The Illusion Will Kill Us If We Don't Learn From It

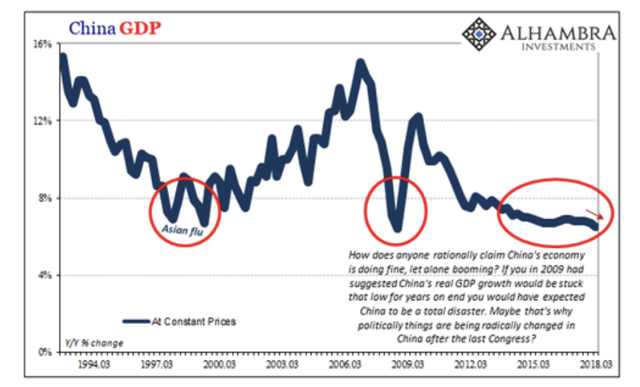

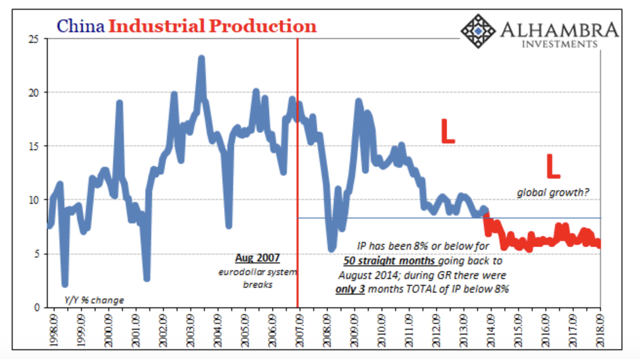

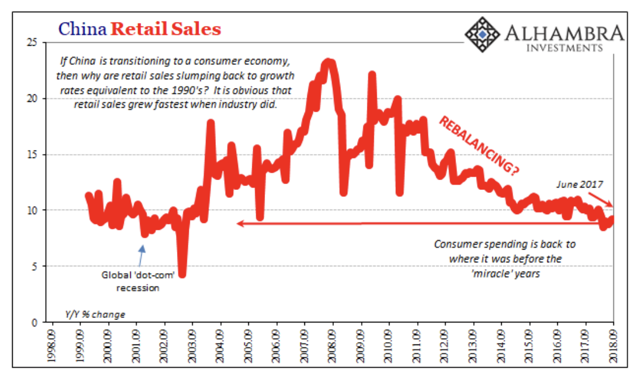

Jeffrey Snider writes a rather horrifying picture of China's current and coming economic decline.

This brings up an interesting question. I seem to be cheering the decline of China. Why am I cheering the decline of the Chinese economy, since the implication is "As China goes, so goes the world, right?" Am I cheering for the destruction of the Global Economy?

