ROBERT KUTTNER

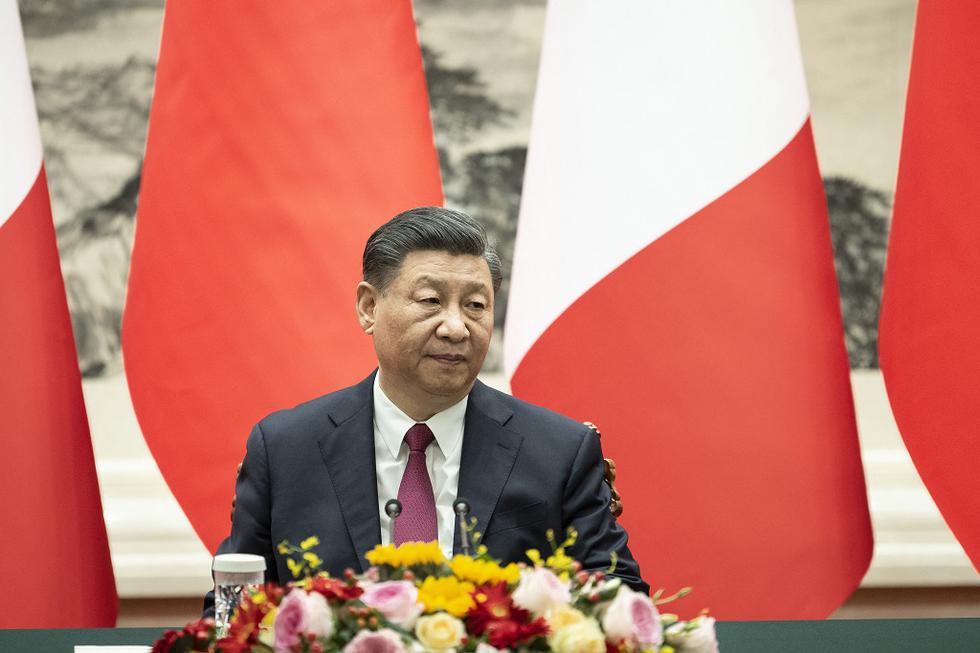

The Chinese economy is in something of a tailspin, suffering from the consequences of deliberate revisions of its model and impulsive mistakes compounded by Xi Jinping’s autocratic leadership. China’s growth rate, long around 10 percent, is more like 5 percent, and headed lower.

Recently released trade data shows that China’s exports to the U.S. declined by 23.1 percent in July 2023 compared with July 2022, while those to the European Union fell by 20.6 percent. Exports to the Association of Southeast Asian Nations fell by 21.4 percent. China also has a youth unemployment crisis, both among college grads who can’t find work and among potential factory workers who are rejecting the going wages and working conditions. Manufacturing data for July showed the fourth consecutive month of slowing activity.

China’s situation poses several questions. How low is down? What will the impact be on the global economy and the U.S. economic recovery? Will the downturn force changes in China’s authoritarian political system and Xi’s one-man rule? How much is U.S. policy—tariffs, export controls—implicated in China’s slowdown? Is this the occasion for the U.S. to ease up on its containment strategy and venture a reconciliation, or a moment to double down?

China’s situation is the result of the interaction of several forces. China’s model of importing capital and production technology, suppressing wages and consumption, and relying on state-financed debt and subsidized exports worked fine when China was a less mature economy. But it no longer works well. Much of China’s state-led investment has gone to unproductive uses, which do not increase growth but add to debt.

The inevitable shift to more domestic consumption and somewhat slower growth was compounded by other random factors. The COVID pandemic devastated China’s internal production machine, and the COVID recession reduced China’s export markets. The regime’s off-again/on-again COVID lockdowns and reopenings reduced both production and consumption, and cut investment because companies were hesitant to make plans.

The extremely chaotic COVID policy was an unforced error. But other parts of the policy shift were deliberate, sensible, and overdue.

China’s debt-driven growth has been heavily reliant on a property boom. Something like 30 percent of China’s GDP is based in the housing sector, which in turn is heavily private and heavily speculative. Big developers borrow money both from prospective homebuyers and from the state and in capital markets. They then use the money to build still more speculative housing.

In 2020, the Chinese leadership, which was more collective then than it is today, saw the makings of a real estate bubble. They warned the developers to pull back. The developers, aware that the state had always bailed them out in the past, didn’t take the warnings seriously, and kept right on borrowing and building.

So the government decided it was time to let some of their air out of the bubble by tightening credit. But as the U.S. Federal Reserve learned early in this century when it saw “irrational exuberance” pushing securities markets to unsustainable heights, bubbles seldom can be deflated gradually. They are more inclined to pop.

