Robert Murray

Commercial opportunities in space-based technologies are expanding rapidly. From satellite communications and Earth observation to space tourism and asteroid mining, the potential for businesses to capitalize on these emerging technologies is vast and known as “NewSpace.”1

The NewSpace model is important for governments to understand because the dual-use nature of space, specifically its growing commercialization, will influence the types of space-based technologies that nations may leverage, and consequently, impact their national security paradigms. By capitalizing on the private sector’s agility and combining it with the essential research efforts and customer role played by the public sector, the NewSpace industry can play a critical function in addressing current and future national security challenges through public-private codevelopment.

As the NewSpace industry expands, the role of government is evolving from being the primary developer and operator of space assets to facilitating their commercialization, while still prioritizing key advancements. US and allied governments can capitalize on this competitive landscape by strategically investing in areas that align with their national security objectives. However, it is crucial for them to first understand and adapt to their changing roles within this dynamic environment.

Indeed, the benefits of the burgeoning NewSpace industry extend beyond the United States. International collaboration and competition in this area can lead to faster technological advancements and economic gains. The global NewSpace landscape is driving down costs, increasing access to space, and fostering innovation that can improve not only economic well-being, but also impact national security models.

To that end, this memo will examine the broad state of the space market, discuss the industry drivers, and propose recommendations for US and allied policymakers as they consider future government investments in those enabling space-based activities that support wider national security ambitions.

The commercial context

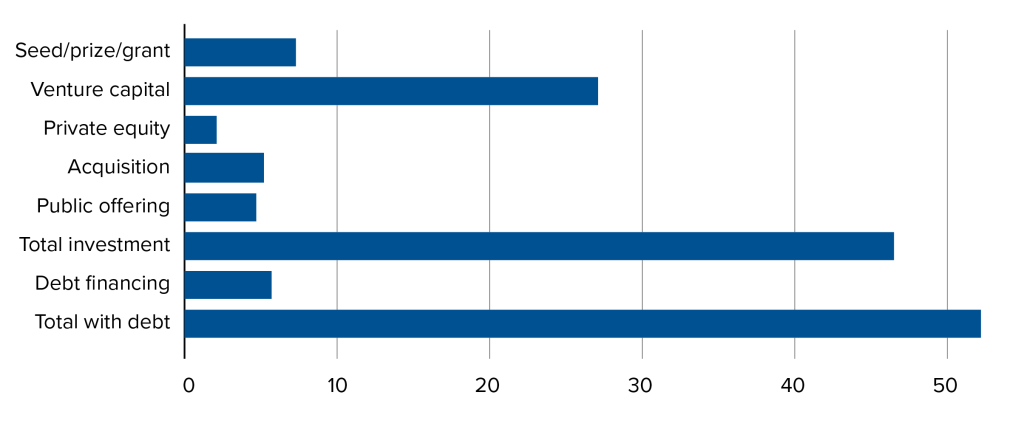

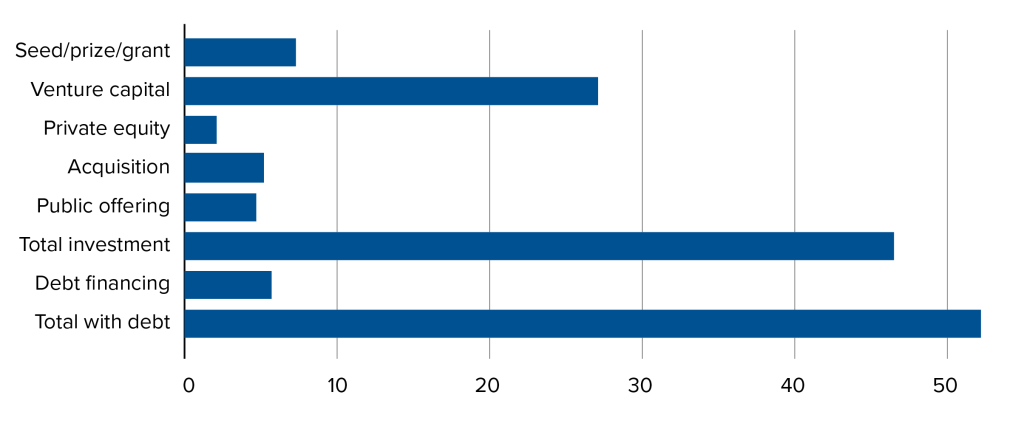

In recent years, the space industry has undergone significant commercialization (NewSpace) in which governments have partnered with private companies and invested more into the commercial space sector. NewSpace companies often carry many of the following characteristics.2

Figure 1: Characteristics of NewSpace Companies

NewSpace contrasts with the historical approach to space-based technologies, which typically involved a focus on standardization to ensure the reliability and quality of space components. This standardization was (and still is) essential for the safety of manned space flight, the longevity of systems, and the overall success of missions. Despite the increased collaboration between the public and private sectors, the failed January 2023 Virgin Galactic launch in the United Kingdom, the failed March 2023 Mitsubishi H3 launch in Japan, and the failed June 2022 Astra launch in the United States serve as clear reminders of the challenges associated with NewSpace technology.3

