Gregory D. Wischer

The war in Ukraine has shocked oil and gas markets, revealing how modern economies depend heavily on some resources. But another critical resource has gone relatively unnoticed: cobalt. This unique element has national security importance. It is a critical input in advanced technologies such as batteries in electric vehicles, superalloys in jet engines, and permanent magnets in advanced electronics.

Yet the United States relies immensely on cobalt refined in foreign countries, including China. Why? Because the United States has no major cobalt refineries. Compounding this problem, the U.S. government’s National Defense Stockpile lacks sufficient cobalt reserves. From approximately 13,000 tons during the Cold War, the National Defense Stockpile now holds only an estimated 333 tons.

Congress should act quickly to not only address this shortfall but also renew America’s cobalt refining capacity. One way to do so is to pass legislation recently introduced by Florida Republican Rep. Byron Donalds: the “Cobalt Optimizes Batteries and Leading Technologies Act,” or “COBALT Act,” which authorizes $800 million from already appropriated funds in the Defense Production Act Fund for the acquisition of domestically refined cobalt for the National Defense Stockpile.

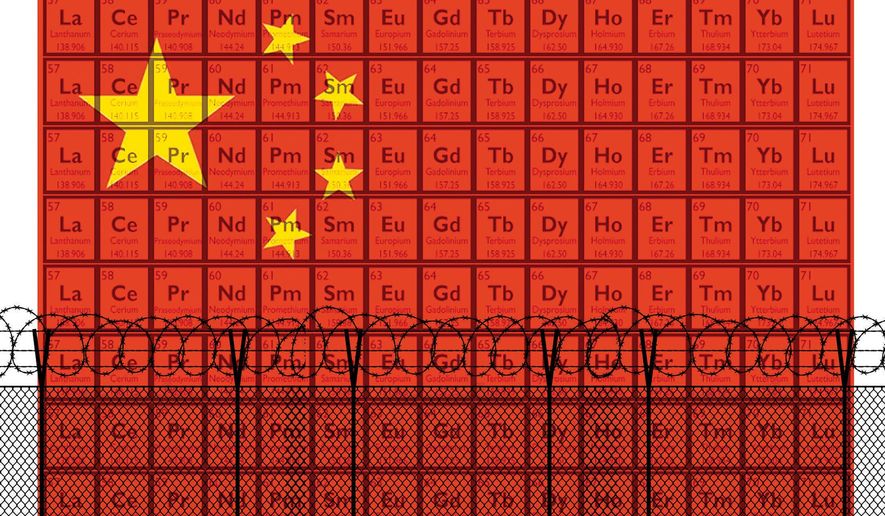

China now refines 72% of the world’s cobalt, while the United States refines 0%. The United States, therefore, relies 100% on foreign imports and secondary scrap materials for its refined cobalt consumption. The United States mainly imports refined cobalt from friendly countries, but China controls the mining supply that these countries source from. For example, Chinese firms control over half of cobalt mining capacity in the Democratic Republic of Congo (DRC), which produces most of the world’s cobalt ore.

China’s supply chain dominance means that it can dictate cobalt market dynamics. If Beijing wants to crimp supply, drive up global cobalt prices and harm downstream consumers — including the U.S. defense industrial base — it can do so. If Beijing wants to dump supply, drive down global cobalt prices and harm midstream refineries, it can do so. China is also the largest purchaser of cobalt ores and concentrates (71%), granting it power over cobalt supply and demand.

Concomitantly, China is expanding its cobalt refining capacity. In 2020 alone, China was responsible for 71% of the global growth in refined cobalt supply. The Chinese company Zhejiang Huayou Cobalt, the world’s largest cobalt refiner and a major supplier for U.S. electric vehicle manufacturers, is building new cobalt refineries. China’s National Food and Strategic Reserves Administration also buys cobalt from Chinese cobalt refineries, both supporting domestic refineries and increasing China’s 7,700-ton cobalt stockpile.

Addressing America’s cobalt vulnerability is the purpose of the Cobalt Act. It aims to increase U.S. cobalt refining capacity by guaranteeing a major cobalt buyer for U.S. cobalt refineries. This bill has legislative precedent: the Atomic Energy Act of 1946 (and the 1954 Act) authorized the Atomic Energy Commission to acquire uranium ore from private domestic producers, dramatically increasing domestic uranium production during the Cold War. In addition to growing cobalt refining capacity, the Cobalt Act may also catalyze cobalt mining in the United States, just as U.S. government cobalt purchases in the 1950s spurred cobalt mining in Idaho.

Just as important, the Cobalt Act aligns with the White House’s push to onshore critical mineral supply chains. On March 31, President Biden issued Presidential Determination No. 2022-11, ordering the secretary of defense to better secure the domestic supply of critical minerals — including cobalt — necessary for large-capacity batteries. The administration determined that purchases and purchase commitments — pursuant to the Defense Production Act — “are the most cost-effective, expedient, and practical alternative method for meeting the need” of cobalt.

Some critics might worry about the environmental impact of cobalt refining. They need not: The Cobalt Act requires the U.S. government to purchase only cobalt refined through chemical vapor metallurgy because this refining process produces no waste, recycles gases that it uses, and consumes the least energy of industrial refining processes. Conversely, the other major refining processes — pyrometallurgy (e.g., smelting) and hydrometallurgy (e.g., acid leaching) — produce hazardous waste. As Muammer Kaya, a McGill-trained Ph.D. mineral engineer, notes, hydrometallurgical methods “[generate] huge amounts of waste acids and sludge, which have to be disposed of as hazardous waste.”

Passing the Cobalt Act is critical for U.S. national defense, given cobalt’s criticality in key technologies and China’s control over cobalt supply chains. As Mr. Donalds said, “Our dependence on foreign countries, such as the CCP, for our domestic cobalt supply is a matter of national security.” The National Defense Authorization Act (NDAA) of 2023 is due to be introduced on the Senate floor this fall, and it is the ideal legislative vehicle for the Cobalt Act, which can be added as an NDAA amendment. If Congress seriously wants to reduce our dependence on foreign regimes like China for critical minerals, it must pass the Cobalt Act.

• Gregory D. Wischer is vice president of government affairs at Westwin Elements, an American company poised to build and operate America’s first major cobalt refinery. His writing has appeared in Newsweek, The National Interest and Georgetown Security Studies Review. Daniel Plitt is director of government Affairs at Westwin Elements.

No comments:

Post a Comment