Inspired by the idea of the innovation chain, Beijing is accelerating its efforts to optimize and align every step of the innovation process. Several support programs are currently undergoing reform, comprising a degree of recentralization, realignment towards strategic needs (technological self-sufficiency in particular), and a shift in focus towards commercialization over other R&D outputs.

Inspired by the idea of the innovation chain, Beijing is accelerating its efforts to optimize and align every step of the innovation process. Several support programs are currently undergoing reform, comprising a degree of recentralization, realignment towards strategic needs (technological self-sufficiency in particular), and a shift in focus towards commercialization over other R&D outputs.China sees improving its capacity in basic research as part of global tech competition. New policies are incentivizing researchers to transfer technology, link up with industry, and focus on national priority areas.

As part of a shift from quantity to quality, Beijing has reduced the number of project-based funding programs and dramatically slowed the approval of new laboratories and development zones. This reverses decades of decentralization, local experimentation, and greater autonomy of research and business communities, which grew from the principle that markets are better at allocating resources than governments.

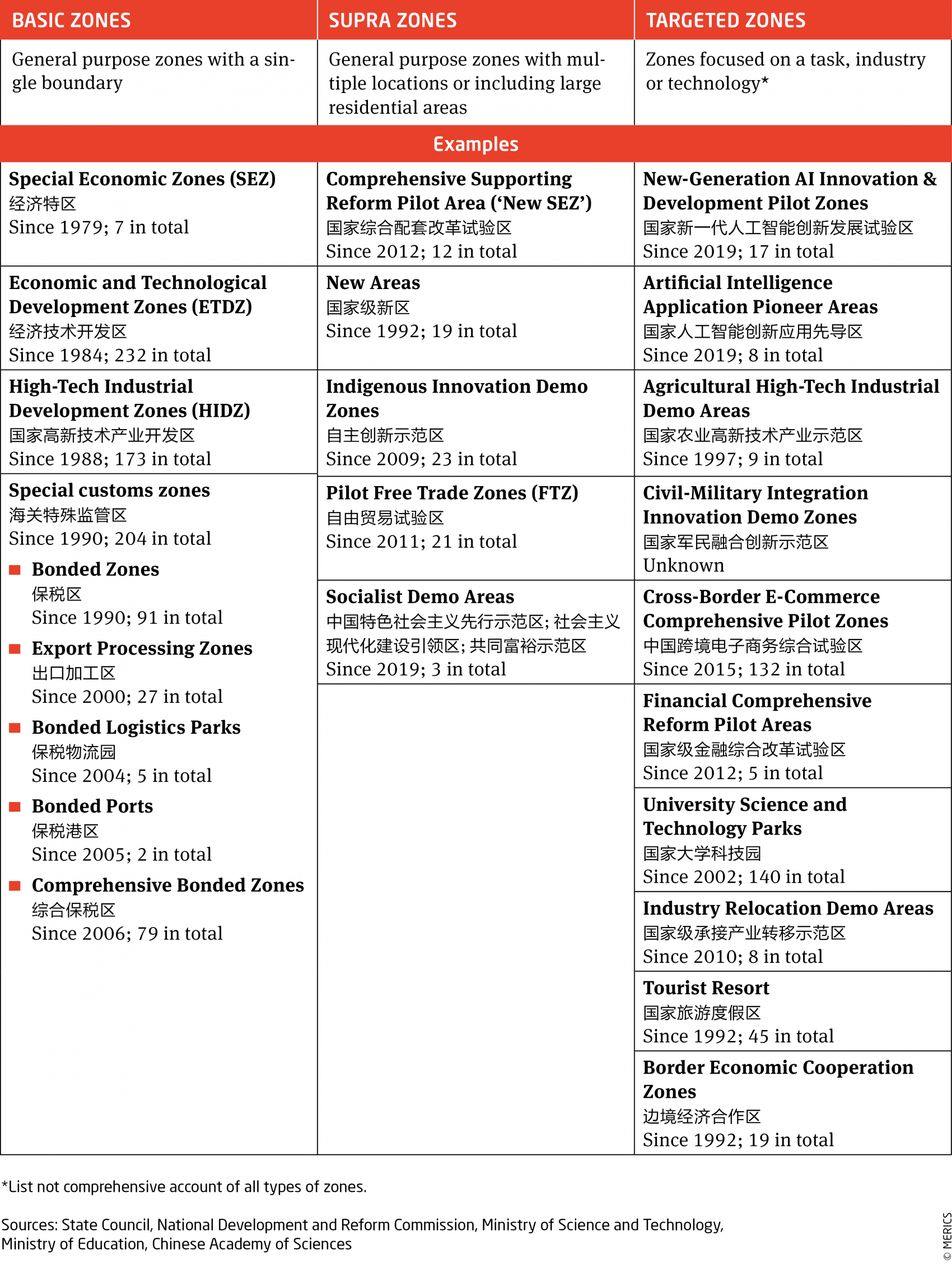

China’s innovation system is increasingly hierarchical, resulting in a greater degree of central coordination and control. Centrally supported “national labs” have the highest ranking. Below them are “key labs” at various levels, such as “state key labs” and “provincial key labs”. Similar hierarchies exist for projects and zones.

The Chinese Communist Party (CCP) continues to define the goals of scientific research in ever narrower national terms. This is causing tension with the principles of openness and international collaboration that govern much of the (basic) research carried out in Europe.

This trend will impact the work of heads of university and corporate research and development (R&D) labs and of science and technology policy decision makers in Europe.

China continues to be an attractive innovation partner and will likely remain so for some time. However, successful collaboration will require European companies, researchers, and other innovation players to navigate the shifting priorities of China’s project-based funding programs, laboratory systems, and development zones.

European actors that engage with China’s innovation ecosystem should be aware that their Chinese partners are under growing pressure to contribute to China’s pursuit of technological self-sufficiency and other major strategic goals.

1. Winning the race for key and core tech leadership

"Guided by China’s strategic needs, concentrate efforts to carry out original and pioneering science and technology research, and resolutely win the battle over key and core technologies.”

