BY PETER CARBONARA AND SCOTT REEVES

With two weeks to go before the election, the nation's financial health is top of mind for Americans. According to a recent Gallup poll, nearly nine out of 10 registered voters say the economy is the most important factor in their decision about who to vote for—ahead of response to the pandemic, crime, race relations and a dozen other key issues. Additionally, nearly half of those polled said that President Donald Trump's recent COVID-19 diagnosis had made them even more worried about the economy than they already were.

No matter what happens between now and Inauguration Day, January 20—even in the unlikely event of a coronavirus vaccine or a second round of stimulus checks—the next president will be looking at an economy that is in rough shape and faces a long recovery.

The current national unemployment rate, after all, is still at a lofty 7.9 percent. While that's well below the nightmare days of late spring when it rose as high as 14.7 percent—a level second only to the rates seen during the Great Depression—it's still in another ballpark from last January, when it stood at 3.6 percent, near its 50-year low.

That pain is not being distributed equally. The Federal Reserve Bank of St. Louis estimates that the unemployment rate for Black Americans is 12.1 percent and 10.3 percent for Latinos, compared to 7 percent for whites; meanwhile, the unemployment rate for men topped out at 13.5 percent in April while hitting 16.2 percent for women the same month. Then too, according to the Labor Department, about five million people are about to join the ranks of the "long-term unemployed," meaning they've been out of work for at least six months, at point at which they are increasingly likely to stop looking for a job altogether.

Total job losses so far: about 30 million and the Labor Department estimates about 4 million of those are permanent. For some individual sectors of the economy, many of them composed largely of small business, the lasting damage has been brutal. Business review site Yelp, for example, recently estimated that 19,590—or 61 percent—of the 32,109 restaurants that have closed this year are gone for good.

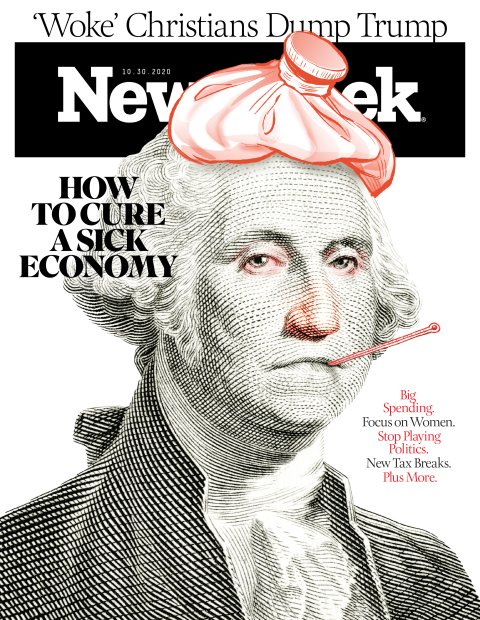

So, with all those depressing numbers in mind and the need for action critical, what should the next president do to fix the ailing economy? Newsweek asked 12 leading economic thinkers to imagine a phone call on January 21 from the nation's commander-in-chief asking them, "What's your best advice for me right now on the economy?"

Below are their answers to that question, edited for space and clarity. We heard a range of specific recommendations, but almost all of them included the federal government pumping a ton of money into the U.S. economy, in the form of both immediate direct aid to individuals and businesses as well long-term investment in things like infrastructure and education. The word we heard repeatedly was "spend." Or as one economist put it: "What's the answer? Money. And lots of it."

EARMARK $3 TRILLION FOR STIMULUS

Mark Zandi

Chief Economist

Moody's Analytics

Zandi looks at the economic fallout of the coronavirus through the lens of the 2008 financial meltdown. He worries that we've forgotten one of the main lessons of that disaster: If the federal government pumps too little cash into the economy, the downturn will be longer and more painful than necessary. "That's why it took us a full decade to get back to full employment," says Zandi. "We can't afford that again."

His advice for the next president: "To get back to full employment as soon as possible, that means go big on fiscal policy and spending–not worry about deficit and debt, not today." Zandi, who believes a President Biden would be better for the U.S. economy than a second term for President Trump, recommends more stimulus checks now "as a bridge to the other side of the pandemic," followed by investment in things that have a direct and long-lasting effect on the economy, like new roads, bridges and other infrastructure and on improving America's schools.

