-start the renewed production on American soil of advanced semiconductors.1 Just two months later, the Joe Biden administration issued wide-ranging restrictions on the export to China of chips and chip-making technology to undercut that country’s ability to manufacture the same class of integrated circuits.2

In August 2022, the US Congress passed the CHIPS and Science Act, a law that approves subsidies and tax breaks to help jump-start the renewed production on American soil of advanced semiconductors.1 Just two months later, the Joe Biden administration issued wide-ranging restrictions on the export to China of chips and chip-making technology to undercut that country’s ability to manufacture the same class of integrated circuits.2Taken together with a steady stream of Biden administration prohibitions on technology sales to key Chinese companies, the US initiatives represent a profound turn toward competition with China in the high-tech realm.3 They also highlight an effort to restructure the complex, multinational supply chains centered on East Asia that manufacture hundreds of billions of dollars of semiconductors a year. As such, the Biden administration has set in motion a process that could alter the business strategies—and fortunes—of homegrown and foreign-invested semiconductor companies based in China, world-leading chipmakers in Taiwan and South Korea, and suppliers around the world that provide the industry with the machinery and myriad inputs that fuel chip production.

The Biden administration insists that its restrictions on sales to China are intended only to limit China’s ability to produce the cutting-edge chips that can feed into the development of weapons and other strategically important technologies—and not to cripple its semiconductor industry. But the current state of play of sanctions and support for US-based semiconductor production, including by Taiwanese and Korean chipmakers, is not the endpoint in this process. Rather, the momentum to constrain Beijing’s semiconductor program is likely to continue in the coming months, at the very least with additional restrictions on Chinese companies and government-linked entities, and unprecedented bureaucratic scrutiny of American venture-capital and equity-financing flows to China.

That amounts to more bad news for corporate leaders in Asia, North America, and Europe who have spent the past generation building a globe-spanning semiconductor industry that has faced few barriers to expansion. As US restrictions mount, and sales of certain technologies to China flag, the once-unimaginable process of reorienting semiconductor supply chains will become an ever-present reality. The CHIPS and Science Act already is becoming an important factor in corporate strategy, providing incentives for Taiwanese, Korean, and American companies to make big bets on new factories in places like New York, Ohio, Texas, and Arizona—witness Taiwan Semiconductor Manufacturing Company’s (TSMC’s) recent decision to build a second factory in Phoenix.4

This paper explores the potential implications of US semiconductor policy for the global semiconductor supply chains and the competition for primacy in an industry that is constantly changing the face of the global economy and one that has implications for global security in all its dimensions. It begins by examining the policies put in place by the Biden administration, and then discusses the changes taking place across the industry, with a focus on Asia.

US Semiconductor Strategy: To “Degrade Their Battlefield Capabilities”

Last year marked a dramatic acceleration in the US effort to control the rise of China’s advanced semiconductor sector. Washington’s move from an earlier goal of ensuring that the United States maintained a steady lead in technological sophistication to an active effort to limit Beijing’s capabilities was expressed most clearly by National Security Advisor Jake Sullivan in a September 16, 2022, speech.5

“We previously maintained a ‘sliding scale’ approach that said we need to stay only a couple of generations ahead. That is not the strategic environment we are in today. Given the foundational nature of certain technologies, such as advanced logic and memory chips, we must maintain as large a lead as possible,” Sullivan said at the Special Competitive Studies Project Global Emerging Technology Summit in Washington, DC. Technology-export controls can serve as a “new strategic asset” that can “impose costs on adversaries” and even “degrade their battlefield capabilities,” Sullivan said. (In the Biden administration’s National Security Strategy issued in October, the White House referred to microelectronics as one of “the foundational technologies of the 21st century.”)6

Just weeks later, on October 7, when the Department of Commerce’s Bureau of Industry and Security announced its sweeping new restrictions, it was clear that the battle over chip domination had entered a new phase.7 Rather than just block China’s ability to acquire advanced chips by barring sales to Chinese companies, the new controls also banned sales of semiconductor manufacturing equipment (SME), effectively limiting China’s ability to produce its own cutting-edge devices. And the new policy did not stop there. It expanded restrictions on third-country production for Chinese customers of chips made with the same SME. It also imposed a ban on US persons—both citizens and those with resident alien status—from working on or supporting in any way the production of advanced semiconductors. That step shocked the industry and led to an exodus from China: Hundreds of engineers from American companies, including American SME makers Applied Materials, KLA, and Lam Research, suddenly left their positions at the most important Chinese chip companies. Major Chinese players hit by the loss of personnel included ChangXin Memory Technologies, Semiconductor Manufacturing International Corporation, and Yangtze Memory Technologies Co.

“The regulations amount to a declaration of full-scale technological economic cold war,” Dylan Patel, chief analyst of SemiAnalysis, a chip consultancy, said at the time. “The US is forcefully decoupling the entire advanced technology supply chain before China in-sources it.”8 Biden “pulled the pin from its grenade,” wrote Stanley Chao, a longtime China-based managing director for a business consultancy.9 What really “got the most attention” of American companies was, for the first time ever, the ban on experts, said one industry insider. While “talent globally had been an issue already,” the move in one stroke devastated Beijing’s multiyear and largely successful effort to lure leading engineers from around the world to China, including large numbers of Taiwanese and Chinese with US “green cards.”