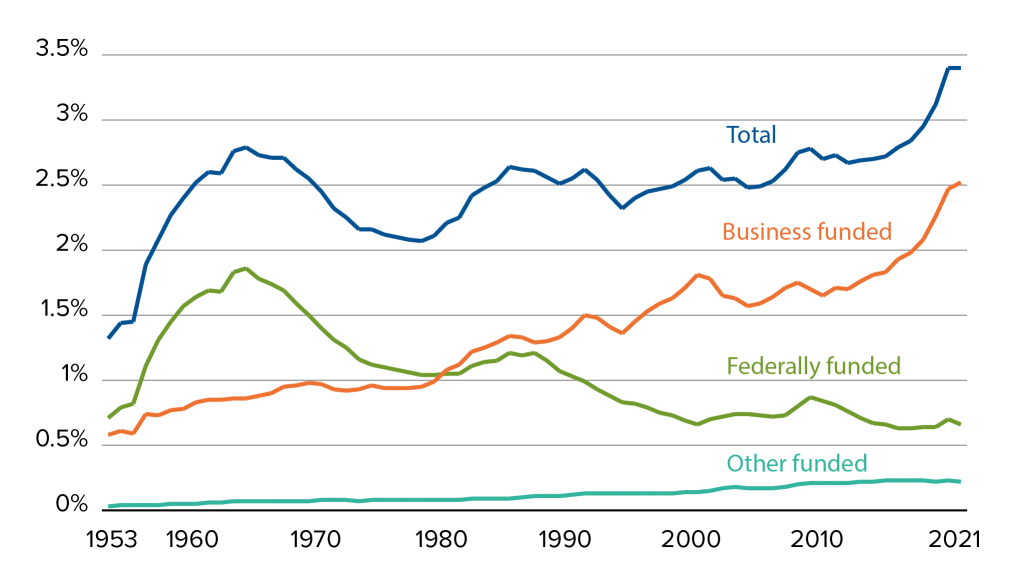

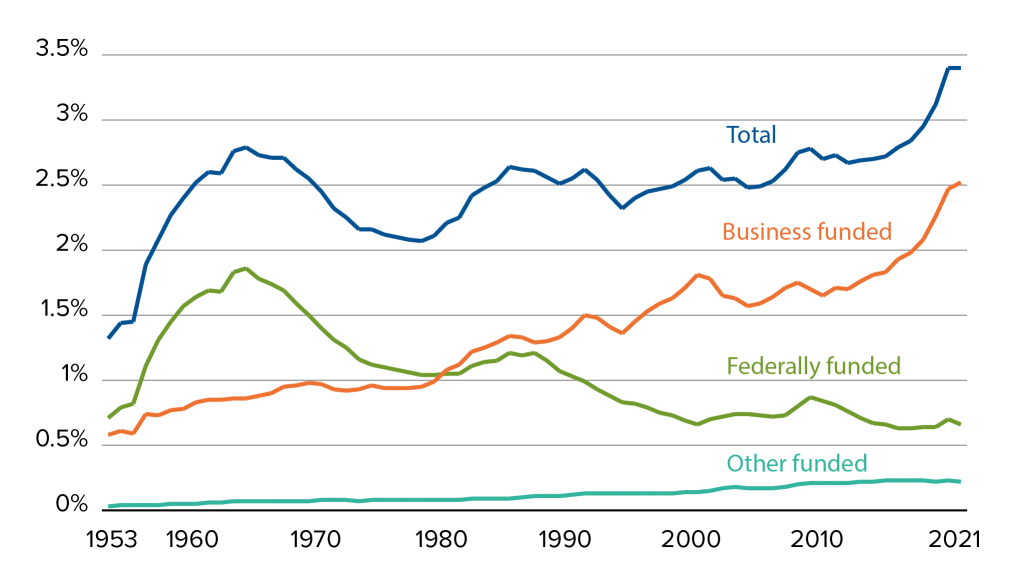

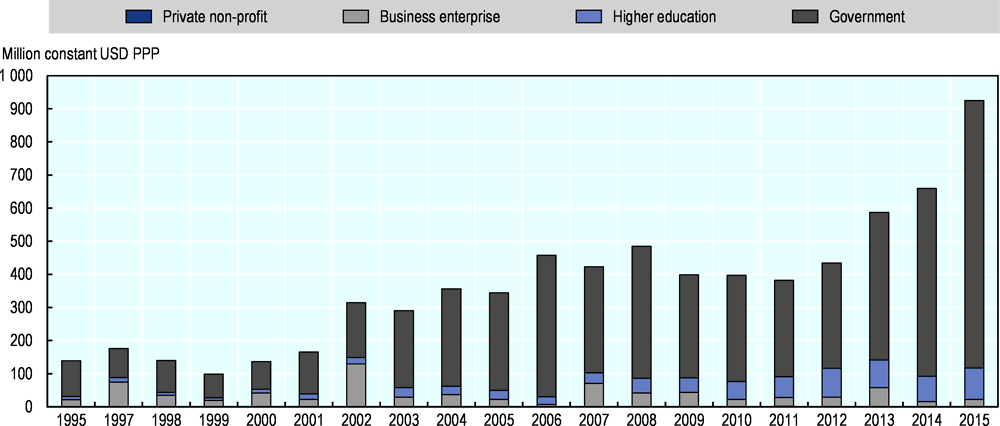

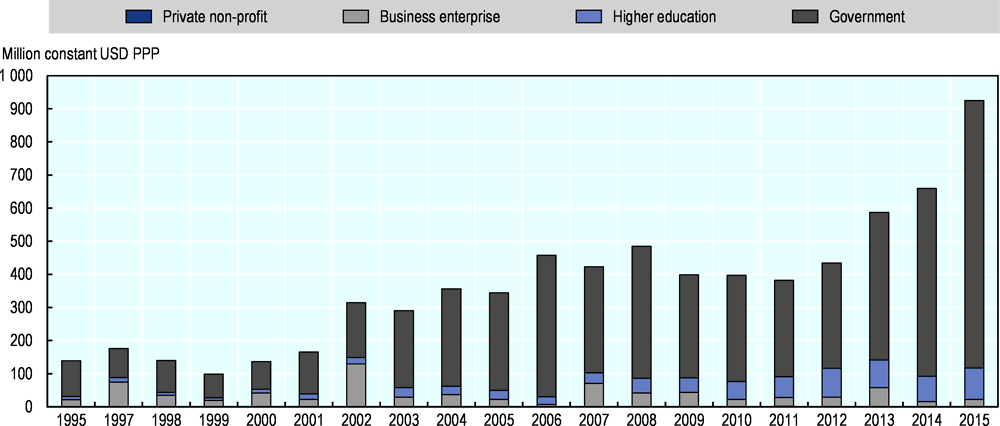

Today, when considering who is spending what on space-based technology research, US and allied governments can be viewed more as customers than as creators. This is in stark contrast to former US President John F. Kennedy’s famous 1962 speech launching the Apollo program, which put NASA at the forefront of driving the necessary technology and engineering needs.4 Indeed, the capital flows of research and development (R&D) from the US government relative to the private sector have shifted significantly since the era of Sputnik (1957), a pattern that also is evident across many allied nations (see Figure 2).5

Figure 2: Ratio of US R&D to gross domestic product, by source of funds for R&D (1953-2021)

For US space technology, this financial shift from public sector to private sector is arguably no surprise given the findings of a 2004 presidential commission on US space exploration, which recommended that:

NASA recognize and implement a far larger presence of private industry in space operations with the specific goal of allowing private industry to assume the primary role of providing services to NASA. NASA’s role must be limited to only those areas where there is irrefutable demonstration that government can perform the proposed activity.6

As a result of the commission’s findings, Congress created the Commercial Orbital Transportation Services Program, which sought to create new incentives to support the privatization of both upstream and downstream space activities.7 In short, the aim of this legislation was to create market forces that would enhance innovation while driving down costs through competition.

