Since the outbreak of the Covid-19 pandemic, European defense has entered uncharted waters. While the economic implications of the ongoing health crisis are difficult to assess, one thing is certain: the public finances of European states will not come out unscathed. In this context, the recent growth in military expenditure in Europe is at risk despite the deterioration of the strategic environment. However, lessons learned from the 2008 financial crisis should help Europeans take the necessary steps to avoid the worst-case scenario of a sharp decrease in defense spending.

Europe has been severely affected by Covid-19, which is still far from being under control. Beyond the immediate implications of this unprecedented crisis, many experts have warned about the medium-term risks for defense budgets in Europe. As public debt explodes and threat perceptions change, European military expenditure could face a new major blow 10 years after the global financial crisis. Identifying ways to prevent this scenario requires drawing on the experience of the last decade but also analyzing more precisely the diverse national situations across Europe.1

The “Lost Decade” of 2008–18

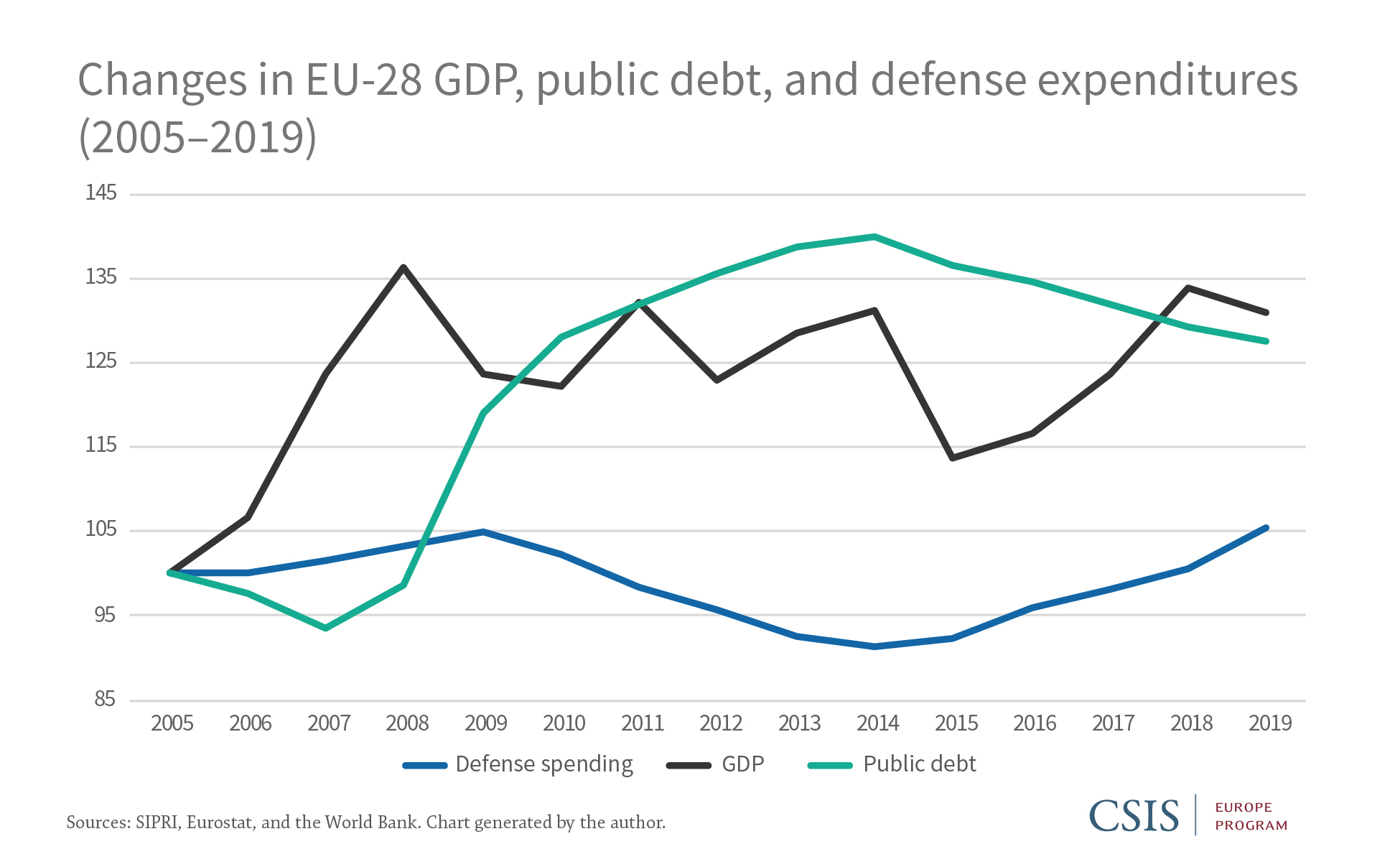

The 2008 financial turmoil took a dramatic toll on European economy. Statistics speak for themselves: in 2009 alone, the gross domestic product (GDP) of the European Union declined by more than 4 percent, followed by years of slow growth. Public debt skyrocketed from 58 percent of GDP in 2007 to 87 percent in 2014 and, as of 2019, remains high at 79.4 percent. Driven by the need to reduce large budget deficits, defense spending also plummeted in Europe between 2009 and 2013 (see Figure 1). According to the North Atlantic Treaty Organization (NATO), defense expenditure in Europe fell by 3 percent in 2009 and continued to decline steadily throughout the 2010–13 period. This trend was even more pronounced in smaller European states such as Lithuania, which cut defense spending by over 36 percent in 2010.

More importantly (given their impact over the long term), new investments in defense also significantly declined during that period. As highlighted by the European Defense Agency (EDA), EU member states’ military investments decreased by 22 percent between 2007 and 2014. Likewise, spending on defense, research, and technology in 2016 was nearly half of what it had been in 2006, hampering Europe’s ability to prepare for the future.

Ultimately, Europeans reversed this declining trend and started to increase their defense budgets again in 2015, primarily in reaction to the rapid deterioration of their immediate strategic environment (as seen by, for example, terrorist attacks and the annexation of Crimea)—efforts aided by an improved economic climate (Figure 1). As NATO Secretary General Jens Stoltenberg highlighted, European NATO allies increased their defense spending every year between 2015 (when it rose by 1.7 percent) and 2019 (when it rose by 4.6 percent).

