TOM O'CONNOR

In his first visit to China since taking office at the beginning of this year, Brazilian President Luiz Inácio Lula da Silva called on countries across the globe to ditch the U.S. dollar in favor of trading in a common currency or existing national currencies, something he did in his own trade with Beijing just weeks earlier.

"Every night, I ask myself why all countries are forced to do their trade backed by the dollar?" Lula asked. "Why can't we do trade backed by our currency?"

Perhaps even more significant than the message Lula delivered was where he delivered it. Lula spoke Thursday at the New Development Bank (NDB), which serves as the Shanghai-based financial institution of the informal BRICS coalition. BRICS, comprised of Brazil, China, India, Russia and South Africa, was first devised some 16 years ago as a vehicle for large emerging economies. But the group has taken on a new life in recent years, with a growing list of nations seeking to forge partnerships.

And though shared geopolitical aims among the five core BRICS members and those seeking to join the expanding group are few, a common goal has increasingly emerged to provide new alternatives to Western-led institutions.

"The NDB is a great example in terms of non-Western multilateral development banks trying to promote an alternative development financing mechanism that is not dominated by the U.S. dollar or by an American standard or Western standard," Zongyuan Zoe Liu, a fellow at the Council on Foreign Relations, told Newsweek.

Fundamentally, it boils down to two things: money and politics.

Brazilian President Luiz Inacio Lula da Silva gestures during a ministerial meeting to celebrate the first 100 days of his government at the Planalto Palace in Brasilia on April 10, 2023.

On the economic end of the equation, being tied to the U.S. dollar, for all of its glory since the establishment of the Bretton Woods system that linked global currencies to the greenback, costs nations money. Conversion fees take a toll, especially when trade is being conducted in large volumes, as is the case among BRICS members.

"For economic reasons," Liu said, "if there are ways to reduce transaction costs, to reduce currency or exchange rate risk, then countries are willing to do that."

For China, in particular, which is the largest trading partner of more than 120 countries, this trend makes sense.

Yaroslav Lissovolik, founder of BRICS+ Analytics and a member of the Russian International Affairs Council, also argued that using national currencies may "be seen by some countries as a way to lower the transactions costs associated with conversions into U.S. dollars, as well as reducing currency mismatches that often accompany high levels of dollarization."

He also saw motivation among BRICS members toward attempting to close the gap on the U.S., which accounts for around 58% of the world's foreign exchange reserves, a substantial lead on the European Union euro at about 20%, the Japanese yen at less than 6% and the United Kingdom's pound sterling at about 5%. The Chinese renminbi comprises just under 3%.

"There may also be a desire by some of the largest developing economies such as China and other BRICS countries to emulate the dollar's success by reaping the benefits of attaining a reserve currency status for their respective currencies," Lissovolik told Newsweek. "The overall pie of potential de-dollarization dividends (given the 'exorbitant privilege' of the dollar in the preceding decades) is substantial and some of the largest developing countries may well aim for getting a chunk of this pie."

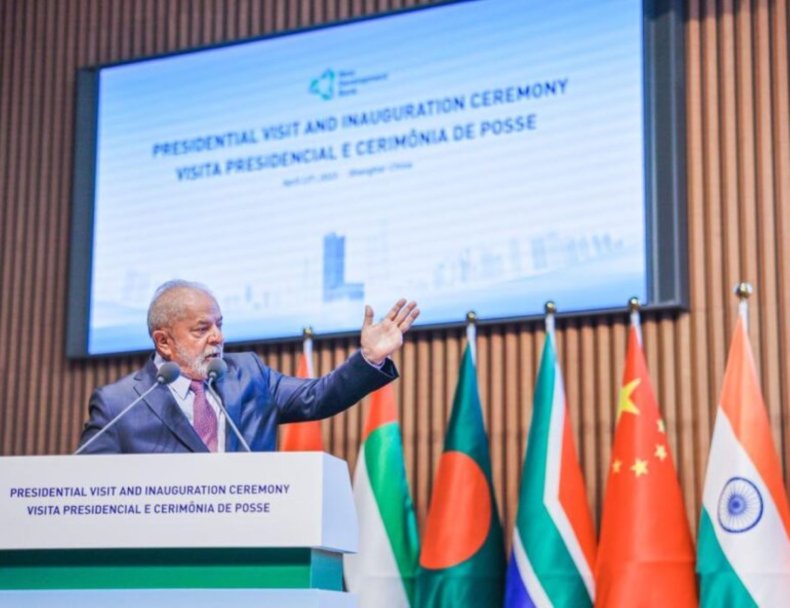

Brazilian President Luiz Inácio Lula da Silva speaks during the presidential visit and inauguration ceremony at the New Development Bank in Shanghai, China on April 13.NEW DEVELOPMENT BANK

Brazilian President Luiz Inácio Lula da Silva speaks during the presidential visit and inauguration ceremony at the New Development Bank in Shanghai, China on April 13.NEW DEVELOPMENT BANKAnd while this aim may be tantalizing, he felt the major benefit of the NDB came in the form of diversifying options for nations in receiving development assistance.

"One of the potential advantages of resources provided by the likes of NDB is that it is an alternative source of financing that offers greater optionality for developing countries," Lissovolik said. "Another potential advantage is the difference in the scale and stringency of conditionality."