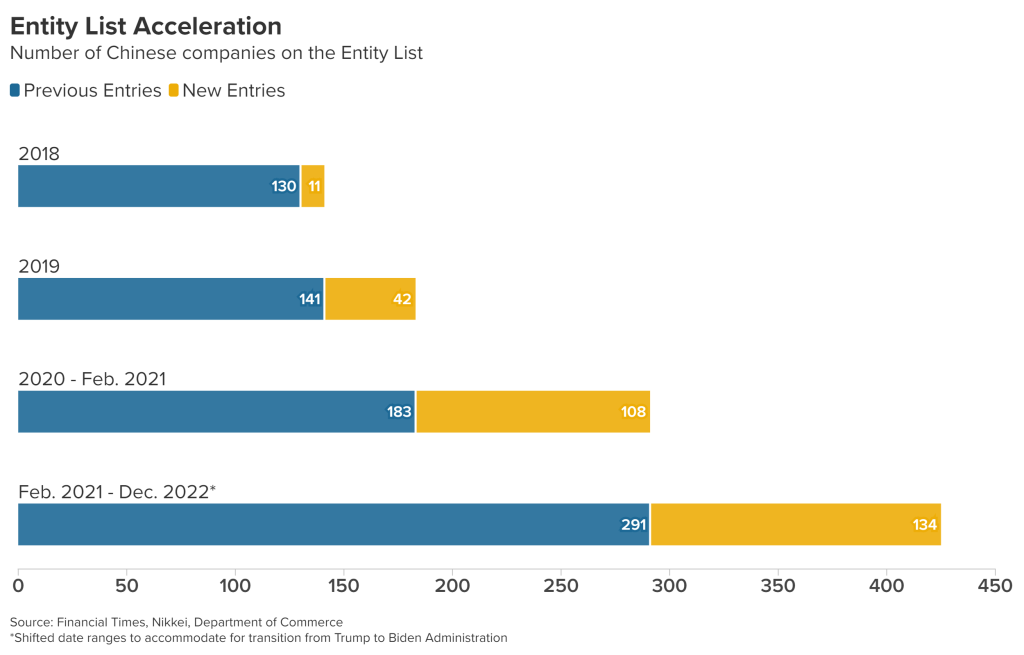

In mid-December, the Biden administration imposed another damaging set of sanctions by adding some three dozen Chinese companies and research laboratories to the Commerce Department’s entity list, a designation that severely restricts exports to foreign companies identified as engaging in activities detrimental to US national security.10 That action added to a who’s who of Chinese companies hit with restrictions (including forced delisting from US stock exchanges and prohibitions on investments by US fund managers), beginning with the administration of President Donald Trump and expanding starting from the early stages of the Biden administration.11 The number of Chinese companies on the entity list has quadrupled over the last four years.12

What is the United States concerned about under the new, more restrictive regime? Again, National Security Advisor Sullivan made that clear in his September speech. It is the recognition that certain fields are so important for national economies and security that they can be considered “force multipliers” and will play a key role in defining the geopolitical landscape. Those include leading-edge computers and artificial intelligence (AI), biotechnology, and clean energy, all of which the United States must lead in as a “national security imperative,” Sullivan said. “Preserving our edge in science and technology is not just a ‘domestic issue’ or ‘national security’ issue. It’s both.”13

Military-Civil Fusion

The new approach in Washington is also informed by the recognition of Chinese leader Xi Jinping’s strategy of military-civil fusion (军民融合), which, at its most basic, is a national effort to “translate China’s economic and technological achievements into military power.”14Given the building-block role that semiconductors play across the technology spectrum from smartphones to ballistic missiles, their development is a top priority for China and also necessary to achieve Xi’s stated goal of having a “world-class military” by 2049. Along with quantum computing, big data, and AI, semiconductors are “inherent ‘dual-use’ … technologies which have both military and civilian applications,” the US Department of State has said. They are also central to military-civil fusion, which the United States has called “an aggressive, national strategy of the Chinese Communist Party.”15

Keeping Away versus Running Faster

This attempt to block the technological advancement of China’s chips companies, or the punitive side of the Biden administration’s strategy, has been hugely important. The Biden approach, however, is as much about the carrot as the stick (the two sides have also been called “run-faster” and “keep-away,” respectively, by former Commerce Department official Kevin Wolf).16 And the biggest carrot, or incentive, to convince companies to help rebuild a stronger advanced semiconductor sector in the United States is the massive $52 billion CHIPS and Science Act. For some, the CHIPS Act is a turning point in American economic policymaking and tantamount to a declaration of support for a “new age of industrial policy.”17

