Nikos Tsafos

Energy prices in Europe have risen sharply over the past few months. This spike has coincided with the release, over the summer, of the European Union’s “Fit for 55” package, a set of measures to achieve climate neutrality by 2050. As expected, higher prices have been used as a political excuse by both sides of the aisle: as a reason to accelerate the energy transition in Europe, and as a caution against a transition that is too rapid. Both perspectives deserve to be taken seriously. But neither is quite right.

Why Have Prices Risen?

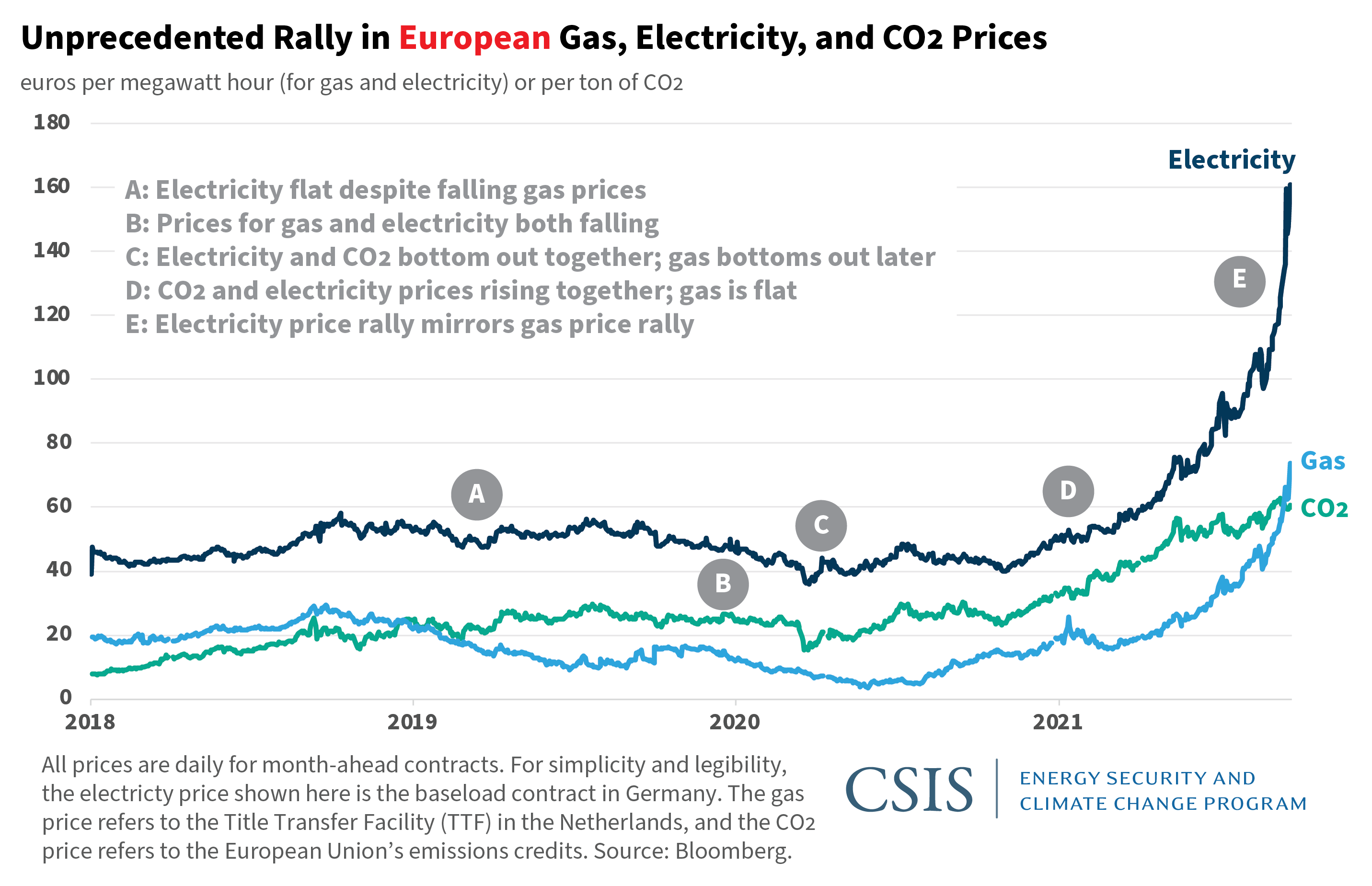

The rally in prices has occurred across three markets: electricity, gas, and certificates for emitting carbon dioxide (for simplicity, carbon prices). These markets, in turn, are driven by dynamics that are both local and global, and they interact in ways that are new and poorly understood. Carbon prices, for example, spent much of the 2010s trading under €10 per ton; they are now around €60/ton. It is thus impossible to rely on history for insight on what drives such a rally in prices or what it means. Gas markets have similarly become more interconnected: shocks that were previously local or regional now have global ramifications. The territory is uncharted.

Despite this complexity, the most recent rally in electricity tracks the spike in gas prices. This dynamic is not constant. In previous years, the price of gas has moved with little effect on wholesale electricity prices (e.g., 2018–2019). Earlier in 2021, it was the carbon price that drove electricity prices while gas prices fell. But more recently, since May 2021, the spike in electricity has occurred while carbon prices stayed flat. It is therefore possible to say that electricity prices were elevated in 2021 in part due to carbon prices, but the most recent spike seems to follow the tightness in the gas market.

The gas market itself is experiencing several dynamics. In the liquefied natural gas (LNG) market, supply has grown by about 5 percent this year (through August, based on data from Kpler). This is robust, but far below the annual growth rate of around 10 percent in the years from 2016 to 2019. The is partly due to the underperformance of several key suppliers: exports from Norway have fallen 93 percent so far this year, from Trinidad 37 percent, and from Nigeria 19 percent. These countries accounted for 10 percent of global supplies in 2020, so their shortfall is material.