Just how big an investment? Zandi favors spending about $3 trillion, close to the $3.4 trillion proposal Democrats initially floated in Congress—and far more than the $1.8 trillion (Republican) to $2.2 trillion (Democrats) packages currently on the table.

Economist Mark Zandi of Moody's Analytics favors earmarking around $3 trillion for additional stimulus—far more than current proposals from either Democrats or Republicans in Congress.C.J. BURTON/GETTY

MANDATE PAID PARENTAL LEAVE

Sallie Krawcheck

CEO and Co-Founder

Ellevest

One in four women in the U.S. is considering downshifting her job or quitting altogether due to the pandemic, according to a recent report by McKinsey and LeanIn—at great potential cost not just to their families and careers but also to the productivity of the country. A critical part of the solution, says Krawcheck, a longtime top Wall Street executive, who now runs a digital investing platform for women: mandating paid family leave. "We have mischaracterized maternal and parental leave as an expense," says Krawcheck. "It's really an investment and it pays for itself in the first year."

Focusing relief efforts on women is a matter of commonsense, in Krawcheck's view. "You are not going to find a bigger target than half the population," she says. "Nothing bad happens when you put more money in the hands of women and a lot of great things happen. Economies grow, societies are fairer, families are better off, nonprofits are better off because women give away a larger percentage of their wealth. If you want a lever toward growing U.S. GDP by trillions, I would focus on women."

Women also typically put money to more economically productive use than men—"Men tend to spend their excess money on drink and fun, women on advancing their families," Krawcheck says—and they've been hit harder by the pandemic. "Women have lost their jobs to a greater degree than men," she says. " Even women privileged enough to work from home are losing productivity."

PRIORITIZE COVID CONTAINMENT

Olivia S. Mitchell

Professor of Business Economics and Public Policy,

The Wharton School, University of Pennsylvania

There can be no resolution of the economic crisis without first tackling the health crisis that caused businesses to shut down in the first place, Mitchell believes. An expert on pensions and retirement whose work typically requires taking a long view, Mitchell wants the next president to focus instead on the here and now. The top priority, she says: "Take seriously the job of halting the coronavirus."

Wharton economist Olivia Mitchell believes that the economic recovery can't be separated from recovery efforts from the healthcare crisis. Her advice: “Take seriously the job of halting the coronavirus.”KILITO CHAN/GETTY

Wharton economist Olivia Mitchell believes that the economic recovery can't be separated from recovery efforts from the healthcare crisis. Her advice: “Take seriously the job of halting the coronavirus.”KILITO CHAN/GETTYFor Mitchell, that means testing and contract tracing on a massive scale, continuing to promote self-quarantining and masks, leaving the scientists alone who are trying to develop a vaccine and fostering the creation of a national vaccine delivery system. That, she says, "would go a long way toward jumpstarting the economy, though some additional stimulus payments are clearly needed for the next year or so."

PUMP UP SPENDING ON SCIENCE

Jonathan Gruber

Professor of Economics

Massachusetts Institute of Technology

Gruber, who was one of the architects of the Affordable Care Act, says he'd advise the new president to follow the example of Eisenhower and other post World War II presidents: "During the decades after World War II, the U.S. government increased public research and development spending to 2 percent of the entire economy, while massively investing in science education at all levels. The result was not only the birth of virtually all modern technologies but also the creation of the greatest middle class the world has ever seen."

Since then the U.S. has lagged other developed countries in government spending on science."The result has been slow growth and falling behind our competitors in technology development and good job creation," he says. "An increased investment of 0.5 percent of GDP in public R&D, paired with system wide devotion to improved and expanded science education, would create 4 million good jobs and make America the innovation engine of the world again."

Gruber also cautions to make sure the benefits of that government spending are widely distributed, and not limited " coastal 'superstar' cities." He says, "There are more than 100 U.S. communities that have the skills, educational institutions and high quality of living that can turn them into the next tech hubs. We should hold a competition to distribute federal funds to the locations that demonstrate the most potential to do so."

HELP THE HARDEST HIT

Rhonda Vonshay Sharpe

Economist and Founder

Women's Institute for Science, Equity and Race

Vonshay Sharpe advocates for a new relief package for households that have been struggling to get by on low unemployment benefits and families helping out young adult members. One provision, she recommends: Allow heads of household to claim adult children as dependents up to age 26, especially if they had been living independently and had to return home or are college students or recent grads, thereby qualifying the parent for more generous relief payments if there's another round of stimulus or bigger tax breaks.