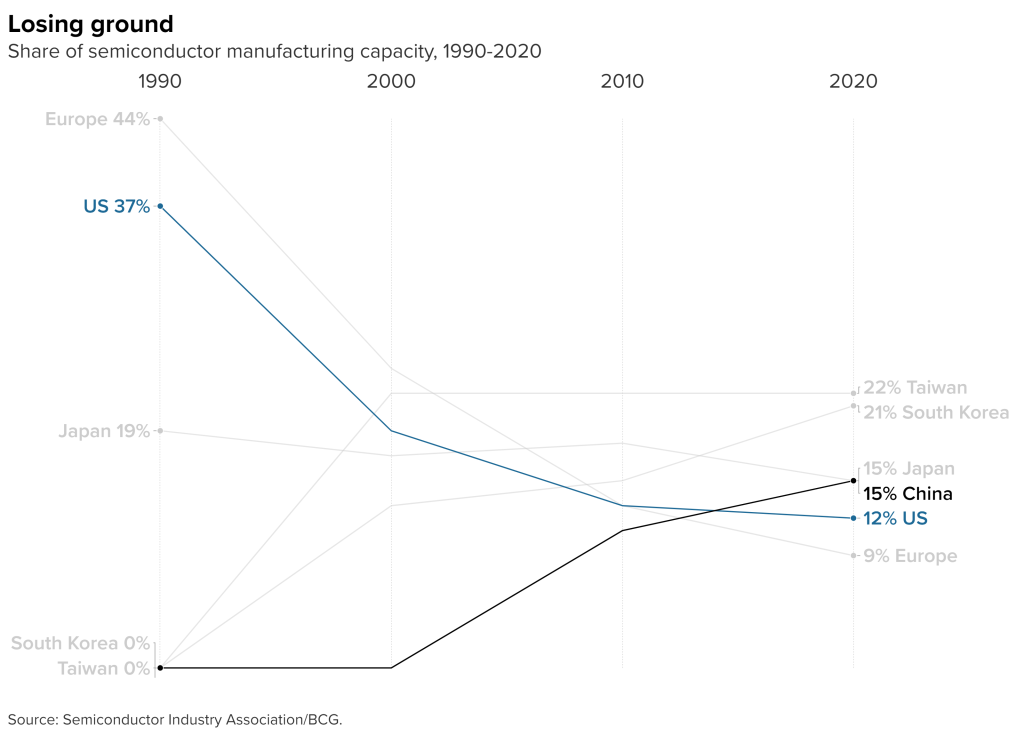

Speaking at the December 6, 2022, ceremony marking the installation of equipment in the first-stage factory of TSMC’s planned $40 billion semiconductor investment in Phoenix, the most notable prize to date from the new act, President Biden noted that the US production of chips had fallen from over 30 percent three decades ago to around 10 percent today. “Where is it written that America can’t lead the world once again in manufacturing? I don’t know where that’s written, and we’re proving it can,” Biden trumpeted to the assembled dignitaries that included TSMC founder Morris Chang, Apple Chief Executive Officer (CEO) Tim Cook, Micron Technology CEO Sanjay Mehrotra, and Secretary of Commerce Gina Raimondo. “American manufacturing is back, folks,” Biden said. “These are the most advanced semiconductor chips on the planet.”18

In reality, the most advanced chips—especially the next generations of logic devices—will continue to be produced first in Taiwan and South Korea, but the subsidies and tax incentives embedded in the CHIPS Act will help significantly narrow the gap with those countries largely by encouraging them to continue investing on American soil. However, $52 billion alone will not be enough to enable the United States to catch up. For example, the US semiconductor industry has vast engineering needs that American university programs cannot meet, and much of the semiconductor supply chain will remain in Asia.19 Nonetheless, the CHIPS Act represents important progress.

The Future and Outbound Investments

What new rules might come next? While some semiconductor industry insiders express the view that the Biden administration is likely to slow the imposition of export restrictions—if only because of the strain the new policy is placing on the agencies charged with enforcing it—senior officials have signaled a willingness to continue tightening controls. At a public forum in late October, Under Secretary of Commerce Alan Estevez made it clear that “We’re not done … I meet with my staff once a week and say, ‘Okay, what’s next?’”20 The December additions to the entity list suggest that scrutiny of exports will continue to expand.

The US Congress is also driving new restrictions. The 2022 National Defense Authorization Act (NDAA), passed in mid-December, prohibits US government agencies from procuring products or services that contain semiconductors made by China’s leading chip manufacturers.21 In introducing the NDAA language targeting Chinese chips, Senator Chuck Schumer memorably described them as “nefarious semiconductor products.”22

There is a strong likelihood that the White House will announce restrictions on outbound investments, particularly focused on China, in a sort of reverse version of the Committee on Foreign Investment in the United States, the interagency group that scrutinizes planned acquisitions of US companies by foreign entities (whose mandate was updated by executive order earlier this year).23 As Sarah Bauerle Danzman and Emily Kilcrease write in a recent Atlantic Council report, “recent congressional efforts to establish new authorities to regulate outbound investment have revived a long-simmering debate in Washington about the economic and security risks associated with US investment in China.”24 In particular, any new rules should have a clear focus on “screening for US investments in Chinese semiconductor entities, focusing on ‘smart money’ investments made in chip design, fabrication, electronic design-automation software, and manufacturing equipment,” the researchers argue, with one preeminent goal (and one that will surely anger Beijing): The rules should focus “on slowing indigenous technology capabilities in China.”25

Challenges

The US strategy now taking shape that aims to “maintain as large a lead as possible” in chips over China will not be easy and indeed faces significant and potentially—if not handled right—fatal obstacles. One of the most dangerous risks is the real possibility of the United States damaging the competitiveness of its own companies. And probably most vulnerable are semiconductor companies that rely heavily on the enormous Chinese market—companies like Qualcomm, Qorvo, Texas Instruments, and Broadcom—all of which source around one-half of their revenues from the mainland and that could, in one scenario, find themselves sanctioned on both sides—Washington hitting them for their support for Chinese chip-making and Beijing punishing them for Washington’s policies, perhaps by restricting their market shares.26

In a worst-case scenario in which US semiconductor sales to China fall to zero, the American Chamber of Commerce estimates that US companies would face a loss of $83 billion annually, costing 124,000 jobs.27 Revenue available for research and development (R&D) would drop too, falling by $12 billion annually.28 And the US consumer would almost certainly face a cost in inflation and potential supply chain disruptions. The global implications would be dire as well. A 2021 International Monetary Fund working paper warned that a complete technological decoupling between China and the United States and its partners “could have profound effects on world production and consumption patterns.”29

Getting Allies On Board

Another significant challenge for the United States will be getting allies to sign on to the same restrictions on China’s chip industry, for their own companies. Just as it is true for many American chip manufacturers or equipment makers, European, Japanese, and South Korean companies are deeply reliant on the Chinese market for their businesses (as detailed in the next section of this paper). Convincing them to forgo this revenue stream will be very difficult. And a failure to get others to follow the US example could backfire too, as companies from outside the United States could easily “backfill” or grab up the foregone US market share.30 An apparent example of success, however, was when it was reported on January 27 that the Netherlands and Japan would join the U.S. in restricting sales of equipment for advanced semiconductors to China.31 Whether that approach, which involved four months of arduous negotiations, can be seen as a model for future cooperation in keeping China in check in the technology realm is unclear—in part because the terms of the agreement have not been announced. At the same time, there is growing resentment about what is seen as the extraterritorial approach to trade by the United States among its allies. A case in point: the strong belief in the European Union (EU) that US subsidies for electric vehicles in the recently passed Inflation Reduction Act discriminate against its own companies. “There is a long history of transatlantic friction on the extraterritoriality of US laws and the Biden package on semiconductors is very extraterritorial and intrusive indeed,” notes one former European ambassador.