The other reason that LNG supply has not grown so fast is the collapse in oil prices from 2014 to 2016. New LNG supply projects take four to five years to build, so whatever gap exists today is because of what happened in the mid-2010s. There was, in fact, a big decline in new investments committed in 2016 and 2017. This investment slump, more than any recent trends in finance for oil and gas projects or any steps to expedite the energy transition, explains the supply dynamics in 2021.

At the same time, demand has been strong. LNG imports into China have grown by 22 percent through August. Volumetrically, China’s demand has absorbed 80 percent of the growth in global LNG supply. In other words, 80 percent of the new LNG produced in 2021 has gone to China, forcing the rest of the world to apportion the remainder. Europe has lost out, its imports falling 20 percent. Imports into Asia have risen 11 percent and into the Americas 59 percent. Europe is the market of last resort in LNG. In 2020, this meant getting LNG no one wanted, crashing prices; in 2021, it means getting too little LNG.

The realities in the European pipeline market are similarly difficult to disentangle. Exports from Russia have been lower than expected, largely because of the need to meet demand and refill storage at home. The amount of gas stored in European facilities is lower than earlier years. This feeds concerns about the coming winter, which has pushed up prices, but not enough to attract LNG away from Asia or South America. Combined with localized events that impact individual electricity markets, this has contributed to a continent-wide increase in power prices. This has affected countries regardless of the greenness or carbon intensity of their electricity systems. It is a gas crisis that has become an electricity crisis.

Some Lessons for Europe

The irony is that Europe’s current position is partly due to two structural shifts that Europe has encouraged over the years. The first is the transition from gas prices indexed to oil to gas prices set at liquid hubs. The second is increased linkages among gas markets around the world. Both are good for energy security: gas prices should reflect the fundamentals of the gas market, not the oil market. And the ability to move gas quickly around the world allows countries to manage shocks more easily.

