Over the last two decades, unmanned aerial vehicles (UAVs) have become increasingly embedded in militaries around the world. The duties of these systems range from strikes against insurgents in conflict zones to surveillance gathering in support of multilateral disaster relief operations. The commercial sector also relies on unmanned platforms for a variety of services, including aerial photography, crop monitoring, and infrastructure inspection. Amid its ongoing economic development and military modernization, China has emerged as one of a handful of global leaders in the development of unmanned systems. As China continues to advance its UAV technology, it is poised to play a dominant role in shaping industry trends.

The Rise of Drones

While the use of unmanned platforms continues to grow, there is no universal standard for classifying these systems. Defense agencies, civilian organizations, and drone manufacturers often use their own categories, typically grouping systems by either their function (e.g. reconnaissance) or key characteristics (e.g. operational altitude). The scheme employed by the US Department of Defense (DoD) favors the latter, and divides drones into five groups detailed below.1

As its military modernization has progressed and its position as a global arms exporter has expanded, China has carefully factored unmanned systems into its strategic planning. President Xi remarked in March 2016 that “UAVs are important operational forces for the modern battlefield.” Additionally, China’s 2019 defense white paper states that “there is a prevailing trend to develop long-range precision, intelligent, stealthy or unmanned weaponry or equipment” and added that “intelligent warfare is on the horizon.”