Xi Jinping, General Secretary of the Chinese Communist Party. Quote from his report to the 20thCCP Congress in October 20221

The work report of the 20th National Congress of the Chinese Communist Party is the latest in a long line of top-level government documents that have progressively underlined the importance of science, technology, and innovation (STI) to national development and security in China. Measures to drive forward STI advances include launching large projects, promoting industry-university-research institute synergy, and integrating the innovation, industrial, capital, and talent chains.

This last notion – of “the innovation chain” – provides the framework within which this report considers China’s alignment of its vast innovation resources with its strategic goals. Trends in the governance of public research funding, research institutes, and development zones illustrate that China’s policy makers are seeking to systematically address and integrate every step of the innovation process.

The 2016 Innovation-Driven Development Strategy (IDDS) enshrined the concept of “the innovation chain”, relating it to “indigenous innovation” and various platforms and projects to focus industry and research resources in key areas.2 Some of these efforts build on the Medium- and Long-Term Science and Technology (S&T) Development Plan (2006 – 2020)3 and Made in China 2025 (released in 2015).4

Urgency increased after 2018, when it became clear that the United States had the capacity to cut off Chinese firms from key technologies.

Integrating the innovation chain is increasingly motivated by the pursuit of technological self-reliance (i.e., security, breaking so-called foreign tech strangleholds)5 rather than economic growth drivers (i.e., development, becoming a first mover in strategic emerging industries). Integrating and aligning innovation resources is also part of a larger trend towards the centralization of political power. The IDDS already introduced a shift from quantity to quality, recognizing that the fragmentation, decentralization, and overabundance of research funds, public labs, and special development zones undermined the ability of the central government to steer the innovation system. This has led to a series of consolidation efforts and reforms that created stronger hierarchies and pyramids (see Exhibit 1).

This report focuses on prominent, nationally recognized types of project-based funding, research labs, and development zones that sit just below the top echelon of each of these pyramids. Each of these innovation support programs is currently undergoing reform, comprising a degree of recentralization, realignment towards strategic needs (technological self-sufficiency in particular), and a shift in focus towards commercialization over other R&D outputs.

Exhibit 1

The Shenyang robotics cluster serves as a microcosm throughout this report (see text box). It demonstrates how local firms collaborate with institutes to research and develop import substitutes. It also shows how research funding and state-supported innovation platforms promote these efforts.