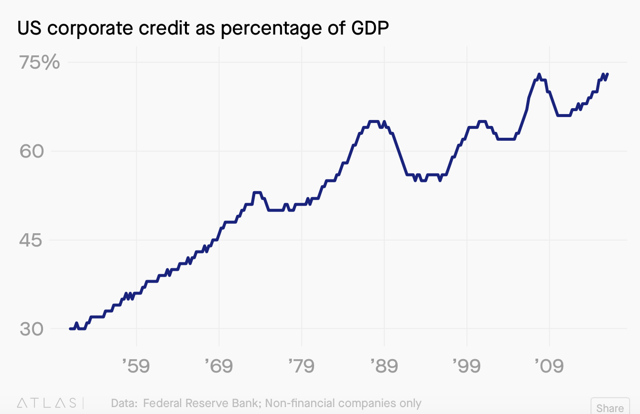

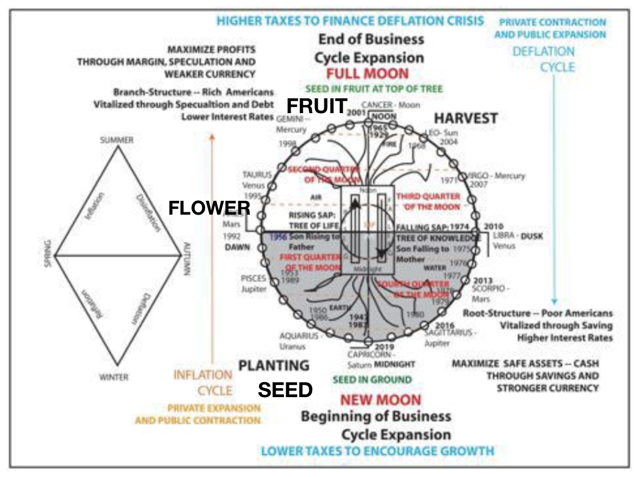

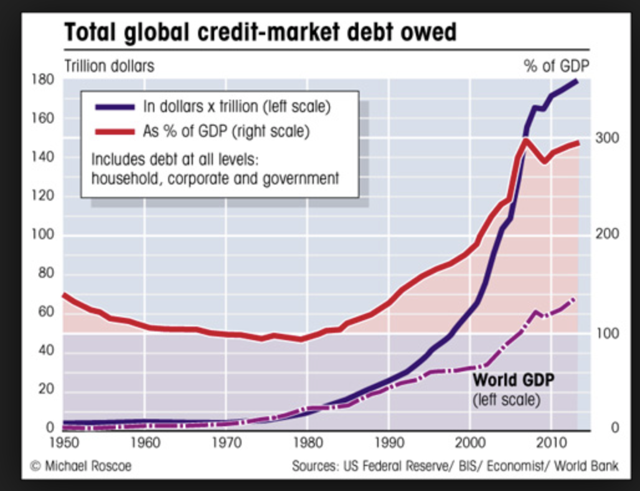

No I am not. But, the Global Economy is NOT a perpetual growth machine -- it is cyclical, seasonal -- and it cannot be sustained by resorting to more and more debt. Debt is not the answer. Debt growth is NOT economic growth. We must understand the seasons of the Economy. A time of Economic Growth (and Debt Growth can play a part in this Season); and then a time of Economic Rest (Debt Growth does not replace or substitute for Economic Growth, or you get huge imbalances and Asset Bubbles and Zombie Corporations sustained, not by earnings, but by Debt).

Economic Growth is vertical orientation; Economic Rest is horizontal orientation. We have been faking economic growth since 2001. America now is experiencing economic growth, right on time, 2019.

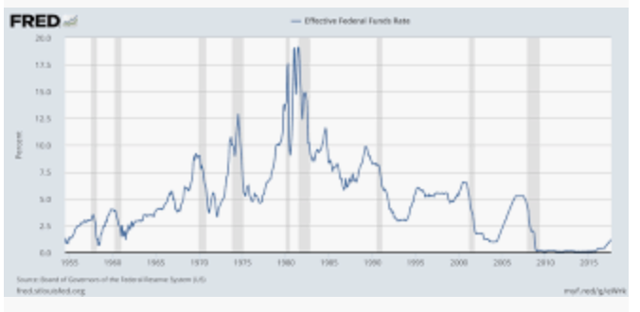

America is the engine of the Global Economy, not China -- but economic growth can't be faked by piling on more debt, since debt makes it more difficult to achieve real economic growth. It is difficult for a global economy to grow its way out of astronomical debt -- this is something which the world is going to experience from 2019-2037. We all should have unloaded debt from 2001-2019. We did not; we took on more debt, to preserve the illusion of growth, bought by more debt, and by stealing money from the future to spend today. I am against ZIRP and I am against central banks seducing more people in to greater debt during a non-grownth economic season (such as 1929-1947; 1965-1983; 2001-2019...).

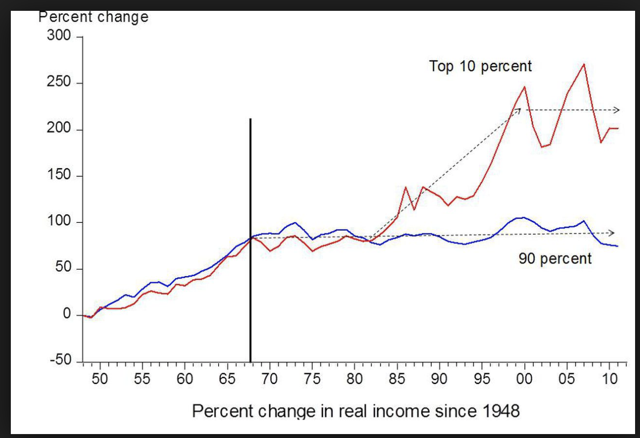

ZIRP is a blank check for the world's top 1%. It helps keep the rest of us from going bankrupt. But it is a blank check for the richest of the rich. Think about it, who has the collateral to keep borrowing as rates inch down to zero? Rich corporations surely. Rich individuals. Not the rest of us.

