MICHAEL SPENCE

If governments are going to engage in trade wars, they should have a clear and pragmatic vision of where they want to end up. Yet the trade war initiated by the Trump administration seems less like a tough negotiating tactic, and more like a guessing game.

If governments are going to engage in trade wars, they should have a clear and pragmatic vision of where they want to end up. Yet the trade war initiated by the Trump administration seems less like a tough negotiating tactic, and more like a guessing game.

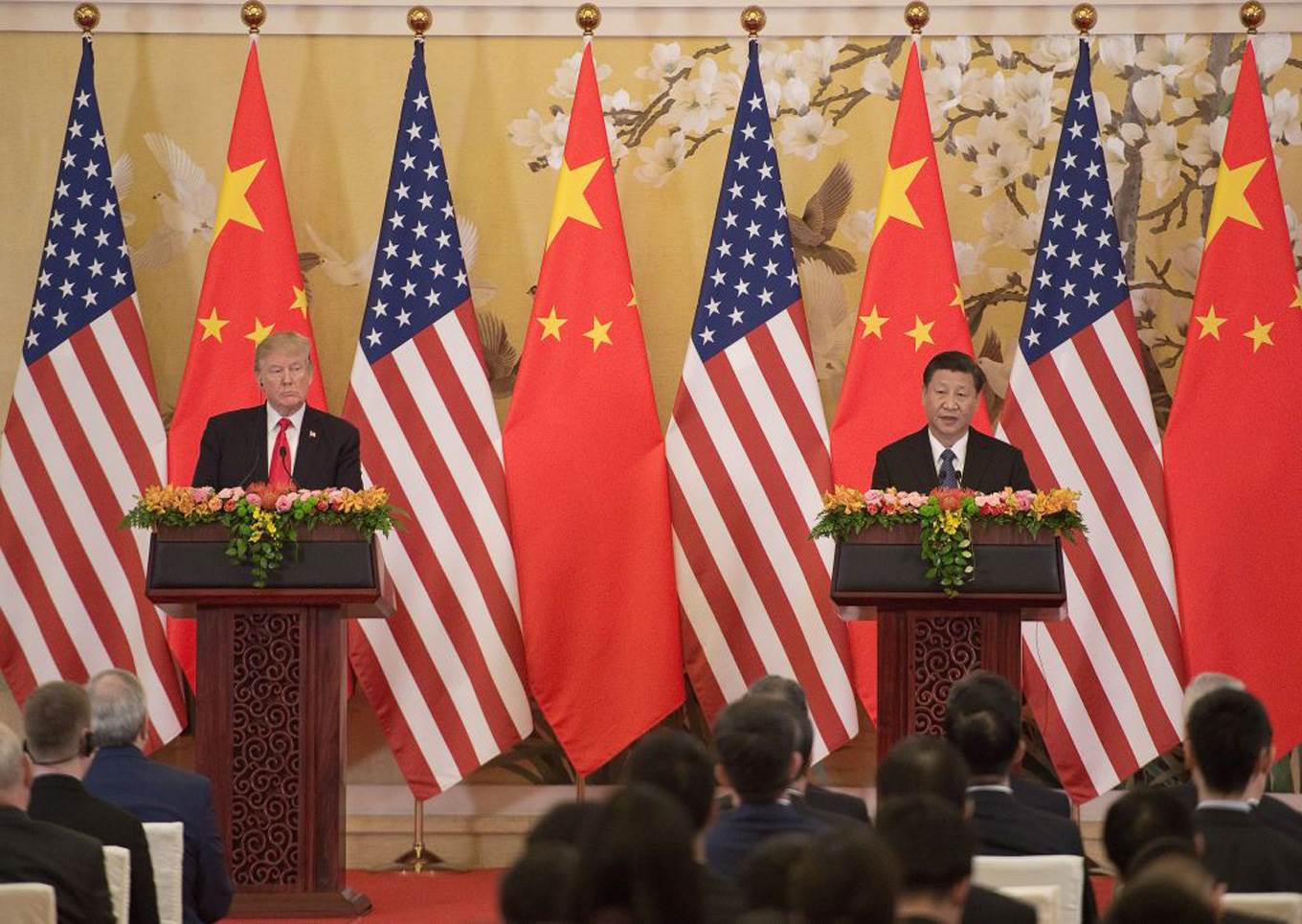

MILAN – Some observers interpret the trade war that US President Donald Trump has initiated with China as a tough negotiating tactic, aimed at forcing the Chinese to comply with World Trade Organization rules and Western norms of doing business. Once China meets at least some of Trump’s demands, this view holds, mutually beneficial economic engagement will be restored. But there are many reasons to doubt such a benign scenario. The long China-US trade war is really a manifestation of a fundamental clash of systems.