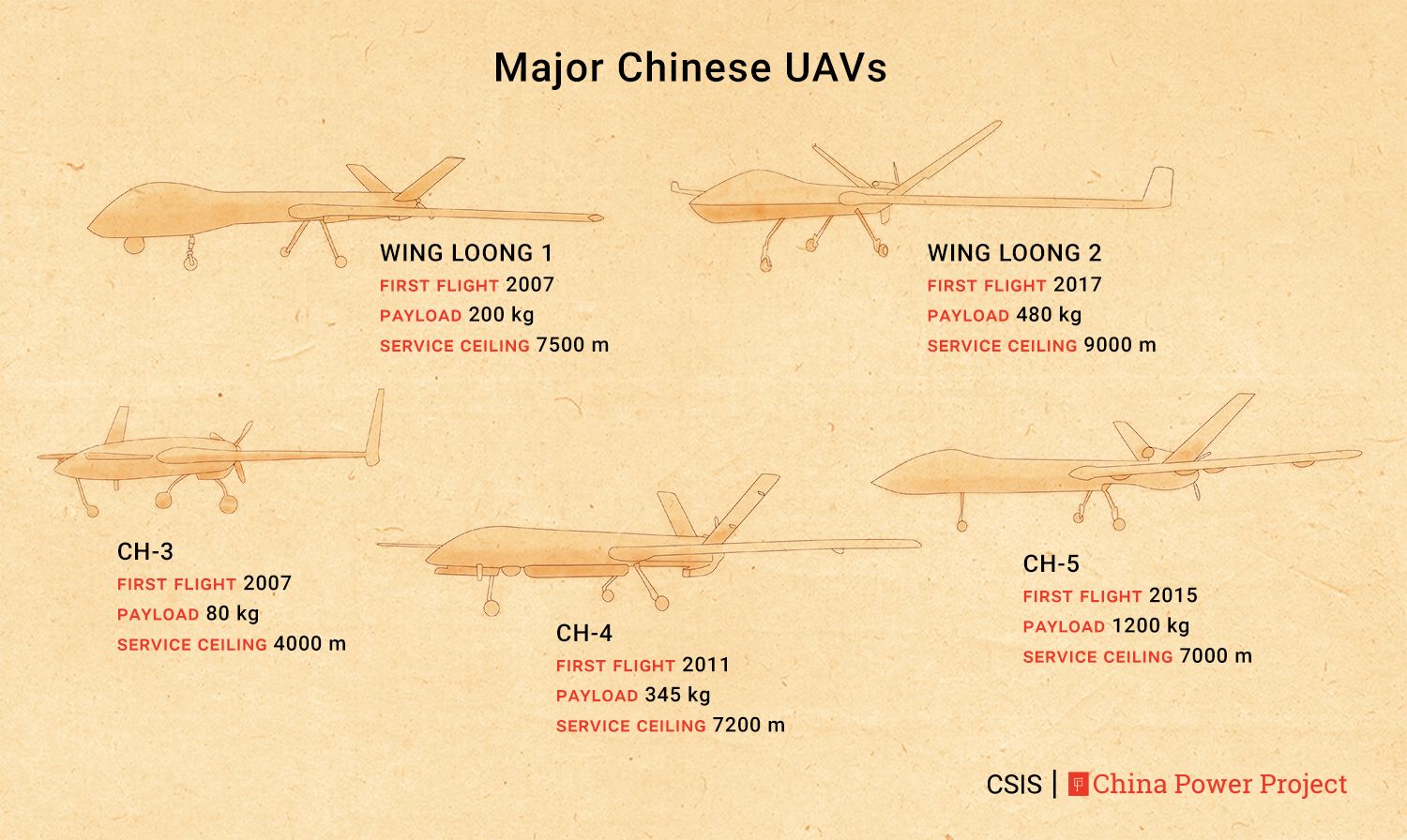

China has found success in producing both strike-capable systems and unweaponized systems for intelligence, surveillance, and reconnaissance (ISR) missions. A 2018 DoD report noted that the People’s Liberation Army Air Force (PLAAF) “is closing the gap with the U.S. Air Force across a spectrum of capabilities, gradually eroding longstanding U.S. technical advantages.” The report also stated that the “PLAAF continues to modernize with the delivery of indigenous manned aircraft and a wide range of UAVs.” Its Wing Loong and Caihong (CH) series have become popular exports to militaries around the globe, particularly to the Middle East and North Africa. Its fleet of reconnaissance drones includes the High Altitude Long Endurance (HALE) Soaring Dragon and Cloud Shadow.2

China has made considerable progress in establishing itself as a leader in global arms sales, particularly drones. Learn more about its growing arms exports around the world.

While there are no reports of the Chinese military carrying out drone strikes, Beijing has utilized drones in a number of non-combat scenarios. Following the 2008 Sichuan Earthquake, China used drones to support various humanitarian assistance/disaster relief operations. Chinese law enforcement has also employed drones to conduct surveillance operations in Xinjiang. In October 2017, China carried out a test flight of an amphibious drone that could potentially ferry supplies to military installations in the South China Sea. More recently, In September 2019, China’s Ministry of Natural Resources deployed a network of drones to the South China Sea to surveil and establish a drone communication system of air and land-based UAVs.