To do this, a new approach was developed to shape the relationship between NASA and its private contractors. Instead of being a supervisor, NASA became a partner and customer of these companies. This shift was reflected in the change of contract type, replacing cost-plus procurement with fixed-price payments for generic capabilities such as cargo delivery, disposal, or return, and crew transportation to low-Earth orbit (LEO).8 As a result, the risk was transferred from NASA to private firms, leading to less intensive government monitoring of cost-plus contracts and more encouragement of innovation.

Ripple effects

In recent years, the European Space Agency (ESA) has also prioritized commercialization activities. This, too, was an outcome of political and economic pressure to rethink European space policy to provide products and services for consumers, with a specific focus on downstream space activities. This policy shift toward greater commercialization was driven, in part, by those structural changes (i.e., competition) emerging from the United States (NASA).9

Likewise, in India—following a 2020 change in Indian space policy—private firms are no longer only suppliers to the government, but the government is now supporting and investing in them, similar to the NASA model.10 These and other shifts in public policy have shaped much of the market we have today.11

However, this market arguably represents a challenge to government control over NewSpace firms and their technologies. NewSpace companies operate with more agility and flexibility than traditional government-led programs.12 This rapid pace of innovation and commercial competition can make it difficult for governments to keep up with regulatory frameworks and oversight. Additionally, the increasing role of the private sector in space activities is arguably leading to a diffusion of state control, making it more challenging for governments to ensure the responsible use of space and manage potential security risks associated with dual-use technologies. Therefore, governments should look to partner, co-develop, and invest in NewSpace firms as alternative ways to influence the sector. Such an approach carries impacts not only on public-sector capital flows but also on national security paradigms.