A local robotics company determined to break China’s import reliance

China’s government has high hopes for the robotics sector. According to the 14th Five-Year Plan (FYP) for the Development of the Robotics Industry, by 2025 annual operating revenue should grow at least 20 percent, and three to five robotics clusters should be created.7 The Shenyang robotics and smart manufacturing cluster joined the elite group of officially recognized “advanced manufacturing clusters” in November 2022.8 The local frontrunner is Siasun, a rising robotics company that was spun out of the Shenyang Institute of Automation (SIA), a branch of the Chinese Academy of Sciences (CAS) with a long history in robotics research.9

Siasun founder and president Qu Daokui has often highlighted both the company’s and the sector’s ambition to break China’s reliance on imports. Like most other high- tech firms, Siasun is supported in its R&D efforts by state-sponsored platforms and government funding. In 2017, for instance, it won a CNY 17 million research grant from the Ministry of Science and Technology to improve human-robot interaction through algorithms that predict human behavior.10 The research project was carried out in collaboration with several local universities and public research institutes including SIA and, according to Siasun’s first quarter report for 2021, resulted in 18 patents.11

2. Research projects: Getting scientists to deliver

2.1. Reforms to grant making process have increased state control

In 2015, China issued plans to improve the efficiency of research organizations, update evaluation systems for scientific work, and bring research closer to industry.12 The plan also kick-started the consolidation of government-funded research programs, which will be the focus of this section. While initially prioritizing improved efficiency, the emphasis of the reforms then shifted towards the closer alignment of research programs with national priorities in lockstep with Xi Jinping’s speeches. S&T achievement evaluation guidelines issued in August 2021 downplayed tech transfer and contributions to industry and society, “especially by solving key and core technological problems”.13

2.2. Various research funds consolidated

The reforms led to a tripartite system composed of 16 megaprojects and thousands of National Key R&D Projects (NKPs), as well as funding administered through the Natural Natural Science Foundation of China (NSFC). This enabled the consolidation of a broad range of preexisting funding schemes under the NKP program in 2016.14

"From a functional positioning perspective, the National Key R&D Program is to provide S&T support for all major industries for national economic and social development.”

Hou Jianguo, Vice Minister of the Ministry of Science and Technology at the launch of the NKP program in 201615

Under this new system, there is no strict division between funding for basic research and support for developing practical applications. The National Key R&D Projects replaced a number of programs for basic research (including the 973 program). The majority of funding recipients are universities and research labs, which also do the bulk of basic research. The NSFC was placed under the Ministry of Science and Technology (MoST) in 2018 to enable the ministry to oversee the integration of the system as a whole.16

2.3. Research with commercial and strategic potential prioritized

Stakeholders in Europe should be aware that National Key Project funding is accompanied by elevated expectations of product commercialization. Updated evaluation criteria and accounting rules confirm that the commercialization of technology is becoming more important.17 In addition, corporate research labs are encouraged to apply for NKP funding. Many NKP calls now include “open competitions” (揭榜挂帅), in which officials and industry formulate challenges to be solved by researchers, which explicitly seek to ensure outcomes benefit China’s national strategies. At the same time, the 5,262 NKPs launched between 2016 and 2021 across 96 topic categories (see Exhibit 2) cover the breadth of scientific research, from “quantum control and information,” and “nanotechnology” to “stem cell and translational research” and “clean and efficient utilization of coal and new energy-saving technologies”.

Exhibit 2

Boosting robotics research at the Shenyang Institute of Automation

Robotics-related terms appear in the titles of 124 of the projects awarded NKP funding between 2016 and 2021, equal to around 2.4 percent. In this period, 17 NKPs were awarded to the Shenyang Institute of Automation, including projects worth CNY 156 million to research “key deep-sea technologies and equipment” in 2016.

SIA’s work on police drones was led by the institute’s State Key Laboratory of Robotics and funded by a 2018 NKP grant of CNY 24 million.18 It resulted in joint publications19 and the demonstration of a prototype for “user representatives” from the Ministry of Public Security and the Academy of Military Sciences.

3. Research labs: Realigning the scientific enterprise

"The root cause of the ‘stranglehold’ problem lies in the weakness of basic research, which determines the depth and breadth of a country’s scientific and technological innovation.”