However, this upward trend is the tree that hides the forest. It took until 2018, 10 years after the outbreak of the crisis, for defense expenditures in Europe to recover their pre-crisis levels, which were already low. In comparison, as of 2019 the United States spends almost 2.5 times more than European NATO allies in absolute terms—equivalent to 3.42 percent of its GDP, well above the alliance’s 2 percent objective. China has also significantly increased its share of world military expenditure, rising from 6 percent in 2005 to 14 percent in 2019, according to the Stockholm International Peace Research Institute (SIPRI).

“There is a point when you are no longer cutting fat; you’re cutting into muscle, and then into bone.” - Anders Fogh Ramussen)

Additionally, budget cuts in procurements led to a severe and lasting downgrade of European armies, greatly limiting their ability to assume their operational responsibilities. Plans to acquire and upgrade equipment were delayed or even canceled, weakening military readiness, as illustrated by the Bundestag’s 2018 report on the state of the German army. Overall, European armies lost 35 percent of their capabilities over the last two decades. As former NATO secretary general Anders Fogh Ramussen said, “there is a point when you are no longer cutting fat; you’re cutting into muscle, and then into bone.” This is just what Europeans did. It is therefore not surprising that the economic crisis triggered by the pandemic is raising fears that such a scenario could happen again.

Aftermath of Covid-19: Back to Square One?

Covid-19 has prompted the worst economic downturn since the Great Depression. According to the International Monetary Fund (IMF), the output of the euro area is expected to contract by 10.2 percent in 2020 and only begin to recover toward pre-crisis levels in late 2022. This economic “ground zero” will necessarily have consequences for defense spending, just as the global financial crisis did a decade ago, notwithstanding its different nature from a macroeconomic standpoint.

“This economic “ground zero” will necessarily have consequences for defense spending, just as the global financial crisis did a decade ago.”

First, this economic shock will result in further public debt in Europe (from 84 percent of GDP in the Euro area in 2019 to an estimated 105 percent in 2020, according to the IMF) and ultimately increase pressure to reduce public spending in the years to come. Second, a recent poll published by the European Council on Foreign Relations shows that this unprecedented health crisis could affect threat perception among Europeans, leading them to reorder policy priorities at the expense of defense. According to this survey, conducted between March and April 2020, policymakers and experts only ranked defense 14 out of 20 priorities, far below issues such as the economy, migration, or climate. This is a worrisome shift compared to the 2018 edition of the survey, in which defense ranked 9 out of 20.