"Also, there may be the rationale of seeking to expand the potential pool of resources that is available for the borrower," he added. "NDB may be viewed as an additional source of financing that may complement the resources coming from the Bretton Woods institutions."

While the Bretton Woods system may have brought prosperity to the West, its effects have not been felt equally across the globe.

"The Global South by some definitions is categorized by socio-economic standards," Akhil Ramesh, a senior fellow at the Pacific Forum, told Newsweek. "Countries in the Global South, that are largely developing nations with higher poverty levels, infrastructure deficits, have an insatiable appetite for development assistance, particularly in the infrastructure space."

"So, with regards to new development banks," he added, "the more the merrier."

Like Lissovolik, he said the "NDB will supplement Western financing" rather than replace it. But he also pointed to the political side of de-dollarization that has gained major traction as a result of Washington's strategy of leveraging its economic weight to punish undesirable policies adopted by countries around the world.

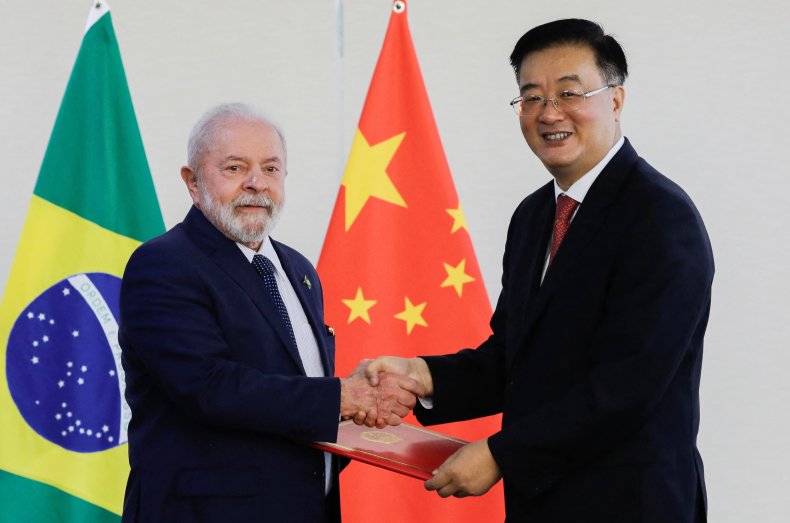

Brazil's President Luiz Inacio Lula da Silva is presented with the credentials of China's Ambassador to Brazil Zhu Qingqiao at the Palacio do Planalto in Brasilia February 03, 2023.SERGIO LIMA/AFP/GETTY

Brazil's President Luiz Inacio Lula da Silva is presented with the credentials of China's Ambassador to Brazil Zhu Qingqiao at the Palacio do Planalto in Brasilia February 03, 2023.SERGIO LIMA/AFP/GETTY"Countries do not want to be victims of the West's unilateral sanctions," Ramesh said. "21st century warfare involved economic weapons such as sanctions and that warrants 21st century solutions. India, China, Russia and Indonesia have all switched or are considering moving away from Mastercard and Visa for the same reason."

Lissovolik agrees.

"One of the main reasons for the shift towards using national currencies is the use of the U.S. dollar in imposing sanctions on other countries—in the case of last year it was Russia," Lissovolik said.

"This use of the dollar in imposing economic restrictions has delivered a strong 'demonstration effect' for the countries of the Global South," he added, "and resulted in efforts on their part to diversify the array of currencies that could be used in international settlements at the expense of the excessive reliance on the U.S. dollar."

Liu, for her part, echoed this point that Russia's war in Ukraine and the resulting unprecedented sanctions campaign against a major world economy demonstrated "the idea that your trade can be cut off, not necessarily because your bilateral trade treaty partners are not willing to come out with a trade, but because the transaction using U.S. dollars cannot be implemented."

The geopolitical motivators go beyond the sanctions against Russia, however, and speak to broader trends that have been emerging for years and have only accelerated in the wake of the conflict in Ukraine.

World leaders pose for a family photo before the meeting in an expanded format at the Shanghai Cooperation Organization (SCO) leaders' summit in Samarkand on September 16, 2022.SERGEI GUNEYEV/SPUTNIK/AFP/GETTY IMAGES

World leaders pose for a family photo before the meeting in an expanded format at the Shanghai Cooperation Organization (SCO) leaders' summit in Samarkand on September 16, 2022.SERGEI GUNEYEV/SPUTNIK/AFP/GETTY IMAGESThe last BRICS summit, held in Beijing in July of last year, drew some 19 world leaders and saw two new applications from Argentina and Iran to join the bloc. Interest has also emerged from another influential player, Saudi Arabia.

After agreeing to reestablish ties with longtime rival Iran last month in a deal brokered by China, Saudi Arabia also applied to another multilateral organization, the Shanghai Cooperation Organization (SCO), which Iran joined last September. The potential entry of the two major oil states to both BRICS and the SCO could prove a major step toward shoring up defenses in the event that deteriorating U.S.-China relations devolve into international sanctions.

"If that's the case, then what we are saying is the Shanghai Cooperation Organization and BRICS basically becomes this kind of large trading bloc," Liu said, "as well sustaining the idea that China exports a lot of goods and services that other countries would actually buy and Saudi Arabia, Iran and Russia export energy to China and India."

"Basically, you have trading partners that are mutually complementary," she added. "In this particular scenario, I think the use of local currency in bloc trade or bilateral trade makes a lot of sense for these countries."

No comments:

Post a Comment