This image from April 24, 2021, shows the SpaceX Crew Dragon Endeavour as it approached the International Space Station less than one day after launching from Kennedy Space Center in Florida. Source: NASA

This image from April 24, 2021, shows the SpaceX Crew Dragon Endeavour as it approached the International Space Station less than one day after launching from Kennedy Space Center in Florida. Source: NASAThe global space market

The space industry is a rapidly growing market that can bring about both commercial and national security benefits: the total sector was valued at $464 billion in 2022 and is expected to reach around $1.1 trillion by 2040, with a projected compound annual growth rate (CAGR) of around 7 percent.13 Of today’s total market, the commercial sector accounts for around 75 percent.14 To put this in perspective, the 2021 global aerospace industry saw the top ten earning companies generate a combined revenue of $417.15 billion.15 Breaking this down further, the United States is currently the largest market for both public and private space activity, holding a 32 percent market share, while Europe and the United Kingdom hold a combined 23 percent.16

However, Asia has experienced the most significant growth in this market over the last five years and now holds 25 percent of the market share.17 In terms of satellite launches, China has been the most active country in the region, with a total of sixty-four launches in 2022, placing it behind only the United States, which launched 87 times that year.18 Trailing China is India, which deployed over fifty satellites across four separate launches in 2022.19

In China and India alike, commercial firms are supported by both government R&D and public programs designed for national needs (including requisite contracts), as well as mature commercial markets that demand advanced satellite systems. What this translates to is an upstream market that relies on government funding to thrive, while the downstream market is more evenly distributed and does not require significant upfront investment or government contracts to sustain itself. This downstream market is currently driven by NewSpace demand for connectivity and location-based services, and its growth is influenced by demographic and regional economic trends, as well as government efforts to close the digital divide as governments finance satellite connectivity.20

