Alicia García-Herrero Pauline Weil

1 Introduction

Semiconductors are China’s main import item, ahead of oil. They are a critical input to information and communication technology production, which China dominates globally, and also to other industries which China either already dominates (solar panels) or wants to dominate (electric vehicles and 5G-ready telecommunications hardware, among others).

Semiconductors are China’s main import item, ahead of oil. They are a critical input to information and communication technology production, which China dominates globally, and also to other industries which China either already dominates (solar panels) or wants to dominate (electric vehicles and 5G-ready telecommunications hardware, among others).Chinese policymakers are fully aware of their country’s semiconductor production limitations. Since 2014, the Chinese government has supported its semiconductor industry, alongside several other strategic industries, through an industrial policy that is oriented towards reducing excessive dependence on the rest of the world (so-called ‘dual circulation’). The semiconductor industry is probably the most important of all strategic sectors because semiconductors are an essential input to many other sectors and, thus, essential to climbing up the value chain. In addition, the United States’s push to contain China’s technological development is very much centred around the semiconductor sector, which is perceived as China’s technological Achilles’s heel. In fact, the US’s so-called ‘Entity List’, or list of Chinese companies, organisations and individuals targeted by US trade restrictions imposed by the Trump Administration[1], focuses on limiting China’s access to high-end semiconductors, among other products. This US pressure has accelerated China’s quest for self-reliance, as clearly reflected in President Xi dual circulation strategy, announced on 14 May 2020 (García-Herrero, 2021).

While the importance of the semiconductor sector for China is by now crystal clear, other major economies have also sought more recently, especially since the pandemic, to ensure their semiconductor supplies. The US and the European Union have both announced major support plans for the design and/or production of semiconductors within their borders. Against such a backdrop, we evaluate China’s industrial policy on semiconductors and compare is to more recent US and EU efforts, in order to assess whether China is an example to follow on the design and objectives of such industrial policies.

2 China’s early industrial policy on semiconductors

Aware of its massive dependence on imports of semiconductors, China started in 2014 to step up its efforts to reduce its reliance on the rest of the world. China’s comprehensive industrial policy strategy, Made in China 2025, published in 2015, includes semiconductors as one of the main areas where China wants to focus its industrial policy. The strategy identified ten high-tech sectors, including semiconductors, of major relevance to reduce China’s technological dependence on the West. Similarly, the National Guideline for the Development and Promotion of the IC Industry (in which IC refers to integrated circuit), published[2] by the State Council in 2014, set out a strategy specifically to reduce the import reliance of the Chinese chips industry.

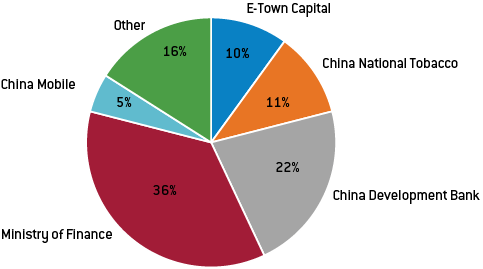

Government support was offered via the creation of integrated-circuit funds at national and state levels, and through other channels, including by guiding banks to support firms (OECD, 2019). The central government also set up two ad-hoc public funds (so called Big Funds). The first investment fund, created in 2014, raised $21 billion[3] (139 billion renminbi) to be administered by the Ministry of Industry and Information Technology (MIIT). The finance ministry disbursed 36 percent of the funds and China’s largest development bank, China Development Bank (CDB) disbursed another 22 percent.

Figure 1: Largest shareholders in China’s first IC investment fund

Source: Bruegel based on Huang (2019). Note: IC = integrated circuit.