Li Keqiang, outgoing premier of China at the Symposium on the work of the National Science Fund for Distinguished Young Scholars, 201920

3.1. Consolidating basic science resources

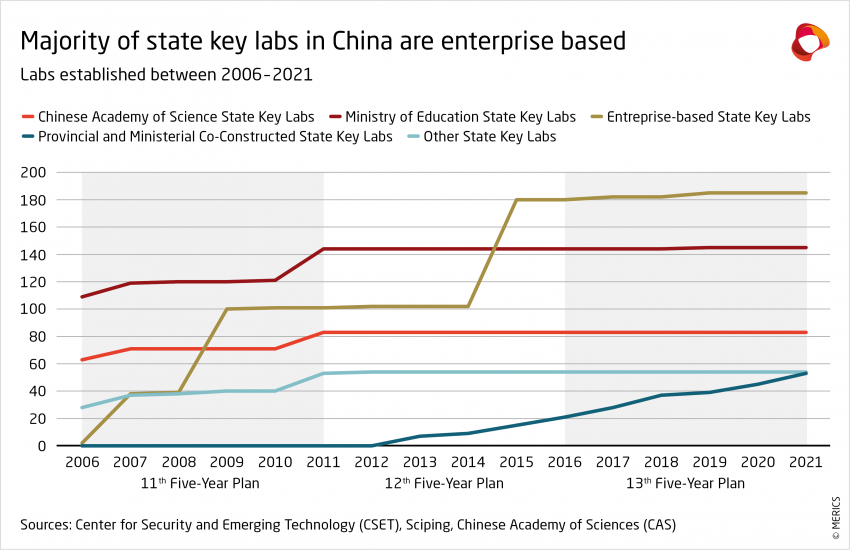

Alongside project-based funding, the establishment and funding of laboratories is a key instrument used by Beijing to shape China’s domestic scientific enterprise. This approach focuses on institution-building and the long-term cultivation of research teams. State key laboratories (SKLs), of which there are 533 according to official statistics (see Exhibit 3),21 make up the largest group of centrally supported labs.22 SKLs are organized around broad disciplinary topics such as biology, physics, or the information sciences. They play a role in fostering “indigenous innovation,” attracting talent from abroad, and commercializing research.23

SKLs are ranked immediately below so-called national labs and research centers, of which there are 20. National Engineering Research Centers (NERC), of which there are 191, have equal status. In contrast to SKLs, which traditionally focus on basic science, NERCs focus on the development of domestic commercial applications.24

The state key laboratory (SKL) designation was launched in 1984 during China’s reform and opening-up period and has since undergone successive waves of reform.25 Research organizations usually have an existing research facility and SKL status granted following a successful application. Once awarded, the facility receives steady annual funding, contingent on successful five-yearly reviews, making this an important and prestigious funding program.

Between 2006 and 2014, Beijing significantly increased the number of state key laboratories (see Exhibit 4). In recent years, however, the approval of new labs has slowed considerably due to government concerns over inefficiency and quality issues. Despite these concerns, in 2018 China’s government announced its intention to increase the number of SKLs to 700 by 2020, a goal it did not reach.26

Exhibit 3

3.2. State key lab system adapting to meet new national needs

In August 2022, the Ministry of Education (MoE) released a policy that identified SKLs and their “reorganization” as an essential component of China’s self-reliance drive.27 Indeed, state key laboratory reform has been part of the political program for several years. In 2018, Beijing signaled changes to the system by issuing the “Opinions on Strengthening the Construction and Development of State Key Laboratories” and by 2021, the reorganization of the SKL system had been anchored in the 14th Five-Year Plan.28

As part of this process, central government support will be withdrawn from certain SKLs, while those deemed useful for the nation will be carried over into a new “National Key Laboratories” system (全国重点实验室) (not to be mistaken for national labs, which are distinct). Beijing has issued a call for researchers to justify the support and recognition they receive from central government by demonstrating how their work serves national needs, solves technical challenges in key and core technologies, and has high international standing.29 Individual lab heads reacted immediately, holding conferences to communicate the direction their work will take. This process will continue until 2025.

3.3. Growing the role of corporate R&D to bring research to market

China’s government has brought the work of State Key Laboratories closer to commercialization by embedding more labs in companies. According to the Center for Security and Emerging Technology (CSET), no fewer than 184 enterprise-based SKLs have been approved since 2006 (see Exhibit 4), when the first State Key Laboratories run by companies were launched. In 2018, China’s government announced its intention to raise the number of company-based SKLs to 270 by 2020, a goal it missed.30 SKLs are based at China’s corporate champions, including Huawei and ZTE.

