Arran Hope

The global semiconductor industry is valued at over half a trillion U.S. dollars, and its products — the microchips used in everything from cars to phones to ballistic missiles, affect every single person on the planet. Making chips is a highly complicated business that involves world-wide supply chains.

Advanced chip design is dominated by American firms. The chips themselves are mostly manufactured in Taiwan, China, and Malaysia, but this can only happen with equipment and chemicals sourced from Europe, Japan, and North America. An example of the complexities involved: To fabricate a wafer — a thin slice of semiconductor material on which an integrated circuit is printed to make a chip — requires over one thousand individual steps, four hundred or so different chemicals, and up to 50 separate types of equipment.

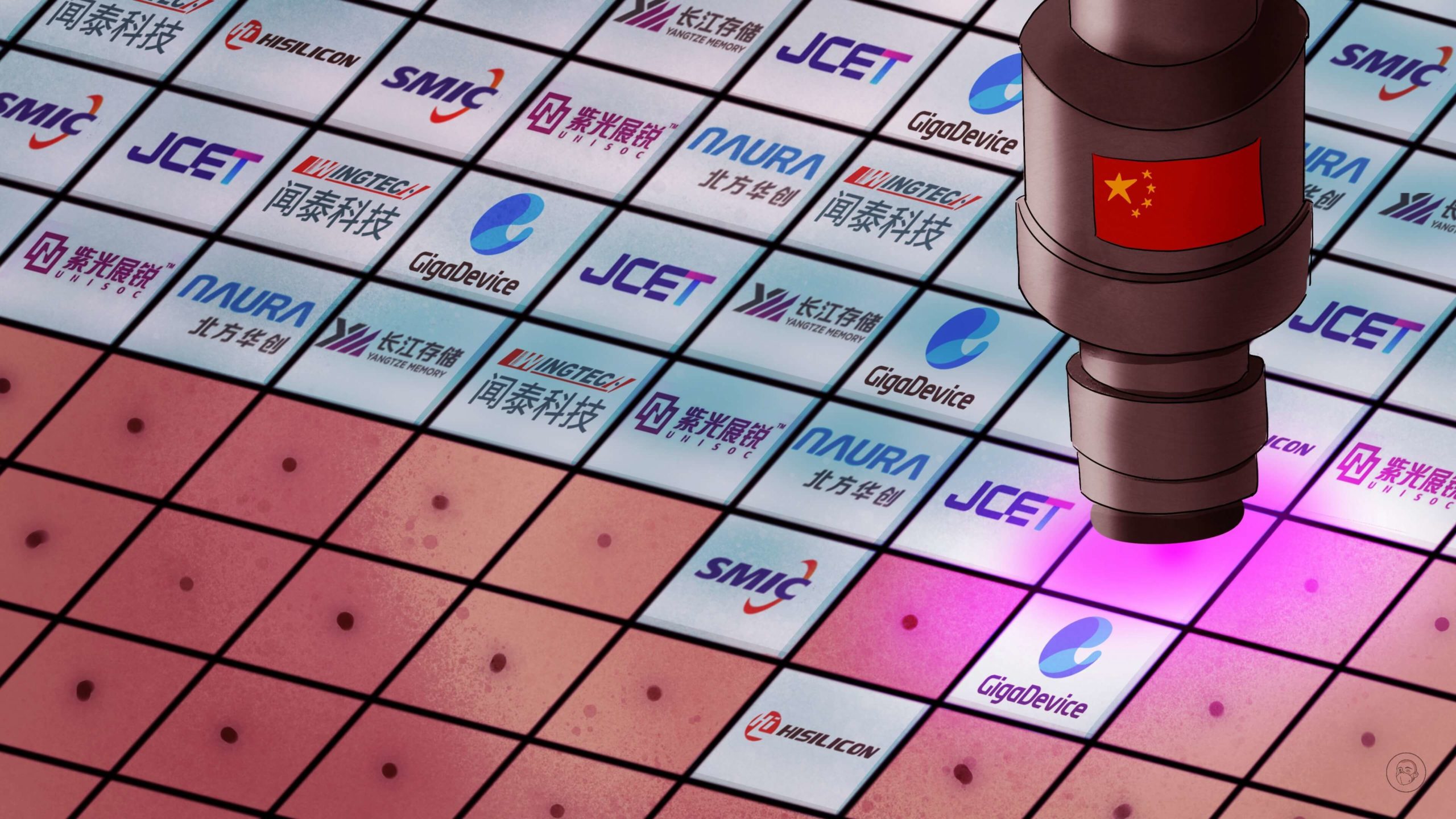

All the chips in China

In China alone, there are tens of thousands of semiconductor companies. The country is also the largest consumer of semiconductors in the world: in 2020, China bought 53.7% of the world supply of chips worth around $240 billion. However, this is yet to translate into Chinese domination of the industry as a whole — far from it. Although China makes plenty of lower-end chips, it remains dependent on foreign suppliers and foreign-owned technologies for the advanced semiconductors needed for phones, smart cars, artificial intelligence, and military applications.