Worrying signals are already evident at the EU level. Even if it represents a historic breakthrough, the agreement on the recovery plan and the multiannual financial framework for 2021–27 is not necessarily reassuring as far as defense is concerned. The budgets of the European Defense Fund and the Military Mobility Initiative, two new flagship defense programs, were significantly reduced from their initial targets. The former’s budget was cut from €11.5 billion (€13 billion in the 2018 prices used in the initial proposal) to €7 billion, and the latter’s was reduced from €5.75 billion (€6.5 billion in 2018 prices) to €1.5 billion. The first State of the Union address delivered by President of the European Commission Ursula von der Leyen illustrates this underlying paradigm shift. During her hour-long speech, the former German defense minister did not mention defense issues once—in striking comparison with her predecessor, Jean-Claude Juncker, who launched bold initiatives in this field, starting with the European Defense Fund.

“This unprecedented health crisis could affect threat perception among Europeans, leading them to reorder policy priorities at the expense of defense.”

Since the fate of defense spending in Europe will ultimately be decided at the national level, a closer look at the particular situation of each European state is key to getting a better sense of the future. Based on their weight in terms of defense expenditure (Figure 2) as well as their diversity, six countries were selected: France, the United Kingdom, Germany, Italy, Denmark, and Poland. The aim of examining the last three countries is to illustrate the wide variety of situations within Europe, even if these countries’ cases do not necessarily portend what will happen in their respective subregions.

France, the United Kingdom, and Germany: Can the “Big Three” Stem the Tide?

France

In comparison to most European countries, France shielded its defense budget from large cuts after the last economic crisis. Under the consecutive military planning laws for 2009–14 and 2014–19, military spending remained steady thanks to a strong political consensus on defense matters. However, despite this stability, there was not nearly enough funding for an overstretched French military whose personnel had been significantly reduced from 320,000 in 2009 to 266,000 by 2012 and which had to modernize while deploying its forces in high-end operations in the Sahel and Levant.

In reaction to the 2015 terrorist attacks, the French government scaled up military expenditure by €3.8 billion ($4.5 billion) for the 2016–19 period. After his election, President Emmanuel Macron pledged to increase defense spending to 2 percent of national GDP by 2025, up from 1.78 percent in 2017. To fulfill this goal, the military planning law for 2019–25 allocates €198 billion ($233 billion) to the armed forces over five years (2019–23), increasing the defense budget by €1.7 billion ($2 billion) per year until 2022 and then by €3 billion ($3.5 billion) in 2023. A quarter of this budget will be invested in modernizing all branches of the French army.

Because the French economy has been harshly hit by the pandemic, the sustainability of this commitment could be in doubt, especially as its most important steps were expected to be enacted after 2022. Even if President Macron seems determined to maintain his strategic ambitions for the French army, the military planning law leaves the door open to revise the planned budget growth downward in 2021 depending on the macroeconomic situation. Next year’s update of the planning law will therefore be an important test case not only for France but for Europe as a whole.

The United Kingdom

The British military was severely affected by the austerity that followed the global financial crisis in 2008. In 2010, the annual Comprehensive Spending Review instructed the Ministry of Defense to reduce its budget by 8 percent over the next four years. As a result, the UK government undertook a draconian downsizing of the British army. By 2016, the size of the regular army fell from 104,000 to 85,000 soldiers, the navy’s surface fleet was reduced from 22 to 19 destroyers and frigates, and there were similar cuts to air force fleets.

Beyond these reductions in the armed forces, the British government also curtailed planned procurements, which created significant capability gaps. The fall of the pound against the dollar worsened the situation by significantly increasing the cost of equipment purchased in U.S. dollars, most notably F-35 aircraft. Even though the British armed forces remain among Europe’s most robust and capable militaries, these cuts have hampered their ability to conduct large and high-end operations.

Against this backdrop—and that of Brexit—the UK government is undertaking an Integrated Security and Defense Review that promises to rethink British priorities in a holistic way. Nonetheless, this review must manage the ongoing economic fallout of Covid-19 and thus risks becoming a budget-cutting exercise. Although the Conservative government has pledged to keep the defense budget above the 2 percent of GDP target, this seems less likely to hold as the economic crisis unfolds. The British Treasury has already decided not to present a budget for 2021 in order to focus on the short-term measures needed to cope with the economic downturn, a decision that raises doubts regarding whether it will move forward with the annual comprehensive spending review scheduled for this autumn.