The United States also runs the risk of angering partners by acting unilaterally—as the Biden administration has done—to impose sanctions on China, and then only after the fact trying to win support from allies. “It is understandable why the unilateral route was appealing for the Biden administration. It is quicker, and effective in the short run,” says Emily Weinstein of Georgetown University’s Center for Security and Emerging Technology. “However, the more the United States continues to rely on unilateral—and especially extraterritorial—controls, the harder it will be to work with allies.” Not taking a more multilateral approach with controls leaves “too many ways for China to undermine or circumvent them.”32

A Global Supply Chain under Duress

Over the past generation, as semiconductors have become central to the global economy, a multinational ecosystem of manufacturers, suppliers, designers, and engineers has driven the industry’s development. The emergence of this supply chain has been marked by a relentless push for efficiencies and innovation, with governments employing subsidies and tax breaks to gain an industrial advantage.

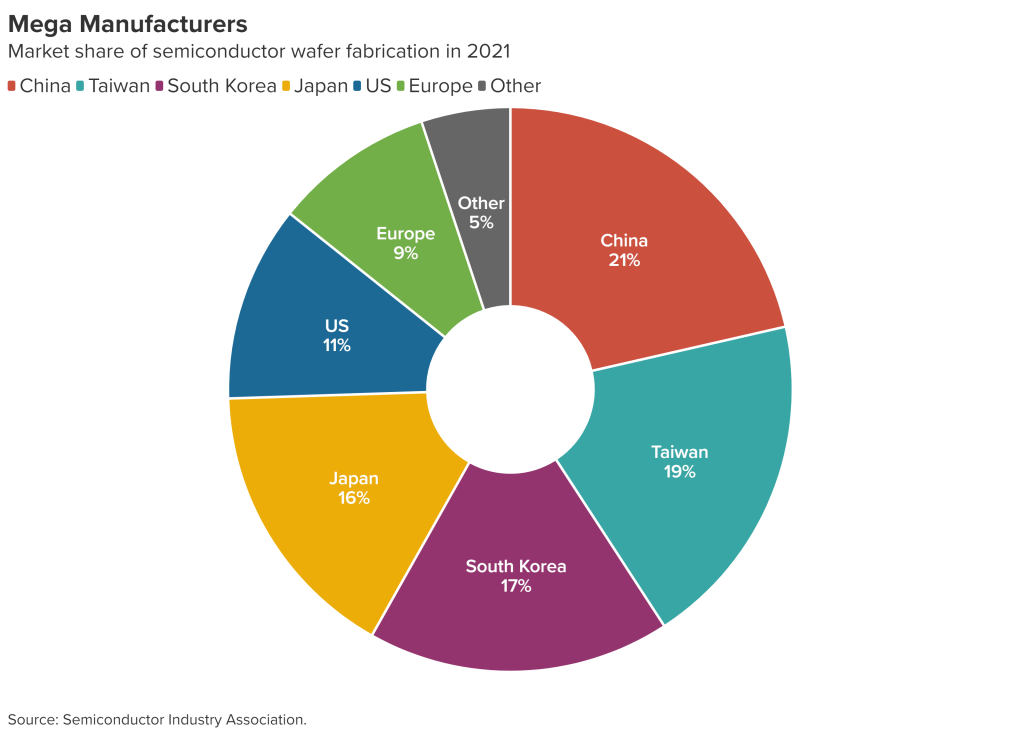

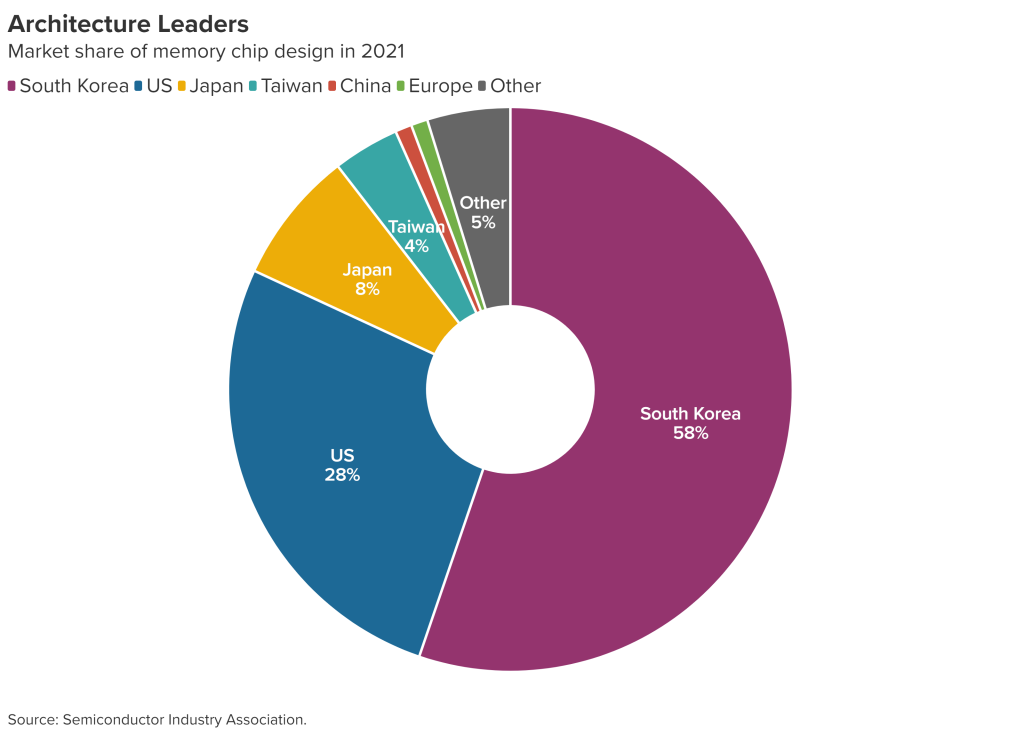

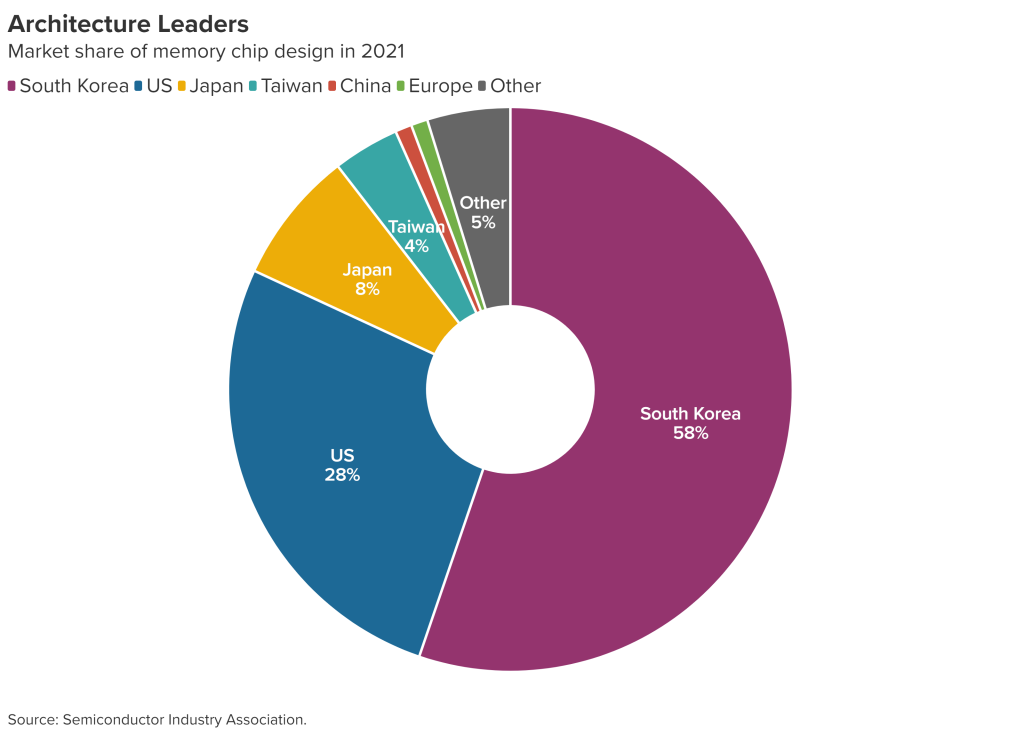

The result has been a business model built on specialization and cost advantage. Taiwan, South Korea, and, most recently, China have emerged as the leading chip manufacturers. The United States, Japan, and the Netherlands monopolize the SME that is crucial to semiconductor innovation. The United States dominates chip-design software, and along with Taiwan is on the cutting edge of designing the most advanced circuitry. China, Taiwan, and Southeast Asia handle final-stage assembly, and dozens of countries supply specialty chemicals, gases, and other inputs.33

Semiconductors have been hostage to the ups and downs of the global economy and the industries they supply—witness the explosion of demand during the Covid pandemic and the recent downturn that has caused many chipmakers to cut production and slow capital investment.34 But the industry’s overall trajectory has been marked by sustained, rapid growth. In 2021 alone, global semiconductor output reached 1.15 trillion individual chips with sales of some $555.9 billion.35While growth slowed in 2022, and 2023 is expected to decline, ASML Holding of the Netherlands, the sole maker of some of the most advanced chip-making gear, projects that the global semiconductor market could exceed $1 trillion by 2030.36