How the CH-5 Drone Stacks Up

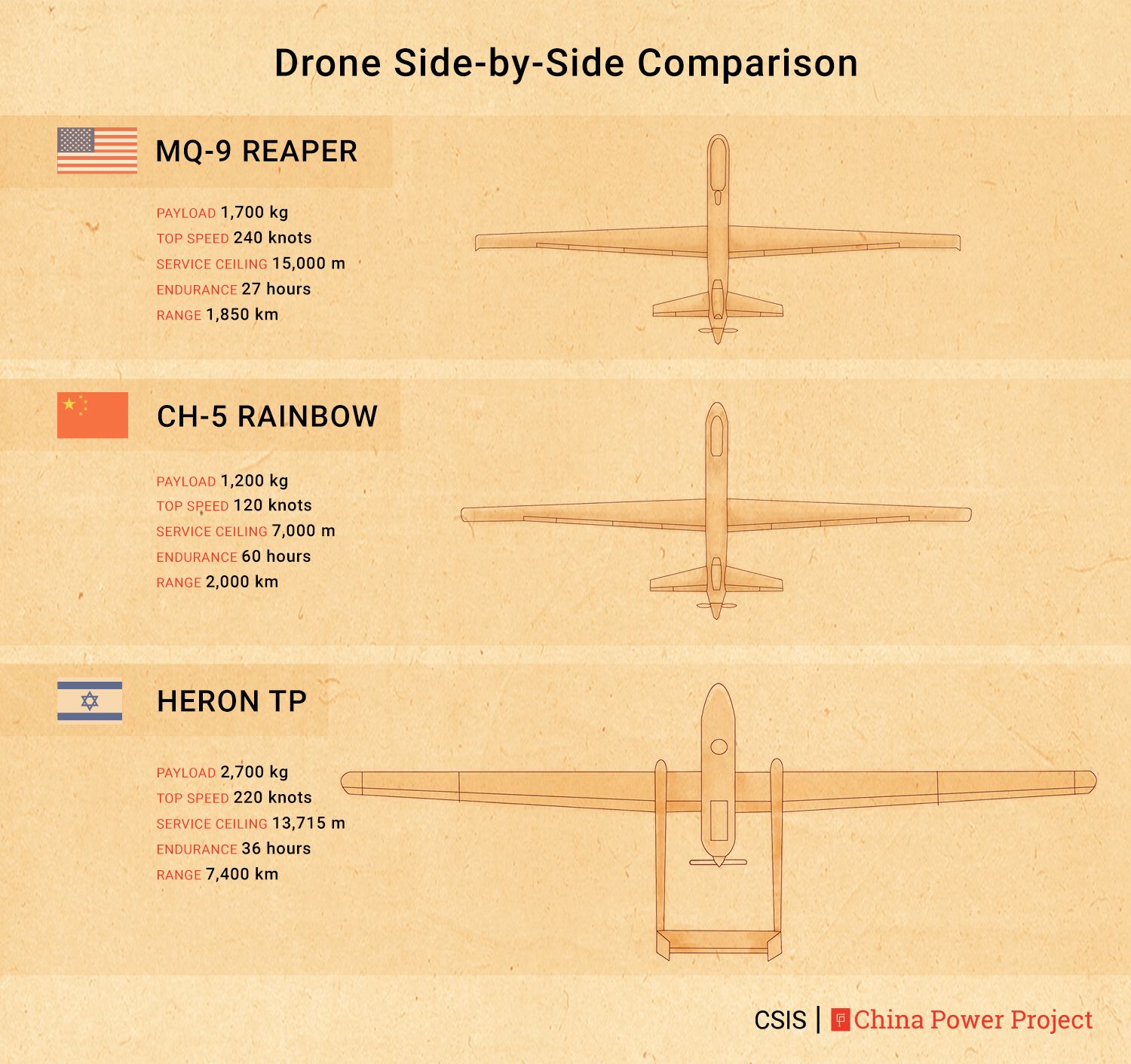

While China produces several types of UAVs, its multi-role strike capable drones see the most widespread use overseas. To better serve the growing needs of the international market, China developed the Caihong 5 (CH-5) Rainbow. The new strike-capable UAV is now production ready, and is expected to compete with American Reaper and Israeli Heron TP.

In both size and form, the CH-5 is almost identical to the Reaper. Both UAVs feature a V-tail and ventral fin. Both measure 11 meters (36 ft) in length and have similar wingspans. Israel’s Heron TP varies considerably in design. It is configured with a twin-boom tail structure and a pair of vertical tail fins. It is also larger, with a wingspan of 26 meters (85 feet), several meters longer than either the Reaper or Heron TP.

The Maximum Takeoff Weight (MTOW) of the CH-5 is approximately 3,300 kg (7,275 lbs), which is about 1,500 kg less than the Reaper and 2,100 kg less than the Heron TP. The lower MTOW of the CH-5 limits the ordinance it can carry when compared to its American and Israeli counterparts. The Reaper can be equipped with a variety of payloads, but it typically carries several hellfire missiles and two 227 kg (500 lbs) bombs.

While it is unclear how the CH-5 will be outfitted, its payload capacity stands at 1,200 kg (2,646 lbs), roughly 500 kg (1,103 lbs) less than that of the Reaper and 1,500 kg (3307 lbs) less than the Heron TP. The newer Avenger UAV, which was designed to succeed the Reaper, has an even more impressive 2,948 kg (6,500 lbs) payload. While operationally ready, the Avenger has yet to gain widespread traction with either the US military or as an export.