Wellington Denahan, CEO of mortgage REIT Annaly Capital [NLY] came out swinging in the investor conference call after reporting earnings yesterday.

Citing a recent report from the IMF, the outspoken exective railed against quantitative easing and the zero interest rate policy as working only to the detriment of average Americans.

In other words, if the folks at the Federal Reserve (she specifically names chair Janet Yellen and predecessor Ben Bernanke) are trying to improve the economic conditions of the average American - that is to say, most of us - then they unequivocally failed and only made matters worse in the long run.

"Despite their noble efforts, I believe policymakers have failed to foster the conditions for a credible sustained recovery," he said. "They have, however, been very successful in creating both debt and equity market bubbles, however reliant they may be on zero interest rates."

But then he lays it on the line:

"Since 2009 when the experiment began, global bond markets have increased in value by roughly $17 trillion, or the size of the U.S. economy, while global equity markets have increased in value by a staggering $40 trillion. Yet the American wage earners have gained a relatively paltry $722 billion in comparison during the same period. Or to put it more clearly, for every dollar gained by the American worker, the global equity markets have gained $55."

When people use the term Great Recession, they are playing into the charade laid out by Federal Reserve and the Treasury Department.

The years 2008 through 2015 should be known as the Great Fleecing.

During that time, the greatest transfer of wealth in the history of the world occurred. Some $4.5 trillion was given to Wall Street banks through its Quantitative Easing program, with the American people picking up the IOU. This is the primary reason the US economy has not been able to recovery from the bank implosion of 2008. Surely if you inject $4.5 trillion into the economy, you will get economic growth. You will get a 4% to 5% increase in Gross Domestic Product for at least a year or two. Yet the Obama administration is the first two-term presidency that has not posted a 3% GDP growth on an annualized basis for 8 years. Even Franklin Delano Roosevelt posted 3% growth year during the Great Depression. That's because the $4.5 trillion was not given to any infrastructure program - it was given to banks, under the misguided notion that they needed the money to remain solvent. The banks promptly invested this money, which kept the stock market humming, but did nothing for jobs, wages or the GDP.

This was by design. The Fed could not allow the bank's largesse to be circulated into the public for fear of rapid inflation. The banks also funded company mergers, company debt offerings and stock buybacks. This activity kept the money sequestered and allowed a greater return for the banks. After all, they were getting free money to invest - there was no way to lose.

Who did this help? The 1%, and pretty much only the 1%.

This is OLD NEWS. We can't do much about it now. We can assume the worst of Obama and Bernanke and Paulson or we can assume the best. Either way, we delayed the Great Depression for a decade by borrowing trillions of dollars from the future and giving it to the banks to spend. Now we are UNWINDING that great mistake or that temporary brilliance, depending upon your perspective.

So, my view of this is, the FED is finally acting responsibly; but this does not mean everything will be painless. There is some speculation that the FED is losing its nerve. I hope it is not. I believe we need a strong Dollar; the fact that it is causing pain overseas is not the most important issue from my perspective as a American (first).

