Jamil Hijazi and James Kennedy

Metal is the only thing that matters

China is slowly surrendering all other parts of its Rare Earth monopoly to further enhance its metallurgical monopoly. Why ? Because 95% of all value derived from rare earths is in the form of metal, alloys and magnets so that is the only point in the value chain that China needs to maintain.

How does this work? China maintains its monopoly through opaque subsidies that may equate to 100% of operating, capital and conversion costs by western standards. For example, the normal markup for finished goods in capitalistic economies is plus or minus 10%, specialized or capital intensive products it can be hundreds of time greater. For China, 10% is the typical markup on REs from oxides to metals. That is the all-in markup when adjusting for oxygen reduction. That may not even cover the cost of energy needed to convert oxides to metal.

Putting numbers in perspective

According to the basic rules of capitalism, free markets and efficient market theory, large markets, with multiple sellers, are the most competitive.

Now Consider The Following: Iron ore is second and steel is the third-largest commodity market in the world by tonnage (lots of sellers), both combined they constitute the second-largest commodity bloc by value by after crude oil. Rare earths are one of the smallest. US annual consumption of Rare Earths from oxides to magnets represents just .0005 Percent of the U.S. economy. Defense contractors and the Pentagon are two key consumers of Rare Earths. However, the Pentagon consumes around one-tenth percent of the United States annual consumption of rare earths.

Neodymium (Nd) is by far the most valuable RE metal by volume (few sellers).

Tons Per Year(tpy) vs Markup:

Global Iron Ore production 3.3 billion tonnes per year (tpy)

Global Steel Production 2.3 billion tpy

Conversion Markup: Oxide to Metal 200 to 500%

New Global Nd Oxide Production* ~ +30,000 tpy

New Global Nd Metal Production* ~ 25,000 tpy

Conversion Markup: Oxide to Metal ~ 10%

The chemical process of converting iron ore to steel and RE oxides to metal is exactly the same. Iron to steel tends to be large batch & mechanized, rare earths are produced in small batches, by hand (literally by hand)

Note:

*From virgin ore, estimate does not include recycled materials.

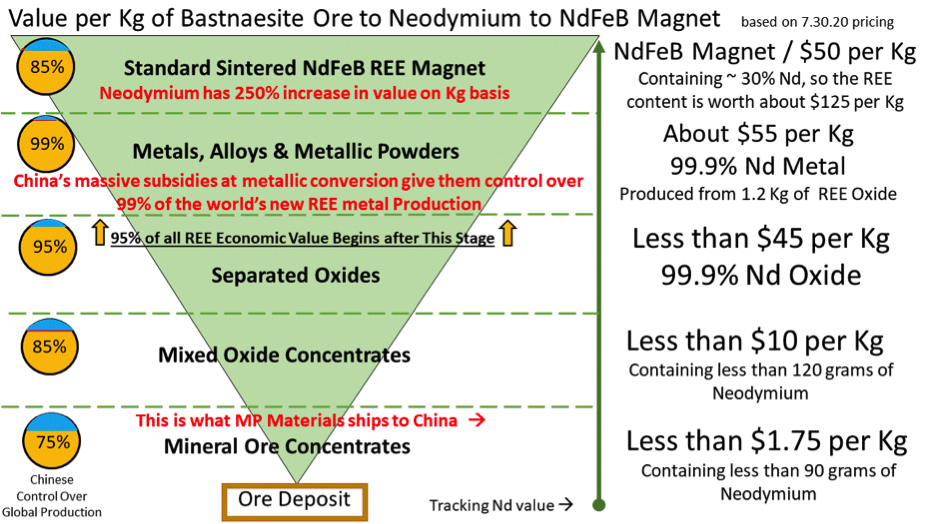

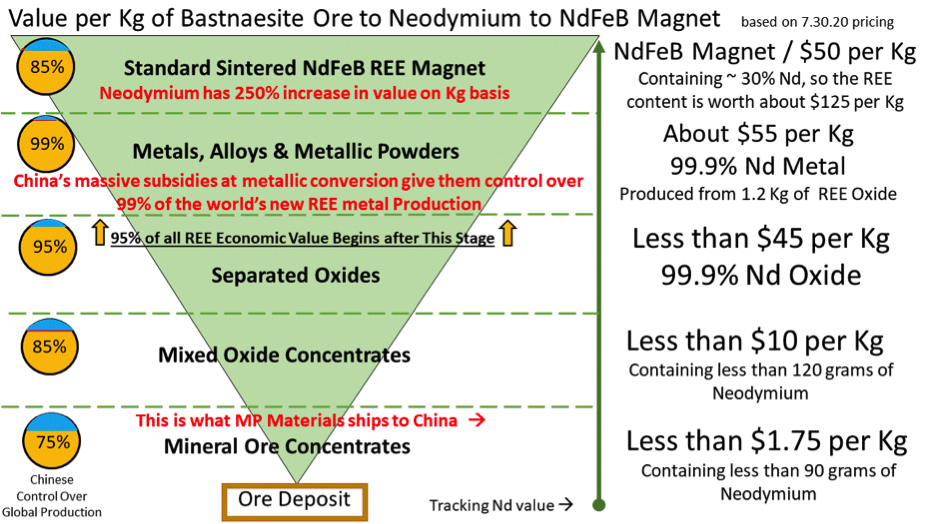

Author’s Figure provided by James Kennedy: Examples of Concentrate / Neodymium Prices at Various Levels of

The Value Chain & China’s Market Share at Each Level

The increase in the price of Neodymium oxide to Neodymium metal appears to be a 20% increase, but this does not reflect that it takes nearly 1.2 Kg of Neodymium to make 1 Kg of Neodymium metal. Adjusting for this the increase is less than 10%. Left scale shows China’s share of global production at each level of the value chain. The Right scale traces the value of Neodymium on a Kg basis, as it is the key ingredient of NdFeB magnets. The largest increases in value occur at mineral ore to mixed oxide concentrate level and at the conversion of metals & alloys to magnets level. When adjusted for transformational cost, most of the proportional increase between the conversion from mineral ore to mixed oxides is eliminated.

Mined materials are processed into 1) mineral ore concentrates, 2) mixed oxides concentrates, 3) separated oxides, 4) metals, alloys and metallic powders, 5) magnets. Without differentiating each of the steps listed above is an invitation for miscalculation, resulting in misinformed policy decisions. The reality is the US and other nations still ships its concentrated Rare Earth materials to China due to lack of processing, refining and metallurgical capacity. This means that the world sells China its low value ore-concentrate and China sells back higher value-end products.

That makes China economically better off in terms of trade than the everyone else. Whether Rare Earths or any other critical raw materials, metal is the only thing matters.

Jamil Hijazi: Jamil is a Mineral Economist and Energy analyst who holds a Dual Master’s Degree from the University of Dundee Centre for Energy, Petroleum, Mineral Law and Policy (CEPMLP). His expertise and research interests are in Supply Security of Critical Raw Materials, Energy transition, Local Content and Development in the Extractives Industry.

James Kennedy is President of ThREE, a consultancy focused on the geopolitical, national security and economic, ramifications of China’s rare earth and critical materials monopoly. He currently consults private industry, the U.S. Federal government and other governments on macro issues and trends related to rare earths, critical materials, and thorium (waste and energy systems).

No comments:

Post a Comment