Germany

Budgetary austerity in the aftermath of the global financial crisis did not initially reach the German defense budget, which actually grew by 32 percent between 2005 and 2010. However, under increasing budgetary pressure, Chancellor Angela Merkel finally announced that the defense budget would be cut by €8 billion ($9.4 billion) between 2011 and 2014. This 22 percent decrease from 2010 levels dramatically weakened the German armed forces, which faced significant downsizing of their force structure, cuts in procurement, and reduced military manpower levels.

The invasion of Crimea in 2014 was a watershed moment for Germany. Following a 2016 White Paper that acknowledged the renewed risk of interstate armed conflicts, German defense spending has increased quickly over the past five years from €35.8 billion ($39.8 billion) in 2005 to €48 billion ($54.7 billion) in 2019. Despite such progress, Germany spent only 1.38 percent of its GDP on defense in 2019, still far behind NATO’s 2 percent goal. It is unlikely to reach this target soon, with Berlin’s objective being to raise it to 1.5 percent by 2025.

The IMF expects the unfolding crisis to lead Germany’s GDP to contract by 7.8 percent in 2020, with its public debt rising from 60 percent to 77 percent. Such a recession could hurt the case for further increases in defense spending, especially in a country where defense remains a politically divisive issue. Given Germany’s size and key role regarding defense matters in Europe, Berlin’s position on this matter will be paramount to regional security. Although the German government is unlikely to backtrack on its commitments in the short term, the draft spending plans for 2021 it unveiled in mid-September send mixed signals. While it should increase the defense budget to meet its stated goals, the government instead decided to reduce defense investments from €17.2 billion ($20.3 billion) in 2020 to €15.9 billion ($18.7 billion) in 2024—a decision that could severely impact the modernization of the German armed forces and the multilateral armament projects in which Berlin is involved.