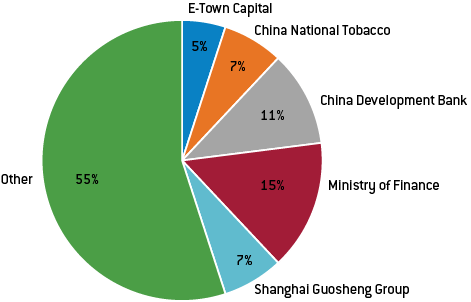

A second national Big Fund was set up in October 2019, having raised $35 billion, or 204 billion renminbi[4], and with similar major state-controlled shareholders (Figure 2). This time, another major state-owned financing vehicle, Shanghai Guosheng, contributed with 7 percent of total funding, even more than Beijing venture capital agency E-Te own Capital. In other words, the state plays a bigger role than might be apparent at first glance, as government-funded investment companies were important players in running these funds, as well as providing their funding. Private firms were included in both funds but represented less than 1 percent of total funding. In the second round, foreign investors were invited, although none have entered the fund[5].

Figure 2: Largest shareholders in China’s second IC investment fund

Source: Bruegel based on OECD (2019). Note: IC = integrated circuit.

In addition to the two big national-level funds, at least 15 local government funds have been created at city or provincial level, totalling at least $25 billion in capital to invest in the sector (SIA, 2021). National Big Funds and local government funds might have channelled up to $150 billion to support the Chinese semiconductor industry from 2014 to 2020 (OECD, 2019; Congressional Research Services, 2021).

While funding relies mainly on state-controlled entities, including state-owned enterprises and local governments, investments also target privately-owned enterprises. In fact, reliance on market forces was the official strategy in the 2014 guidelines to increase the return on the public funds. The strategy was also for the Big Funds to remain minority investors. Overall, however, ownership linkages are opaque, making it difficult to identify the ultimate beneficial owners (OECD, 2019). While the state-controlled funds are not majority investors in most firms, the state has become a majority shareholder in most medium- and large-sized semiconductor enterprises in China (OECD, 2019).

Beyond the funds described above, government support for the semiconductor sector is also provided through government grants, tax incentives and low interest loans, for an amount estimated to hover around $50 billion (SIA, 2021). Tax breaks were introduced to encourage the production of higher-end semiconductors. Firms that have operated for more than 15 years were exempted from corporate income tax for up to 10 years if they manage to produce 28 nanometre (nm) chips or below[6]. Producers of chips from 65nm to 28nm, were exempted from corporate income tax for five years, and could get a 50 percent discount on the corporate rate for the next five years. Additional financial support comes in the form of borrowing at below-market rates; banks were encouraged to support the sector. There are also tax incentives for the conducting of research and development (R&D), with companies allowed to deduct from its taxable income 200 percent of its R&D costs. While these measures have supported the chip industry in China, they have created distortions globally, especially given the sheer size of China’s market.

The government also supports semiconductor producers in raising equity on the Shanghai Stock Exchange (SSE) Science and Technology Innovation Board (STAR Market), established in 2019. On the SSE STAR Market, 17 percent of companies were in the chips sector in January 2021, nearly half of which worked in design. China’s regulatory environment has also helped when mass producing new semiconductors, including by easing consumer protection measures. Lastly, semiconductor companies, both for fabrication and assembly, have been offered land at below market prices.

3 Assessment of China’s strategy of state support

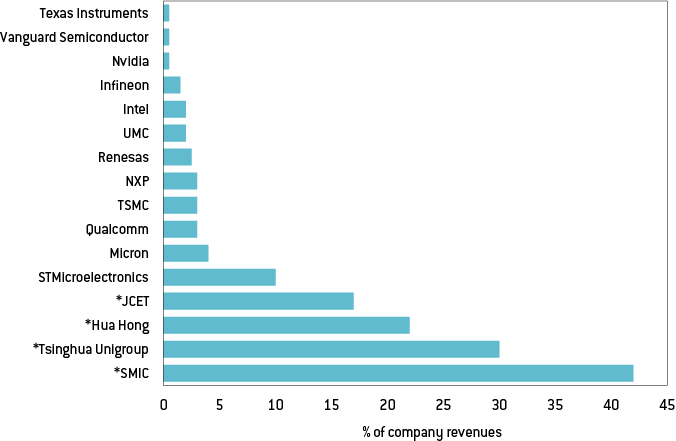

China provides more support to its chips industry than any other economy. China has invested massively in chip companies, when compared with global peers (Figure 3). The Big Funds have also provided vast support to international mergers and acquisitions (M&A) in the sector. China became the second biggest player after the US in semiconductor firm M&As, though it has fallen further behind since 2017 when Beijing introduced additional measures to control capital outflows (OECD, 2019).