Like other Chinese aviation platforms, the CH-5 is limited by its engine. As a result, the multi-role striker flies at a max speed of 120 knots – more than 100 knots slower than the Reaper and Heron TP. Compared to the Avenger, which boasts a max speed of 400 knots, the limitations of the CH-5 are even more pronounced. The CH-5 also flies at a lower altitude, reaching just 7,000 meters (22,965 ft), far below the 15,000m (50,000 ft) ceiling of the Reaper and 13,716m (45,000 ft) ceiling of the Heron TP. The CH-5’s limited ceiling makes it more vulnerable to anti-aircraft weaponry.

To help compensate for these issues, the CH-5 can be outfitted with an optional heavy-fuel engine that extends the craft’s operational endurance to 60 hours – a 20 to 30 percent boost from its standard engine. This is more than double the Reaper’s fly time of 27 hours, and still significantly longer than the Heron TP’s 36 hours.

According to state media reports, the CH-5 can be “operated by an undergraduate student with basic knowledge of aviation after only one or two days of training.”

Longer endurance gives the CH-5, in theory, an edge in its operational range. Paired with the heavy-fuel engine, the CH-5 has a manufacturer reported range of 6,500 to 10,000 km (4038 to 6,214 miles). Nevertheless, China’s limited command and control capabilities may in practice limit the CH-5’s operational range to under 2,000 kilometers (1,243 miles).

The CH-5 features a range of electronic warfare systems that are comparable to other UAVs, including infrared/electro-optic and thermal imaging capabilities for air-to-ground intelligence gathering. The CH-5 can also identify targets through walls, furthering its capacity to carry out missions in urban settings. One of the CH-5’s most notable features is that it shares a control system with its predecessors, the CH-3 and CH-4, enabling joint strike operations. According to state media reports, the drone’s autonomous flight option drastically reduces the learning curve for operators, allowing the drone to be “operated by an undergraduate student with basic knowledge of aviation after only one or two days of training.”

Chinese Drones Around the World

China has quickly emerged as a major exporter of multi-role strike capable UAVs. Between 2008 and 2018, China sold a total of 181 drones to 13 different countries.3 Over three-quarters of these sales were of strike capable systems, including those of the popular Caihong (35.4 percent of sales) and Wing Loong (53.6 percent) series. The newest Caihong model, the CH-5, is expected to build on this success.

In terms of total UAV sales, however, China lags leading exporters. Between 2008 and 2018, the US led global drone exports with a total of 292 drones sold to partners around the world. Israel followed closely with the sale of 265 UAVs. The majority (88 percent) of US sales have been composed of ISR drones, ranging from the mini-surveillance drone Scan Eagle up to larger platforms like the Global Hawk. Roughly 70 percent of Israel’s UAV exports have been ISR platforms, including the Searcher and Aerostar.

No orders have been placed yet for Chinese HALE drones, and Beijing rarely exports its smaller surveillance systems. Instead, China has positioned itself to specialize in exporting strike-capable UAVs. Between 2008 and 2018, China delivered 163 Caihong/Wing Loong series drones, surpassing the 35 Reaper/Predator drones exported by the US and the 166 Hermes/Heron TP drones sold by Israel.

Beijing is working with partners around the world to sell more of its UAVs. In 2017, Saudi Arabia signed an agreement to purchase 300 Chinese UAVs and to build a manufacturing and servicing facility in Saudi Arabia to produce CH-series drones. In 2018, China and Pakistan reached an agreement to coproduce 48 Wing Loong II long endurance drones.

Through 2018, the main purchaser of Chinese drones has been the UAE (22.1 percent of sales), followed by Saudi Arabia (19.3 percent), Egypt (15.5 percent), and Pakistan (13.8 percent). China has recently begun making headway into new markets. In September 2019, Serbia announced that it will buy nine Wing Loong drones from Chengdu Aircraft Industry Group, marking the first time a European country has purchased Chinese UAVs. While the United States sells surveillance drones to countries around the world, exports of strike capable drones have been limited to its European and East Asian allies. Israel is less restrictive with its exports, selling strike capable drones across Latin America, South Asia, and Europe.