Beijing wants China to to become a key player in the global industry, and to end its reliance on foreign companies. To this end, it established the National Integrated Circuit Industry Investment Fund 国家集成电路产业投资基金, also known as the “Big Fund” (大基金) in 2014 which has a a minority shareholding in 74 companies and has invested in 2,793 entities, the majority of which are semiconductor firms.

According to the Semiconductor Industry Association’s State of the Industry Report, published in November 2022, China’s share of the global chip design market is projected to rise from 9% in 2020 to 23% by 2030 (compared to a U.S. decline from 46% to 36%) — a substantial increase, but still far from world-beating.

While yet to be competitive in the design and production of leading edge chips, China does have an advantage relative to the U.S. in packaging and testing (known in industry jargon as outsourced semiconductor assembly and testing or OSAT), where in 2021 it accounted for 38% of the global market.

However, as the U.S. continues its campaign to curb sales of advanced technologies to China, the country’s chances of catching up look slim.

What follows below is an introduction to ten key Chinese firms that cover various aspects of the industry. We should note that these are not in a ranked order, as it makes little sense to analyze these widely differing companies according to a single set of metrics.

1. SMIC 中芯国际

Semiconductor Manufacturing International Corporation (SMIC) is perhaps China’s best known chip company. Founded in 2000, it has grown to become the largest contract chip maker in mainland China and the fifth-largest globally. It is partially state-owned, with both China’s Big Fund and the civilian and military telecommunications equipment provider Datang Telecom Group 大唐电信科技产业集团 as major shareholders, and is also listed on both the Shanghai and Hong Kong stock exchanges. It was previously listed on Nasdaq for fourteen years, but voluntarily delisted in 2019, citing low trading volumes (and following Huawei’s blacklisting by the U.S. government). Regarded as China’s “logic champion,” it makes logic chips for processing information (as opposed to memory chips that store information). SMIC has wafer fabs in Beijing, Shanghai, Tianjin, and Shenzhen, and is currently constructing further plants in those cities.

Last year it was reported that SMIC had been able to manufacture some 7-nanometer (nm) chips since 2021 — an unexpected advance that observers had previously thought would take a Chinese company much longer to achieve. (The thinner the chip, the faster: most Chinese fabs are stuck at the 12-16 nm level.) News of SMIC’s 7 nm chips may have been a key impetus for the American Bureau of Industry and Security (BIS) export controls — without American technology, SMIC will be unable to produce 7 nm chips at scale for several years. In any event, it does not seem that SMIC has been able to produce these chips at a commercial scale. In the future, the company is likely going to concentrate on manufacturing chips for domestic technology firms rather than being a foundry for foreign companies.

2. HiSilicon 海思

HiSilicon, founded in 1991 and based in Shenzhen, has been a wholly owned subsidiary of Huawei since 2004. It is a fabless firm, focusing only on chip design. For its “Systems on a Chip” (SOCs), it purchases licenses for central processing unit (CPU) designs from ARM Holdings (a British company). It is perhaps best known for producing all of the chips for Huawei’s range of smartphones and tablets, for which its flagship models are the Kirin range: it describes the Kirin 9000, for instance, as the “world’s first 5 nm 5G SOC,” which is optimized for gaming and AI video applications (and consists of 15.3 billion transistors). However, it should be noted that this chip depends on not just ARM’s IP, but also the Taiwanese chip giant TSMC’s manufacturing to craft chips at the 5 nm specification.

The company’s successes have largely been tied to the fortunes of its parent, and it has suffered from the worsening international environment for Huawei. Nevertheless, one of Huawei’s chips was recently shown to outperform rival American firm Nvidia’s flagship V100 chip in certain tasks, according to a study by Chinese scientists, though they did cite some shortcomings. Furthermore, in recent weeks there have been — hitherto unsubstantiated — rumors that HiSilicon will become the first Chinese firm to produce 12 nm and 14 nm chipsets this year, and that it had filed a patent for advanced lithography, which it could sell to foundries in China like SMIC to start manufacturing competitive advanced chips.