She also suggests making unemployment assistance pay at least as much as a worker would get for a full week at the federal minimum wage ($290 a week). According to a CNBC report, 21 states make some unemployment payments at a rate less than the federal minimum wage of $7.90 an hour and six have capped their benefits below that level. Even better than matching or topping the federal minimum wage, Vonday Sharpe says, would be a check equal to the median between what the out-of-work person's gross income was and what they are now entitled to under their state's program.

Lastly, she favors grants and loans for small businesses, particularly to cover anti-coronavirus expenses like personal protective equipment or a redesigned workspace that allows for adequate social distancing and other safety measures. She says, "The choice between livelihood and life should not be a privilege only afforded to those with means."

ESTABLISH AN ECONOMIC BILL OF RIGHTS

William A. Darity, Jr.

Professor of Economics, Political Science and African American Studies

Duke University

Darity urges the next president to focus on the middle and lower income people who have been hit hardest and often get left behind during recoveries. "I'm a longtime proponent of an economic bill of rights for the 21st century so that is what I'd propose," says Darity, a pioneer in the field of "stratification economics," which focuses on the role of class, race and caste in creating and maintaining wealth and income inequality in society. "The economic bill of rights is a series of policies that I wish had been in place before the start of the coronavirus crisis. I think it would have curbed a lot of the economic ramifications significantly."

The legislation Darity has in mind would include a federal job guarantee (people who can't find private sector work would get government jobs at salaries they could live on); a national health insurance program along the lines of Medicare for All ("No more pussyfooting around with ACA," he says) and a public banking system to provide quality services to small depositors who are underserved by big banks now and are subject to predatory lending practices like reliance on payday loans.

BACK OFF FURTHER STIMULUS

Chris Edwards

Economist, Director of Tax Policy Studies,

The Cato Institute

While most economists have joined the chorus calling for more stimulus—how much, not if, is typically the focus of the debate—Edwards is a singular voice who would advise the next president to put the brakes on. "The government is overdoing it on relief," he says.

"Overall American incomes were higher in recent months than they would have been without a recession because of the huge amount of federal relief," Edwards says. "As for state aid, state government revenues have only dipped modestly, and local government revenues are stable because property tax revenue continue to edge upwards. At best, additional stimulus spending would modestly boost GDP for a quarter or two, but that would come at the expense of slower growth later on because of the higher debt or taxes. The economy will return to full strength on its own when the health crisis subsides."

Edwards would also advise President Biden, if elected, to back off his proposal to double the capital gains rate. Edwards believes that would undermine America's high-tech economy by robbing the entrepreneurs, angel investors and venture capitalists who invest in these high-risk ventures of their full rewards. If Trump wins, Edwards instead urges spending cuts. "The easy one is Social Security," he says. "Reduce the growth rate of benefits for middle- and higher-income workers by "progressive price indexing" of initial benefits."

PUT RELIEF ON AUTO PILOT

Justin Wolfers

Professor of Public Policy and Economics

University of Michigan

Given the degree of financial pain that households are suffering, Wolfers, like many economists, would urge the next president to get more money into the hands of Americans fast. But he'd also advise the president to remove—or at try to least reduce—the politics that have gummed up the federal government's ability to respond quickly to the financial crisis thus far by taking some decisions out of human hands.

"The last few weeks of stimulus talks being on again, then off again, as electoral fortunes—and the president's steroid doses—fluctuated are a primary example of the system not working," he says. "The fiscal need didn't change, just the politics. So why not simply agree in advance that if the economy gets this bad, we'll execute some specific amount of fiscal stimulus?"

A good way to accomplish this, Wolfers says, is through "what economists call automatic stabilizers, which are programs that automatically spend more and tax less when the economy tanks." One current example: the Supplemental Nutrition Assistance Program, commonly known as food stamps. During tough economic times, the number of people who meet the program's income and savings requirements go up and the program costs more. When times are good, the reverse happens.

FOCUS ON JOB CREATION

Beth Ann Bovino

U.S. Chief Economist

S&P Global Ratings

Even though the unemployment rate has fallen sharply since its spring peak, Bovino points out that joblessness remains high and the improvement seems fragile. "While the U.S. economy is no longer teetering into depression territory, the still-high unemployment rate says the U.S. remains mired in a severely weakened recovery and we still face a 30 to 35 percent chance of falling back into recession," she says. "The harsh reality is the next president has his work cut out for him."