China is in for a period of slower growth, but not a collapse.

Today, China’s two biggest housing developers are in deep trouble. Last Tuesday, Country Garden, the country’s biggest private-sector developer, which has built over 3,000 housing projects, missed interest payments on two U.S.-dollar-denominated bonds. The company now has a 30-day grace period to avoid an official default.

The Evergrande Group, China’s second-largest housing producer (700 projects) and most heavily indebted developer, has lost $81 billion over the past two years.

The overbuilding and the unwinding of all this debt has knock-on deflationary consequences. As property values have fallen, homeowners have seen their equity evaporate, reducing purchasing power and making other prospective homeowners reluctant to buy. Home sales in July 2023 by China’s 100 biggest developers were down 33 percent from a year ago.

If this were a market economy, the result would be a first-class depression. But because this is China, some entrepreneurs, their shareholders and creditors will lose, and the state will eventually own a lot of housing, which it in turn will sell off at reduced prices to buyers once the shakeout ends.

And that is not a bad metaphor for what we can expect going forward. China is in for a period of slower growth, but not a collapse. China’s exports have fallen some, but are still immense. The huge power of the state as economic player can cushion some of the downturn.

At the same time, there have been other unforced errors. Xi responded to some of the increased pressure from Washington by taking a harder line against selective Western financial companies, accusing them of spying. It’s not clear how much of this was retaliatory and how much was paranoia. But the result was to scare off Western investors.

As The Wall Street Journal has reported, a campaign led by Xi has hit Western management consultants, auditors, and other firms with a wave of raids, investigations, and detentions. Meanwhile, an expanded anti-espionage law has added to foreign executives’ worry that conducting routine business activities in China, such as market research, could be construed as spying.

The perception that doing business in China has become much riskier is reducing Western capital flows into an economy already struggling with weak investment and consumption. Foreign direct investment in China fell to $20 billion in the first quarter of 2023, compared with $100 billion in the first quarter of 2022. Venture capital investment in China declined from a peak of $43.8 billion in the last quarter of 2021 to $10.5 billion in the second quarter of 2023.

HOW MUCH WILL ALL OF THIS SLOWDOWN IN CHINA affect the global economy? Not as much as you might think. Several China scholars whom I’ve discussed this with point out that if the U.S. were undergoing this kind of contraction, the global effects would be severe. But the U.S. has a chronic trade deficit and absorbs much of the world’s production, while China is a nation with a chronic surplus. So its impact on the rest of the world, except when the result is scarcity of inputs as during the pandemic, is far less contractionary.

Some sectors and nations, such as exporters of raw materials (Brazil, Australia) will be affected. Likewise companies that export luxury products to China’s affluent classes. But the slowdown in China will not tip the world into recession.

Will this downturn shake Xi’s one-man rule? Not a chance, say the scholars whom I most respect. Xi’s control of both the Politburo and the security apparatus is tighter than ever, says James Mann of Johns Hopkins University’s School of Advanced International Studies, author of books on China and a member of the U.S.-China Commission. Former U.S. trade rep and China expert Robert Lighthizer agrees, as do the editors of the authoritative China Beige Book.

How much of the get-tough policy initiated by Trump and then refined by Biden is responsible for China’s current economic situation? The direct effect is not huge. The tariffs cost China some profits but did not depress exports much, if at all. Most of China’s slowdown is the result of a long-overdue revision of its model plus some policy blunders reflective of one-man rule.

However, the indirect effects may be more consequential. The harder line made some Western investors think twice, and Xi’s paranoid response made them think yet again.

Also, much of the U.S. hard line isn’t that hard. Biden’s long-delayed export control order is feeble. The exports it does control are extremely narrow. It’s only a draft order put out for comment. The final order doesn’t take effect until next year and business gets six months to make comments, which is to say to lobby to weaken the order.

Worst of all, the agency responsible for the details of the final order and its execution is the Treasury Department, the most naïvely “free-trade” of all the Cabinet departments. Secretary Yellen has publicly opposed the China tariffs.

What now? The usual suspects who never liked any policy smacking of containment of China, such as Adam Posen of the Peterson Institute, say now is a good moment for a rapprochement (when isn’t?). Writing in the most recent Foreign Affairs, Posen argues: “Removing most barriers to Chinese talent and capital would not undermine U.S. prosperity or national security. It would, however, make it harder for Beijing to maintain a growing economy that is simultaneously stable, self-reliant, and under tight party control.”

But there is no evidence that this is the case. The core, objectionable elements of China’s grand mercantilist strategy remain, even as Xi revises the details of the growth model. And they still need to be contained.

No comments:

Post a Comment