The industry’s development has unfolded largely without geopolitical constraints, enabling goods and investments to cross borders freely and frequently.37 One important example: Taiwan’s chip sales to China—representing about 60 percent of Taiwanese semiconductor output—have provided some guardrails as tensions have grown between the two countries.38 Indeed, the pull of mutual dependence has become something of a mantra within the industry.39

However, the sharp increase in US-China tensions since 2018, and the latest American restrictions on sales of semiconductors and related technology, has alarmed the industry. While US policy is focused on restricting chip and related exports that would help China gain an advantage in AI and other technologies with military applications, uncertainty about long-established commercial ties has grown. US policy, write Sujai Shivakumar and Charles Wessner of the Center for Strategic and International Studies, represents “an unprecedented departure from the precepts of the integrated global economy.”40

An assessment of key countries’ roles in the semiconductor supply chain provides a clearer picture of the challenges that governments and businesses are confronting.

China: Chokepoints Work Both Ways

The impact of the Biden administration’s trade restrictions on China’s efforts to produce and use advanced semiconductors has been well documented in other settings, especially the implications for its efforts to develop advanced AI capabilities and memory-chip production.41 Less attention has been directed to the role that China plays in the semiconductor supply chain as an important market for chips—both imported and made on its own soil by foreign companies; as a rising producer in its own right; and as one of the largest providers of chip assembly, packaging, and testing (APT) services, which is the final stage of the manufacturing process. In addition, a vast number of integrated circuits made outside the country end up on Chinese assembly lines for devices ranging from computers to smartphones and automobile parts. The immutable reality of the semiconductor supply chain is that the target of US sanctions is also one of the industry’s central players.