Italy, Denmark, and Poland: A Tale of Three Europes

Italy

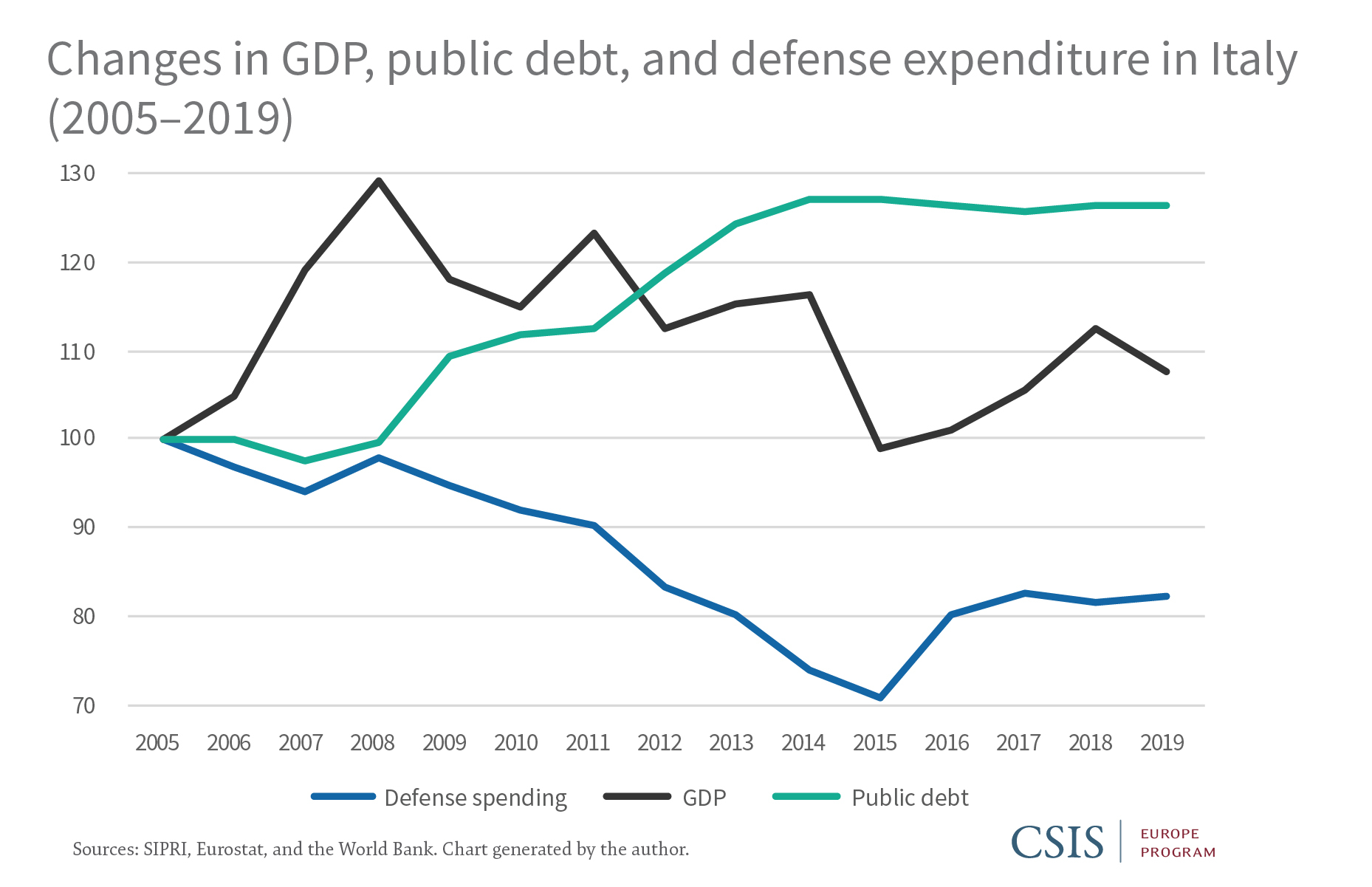

Since the last financial crisis, Italy’s economic situation has been particularly precarious. Between 2007 and 2019, it experienced twenty quarters of recession (42 percent of the time). Years of austerity have not spared the Italian defense budget, which steadily fell from 1.3 percent of GDP in 2011 to 1.1 percent in 2017. In 2019, it rebounded to €21.4 billion ($24.5 billion), or 1.22 percent of GDP. While personnel costs represent more than 70 percent of the Italian defense budget (compared to 40 percent in the United Kingdom or 50 percent in France and Germany), most of the budget cuts were to military investments. Italy nonetheless managed to maintain a high level of investment in some strategic sectors such as the naval and space domains. Starting in 2016 and following the publication of its 2015 White Book, Italy ultimately decided to substantially increase its equipment expenditure, which now represents more than 20 percent of its defense budget, compared to less than 10 percent in 2015.

The epicenter of the pandemic on the European continent, Italy is facing nevertheless unprecedented economic losses, among the highest in Europe, with the IMF projecting that its GDP will drop by 12.8 percent and its already high public debt will expand from 135 percent of GDP to 166 percent by the end of 2020. In that regard, Italy is representative of the economic predicaments hitting southern Europe at large, and defense spending is unlikely to be increased or even maintained in the years to come. Even though the coalition currently in power has reaffirmed its commitment to preserving the defense budget, some of its recent decisions—such as the reallocation of €20 million ($24 million) originally earmarked for purchasing Eurofighters in favor of the national civil security program—might be indicative of a change in government priorities.

Denmark

Following the global financial crisis, the Danish government initially resisted pressure to reduce defense expenditures, which remained stable for a couple of years before fiscal austerity had the final say. The Danish defense agreement for 2013–17 was crystal clear: “Denmark is facing a time of economic challenges, and a continuity of public finances must be secured. The political parties behind the Defense Agreement. . . agree that the defense must also contribute to this continuity.” Defense spending was cut by 15 percent, weakening an already overstretched military that was engaged in many operations despite limited and aging capabilities.

The Russian annexation of Crimea was a wakeup call for Denmark and the other Nordic countries. Denmark’s new defense agreement for 2018–23 plans to increase defense expenditures from 1.17 percent of GDP in 2017 to 1.3 percent by 2023. The agreement aims to reinforce areas that were most neglected in the aftermath of the Cold War, such as anti-submarine capabilities, air defense, and even conventional defense. The impact of the ongoing economic downturn on Danish defense spending is difficult to evaluate. Even though Denmark is affected by the global depression (its economy is expected to shrink by 6.5 percent in 2020), its economic foundations remain strong. What is more, the defense agreement, which was endorsed by the main political parties, should lock in military expenditures at least until 2023.