3. Yangtze Memory Technologies Corp (YMTC) 长江存储科技

YMTC is one of China’s success stories. Founded in Wuhan in 2016 with the explicit goal of reducing dependence on foreign firms, it has profited from generous state funding to become China’s leading memory chip manufacturer. It has also apparently been aided by the poaching of a number of South Korean engineers. YMTC has racked up more than 8,000 patent applications, and with its innovative Xtacking technology they have fabricated denser NAND flash memory chips than any other company in the world. As of 2021 it held 4.5% of global market share for these chips.

However, 2022 was a tumultuous year for the company. A high point came when Apple announced that they were planning to use YMTC chips in their products, though this quickly changed following the imposition of export controls by BIS, after which Apple reversed the decision. This compounded external pressure on the company after the U.S. Congress banned the Federal Government from buying or using chips from YMTC. The company aims to rival South Korean industry leaders SK Hynix and Samsung. Its ability to do so remains to be seen following both the U.S. moves and the debt problems that Tsinghua Unigroup 紫光集团, which owns a controlling stake in YMTC, experienced last year.

4. UNISOC 紫光展锐

Another firm owned largely by Tsinghua Unigroup (which as of 2023 is owned by Beijing Zhiguangxin Holding, whose main shareholder in turn is an Anhui-based state-owned fund), UNISOC is China’s largest mobile phone chip designer. As of 2021 it was the fourth-largest in the world after Mediatek, Qualcomm and Apple, with a 9% global market share. This fabless firm was formerly known as Spreadtrum, under which name it was listed on Nasdaq until 2013. UNISOC has been very successful, as it overtook HiSilicon in 2021 in terms of domestic share for smartphone application processors, though this was also partly due to HiSilicon’s difficulties with geopolitical headwinds (see above). UNISOC splits its focus between consumer electronics such as smartphones and wearable tech, and industrial electronics such as Internet of Things devices and smart display.

Despite its consolidated gains and substantial production of 4G-related chipsets, which it supplies to clients such as Samsung, Honor, ZTE and Motorola, it lags far behind when it comes to leading edge chips. If market-leading firms increasingly focus on the most advanced chips, this could help UNISOC further establish itself in the provision of these mid-to-low end chips. Its ambitions at the cutting edge were stymied somewhat in 2019, when a multiyear venture with Intel to work on 5G modem chips was scuppered due to concerns from Washington.

5. Naura Technology Group 北方华创

Naura is China’s largest chip production equipment manufacturer. As such it is a key firm supporting the semiconductor industry. Its main semiconductor-oriented products include plasma etching (Etch), physical vapor deposition (PVD), chemical vapor deposition (CVD), oxidation/diffusion, cleaning system, and equipment for annealing (a form of heat treating).

Headquartered in Beijing and partially state-owned, Naura is listed on the Shenzhen Stock Exchange. Naura is enormously important for the domestic OSAT industry, which is one of the few areas in which China is internationally competitive.

Amid the struggles that have beset the sector in recent years, Naura completed the acquisition of American firm Akrion Technologies, a supplier of advanced wafer surface preparation technology used in the fabrication of microelectronic devices, in 2018. More recently, Naura was removed from the BIS’s unverified list in December 2022, following on-site inspection by U.S. officials. However, to achieve this Naura did have to ask its U.S. engineers (or those with Green Cards) to stop working on research and development projects.

6. Will Semiconductor 韦尔半导体

Will Semiconductor is another fabless semiconductor design firm, headquartered in Shanghai, where it is listed on the STAR market. Founded in 2007, it is one of the few key players in the industry not to receive any financial support from China’s Big Fund. Its primary focus is on research and development for semiconductor design, for which its main products are applied in mobile communications, vehicle electronics, Internet of Things devices, and security products. This latter category mainly includes cameras, which employ Will’s CMOS image sensor (CIS) technology. CMOS refers to “complementary metal-oxide semiconductors,” which are fundamental to the type of analogue chips which are used in all image sensors. This technology is widely employed in the extensive camera-enabled systems currently being added to automobiles.

In 2019, Will Semiconductor acquired the American firm Omnivision, which won the Guinness World Record for the World’s Smallest Image Sensor that same year. Will’s Chairman and co-founder, Yú Rénróng 虞仁荣, was among the top fifty richest people in China in 2021. That same year, WillSemi ranked second at the annual China Semiconductor Investment Alliance Conference, indicative of the company’s success in becoming an important global player.