Serious investment in America's infrastructure could create more than 2 millions jobs by 2024 and and add nearly $6 trillion to GDP over the next decade, says Beth Ann Bovino, U.S. chief economist of S&P Global RatingsJUNG GETTY/GETTY

Serious investment in America's infrastructure could create more than 2 millions jobs by 2024 and and add nearly $6 trillion to GDP over the next decade, says Beth Ann Bovino, U.S. chief economist of S&P Global RatingsJUNG GETTY/GETTYBovino believes that the next president's first priority should be to create jobs, which would require spending a lot of money. To get the biggest bang for the buck, she recommends an ambitious effort to fix or replace America's dilapidated bridges, tunnels, highways and airports." Serious investment in infrastructure that meets the magnitude of this crisis is the biggest light at the end of the tunnel," she says. "An investment of $2.1 trillion would create more than 2.3 million jobs by 2024, increase per-capita income by $2,400 and add $5.7 trillion to GDP over the next ten years. That would be 10 times the recession losses. It's not spending, it's a rock-solid investment in our country and our workforce."

GIVE A BIGGER HAND TO STUDENT BORROWERS

Fenaba Addo

Economist, Associate Professor

University of Wisconsin-Madison

The next president should extend and expand help for the 43 million current and former college and graduate students who collectively are on the hook for more than $1.7 trillion in higher education debt, says Addo. Research shows that the most vulnerable borrowers are those who may have comparatively small loans but are in the worst position to pay them back—often because they were unable to finish their degree and, as a result, have trouble finding livable-wage jobs. She says, "They have had to prioritize non-debt related needs, at potential cost to their own credit, so that their families are not facing housing or food insecurity."

At the moment, the Department of Education has suspended student loan payments through the end of the year and some private lenders have been willing to cut individual deals with people who can't make their payments. Addo hopes the next president will go further on relief efforts, and cancel at least a portion of these loans, possibly along the lines of a recent proposal by Democratic senators to have President Trump use his executive powers to forgive up to $50,000 per student in debt.

Addo recognizes, though, that loan forgiveness is politically unlikely. "If debt cancellation is not an option," she say, "loan payments should continue to be suspended and households provided money, such as the stimulus direct cash payments, to pay their expenses until there is a vaccine."

RESTOCK THE LABOR POOL

Jeffrey Korzenik

Chief Investment Strategist

Fifth Third Bank

Even while unemployment numbers have soared, Korzenik says, the next U.S. president will need to deal with a longer-term shortage of workers that will hurt GDP after the pandemic is over. Part of this shortage, he says, comes from declining birth rates as well the retirement of baby boomers. Newer and more worrisome is "the declining participation of 35- to 54-year-old women, which had previously been a bright spot in workforce growth." Korzenik thinks a big factor is that so many women now need to be home with school-age kids who are attending school remotely. He thinks incentives for employers to provide childcare would help as well as enhanced health measures for schools so they can begin in-person teaching faster.

He is also concerned that, in terms of joblessness, "the worst is yet to come," as people who were laid off early in the pandemic join the ranks of the long-term unemployed. In general, the longer you've been out of work, the harder it gets to find work and the more likely you are to drop out of the workforce. One way the next president could help the situation, Korzenik says: Provide back-to-work bonuses as an incentive for discouraged workers to continue to look for jobs.

DOLE OUT A FEW TAX BREAKS

Joel Griffith

Research Fellow

The Heritage Foundation

Instead of asking the new president to spend more money, Griffith wants the next administration to concentrate on cutting taxes and business regulations. He points out that while President Trump's cuts for corporations are intended to last forever, most of the cuts for individuals expire in 2025. Making them permanent, as well as letting businesses deduct the full cost of some capital investments, he says, "will provide a permanent boost to long-term economic growth."

Not that he sounds very optimistic. Given the additional funds for stimulus that the government will likely pass, on top of what's already been spent, along with the huge federal deficit that existed before the pandemic began, he believes that tax increases are more likely. Still, Griffith says that's the wrong way to go: "Pro-growth tax policy ultimately requires getting our fiscal house in order."

ILLUSTRATION BY BRITT SPENCER FOR NEWSWEEK; SOURCE PHOTO BY VAARA/GETTY

No comments:

Post a Comment