China imported over $430 billion of semiconductors in 2021, but its purchases declined last year in large part because of the zero-Covid restrictions that sharply reduced economic growth.42 The Biden administration’s export restrictions are likely to affect only a relatively small portion of those imports, largely advanced chips used in AI and other cutting-edge applications. But even in those cases, US chipmakers are now designing chips for the Chinese market that fit the parameters of the latest restrictions.43

However, American sales of SME that enable China’s production of sophisticated chips are likely to be hit hard, as will those by industry leaders in Japan and the Netherlands (see below). For example, before the restrictions were imposed, US companies Applied Materials and LAM Research saw 33 percent and 31 percent, respectively, of their SME sales going to China.44 The Biden administration is targeting a critical vulnerability for China’s semiconductor industry, but hurting leading American companies in the process.

Another potential chokepoint in China is the central role played in its production of memory devices by two Korean companies, Samsung Electronics, and SK Hynix. Production of NAND flash chips by Samsung in Xian and dynamic random-access memory (DRAM) devices by Hynix in Wuxi represent a significant proportion of China’s domestic output and exports of those chips. Both companies have received one-year US waivers on their use of specific technology affected by export restrictions. Any withdrawal of those waivers would impact China’s access to memory devices, especially because of the recent decision to add YMTC—an important NAND producer in its own right—to the US entity list. That, in turn, would have grave implications for Korean companies (see below).

However, chokepoints can work both ways, and China’s importance as a base for APT, and the semiconductor industry’s growing reliance on those Chinese services, has emerged as a risk for chipmakers worldwide. China’s role in APT stems largely from its cost advantage in what is a relatively labor-intensive segment of the industry. The largest assembly and packaging companies in the world, ASE Group and Powertech Technology from Taiwan and Amkor Technology of the United States, have a major manufacturing presence in China, and Chinese companies are rapidly expanding their APT operations. In many instances, chips that are fabricated in the United States are shipped to China for final processing.45 This situation would present a significant vulnerability to the United States if tensions with China increase in the future.

Taiwan: Manufacturing and Innovation Powerhouse

Taiwan has become known as the factory floor of the chip industry and a font of engineering innovation, in large measure because it is home to TSMC, one of the most important companies in the world. In fact, Taiwan lays claim to several other important semiconductor manufacturers, enabling it to become central to the chip industry’s international division of labor. Even as Taiwanese companies import many key manufacturing inputs from partners around the world, they also have built a highly integrated supply chain—a web of factories, design firms, silicon wafer and specialty chemical makers, APT plants, specialized construction firms, and universities that churn out engineers and technicians for the industry.

The country’s undisputed leader is TSMC, which manufactures semiconductors for many of the largest multinational corporations (led by Apple with 26 percent of TSMC’s sales46). Most importantly, TSMC produces 92 percent of the world’s most advanced integrated circuits.47 The motherlode of the company’s dominance is its R&D prowess, which has enabled it to pioneer several generations of breakthroughs in semiconductor manufacturing in close cooperation with SME makers and chip designers. It amplifies those breakthroughs with the brute force of capital spending—some $100 billion of which is planned through 2024 in Taiwan, Arizona, and Japan, with possible investments in Singapore and Germany to follow.48 Along with South Korea’s Samsung Electronics, TSMC determines how, where, and when the boundaries of electronics engineering will expand, and its customers follow its lead.

With over half of Taiwan’s semiconductor output destined for the Chinese market—to Chinese, Taiwanese, and other foreign customers—the uneasy economic interdependence across the Taiwan Strait has placed Taiwan’s industry, and especially TSMC, firmly on the radar of Washington policymakers. The Trump administration’s campaign against Chinese telecommunications giant Huawei Technologies included strict restrictions on semiconductor sales to the company; those sanctions halved TSMC’s exports to China to 10 percent of its global sales.49 The company is now under increasing pressure to police the orders it receives from other Chinese companies, and as the Biden administration tightens export controls, the Taiwanese company has canceled more Chinese contracts.50 TSMC’s two factories in China so far are relatively unaffected by US actions because they make older generations of chips, and, like the Korean chipmakers, have received a one-year waiver from the Biden administration on the use of American SME.51

TSMC aside, the latest US restrictions appear to have limited impact on Taiwan’s other chipmakers, which produce less-sophisticated chips for the Chinese market. However, Kristy Tsun Tzu Hsu of the Chung-Hua Institution for Economic Research in Taipei says that some Taiwanese design houses, which rely heavily on Chinese customers, are likely to be hit harder by the crackdown. In addition, she says, many Taiwanese engineers at Chinese semiconductor producers are affected by the Biden administration rules that restrict US passport and green card holders from working in China’s industry.52

Taiwanese government officials have been the most understanding among US partners in their public responses to the Biden policy. In an October 2022 visit to Washington, Economy Minister Wang Mei-hua said that Taiwan “will follow whatever rules and guidelines are set forth by our trading partners … we do not have a lot of room to bargain.”53 Taiwan has accepted the Biden administration’s invitation to join the Chip 4 group of semiconductor-producing nations, both for the regional recognition the group gives it and to strengthen ties with the United States.54

The Taiwanese government also responded positively to US pressure on TSMC to build its factories in Arizona. Taiwanese President Tsai Ing-wen highlighted her government’s view of the strategic advantages of a semiconductor supply chain that includes a TSMC production base in the United States when she told then-Arizona Governor Doug Ducey in August 2022: “This will help build more secure and resilient supply chains. We look forward to producing democracy chips to safeguard the interests of our democratic partners.”55 The expansion of the subsidies and tax incentives in the CHIPS and Science Act to foreign companies helped ease TSMC’s initial hesitancy about expanding because of higher costs and shortages of experienced engineers in the United States.56

While some Taiwanese politicians have decried the Arizona investments as the first step in what they call the “hollowing out” of Taiwan’s semiconductor industry, the company’s executives and board have defended the expansion and insisted that the company’s cutting-edge R&D and production will remain at home.57 In fact, TSMC began 2023 by launching commercial production of three nanometer chips at a new Taiwanese plant and is building a next-generation two-nanometer facility there as well.“58

South Korea: Memory Muscle

US efforts to contain China’s high-tech progress pose a greater challenge to South Korean semiconductor companies, because they are much more embedded in the Chinese economy than their Taiwanese competitors. The Korean economy is dominated by giant conglomerates, and its semiconductor industry has only a few producers, with production largely focused on high-volume memory products.