Challenges to and opportunities for NewSpace industry growth

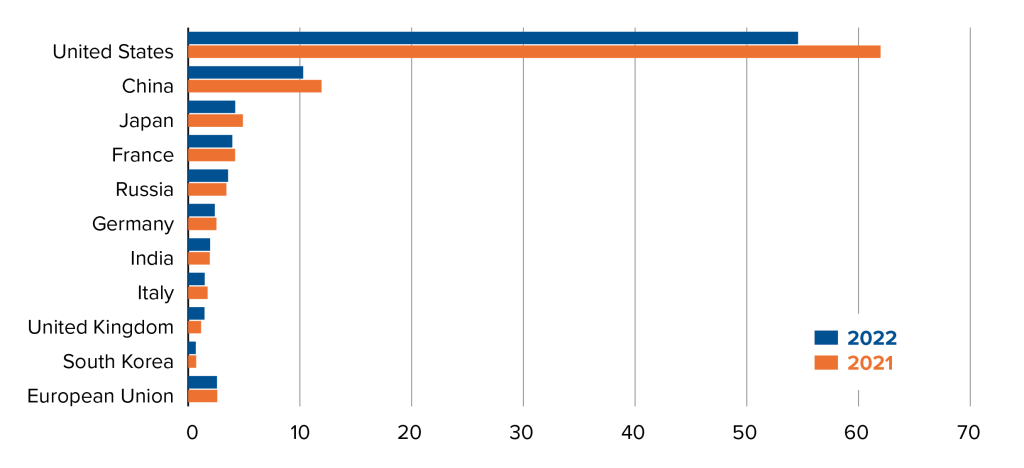

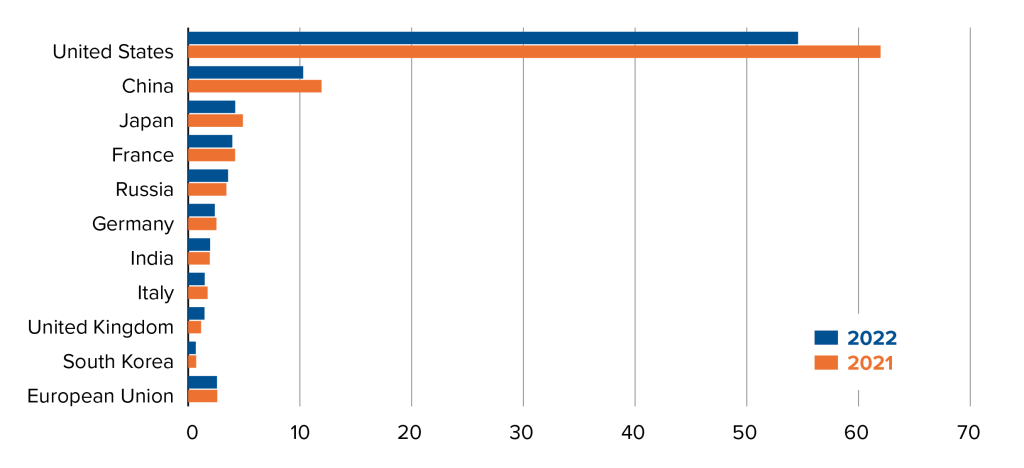

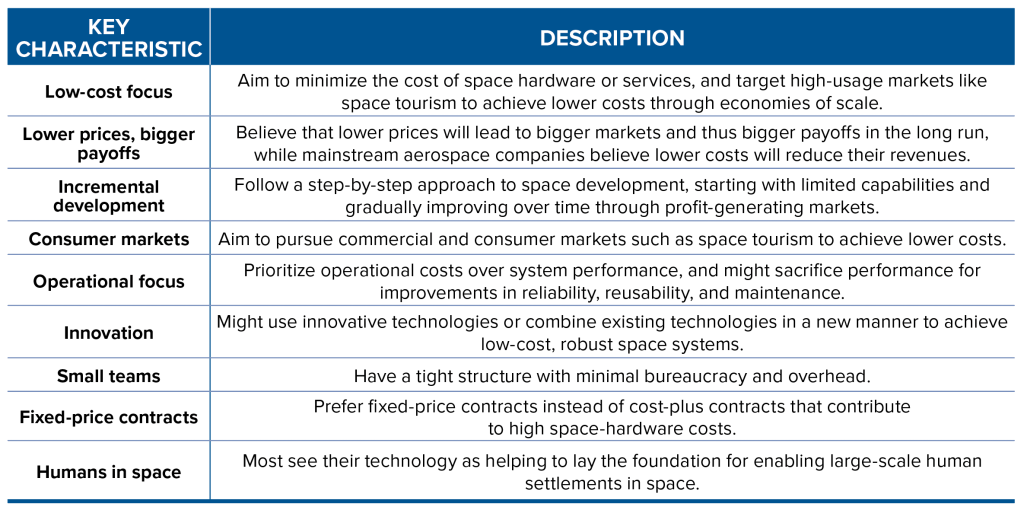

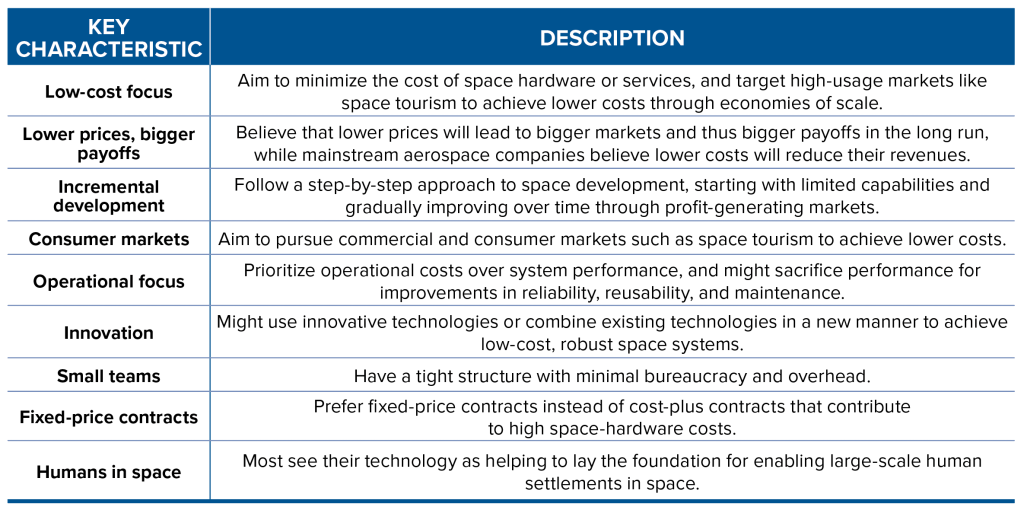

The key challenges to NewSpace industry growth are the regulatory landscape and access to financing. This is evidenced by the European NewSpace ecosystem where, at a structural level, regulatory frameworks do not facilitate the scaling of the financial resources (public and/or private) necessary to match the political and commercial intent (demand) espoused by European political and business leaders. This mismatch between demand and financial firepower results in slower development and uptake of NewSpace opportunities despite significant engineering and entrepreneurial talent residing within Europe.21 Figure 3 shows the breakdown of global government investment in space technologies between 2020 and 2022 in real terms, and figure 4 shows how such expenditure relates to GDP, while figure 5 shows the global private sector space investment breakdown, which highlights a significant role for venture capital (VC) firms.22

Noting that the United States accounts for almost half of the world’s available VC funds, while Europe only accounts for around 13 percent, it is evident that the sheer scale of investment from the United States enables NewSpace to flourish within the US market, while many allies and partners struggle to access private funding.23 For Europe to embrace the NewSpace model, conditions must foster timely connections between both public and private finance and NewSpace opportunities.24 That said, given the deep technology nature of NewSpace, and the long time horizons for venture capitalists to see a return, financing this sector writ large remains a challenge.