Exhibit 4

Enterprise-based SKLs are distinct from ministry- or CAS-run labs in that they are expected to align more tightly with China’s industrial goals than discipline-based SKLs and should develop technologies that are closer to market readiness.31 SKLs embedded within companies are also expected to contribute to China’s aim to set more global technology standards. According to an in-depth government study published in 2016, enterprise SKLs contributed 669 international, national, and industry standards that year.32 In 2021, China issued a national standards development strategy33 and a few months later the European Commission followed suit.

Meanwhile, China’s government has adjusted its guidance for evaluating the work of researchers in general.34 Beijing’s decades-long fixation on the quantity of science publications led to a dramatic increase in the number of Chinese research papers produced. In 2018, China was declared the world’s leading producer of scientific publications35 and in 2022 it topped the charts in terms of most-cited papers.36 However, Beijing is now moving away from a focus on publication quantity when evaluating research and is issuing policies to incentivize commercialization (see text box).

Boosting research outputs at the State Key Laboratory of Robotics in Shenyang

The 14th Five-Year Plan for the Development of the Robotics Industry identifies key labs as important centers for robotics R&D.37 A consistently well-performing key lab is the State Key Laboratory for Robotics housed at the Shenyang Institute of Automation.38 Founded in 2007, the lab boasts 82 fixed research staff39 and is steered by an academic committee composed of established researchers, including Siasun CEO Qu Daokui.40

In a 2016 interview, Yu Haibin, director of the lab, said: “The SKL’s mission is not to provide industry with mature technologies, but to position itself as the source technology for future robotics development.”41

In its first official evaluation in 2012, the lab received a “good” rating.42 It was concluded that, in order to boost its rating, SKL researchers would need to publish more frequently in journals captured by the Science Citation Index (SCI), a system that includes the most important journals while sidelining smaller publications, often in emerging fields.43 Yu underlined: “Although a paper is not a scientific achievement, it is an important representation of a scientific achievement.”

In 2017, the lab claimed to have published 149 papers, 64 of which appeared in SCI-ranked journals.44 That year, the lab’s work was reviewed again and recognized as “excellent”.45 Three years later, China’s government, recognizing that its heavy emphasis on SCI-ranked publication numbers did not necessarily translate into good research, signaled it was turning away from SCI as a performance metric.46

4. Development zones tasked with facilitating innovation

"National high-tech zones and firms need to do better and deliver on high-quality development, self-reliance, stable growth, job creation, and other tasks.”

Wang Zhigang, Minister of Science and Technology, August 202247

4.1. Zones adjusting to shifting political priorities

The central government is also looking to align industrial and development zones more closely with national goals. This is a gradual process, as zones have become an engrained feature of the national economy and encompass a large part of China’s national economic activity, which also involves strong local interests. Over the past decades, zones have been key to China’s state-led development, embodying features such as decentralization and local policy experimentation.48 Successful zones in Shenzhen, Beijing (Zhongguancun), Shanghai (Zhangjiang), and Suzhou have become the face of reform and opening up. But their success also led to overabundance, fragmentation, and incoherence, which Beijing is now addressing.