Like Taiwan, South Korea sends about 60 percent of its chip exports to China, but Korean chipmakers produce a much larger amount than Taiwanese firms at Chinese factories.59 Overall, reliance on China is much more significant: Some 30 percent of Samsung Group’s exports of $11.2 billion to China in the first quarter of 2022 came from Samsung Electronics’ sales of semiconductors.60

The Korean companies’ Chinese factories are very vulnerable to US trade restrictions. One-half of SK Hynix’s production of DRAMs comes from its Wuxi plant, while Samsung’s production base in Xian supplies 40 percent of its global output of NAND chips. The companies use those Chinese operations both for export and to supply China’s domestic market, meeting about 45 percent of China’s demand for memory chips.61

The Biden administration’s restrictions on exports and technology transfers to China have placed the Korean companies in a bind despite their one-year waivers from Washington. That, in turn, puts the South Korean government in a difficult position as it seeks to balance its strategic alliance with the United States and its economic reliance on China. The calculus of interdependence is similar to that faced by policymakers in Taipei, but with the added dimension of Seoul’s sensitive interactions with Beijing over North Korea.62 Seoul is mindful of China’s imposition of punitive sanctions in 2016 after South Korea decided to deploy a US antimissile system as a defense against North Korea.63

So far, the South Korean government has been cautious about declaring its willingness to join the Biden administration’s Chip 4 initiative—in contrast to Taiwan’s open-arms welcome. Seoul participated in the initial meeting of the group, but as, of December 2022, remained coy in its public statements.64 As of January 2023, a second meeting of the Chip 4 group had not taken place.

It is the exposure of Samsung and SK Hynix to US-China tensions that poses the most significant risk in the chip standoff, with SK Hynix saying soon after the US export restrictions were announced that it may consider selling its Chinese operations.65 Meanwhile, Samsung’s long-term solution appears to be to beef up its presence in the United States thanks to the CHIPS and Science Act. The company has one chip factory in Texas, with another under construction. It has also announced that it intends to invest an additional $200 billion in factories there over the next twenty years, but such long-range plans appear aspirational—or intended to curry favor with Washington at a delicate moment.66

Japan and the Netherlands: Monopoly Powers

Japanese and Dutch companies command monopolies in key niches of the semiconductor supply chain. Each controls the manufacture of SME essential to the production of the most advanced integrated circuits. The Dutch company ASML is the only company making the extreme ultraviolet (EUV) lithography machines (which cost some $200 million each) used to etch hundreds of millions of circuits on a single chip in the current generations of advanced semiconductors.67 Japan’s Tokyo Electron produces the EUV photoresists that are essential in cutting-edge manufacturing, while Nikon Corporation makes various key lithography components.Dylan Patel, “Lam Research, Tokyo Electron, and JSR Battle It Out in the $5B+ EUV Photoresist, Coater and Developer Market—CAR vs MOR vs Dry Resist,” Semianalysis, November 18, 2021, https://www.semianalysis.com/p/lam-research-tokyo-electron-jsr-battle; Khan, Mann, and Peterson, The Semiconductor Supply Chain, 30-31. In addition, Japanese manufacturers dominate the market for several specialty chemicals used throughout the industry.68

US efforts to contain sales by the SME companies to China have proven to be among the most controversial steps of the effort to contain China’s semiconductor aspirations. The Trump administration prevailed on the Netherlands to block sales of ASML’s EUV equipment to China. (The company’s sales to China in 2021 represented about 15 percent of its total revenue.)69 In addition, the US constraints on American citizens and green card holders working with Chinese chipmakers have affected ASML’s interactions with existing Chinese customers.70

Meanwhile, Tokyo Electron earned about one-quarter of its revenue from sales to Chinese companies, including those targeted by the US export controls and other sanctions.71 It recently downgraded its earnings forecast for the fiscal year ending March 31 by 8 percent in the wake of the October 2022 restrictions.72

The dispute among allies over SME sales largely played out in the diplomatic shadows.. While Japan maintained its public restraint on the issue—as it does in most disputes with the United States—Tokyo Electron was reported to be strongly opposed to the US curbs.73 The Dutch were more outspoken, with Foreign Trade Minister Liesje Schreinemacher declaring in November 2022 that “the Netherlands will not copy the American measures one-to-one.”74

The agreement on SME sales reached by the three governments in January after months of negotiations, was reported to include export restrictions on additional ASML gear used in deep ultraviolet lithography, a slightly less advanced manufacturing process.75 However, with the details of the agreement remaining unclear, it is difficult to judge whether diplomatic differences remain.

The dispute underlined the difficulty Washington is likely to face if it pressures its partners to take additional steps against China that hurt the allies’ commercial interests—something there is every reason to expect if tensions between Washington and Beijing continue to build.