Already, the adverse impact of the two sides’ tit-for-tat tariffs – and, especially, the uncertainty that they engender – is plainly visible. For China, the psychological effects are larger than the direct trade impact. China’s stocks have dropped by some 30% since the conflict began, and further declines are expected. Because equity-backed debt has been issued to China’s highly leveraged corporate sector, the decline in stock prices has triggered collateral calls and forced asset sales, putting further downward pressure on equity values.

In order to limit a negative overshoot, Chinese policymakers have been talking up the strength of equity markets, while shoring up and expanding credit channels for the private sector, particularly for otherwise healthy and creditworthy small and medium-size enterprises, which remain disadvantaged relative to their state-owned counterparts. Whether the government will intervene directly in equity markets remains to be seen.

But beyond the short-term risks, it seems increasingly likely that the trade war will have significant long-term consequences, affecting the very structure of the global economy. The rules-based multilateral order has long been underpinned by the assumption that growth and development would naturally lead China to embrace Western-style economic governance. Now that this assumption has largely collapsed, we are likely to face a prolonged period of tension over differing approaches to trade, investment, technology, and the role of the state in the economy.

Whereas Western governments tend to minimize their intervention in the private sector, China emphasizes state control over the economy, with far-reaching implications. For example, subsidies are difficult to detect in the state-owned sector, yet doing so is crucial to maintaining what would be considered a level playing field in the West.

Moreover, Chinese foreign direct investment is often carried out by state-owned enterprises, and thus frequently packaged with foreign aid – an approach that can put Western-based firms at a disadvantage when bidding for contracts in developing countries. Lacking any version of America’s Foreign Corrupt Practices Act, China is also willing to channel FDI toward countries and entities that US companies might eschew.

Then there is the Internet. Despite common goals with regard to data privacy and cyber-security, the US and China have very different regulatory regimes, shaped, yet again, by conflicting ideas about the state’s appropriate role.

On the technology front, China will also continue to pursue its “Made in China 2025” strategy, the goal of which is to put the country at the global frontier in areas that its leaders have deemed essential for both economic growth and national security. While America’s increasingly aggressive policies with respect to trade, investment, and technology transfer may slow this process, China will achieve its objectives by investing heavily in research and development, technological diffusion, and human capital.

Given the broader strategic competition between China and the US – now exacerbated by the ongoing trade war – we should not expect a return to some variant of the post-World War II rules-based order, based on Western values and systems of governance. The global order could come to be defined less by shared rules than by a balance of economic, technological, and military power.

For example, there are likely to be more stringent restrictions on technology transfer and investment, owing mainly to national security considerations. Countries may also pursue greater economic self-sufficiency, with major implications for global supply chains and trade.

Some version of an open multilateral system may still be possible; for smaller and/or poorer countries, it is vitally important. But such a system will have to account for balance-of-power considerations regarding the US and China, and potentially other major economies, such as the European Union and India.

In a world where the major players’ governance models diverge sharply, designing a workable system will be a major challenge. There is a real risk that smaller countries will end up forced to choose between two incompatible spheres of influence.

With the Trump administration lacking enthusiasm for multilateralism of any kind, and perhaps owing to lingering hopes that the old multilateral order can be preserved, no one is so much as attempting to develop feasible alternatives. What the US administration has done recently is reverse its negative stance on foreign aid, presumably in response to China’s massive investment in developing countries.

If governments are going to engage in trade wars, they should have a clear and pragmatic vision of where they want to end up. As it stands, China is unwavering on territorial issues and the central role of the Communist Party of China in the economy, as well as its goal of catching up to, or surpassing, the US technologically. But the US does not seem to have decided exactly what it is fighting for.

Of course, many possible candidates can easily be discerned. The US wants to reduce the bilateral trade deficit and repatriate manufacturing jobs. To do that, it wants China to eliminate subsidies, mandatory technology transfer, and other forms of “cheating”; level the playing field for foreign investors in the Chinese market; and even adopt more Western-style governance practices. Crucially, the US also wants to retain its technological and military superiority.

Yet the extent to which any of these goals is negotiable remains unclear. As a result, the trade war seems less like a tough negotiating tactic, and more like a guessing game around a wish list. This will prolong the conflict, further diminish trust, and, in the long term, make it harder to restore any semblance of mutually beneficial cooperation, implying significant long-term consequences for the global economy.

No comments:

Post a Comment