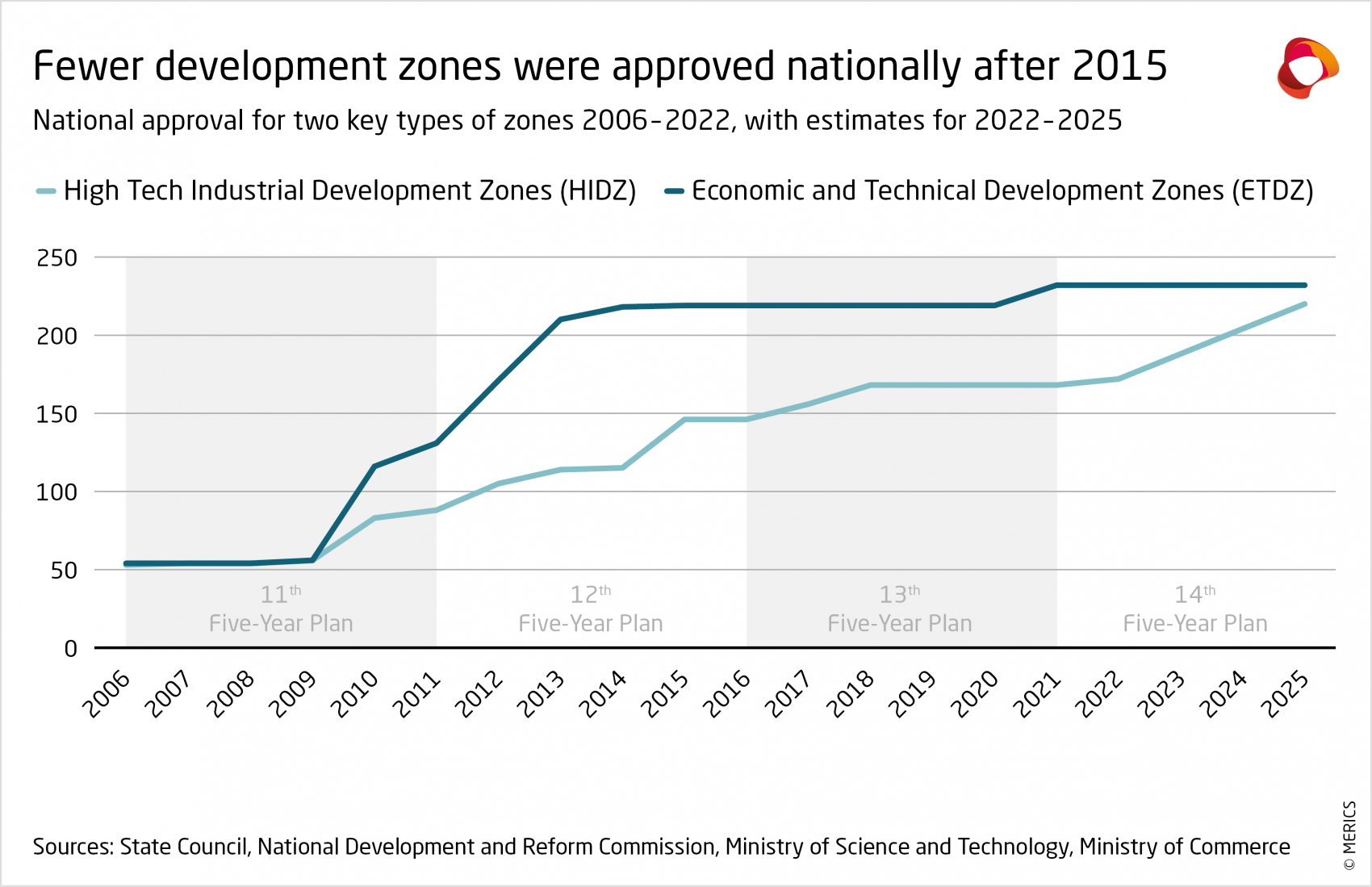

The National High-Tech Industrial Development Zone (HIDZ) designation is a good illustration of these trends. The 173 HIDZs that have been set up since 1988 play a growing role in integrating the innovation, industrial, capital, and talent chains. In 2020 State Council tasked them with “conquering a number of key and core technologies”.49 HIDZs should set up incubators, accelerators, and other support for tech transfer unicorns, and encourage firms to invest more in R&D. The MoST Torch Center adds that HIDZs should do more to pool their R&D, presenting the Yangtze River Delta Integrated Circuits HIDZ Innovation Alliance as an example.50

This adds direction and urgency to HIDZ’s contributions in innovation. HIDZs fall under the remit of the Torch Center, a subsidiary of the Ministry of Science and Technology (MoST) charged with developing high-tech industries in China51 and host 84 percent of State Key Laboratories.52 According to the China Center for Information Industry Development, a think tank affiliated with the Ministry of Industry and Information Technology (MIIT) that publishes an annual ranking, these zones generated 13.4 percent of national GDP in 2021.”53

"The biggest historic mission of high-tech development zones during the 14th five-year period (2021 – 2025) is S&T self-reliance. They should serve as icebreakers, advance troops, and demo areas for the innovation-driven, high-quality development strategy.”

Zhang Jing’an, chair of the S&T Systems Reform Study Group (under MoST), December 202154

4.2. Stronger hierarchy of zones emerging

The central government in China is seeking to consolidate zones by embedding them in larger spatial planning entities (see Annex 2).55 Starting in 2009, several HIDZs were grouped and elevated into 23 “indigenous innovation demonstration zones”, and, after 2012, many became part of the 21 pilot free trade zones.