Figure 3: Government expenditure on space programs in 2020 and 2022, by major country (in billions of dollars)

Figure 4: Government space budget allocations for selected countries and economies (measured as a share of GDP in 2020)

Figure 5: Value of investments in space ventures worldwide from 2000 to 2021, by type (in billion U.S. dollars)

In addition to attracting financing, the business models of NewSpace companies rely on foundational technologies—often resourced by governments—to be in place. Such technologies include: access to low-cost launch capabilities; conditions for in-space manufacturing and resource extraction for space-based production; foundational research to support space-based energy collection, combined with reliable radiation shielding; and debris mitigation efforts in an increasingly busy orbital environment. This indicates that there is a persistent role for governments to actively invest in deep technologies to help foster the commercial markets that NewSpace can bring about. Only governments have the financial risk tolerance (a tolerance that takes one beyond risk and into uncertainty) to undertake such endeavors.

While each of these foundational technologies has limited profitability, together they form a self-sustaining system with enormous potential for profit when subsequently exploited through relatively cheap NewSpace technologies. Indeed, the economics of human space activities often mean that the whole is greater than the sum of its parts. To that end, one might envisage how a potential self-reinforcing development cycle would support the space economy, with cheaper and more frequent rocket launches enabling short-term tourism and industrial and scientific experimentation, leading to demand for commercial space habitats, which would then create demand for resources in space. However, it is doubtful that this path will be easily achieved without government support.25

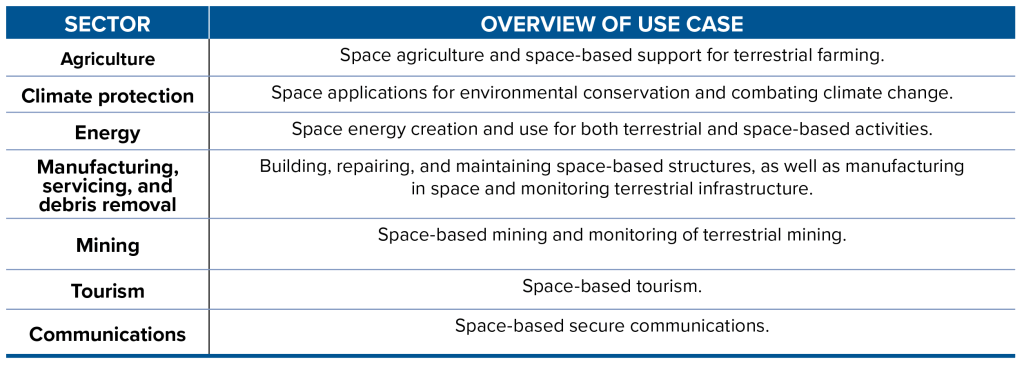

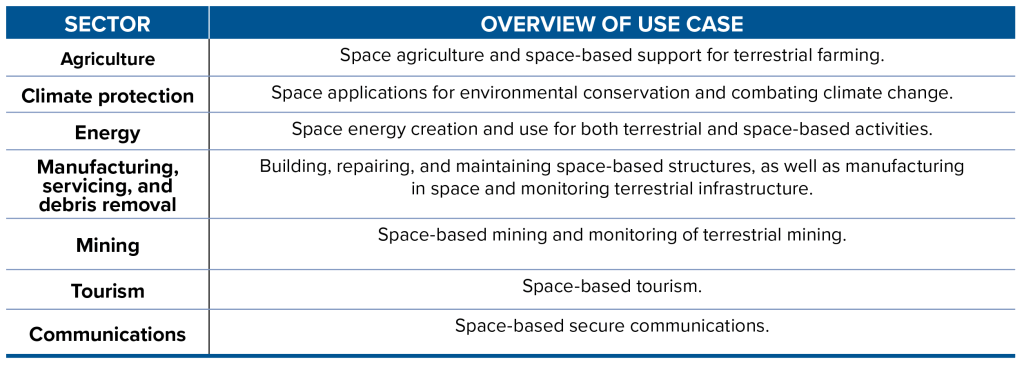

In addition to traditional space-based areas of monitoring, observation, and communications, the sectors listed below offer further commercial opportunities NewSpace is likely to exploit.26

Figure 6: Commercial opportunities for NewSpace companies

Allied advancements in NewSpace

While the above table represents a broad perspective, many US allies and partners are already at the leading edge of aggregating NewSpace technologies to take advantage of growing markets.