7. Wingtech 闻泰科技

Wingtech is a pure-play foundry integrated device manufacturer (IDM) that manufactures semiconductors. It was founded in 2006, though changed its registered name to Wingtech only in 2017. Its main manufacturing plant is in Guangdong Province, though it also has facilities in Wuxi, Kunming, and Jiaxing, alongside research and development centers in Shanghai, Shenzhen, Wuxi, and Xi’an. It has quietly built up its manufacturing capabilities supplying domestic brands, chiefly for smartphones, but recently has started to look for customers among global giants like Apple and Samsung. In fact, people involved in Apple’s supply chain are reportedly looking at Wingtech as one of two firms that could become assemblers for its products as it starts to de-risk and increase the resilience of its supply chains.

Wingtech is part-owned by a number of state-owned enterprises, including the Wuxi City Government (9.74%), the Kunming City Government (5.67%), and the Yunnan Provincial Government (5.2%). Wingtech is known in the West through its ownership of the Dutch semiconductor manufacturer Nexperia. In 2021, Wingtech (via Nexperia) purchased Newport Wafer Fab, a plant based in Wales. However, in November last year, British officials reneged on their decision to permit the sale, forcing Nexperia to divest 86% of its ownership on the basis of national security. This is now pending judicial review, and it is unclear what impact this will have on Wingtech’s operations more generally.

8. GigaDevice Semiconductor 兆易创新

GigaDevice is a fabless chip design firm. It is one of China’s leading designers of NOR memory chips, and is currently ranked third globally in terms of sales volume for this segment of the market. Unlike NAND chips (another kind of flash memory, see YMTC above), NOR is mostly used for mobile phones, scientific instruments and medical devices. While these are GigaDevice’s main output, the firm also designs microcontrollers (using ARM technology), and touch screen sensors, as well as other forms of flash memory chips. GigaDevice was founded in Silicon Valley, is headquartered in Beijing, and has traded on the Shanghai Stock Exchange since 2016.

GigaDevice has not yet been added to the BIS unverified or entity lists. However, two of its board members (both Chinese Americans) resigned in late October, likely to avoid problems resulting from such an eventuality.

9. Jiangsu Changjiang Electronics Tech (JCET) 长电科技

The oldest firm on this list, JCET was founded in 1972. Like Naura, it is an OSAT company, involved in a range of semiconductor-related endeavors, including packaging, assembly, manufacturing, and testing products. It is China’s largest OSAT firm, and the third largest globally — testament to China’s strength in this sector. June 2023 will mark two decades for JCET as a publicly traded company on the Shanghai Stock Exchange. Its largest shareholder is currently a subsidiary of SMIC. JCET currently runs two research and development centers in China and Korea and six manufacturing plants across China, Korea, and Singapore. It was announced on January 11 2023 that JCET had achieved high-volume manufacturing of integrated packaging for 4 nm chips, something which had not previously been achieved by a Chinese company.

10. Hua Hong Semiconductor 华虹集团

Hua Hong was founded in 1996 to help boost China’s then-inchoate integrated circuits industry, as a JV between Hua Hong Group (a majority State-Owned organization) and Japan’s NEC (then the third-largest chip producer globally). At the turn of the millennium, Hua Hong was involved with DRAM memory chip production, though this was phased out, and since then the company has been a pure-play foundry. In 2011 it acquired Grace Semiconductor Manufacturing, and it is now China’s second-largest chip fab after SMIC, running three manufacturing plants in Shanghai with a collective monthly output of 180,000 wafers and a further plant in Wuxi with an output of 65,000. A second Wuxi plant is underway, with financial backing from China’s Big Fund.

Globally, Hua Hong ranks as the sixth-largest foundry, accounting for 2% of total market share. The company manufactures mid-range nodes, with the smallest currently at 28 nm, and is focusing on honing older technology rather than cutting-edge chips. It has evaded the headwinds faced by its compatriots from U.S. export controls. Hua Hong listed in Hong Kong in 2014. Its largest owners are the Shanghai government, followed by SAIL 上海联和金融, an investment firm owned by the son of Jiāng Zémín 江泽民, Jiāng Miánhéng 江绵恒. In November 2022, it was greenlit for a secondary listing on Shanghai’s STAR market, where it could become the third-largest domestic IPO in China’s history.

Hua Hong has recently stated that it aims to develop advanced 14 nm chips, which rival those SMIC has already commercialized, though it currently lacks a detailed plan for this. For now, however, Hua Hong is expanding its focus on legacy chip production, with applications ranging from electric vehicles to smart home appliances.

Frauds and failures

For all the successes mentioned above, there have also been teething problems in the industry, from simple misallocation of resources to multi-billion dollar fraud. Here we briefly summarize three of the most egregious examples.