As a result of this approach, much of the pre-existing infrastructure remains in place, and consolidation remains uneven. In contrast to research funding (NKP) and research institutes (SKLs), reforms to the national zone system were not announced by Beijing.

Despite tensions in government policy between extending the network of zones to every corner of the country and raising quality by focusing limited resources, the central government has dramatically slowed the approval of new zones (see Exhibit 5). For instance, only five HIDZs have been approved since January 2018, causing MoST to miss its target of 240 HIDZs by 2020.56 A similar trend can be observed for Economic and Technological Development Zones (ETDZs), which are very similar to HIDZs but fall under the responsibility of the Ministry of Commerce.

Exhibit 5

Behind this shift lies the Innovation-Driven Development Strategy (IDDS) and its prioritization of quality over quantity, which has permeated State Council policy since 2016, as well as the updated evaluation metrics issued by MoST in 2021.57 In order to guide zones towards better performance, these policies recommend merging smaller, less active zones with larger, more successful ones, effectively consolidating them. Because zones often overlap with district governments, this leads to the merging of administrative districts, as happened in Shenyang (see text box). Meanwhile, the Five-Year Plan for HIDZ towards 2025 states that every prefecture-level city should have an HIDZ, aiming for a total of 220.58

4.3. Zones have become anchors on the local innovation map

City clusters including Jing-Jin-Ji (around Beijing), the Yangtze River Delta (around Shanghai), and the Greater Bay Area (around Guangzhou) have formulated plans to integrate innovation resources in their areas, responding to the official designation of these cities as “national STI centers”.59 As a result, HIDZs have become part of innovation corridors60 and other urban planning concepts.61 These local innovation maps also intersect with national plans to identify industrial clusters and boost their joint innovation capabilities, for instance those developed by the MoST Torch Center62 and the Ministry of Industry and Information Technology.63

Pooling innovation resources in Shenyang’s Hunnan District

The planned Hunnan Science and Technology City (HSTC), a project of Shenyang’s Hunnan district government, has already attracted more than 80 industry projects valued at CNY 115.6 billion. Shenyang city envisions that the HSTC will eventually involve 100 research institutions and projects including the Shenyang Institute of Automation and its robotics spin-out Siasun, both headquartered in Hunnan District.

The formation of Hunnan District between 2001 and 2014 created a district government responsible for a considerable chunk of Shenyang’s industrial and innovation resources. Moving forward, infrastructure and architectural projects will link Hunnan District to a cluster formed around Northeastern University, situated just north of the district, creating a seamless “innovation corridor.”64 Chinese media frame this as stitching together research and commercial activities into a Shenyang-based “whole- chain innovation system,” a vision to be completed by 2035.65

This concentration of resources also enables links to nearby cities through even larger constellations. The Hunnan HIDZ is part of the Shenyang-Dalian Indigenous Innovation Demo Zone and the Shenyang branch of the Liaoning Province Pilot Free Trade Zone.66

5. Global innovation trajectories are changing

"Science has no borders, but scientists have motherlands.”

Xi Jinping, speech at a scientists’ forum, September 202067

Beijing is increasingly focusing on steering scientific research and technological development in the direction of technologies of national and strategic interest. This growing emphasis on nationalized science includes a direct appeal to the community of researchers.

In a series of speeches given in 2018,68 2020,69 and 2021,70 President Xi used increasingly urgent language to tell China’s top scientists that their work should serve national development. At a May 2021 meeting of the Chinese Academy of Sciences (CAS), the Chinese Academy of Engineering, and the China Association for Science and Technology, for example, Xi stressed that national power relies on strength in the field of science and technology and urged academicians to set an example in their love for the motherland and service to the people.71

At the same time, China’s sizeable scientific enterprise is filled with individuals with deep ties to international peers. Like all researchers, China-based scientists often desire to take part in the international community of researchers. Consequently, there is growing tension between the principles of openness that characterize the global community of researchers and an increasing effort in Beijing to steer the work of research toward strategic concerns such as stranglehold technologies.

At the same time, China’s central government is focusing on extracting more economic value out of research spending and developing market-ready technologies that may provide an advantage in a geopolitical era where technological supremacy is seen as a key source of power. This desire to commercialize research has led China’s government to reorganize its innovation system around the idea of the innovation chain.

To achieve this, Beijing has embarked on a long and painful process of reforming funding programs, institutional support, and zoning policies. In this paper we outlined the steps Beijing has taken to line up disparate steps more carefully within the innovation system.