Conclusion and Recommendations

The global semiconductor supply chain is coming under increasing strain as US-China tensions magnify the vulnerabilities of an industry built on once-unfettered cross-border trade and investment. US export restrictions aimed at restraining China’s progress in advanced chip manufacturing are amplifying business risks and straining diplomatic relationships with American allies. The Biden administration’s effort to revitalize chip-making in the United States with the CHIPS and Science Act may begin to restructure the supply chain, but the industry’s foundations in East Asia, built up over thirty years, are unlikely to change significantly. Ultimately, this should be regarded as a positive because the forces of interdependence embedded in the globalized semiconductor industry can serve as a stabilizing counterweight to potential geopolitical turbulence. The issue, then, is how to give appropriate weight to the national security challenges posed by China’s technological rise while avoiding undermining an industry that is essential to continued global economic growth.

Do not cripple supply chains—While the steps taken by the Biden administration to constrain China’s progress in producing cutting-edge semiconductors appear calibrated to avoid widespread industry disruption, the policy has produced painful consequences that cannot be downplayed. The US, Dutch, and Japanese companies that dominate SME manufacturing have all taken a hit from the loss of Chinese orders. South Korea’s memory chipmakers are facing a fundamental threat to the viability of their production bases in China. Any additional US restrictions will only add to these pressures across the industry, and the damages will become globalized.

The industry’s growth in the coming years—including the potential lift from investments in new US chip factories—could help make up for some of those losses in China. But the bottom-line impact may be felt in terms of what the industry terms a “significant loss of scale” that could yield fewer resources for R&D and new investments.76 Money is the lifeblood of innovation in any industry, and semiconductors require regular transfusions of capital on an unprecedented scale. US policymakers who are focused on the threat posed by China should also be wary of moving so fast on so many fronts that they end up unwittingly damaging key links in the complex supply chain. In a climate in Washington where there is bipartisan political support for restrictions on technology trade with China, it is essential that the semiconductor industry—and US allies, as discussed below—have a voice in assessing the potential impact of additional proposed constraints. Communication is essential to avoid unintended consequences.

Do not undervalue interdependence—As China has adopted a more truculent external posture and relations with its trade and investment partners have deteriorated—certainly with the United States, but also with Japan, South Korea, Taiwan, and Europe—the downsides of economic openness have become amplified. Chips designed in China and manufactured in Taiwan have ended up in China’s most advanced weapons, and technology obtained openly—and stealthily from the West—has been central to these advances. Semiconductors have pride of place in Xi Jinping’s strategy of military-civil fusion, so restrictions on Beijing’s efforts to develop the most advanced chips are fully justified.

But economic interdependence with China—as much as it has fallen out of favor in US policy circles—can serve as a brake on Beijing’s worst political impulses. It has served an important economic and political purpose for many countries, not the least of which is Taiwan, whose leaders have continued to underline the importance of cross-strait economic ties in recent years, even as Beijing has ramped up military pressure. So, avoiding blanket bans on semiconductor trade and investment in favor of carefully calibrated restrictions may prove most effective. Such trade-offs can enhance stability and avoid diminishing the global importance of US multinationals in the semiconductor—and other—industries.

Diplomacy is not a sometime proposition—The Biden administration came to office committed to rebuilding US alliances that had been shredded by its predecessor. Considerable efforts have been put into restoring Asian and European trust in the United States. However, the abrupt imposition of the October semiconductor export restrictions on China caused upset in several capitals, and January’s opaque agreement among the US, Japan and the Netherlands over SME sales may only put off the diplomatic day of reckoning over differences rooted in core commercial interests. Unilateral American actions—no matter how much effort is put into mending fences after the fact—do not serve US interests, as Sarah Bauerle Danzman and Emily Kilcrease state so clearly in their recent Foreign Affairs article.77

The proposal to set up a Chip 4 alliance that would bring together the United States, Japan, South Korea, and Taiwan to coordinate semiconductor policy is an important initiative. But the group needs to include Europe, especially the Netherlands because of the crucial role of ASML as supplier of the most advanced chip-making equipment. Only a serious multilateral effort can produce a coordinated, effective approach to China. In its absence, there is a risk that countries will seek advantage, including by developing—and selling to China—semiconductors and SME made without American technology and thus beyond US trade restrictions. In addition, Taiwan needs to be granted equal status in the alliance—commensurate with its leading global role in the semiconductor industry.

Address US semiconductor chokepoints—The CHIPS and Science Act is an important initiative that can help revitalize semiconductor manufacturing on American soil. But manufacturing cutting-edge chips is not the same as duplicating the supply chain. US semiconductor manufacturing will remain dependent on imported equipment, silicon wafers, specialty chemicals, and many other inputs. (Not to mention that the United States will continue to buy the most advanced chips in Asia for years to come.) However, there are areas where government financial and regulatory support will be required to eliminate key chokepoints. Two examples include the following:

First, the industry-wide reliance on China for chip assembly, testing, and packaging poses a danger. Because of the labor-intensive nature of much of that work, it is not commercially viable to build a significant ATP capability in the United States. However, with incentives, it would be possible to build up ATP in the western hemisphere. In particular, Mexico could present a longer-term solution, especially with tens of billions of dollars in chip investment now targeted at Arizona and Texas. Chip assembly and packaging is not as sexy as semiconductor fabrication, but it must be an essential part of any committed effort to rebuild a secure US chip manufacturing base.78

Second, the US semiconductor industry is facing a serious—and growing—shortage of engineers and technicians. By one estimate, fifty thousand new engineers will be needed over the next five years because of CHIPS Act investments.79 Some of those specialists can be hired abroad. But ultimately it will be essential to expand US university programs—at the graduate and undergraduate levels—that can train a new generation of engineers and technicians. That will also require fixing the US visa system so it does not block or discourage international students from studying—and working—in the United States. That should include Chinese students (while taking necessary precautions to stop technology theft or espionage) as many of them have made important contributions to US scientific advances80

No comments:

Post a Comment