China’s exports have benefited from American export controls. The US has historically restricted foreign sales of strike-capable drones as part of its participation in regulations like the Missile Technology Control Regime (MTCR). The MTCR is a voluntary multilateral agreement that was established in 1987 to limit the proliferation of platforms capable of delivering chemical, biological, and nuclear weapons. As a result of somewhat dated regulations like the MTCR, many long-range drones have come to be characterized as cruise missiles. In a push to facilitate greater drone sales, President Trump relaxed export rules in April 2018, but these changes appear to have had a limited effect on the competitiveness of US drone sales in the global market.

Israel, on the other hand, experiences political limitations instead of legal restrictions. While it has supplied over 60 percent of the world’s UAVs in the last three decades, numerous political and strategic factors have limited sales to Middle Eastern countries.

The CH-5 is estimated to cost $8 million, roughly half the cost of the American-made Reaper.

Perhaps the biggest draw to Chinese drones is their price tag. The new CH-5 is estimated to cost half that of the $16 million Reaper. The CH-4 and Wing Loong II are even cheaper, estimated to cost between $1 to 2 million – far less than the comparable $4 million Predator. Countries looking to shore up their security needs on a budget have been particularly attracted to these systems. For instance, the Iraqi Defense Ministry opted in 2014 to purchase four CH-4s instead of the costlier US Predator. The UAE also purchased 25 Wing Loong Is between 2013 to 2017, and showed interest in ordering hundreds of Wing Loong IIs in 2018.

These sales and their subsequent use have helped boost the profile of Chinese unmanned systems. On December 6, 2015, the Iraqi Defense Ministry released a video showing a CH-4 variant carrying out a missile attack on the Islamic State (ISIS). Iraqi authorities have reported that since that strike, CH-4s have conducted over 260 air strikes against ISIS targets, with a success rate of nearly 100 percent. The growing visibility of Chinese unmanned platforms is likely to help grow its export profile in the coming years.

The Commercial Drone Market

While China is well-positioned to compete with other exporters of military UAVs, it has already cornered the commercial drone market. Chinese drone companies are estimated to control nearly 80 percent of the market worldwide.

The global commercial drone market totaled an estimated $14 billion in 2018 and is expected to increase to over $43 billion by 2024. The US is poised to play a major part in this growth. A 2017 McKinsey study found that by 2026, commercial drones will have an annual impact of $31 billion to $46 billion on US GDP. This growth is driven by the expanding role of drones in industries from infrastructure, agriculture, and transportation to media and entertainment.

China’s dominance in the commercial drone industry can be attributed primarily to one manufacturer, Dà-Jiāng Innovations (DJI). Due to its speed in producing cutting-edge technology at a low cost, DJI commands an estimated 74 percent of the market. Its market penetration is so significant that DJI became the most widely used commercial drone by the US Army. Due to rising security concerns, however, the US Army discontinued the use of DJI drones in August 2017. Additionally, on September 18, 2019, the US Congress introduced the American Security Drone Act of 2019, which would bar federal agencies from buying drones from China and any other country deemed a national-security risk.LEARN MORE"Is China a Global Leader in Research and Development?"

China’s civilian drones sector is increasingly developing drones with military applications. In large part due to reforms introduced in 2013, private companies are now able to compete against SOEs to produce and sell UAVs to the military. Newcomer drone company Tengoen Tech, for instance, is designing an eight-engine drone that can be customized for search and rescue, aerial refueling, and intelligence gathering missions.

The blurring of commercial and military UAV development could serve both sectors. As noted by Jane’s, this marriage has “created a vibrant, active and fast-moving UAV development and, increasingly, innovation environment[.]” China also integrated the development of UAVs into a national strategy to become a world leader in AI by 2030, making UAVs one of the focus sectors of the State Council’s 2017 “New Generation of Artificial Intelligence (AI) Development Plan.”

No comments:

Post a Comment