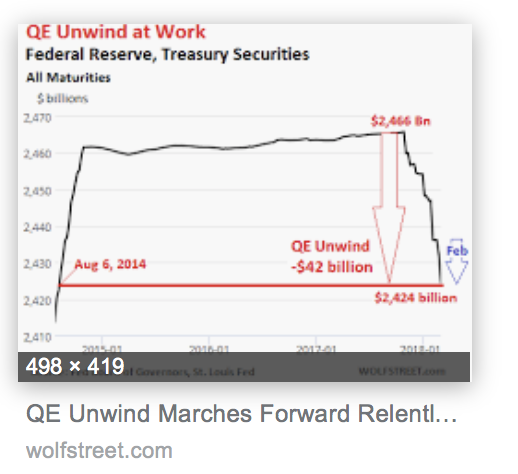

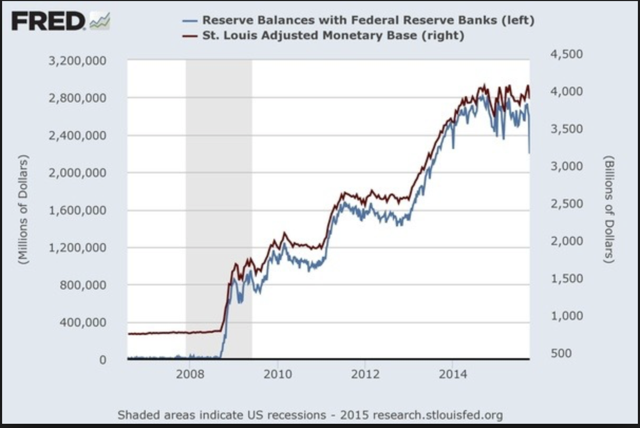

Shrinking the balance sheet effectively constitutes a form of policy tightening by putting upward pressure on long-term borrowing costs, just as expanding it via bond purchases during the financial crisis made financial conditions easier. Since beginning the shrinking process in October, the Fed has trimmed its bond portfolio by around $150 billion to $4.3 trillion, while remaining vague on how small it could become.

Scarce Liquidity

This reticence is partly because the Fed doesn't know how much cash banks will want to hold at the central bank, which they need to do in order to satisfy post-crisis regulatory requirements.

Officials have said that, as they drain cash from the system by shrinking the balance sheet, a rise in the federal funds rate within their target range would be an important sign that liquidity is becoming scarce.

Now that the benchmark rate is rising, there is some skepticism. The increase appears to be mainly driven by another factor: the U.S. Treasury ramped up issuance of short-term U.S. government bills, which drove up yields on those and other competing assets, including in the overnight market....

When I say the FED is finally trying to become responsible, I add the note that they are trying to correct the mistakes made my messers Greenspan and Bernanke, but mostly by Bernanke. The UNWIND still has a long way to go.

Can this UNWIND be done without pain in the world? No, it cannot be. We were supposed to feel the pain of deflation between 2001-2016. Instead we chose to "kick the can down the road" and let someone else become responsible for the pain. Hence, the new FED will become the scapegoat, so that Bernanke could avoid being the goat. This is the perfect definition of a "politician" and not a "leader".

I admire Jerome Powell; as I admired Paul Volcker in the early 1980's. Volcker jacked up the FED FUNDS rate to 20% to break the back of inflation (price inflation, not debt inflation, which is our version of inflation today).

If President Trump could understand that Jerome Powell's FED, in attempting to UNWIND the "mistakes" of Ben Bernanke (yes, I think these were mistakes, perhaps with decent intentions), then he would support the FED's strong dollar policies and stop chipping at him, demanding the return of low-interest policies, which have weakened America and weakened the foundation upon which our nation stands (or falls), the US Dollar.

Instead of everyone suffering together in 2001-2014, we instead had the richest people in the system get away like bandits and the rest of us survive in a paralyzed FED-controlled zombie state.

Instead of everyone suffering together in 2001-2014, we instead had the richest people in the system get away like bandits and the rest of us survive in a paralyzed FED-controlled zombie state.