In Denmark, the government and private commercial actors are working on project BIFROST, with plans to launch in early 2024. BIFROST is a satellite-based system for advanced on-orbit image and signal analysis that aims to demonstrate artificial intelligence-based surveillance from space. The satellite will have versatile payloads on board to provide information on applied AI in space for Earth-observation missions—detecting ships, oil spills, and more. The main purpose of the mission is to establish: “a platform in space for gaining further experience in AI-based surveillance and sensor fusion using multiple on-board sensors. The satellite will also test means of communication between different satellites to achieve real-time access to intelligence data and demonstrate the feasibility of tactical Earth observation.”27 Additionally, the mission will evaluate the capability of changing AI models during its lifespan to improve the surveillance system.28

In Sweden and Germany, OHB (a German-based European technology company) is working with Swiss start-up ClearSpace SA for its space debris removal mission, ClearSpace-1. OHB will provide the propulsion subsystem and be responsible for the complete satellite assembly, integration, and testing. The mission is aimed at demonstrating the ability to remove space debris and establishing a new market for future in-orbit servicing. The mission will target a small satellite-sized object in space and be launched in 2025. Carrying a capture system payload—“Space Robot,” developed by the ESA and European industry—it will use AI to autonomously assess the target and match its motion, with capture taking place through robotic arms under ESA supervision. After capture, the combined object will be safely deorbited, reentering the atmosphere at the optimum angle to burn up.29

In Belgium, entities such as Interuniversity Microelectronics Centre, aka imec, are at the leading edge of developing nanotechnology that is being commercialized for space. Imec’s Lens Free Imaging system is a new type of microscopic system that is not dependent on traditional optical technologies and fragile mechanical parts. Instead, it operates through the principle of digital holography, which allows images to be reconstructed afterward in software at any focal depth. This eliminates the need for mechanical focusing and the stage drift that occurs during time-lapse image acquisition, making it a more robust and compact system suitable for use in space.30 Imec is also perfecting manufacturing in space leveraging microgravity, which minimizes “gravitational forces and enables the production of goods that either could not be produced on Earth or that can be made with superior quality. This is particularly relevant for applications such as drug compound production; target receptor discovery; the growth of larger, higher-quality crystals in solution; and the fabrication of silicon wafers or retinal implants using a layer-by-layer deposition processes,”31 all of which are enhanced in microgravity.

The SpaceX Falcon 9 rocket carrying the Dragon capsule lifts off from Launch Complex 39A at NASA’s Kennedy Space Center in Florida on July 14, 2022. Source: SpaceX

The SpaceX Falcon 9 rocket carrying the Dragon capsule lifts off from Launch Complex 39A at NASA’s Kennedy Space Center in Florida on July 14, 2022. Source: SpaceXIn the United Kingdom, collaboration between the agricultural and space sectors seeks to enhance societal resilience through more efficient and self-sustaining crop production. Research entities such as the Lincoln Institute for Agri-Food Technology is commercializing technologies on LEO satellites to improve the spatial positioning of robots in agriculture to enhance their precision weeding, nutrient deployment, and high-resolution soil sampling capabilities.32 Furthermore, UK start-ups such as Horizon Technologies have developed novel ways of creating signals intelligence focusing on specific parts of the electromagnetic spectrum, allowing the company to leverage meta data for both commercial and government clients. An important component to Horizon’s success is the reduction in productions costs combined with accessibility to space launches.

Across Europe, the ESA is conducting R&D to harness the sun’s solar power in space and distribute that energy to Earth. Under Project Solaris, space-based solar power is harvested sunlight from solar-power satellites in geostationary orbit, which is then converted into microwaves, and beamed down to Earth to generate electricity. For this to be successful, the satellites would need to be large (around several kilometers), and Earth-surface rectennas33 would also need to be on a similar scale. Achieving such a feat would enhance Earth’s energy resilience, but would first require advancements in in-space manufacturing, photovoltaics, electronics, and beam forming.34

The United States also partners with allied firms on foundational research to support upstream and downstream NewSpace technologies. The Defense Advanced Research Projects Agency (DARPA) Space-Based Adaptive Communications Node (BACN) is a laser-enabled military internet that will orbit Earth. The Space-BACN will create a network that piggybacks on multiple private and public satellites that would have been launched regardless, using laser transceivers that are able to communicate with counterparts within 5,000 km. The satellite network will be able to offer high data rates and automatic rerouting of a message if a node is disabled, and it will be almost impossible to intercept transmissions. DARPA is working with Mynaric, a German firm, which designs heads for Space-BACN, and MBryonics, an Irish contractor, which uses electronic signals to alter light’s phase, with the aim of having a working prototype in space in 2025.35

While US allies and partners offer a plethora of specific space-based commercial opportunities, the criteria for successful development remains constant: the combination of multiple technologies, reduction in production and maintenance costs, and safe access to operate in space. With that in mind, the US government can play two roles to help further expand this market:Act as a reliable, adroit customer who can issue contracts quickly (noting that many NewSpace firms do not carry large amounts of working capital and therefore cannot wait months for contractual confirmation).

Continue to invest in deep technologies and develop those foundational upstream building blocks that NewSpace will seek to leverage.

Notably, however, some US executives are deliberately registering firms in allied jurisdictions and conducting all research and patenting there, too, to avoid the bureaucratic challenges of dealing with US International Traffic in Arms Regulations (ITAR) and, specifically, the tight controls associated with exporting NewSpace dual-use products for commercial use. This suggests two things: The first is that, while allies may lack financial firepower, they have jurisdictional strengths that can attract NewSpace firms to their shores; and the second is that US ITAR controls impacting dual-use technologies need to be updated to enable NewSpace firms to thrive. If such companies are blocked from selling to allied and partner markets, then the very model of dual-use becomes diminished and governments will be unable to benefit from the competition and iterative technology development that spill over from such commercial settings into the public sector. As Figure 2 shows, the US government does not currently invest enough in technologies relative to the private sector to enable such a stringent export controls program in the context of NewSpace. The two policies are incongruous: limited government R&D spending and excessive export controls.

