BRENDAN COLE

Russia's state energy holding company, Inter RAO, has started restricting electricity supplies to China after Vladimir Putin's key ally and trading partner rejected a price hike.

Russia's state energy holding company, Inter RAO, has started restricting electricity supplies to China after Vladimir Putin's key ally and trading partner rejected a price hike.The dispute stems from China facing severe electricity problems due to droughts and limits on increasing domestic coal production, while Russia is trying to offset the slump in its currency, which has hurt export revenues.

One expert told Newsweek that China is displaying a "hard-nosed" negotiating approach over Russia's demand and that it's in a strong bargaining position.

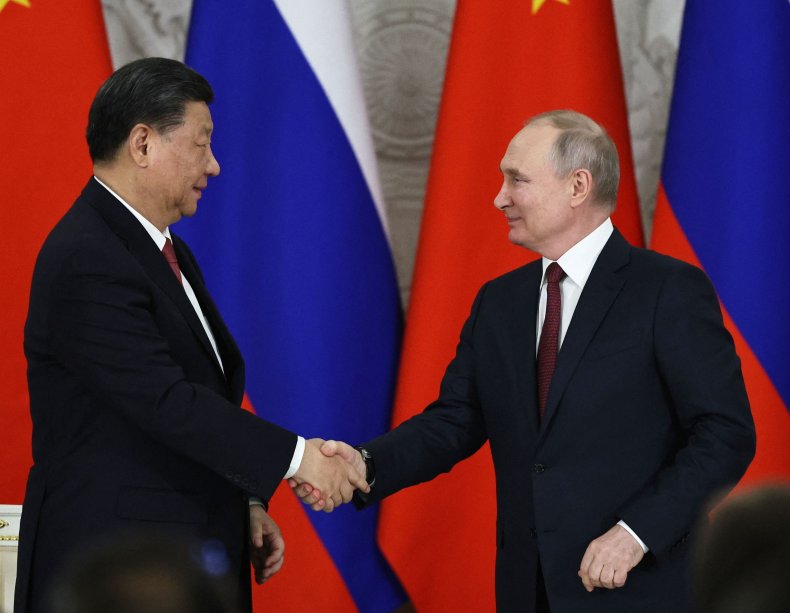

Western sanctions on Russia, which followed Putin's full-scale invasion of Ukraine, have forced Moscow to pivot to other trade markets, with Russia terming countries "friendly" and "non-friendly." Putin championed this new world order and touted Moscow's strong ties with Beijing during a visit to Moscow in March of Chinese counterpart Xi Jinping.

Outside the Moscow-led Eurasian Economic Union of other former Soviet states, China was the biggest market for Russian electricity exports in 2022, receiving a record 4.7 billion kWh (kilo watt/hour), Russian state news agency Tass reported.

Inter RAO said that new export duties that came into force on October 1 would mean it would raise electricity prices by 7 percent for customers in China, as well as in Mongolia, Azerbaijan and the breakaway Georgian region of South Ossetia.

Moscow announced in September that these export duties would be linked to the ruble exchange rate on certain goods between 4 percent and 7 percent, if the ruble was less than 80 to the U.S. dollar.

On Tuesday, the Russian currency traded at 99 to the greenback. Oil and gas were among Russian exports exempt from the price hike that has come into force.

In August, Russian business newspaper Kommersant reported that Inter RAO representative Alexandra Panina had told reporters that if the price were to be rejected it may "completely cut off" electricity supplies.

"Talks with China are continuing," an Inter RAO representative told Reuters. "We are starting partial restrictions from today." Mongolia agreed to Russia's price rise.

"Chinese energy firms and the state have always been famously hard-nosed and very patient in energy negotiations with Russia," said Thomas O'Donnell, a Berlin-based geopolitical analyst and energy expert who is a global fellow with the Wilson Center think tank.

"China has reaped great benefits for squeezing Russia when in a bind to export oil and gas," he told Newsweek, with Beijing getting beneficial prices for piped gas and cheaper oil after Putin's "fiasco" of losing the European market due to sanctions.

"The Russian state power export monopoly can't make a profit, or very little with a 7 percent export tax," O'Donnell said. "So it must demand higher rates from their biggest customer, China, and some other customers."

He said that Chinese resistance to paying higher rates for Russian electricity imports suggests that "given the power sector crisis in China, it may aggressively turn to LNG gas imports for generation."

"Unlike last year's winter, when still under COVID lockouts, it resold LNG deliveries, greatly benefiting Europe. This could change Europe's luck this winter to secure sufficient non-Russian natural gas," he said.

No comments:

Post a Comment