But in a market where gas prices respond to near-term fundamentals and markets are linked closely, Europe is far more exposed to global events—a spike in demand from China, a draught in Brazil, production outages in Norway, or declining output in Trinidad. It is also more exposed to fluctuations in Russian output—whether deliberate or incidental. Importantly, this latter vulnerability—Russia’s market power—exists regardless of what happens with the Nord Stream 2 pipeline, which is one reason why the argument that Nord Stream 2 pipeline gave Russia new powers to exert influence over the European market never made any sense. It has that power already.

This market reality also exposes another flawed idea that gained traction over the years: that U.S. LNG could protect Europe against Russia. The proposition itself has always been suspect, reducing a complex system into a two-player game. In today’s market, its hollowness is even clearer. U.S. LNG, like other LNG, responds to market forces, and if other markets are willing to pay more than Europe, Europe has no immediate remedy. New supply, including from the United States, can offer a bargaining tool that keeps prices in check in the medium to long term. But it is no response to a short-term shock.

This is a broader predicament for European energy security. Europe has single-mindedly focused on a narrow problem: how to deal with a sudden interruption in gas supplies. This is a logical response to the crises of the 2000s. In such a conception, the solution is cross-border connectivity and access to LNG. But if LNG is too expensive or not available, as it is today, such a strategy fails to deliver security. Europe needs an energy security dogma for the world of today, not just for the challenges it faced in the 2000s. And the energy transition, on its own, is not enough of a strategy.

Will the Energy Transition Lower Price Volatility?

There is no reason to expect energy prices to be less volatile in a low-carbon world. First, fossil fuels continue to play a role in the energy transition: in the International Energy Agency’s Net Zero by 2050 roadmap, oil and gas still provide around 20 percent of the world’s energy in 2050 (mostly as a feedstock, paired with carbon capture and storage). Prices for fossil fuels will remain volatile, perhaps more so than today since the risk of a supply-demand imbalance is greater in a market that is shrinking where the case for further investment is weak, which could produce short-term rallies.

Second, the energy transition will need a lot of commodities whose prices can be volatile. Some of these commodities are inputs into a manufacturing process, so volatility might not affect end-users immediately (e.g., lithium, cobalt, nickel, lithium, copper). But other products will impact end-user prices directly. Prices for biofuels, for example, can fluctuate due to their tie to food markets. Carbon prices will go up and down. And the energy transition will rely heavily on hydrogen in part because it can be stored—and the whole business case for storing something rests on volatility.

Third, electricity prices are often more volatile in the short term than fuel prices because the costs of imbalance are more acute. A car can fill up later. A factory might cancel a shift. But brownouts and blackouts are costly, and keeping a system balanced at all times is expensive. This challenge will become more acute as intermittent energy sources grow their market share. The world has enormous storage capacity in solid and liquid fuels and in gases. It will take decades to replicate that capacity and deliverability through batteries, hydrogen, and other dispatchable technologies. Volatility will be a fact of life—in fact, a necessary precondition for these options to be commercially viable.

Fourth, climate change will stress our energy and electricity systems. Over the past few years, the world has experienced some of the nightmare events that keep strategists up at night: an attack against the Abqaiq complex in Saudi Arabia, a cyber-attack against a major oil pipeline in the United States. Yet extreme weather has had far more devastating effects, a reminder of the need to plan for the events that really shake a system, not just those that make sensational headlines. The combination of an electricity system run on intermittent energy sources and a demand environment characterized by extreme weather is bound to be volatile and produce enormous short-term stress.

In the end, Europe must be realistic about what the energy transition can do for it. It is no release from the messy geopolitics of energy, nor an isolation from other parts of the world. There is always a hope that a low-carbon system might be self-sufficient and thus insulated from shocks. But self-sufficient systems are not resilient, and they need far more spare capacity to cope with shocks on their own. Security is easier to accomplish through trade and interconnectedness by pooling risks together, and this reality will connect Europe to the rest of the world. No matter how far Europe advances its progress toward climate neutrality, the need to balance the energy system will remain, with all the challenges and price volatility that such a task entails.

No comments:

Post a Comment