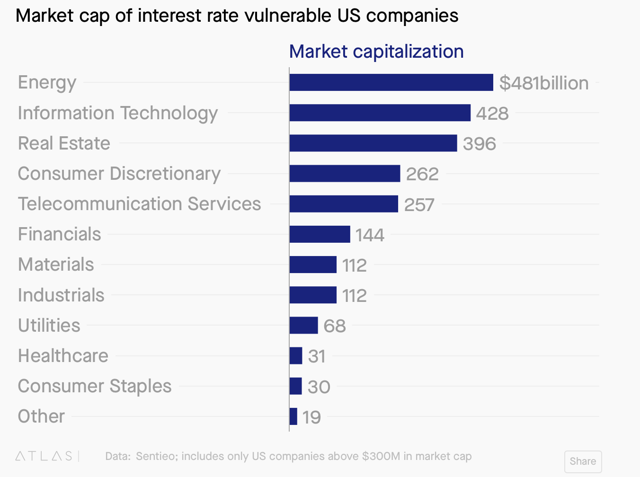

Capitalism, in its true state, depends upon recessions to destroy non-competitive companies and corporations. ZIRP undermines this, allowing weak corporations to survive off of loans, regardless of their health. ZIRP is SOCIALISM FOR THE RICH. ZOMBIE CORPORATIONS are those companies dependent upon low interest rates to stay in business.

Bernanke's policies allowed weak companies to survive the Great Recession by having you and I bail them out. Corporate Socialism. We should OWN these companies now. We should all have a capital stake in these companies, as we "loaned" them money so they could survive.

Our Capitalist forefathers would role over in their graves to hear that we perverted Capitalism doctrine to such an extent -- "the survival of the most adaptable" -- and have now become a society that believes that the corporations should only be taxed at a minimum rates during Growth Seasons and that the working public should bail them out during periods of darkness and recession. Is this what we have become? We exist for the survival of the Corporations? Which is worse, this scenario, or the Socialist scenario, that Corporations and Capitalism exist for the welfare of the masses?

We now have corporations that are addicted to low interest rates for their existence, many of which (10%?) will die if we raise interest rates. This is a rock and a hard place.

We cannot have Perpetual Growth. Expansion-Contraction. Expansion feels good, growth feels good. Contraction hurts people. We cannot simply ignore the laws of nature because they sometimes cause pain. Life sometimes is painful, sad, demoralizing. I wish it was not. But it is.

THE SEASONS OF THE ECONOMY

1983-1992: REFLATION

1992-2001: INFLATION

2001-2010: DISINFLATION

2010-2019: DEFLATION

Take these "seasons" back in history and forward in history. You may scoff at these stringent seasons. But remember, every winter is not the same; history does not repeat. But every WINTER SEASON runs from 21 December through 21 March. Some winters are extreme and deadly; some are mild. But they all run through the same season in terms of time. History does not repeat; but the Seasons of History ALWAYS repeat.

CONCLUSION:

The world simply has too much debt. Low interest rates kow-tow to credit markets. But this cannot go on for ever. It is a deal with the devil.

The economy is an old snake that needs to slough-off its old skin to be reborn in a new skin. The Strong Dollar helps the economy slough-off its old skin. The weak dollar is the old skin.

I do not believe in a Strong Dollar perpetually. The Weak Dollar seeds the Global Economy; the Strong Dollar harvests the Global Economy. The Global Economy is the fruit. We have had a form of the fruiting economy in the years:

2001

1965

1929

1893

1857

1821

1785

1749

1713

1677

1641

1605

1569

We will have a fruiting global economy also in the year 2037. The economy cannot fruit perpetually. This is not its character, no matter how hard we try to make it nature's character.

Can we grow our way out of the nascent deflation brought on by the strong dollar? As you can see by the charts, I believe 2019-2037 is a GROWTH period. So the economy WANTS to grow. It is trying to grow with a TITANIC DEBT BUBBLE on its back. Can it do that? Can it grow when the Dollar is strengthening and interest rates are rising? That is the Million Dollar Question.

My view is that we NEED a stronger dollar and we need to deflate the Debt Bubble. This should have been our number one goal from 2001-2019. Instead we chose to inflate a DEAD ECONOMY, so we now have a ZOMBIE Economy with many ZOMBIE Companies and Individuals, dependent upon ZIRP. These ZOMBIES will need to go bankrupt. Much debt will have to be defaulted, without taxpayer bailouts. This is nature's law. We cannot fudge this, no matter how good fudging sounds. The FED needs to stop being the FUDGE FACTORY of last resort -- Jerome Powell seems to understand this.

We need to put America First -- Trump needs to get this.

America First today (strong US Dollar, harvesting the global economy) -- so that we can again put America LasT tomorrow (weak US Dollar, seeding the global economy).

Good fortune to all.

No comments:

Post a Comment