Legacy programs (labs and zones) have been consolidated, separate funding programs – some of which were originally designed to keep basic and more applied funding separate – have been bundled into new ones, research laboratories are being encouraged to engage more with enterprise, and zoning policies are being tweaked to help labs and startups move along the innovation chain. Additional policies and updates to evaluation criteria for scientific research are also shifting emphasis to marketization over other R&D outputs.

This has profound implications for European engagement at corporate, university, and individual levels. If current trends continue, the centralization of science, technology, and innovation will gradually extend to all corners of China and all segments of the innovation chain, buoyed by global tech rivalries that look poised to intensify. As a result, collaboration between European and Chinese counterparts is set to become more political, limited, and transactional. Reduced global interaction and stronger top-down organization will also impact China’s innovation trajectory.

Impact of China’s science and technology policies on European stakeholders

In many parts of the world, there is growing emphasis on converting research into market- able products. Governments are using a variety of tools to accomplish this.

However, as China’s government looks to extract more commercial value out of its research spending, European stakeholders face the growing risk of unwanted technology transfer.

European R&D stakeholders should be aware that the National Key R&D Projects (NKP) program, one of China’s most important project-based funding program, is designed to both support basic research and to develop commercial products.

China’s government is currently reorganizing one of its signature laboratory funding programs, the State Key Laboratory (SKL) system. Several laboratories are beginning to communicate how their work will relate to breakthroughs in key and core technologies and serve national needs while maintaining international standing

China’s central government is trying to shift the emphasis of zoning policies towards self-sufficiency. Beijing is looking to link up disparate parts of the innovation chain by attracting laboratories, funding, and companies. High-Tech Industrial Development Zones (HIDZs), a key legacy zoning policy, are leading the way.

Annex 1: Data analysis

For this project, we used data obtained from the Chinese Ministry of Science and Technology’s portal on National Key Projects.72 By cross-checking against other sources, we were able to identify a consecutive project number for each project line. Missing project numbers were searched for manually and appeared to be cancelled projects. Up to 2018, in addition to “principal investigator”, “main institution” and “duration”, we were able to obtain the funding awarded to each project. MoST stopped reporting the amount of funding for projects in that year. Therefore, this information was not available for all projects in our dataset.

To calculate the percentage of robotic-related NKPs, we identified a set of seed keywords related to robotics and searched for keywords that frequently co-occur.73 We also identified the keywords most often used in the titles of NKP projects classed as robotics related. False positives, such as non-robotics-related exoskeleton projects, were excluded manually.

Our analysis of state key laboratories74 relies on a dataset compiled by the Center for Security and Emerging Technology (CSET) at Georgetown University. This dataset includes 469 state key laboratories. To understand changes to the system over time, we combined this data with the approval year of each lab, obtained from the Chinese Academy of Sciences, the Ministry of Science and Technology, and other public sources.

These approval years were identified for all SKLs in the data set except for two and were therefore not included in our analysis. The approval year for the second batch of enterprise- based SKLs could not be precisely determined to be either 2009 or 2010. Batch 2 was scored as having been approved in 2009 though several may have been approved the following year.

Our dataset also includes 53 so-called provincial-ministerial co-constructed State Key Laboratories. This dataset is likely not complete as aggregate numbers published by the Chinese National Bureau of Statistics indicates the existence of more labs than were captured in this list. We also collected the names of delisted labs (those that lost their central government recognition due to poor review) but left them in the data set.

For development zones, we used a catalogue issued by the Chinese National Development and Reform Commission in December 2018.75 We updated this using official announcements of newly approved development zones, primarily from the State Council.

Annex 2: Emerging hierarchy for China's development zones

Acknowledgements

This report benefited from the “China Science, Technology, Innovation, and Industrial Eco- systems” project that is supported by the US State Department, and particularly a workshop hosted by the University of California at San Diego in October 2022. The authors would like to acknowledge comments on draft versions of this report by Barry Naughton, Emily Wein- stein and Marcus Conlé. Any mistakes or errors in this report are those of the authors.

Michael Laha would like to thank the Alexander von Humboldt Foundation for support in the form of the German Chancellor Fellowship to support his time at MERICS.

The authors would like to express their thanks to Antonia Hmaidi for her valuable support with data collection and analysis.

No comments:

Post a Comment