HSMC

Wuhan Hongxin Semiconductor Manufacturing (HSMC), which collapsed in 2020, is one of the more remarkable scams of the century, and a paradigmatic example of what National Development and Reform Commission (NDRC) spokeswoman Mèng Wěi 孟玮 referred to at the time as the “three nos” that were plaguing new entrants: no experience, no technology, and no talent.

Founded by Cáo Shān 曹山 (real name Bào Ēnbǎo 鲍恩保), a con artist with no more than an elementary school education, HSMC managed to expand rapidly, attracting the renowned figure Chiǎng Shàng-Yì 蒋尚义, former head of research and development for TSMC. Through Chiang, the firm acquired an ASML photolithography machine for making advanced chips — something other mainland firms could only dream of. However, HSMC’s supposedly purpose-built factory was not even built to accommodate the machine when it arrived. In fact, at the time, a surveyor projected that in two years the factory would be scrap.

It wasn’t just the physical edifice that was destined to fold, but the entire house of cards itself: after stealing a total of 12.4 billion yuan (roughly $2 billion) in three years, what some have called “China’s Theranos” filed for bankruptcy, without fabbing a single chip. This has not been uncommon: Between 2019 and 2020, seven large foundry firms were launched in China, none of which got off the ground. These flops can be added on top of tens of billions of dollars of investment that has also disappeared on other projects such as Chéngdū Géxīn 成都格芯 and Nánjīng Dékè Mǎ 南京德科码.

Arm China

A different sort of drama unfurled between 2020 and 2022 at ARM China. The company is a Chinese subsidiary of Softbank’s U.K.-based chip design firm ARM, though ARM only maintains a 49% stake. ARM China spent the best part of two years in disarray during which the CEO, Allen Wú Xióngáng 吴雄昂, refused to step down after being fired by the company’s board.

On June 4, 2020, the ARM China board voted 7-1 to fire Wu after it came to light that he had been leveraging his position for personal gain through his own venture capital firm, a serious conflict of interest.

However, by co-opting loyal employees, deploying security guards, and blocking emails through control of the firm’s IT infrastructure, Wu kept a tight grip on the firm’s Shanghai headquarters, bank accounts, and social media channels, the latter of which he used to propagate attacks on Softbank as a “big Western capital consortium” bent on destroying China’s semiconductor industry.

Wu’s close guard of the company’s official seals (also known as chops from the Hindi word “chapa”), which are vital for signing off on official documents, allowed him to maintain power, until eventually the Shenzhen local government issued new chops to another Arm official and registered them as the firm’s new legal representative.

The Big Fund

Rising above these and other issues are corruption charges that go right to the top: China’s National Integrated Circuit Industry Investment Fund. On January 19, the Big Fund’s former head Lù Jūn 路军 was formally charged with accepting bribes.

This is only the latest in a string of arrests. In November 2021, Gāo Sōngtāo 高松涛, the former Vice-President of Sino-Ic Capital 华芯投资管理, which invests on behalf of the Big Fund, was arrested. Then in July 2022, it was announced that Lù had been arrested, along with the fund’s former president Dīng Wénwǔ 丁文武 and Wáng Wénzhōng 王文忠, a partner of the fund. Most recently, on December 18 2022, the former Minister for Industry and Information Technology Xiao Yaqing 肖亚庆, who had been playing a key role in the chip industry, was formally relieved of his duties and expelled from the Party.

The corruption scandals appear to have influenced the fund’s investment activity in 2022: From late March through August, the Big Fund made precisely zero investments.

Looking ahead

Now in 2023, China’s semiconductor industry is entering some of the toughest operating conditions it has ever had to face. On the one hand, the internationally-coordinated imposition of export controls, spearheaded by the U.S., has left many firms in the difficult position of being unable to acquire a lot of the technology they need to advance their businesses. HiSilicon has had something of a head start on this front, having faced export restrictions for over two years now. But even so, Chinese officials are now having to completely rethink how Chinese companies will be able to develop core technologies.

Internally too, there are problems: The spigots from Beijing are running dry, as suggested by recent signals that a huge investment plan for the industry is being overhauled. While the previous model led to the kinds of excesses of HSMC and others, the industry is nevertheless enormously capital intensive. But with the priority on returning the Chinese economy to robust growth this year, such profligacy on projects that won’t see returns for years to come will be hard to maintain.

Some firms will fold, others will focus on churning out less advanced chips, and the sector as a whole will keep striving for self-reliance. The other response we are likely to see is a retaliatory action from the Chinese government against U.S. restrictions. What form this will take remains to be seen. But for now the chips are very much down, and Beijing does not have the strongest hand.

No comments:

Post a Comment