Poland

Among European countries, Poland is an exception when it comes to prioritizing defense spending. While the global financial crisis took a toll on defense expenditure across Europe, Warsaw made a political decision to continue to increase its defense budget, which grew by 50 percent between 2005 and 2010. Russia’s aggressive behavior only confirmed and accelerated Poland’s determination to modernize its armed forces in order to be able to both serve as a deterrent and defend the country, as reaffirmed in its 2017 national defense concept.

The planned Polish defense budget reached $13 billion for 2020 (2.1 percent of its GDP), a quarter of which is geared toward the “deep transformation” of Poland’s military through substantial procurement investments. According to the most recent technical modernization plan, which covers the 2021–35 period, it will invest more than $133 billion in new arms and equipment across the capability spectrum.

These military ambitions are unlikely to be affected by the ongoing economic crisis. Although the IMF expects Poland’s GDP to fall by 4.25 percent in 2020, the country entered the crisis on strong economic footing. There is also a robust consensus across the political spectrum on the need to continue ongoing modernization efforts. Backed by both the ruling conservative Law and Justice Party and the opposition, a 2017 bill pledged to increase the defense budget to 2.5 percent of GDP by 2030.

Recommendations

Despite a few outliers, it is hard not to foresee grim scenarios for military expenditure in Europe as a whole. The reduced funding for the European Defense Fund and Germany’s decision to reduce its defense procurements could be harbingers of things to come. Nonetheless, a downgrade in defense spending and output in Europe is not yet a foregone conclusion. As illustrated by France and Poland (Figure 4), recessions are not automatically followed by declines in defense spending. Building on the lessons from the last economic downturn, Europe can still shape the outcome of the unfolding crisis by taking the following steps:

Maintain collective political pressure on defense spending levels. The Defense Investment Pledge taken at the 2014 NATO Wales Summit plays an instrumental role in encouraging European governments to increase their defense spending. Despite its inherent flaws, the 2 percent of GDP target has been an effective political tool to sustain peer pressure within the alliance for bigger defense expenditures. Should defense spending become more constrained, it will be even more important for allies to focus on qualitative metrics such as ensuring defense budgets include new procurement (such as spending 20 percent of defense budgets on major equipment), meeting readiness targets (such as those outlined in the 2018 NATO Readiness Initiative), or boosting operational engagement. The European Union could play a similar role by following up more strongly with member states regarding their commitments under Permanent Structured Cooperation (PESCO).

Incentivize coordination and collaboration over national solutions. One key lesson learned from the 2008 financial crisis is that cuts in defense spending often lead to less cooperation at a European level. A repeat of this would be detrimental to ongoing major European armament programs, whether they are at an early research stage, such as the Franco-German plans for the Future Combat Air System and the Main Ground Combat System battle tank; in development, such as the “Eurodrone,” a Medium Altitude Long Endurance Remotely Piloted Aircraft System (MALE RPAS); or in procurement, such as the Airbus A400M Atlas or the European multipurpose frigate. Ideally, European countries would agree to ring-fence ongoing common projects or existing commitments even if their defense budgets decline. The financial incentives within the new European Defense Fund, even with its reduced budget, could be a powerful mechanism for stimulating cooperation among EU member states.

“Building on the lessons from the last economic downturn, Europe can still shape the outcome of the unfolding crisis.”

Raise collective awareness on the persistence of security threats. Without minimizing the new challenges revealed by the pandemic, it is essential that all Europeans be made aware of the persistent and worsening security threats against Europe. Current parallel forward-looking processes in NATO (reflection process) and the European Union (strategic compass) can help members reach a common understanding of the strategic challenges and provide a basis for reaffirming the need to preserve a strong military with European publics.

Protect the defense industry from the ongoing economic slowdown. Maintaining a robust defense industry is a prerequisite for the continued modernization of European armies. However, the global defense industry—Europe’s being no exception—is being dealt a double blow: a supply crisis stemming from the temporary shutdown of production, and a demand crisis both among companies involved in civil aviation and for all countries whose export markets are filled with uncertainty. It will therefore be critical to support European industries at the national and EU levels, but without distorting free and fair competition.

Pierre Morcos is a visiting fellow with the Europe, Russia, and Eurasia Program at the Center for Strategic and International Studies (CSIS) in Washington, D.C.

This brief is made possible by general support to CSIS. No direct sponsorship contributed to this brief.

No comments:

Post a Comment