Recommendations for US and allied policymakers

Taking all the above into account, US and allied policymakers should focus on enhancing regulations and financial resources. Governments need to continue to create the conditions for the NewSpace market to prosper by playing the roles of a nimble customer and deep technology investor, enabling NewSpace companies to quickly access government contracts, while also helping mature next-generation space-based technologies. This helps such companies grow, become competitive, and enhance the sector. Specifically, US and allied governments should consider the following.

Recommendation #1: US and allied governments must continue to provide a stable and progressive regulatory environment for the NewSpace industry. This includes providing a clear and predictable legal framework for commercial space activities, as well as ensuring that regulations are flexible and adaptable to the rapidly changing technology and business models of the industry. ITAR is one area that needs urgent reform, given the dual-use nature of many new space technologies. This problem is exemplified by US talent establishing next-generation space companies in Europe to avoid overly controlling and outdated ITAR constraints, according to interviews with industry participants.36 Given the cross-cutting nature of ITAR, the US National Security Council should examine ITAR rules and their utility for dual-use technologies impacting NewSpace, assessing such rules from a holistic perspective covering defense, trade, and economics.

Recommendation #2: US and allied governments should maximize coinvestment with industry in R&D to support the codevelopment of new technologies and capabilities for both the public and private sectors. This includes funding for research into new propulsion systems, as well as materials and nanotechnologies that will enable more cost-effective and reliable access to space. To support such funding—and noting the challenge of private investment finding its way to allied entrepreneurs and engineers—the US government should consider establishing with allies and partners a new multilateral lending institution (MLI) focused on space technology to provide funding and other forms of support to companies in the commercial space industry. The MLI or “space bank” could provide loans, grants, loan guarantees, insurance, and other forms of financial assistance to companies engaged in commercial space activities, helping to mitigate the high costs and risks associated with space ventures. This could be modeled after any of the MLIs of which the United States is already a member.37

Recommendation #3: Furthermore, the US government could provide tax credits and grants to NewSpace firms (US and allied) based on certain provisions that support wider government objectives—such as manufacturing locations, supply network participants, and expected labor market impacts.

Any such credits and grants should be complemented by leveraging a suitable financial vehicle to conduct direct investment to take equity in NewSpace firms both at home and abroad. Crucially, this should be conducted without the government owning any of the intellectual property, as this impacts export opportunities and thus undermines the dual-use model. Such an effort would go some way in minimizing the socialization of risk and the privatization of rewards, and could be a role for either In-Q-Tel and/or the Department of Defense’s new Office of Strategic Capital.38

Recommendation #4: To further support such an approach, the US government might create a national space co-R&D center of excellence for government and industry to work hand in glove to drive the codevelopment of breakthrough technologies, taking inspiration from a conceptually similar UK model of designing government contracts to address specific problems and awarding them to capable small companies.39

An increasing number of nations are launching an increasing number of space missions. United Launch Alliance Atlas V rocket carries Cygnus cargo vessel OA-6 for commercial resupply services supporting the International Space Station. Credit: United States Air Force Flickr

An increasing number of nations are launching an increasing number of space missions. United Launch Alliance Atlas V rocket carries Cygnus cargo vessel OA-6 for commercial resupply services supporting the International Space Station. Credit: United States Air Force FlickrConclusion

NewSpace is making significant strides in developing cost-effective and innovative technologies for both public- and private-sector customers. This is important because it drives economic growth and can enhance national security through the delivery of new, cost-effective, and resilient technologies. Indeed, the NewSpace market is unquestionably growing, and governments, including the United States and its allies, have a critical role to play in shaping this market by acting as both customers and codevelopers with NewSpace firms. Such an approach allows governments to exert a degree of influence in the sector without constraining its creativity. However, this way of working may carry wider implications for national security paradigms in terms of dual-use technologies and public/private partnerships.

While use cases for NewSpace are almost limitless, multiple US allies and partners are already forging niche NewSpace areas of excellence that can bring about a degree of comparative advantage. To make best use of such opportunities, the United States should:Keep its market as open as possible to encourage competition and thus drive innovation.

Provide specific programs and locations for codevelopment between allied academia, government, and industry without taking any intellectual property.

Act as a nimble customer.

Ensure there is a pragmatic balance between regulations that protect US space interests (i.e., ITAR) and those that unleash innovative dual-use endeavors.

Create new financial instruments with allies through an MLI bank to support the financial investment needed to help the private sector commercialize the next generation of breakthrough space-based technologies.

No comments:

Post a Comment