Figure 3: Estimated total government support provided to semiconductor firms, 2014-2018

Source: OECD (2019). Note: * indicates Chinese firms.

China’s largest semiconductor firms have attracted the biggest shares of state support since the two Big Funds were set up. In particular, Hua Hong Semiconductor, JCET, SMIC and Tsinghua Unigroup have received equity funding of about $10 billion, which represents slightly less than half of the funding available from the first national Big Fund (roughly $23 billion). These firms are active in the industrial steps of semiconductor production: fabrication and assembly.

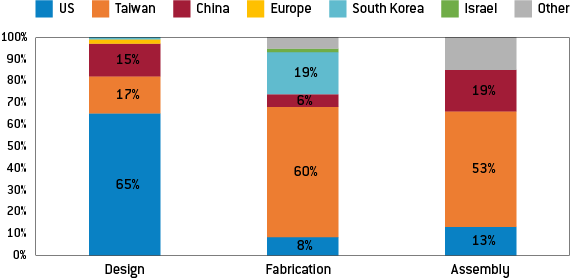

Figure 4: Market shares of semiconductor production steps by firm headquarter location, 2019

Source: Bruegel based on IC Insights, Seeking Alpha and Stiftung Neue Verantwortung.

3.1 Big support and big losses in the fabrication segment

The bulk of Chinese government support, estimated at 67 percent of the first Big Fund[7], and of local government support, has been directed to the construction of foundries (semiconductor manufacturing plants). Although, China’s capacity to fabricate chips has grown fast (SIA, 2022), there have also been major setbacks, such as the bankruptcy of one of China’s most important home-grown semiconductor companies, Tsinghua Unigroup (see below). However, investment in the fabrication segment has yielded some success in the production of memory chips[8]. These achievements, however, are underwhelming compared to the objective set for China’s industrial policy for the sector, namely to become self-sufficient in the high-end, smaller-node, chips[9].

Another important development, against the stated objective, is the increase in state participation in key players in the sector. Tsinghua Unigroup and CXMT are state controlled, and state participation in Semiconductor Manufacturing International Corporation (SMIC), China’s biggest chip company, has also increased, from below 15 percent in 2004 to over 45 percent as of 2018, much of which was funded by the two Big Funds (OECD, 2019).

Moreover, Shanghai’s local government, together with $1 billion in funding from the national Big Funds, set up a joint venture with SMIC[10] to build a foundry in Shanghai focusing on mid-sized chips, namely 14nm ones. In 2021, SMIC also announced plans for a new foundry in Shenzhen, based on a $2.35 billion joint investment with the local government, following the same model as the Shanghai plant. Thanks to such massive investments, SMIC has become the fifth biggest player globally[11]. However, the company is on the US Entity List (see section 1) meaning production upgrades are suspended. SMIC cannot buy from key companies, in particular ASML, a European producer of lithography equipment, which is necessary for the fabrication of high-end smallest nodes chips (below 14nm) (NSCAI, 2021).

Tsinghua Unigroup became an integrated device manufacturer, or firm that both designs and fabricates chips, after it acquired in 2013 two of the four leading Chinese chip designers for the equivalent of $2.1 billion. The firm also collaborated with local governments and the Big Funds to invest in the construction of at least four factories producing memory chips (OECD, 2019). However, in January 2021, Tsinghua Unigroup defaulted on several bond repayments, amounting to $3.6 billion. The company continues to struggle to generate positive cash flows and remains highly indebted, making it a good example of a firm receiving huge public funds without absorbing them successfully.

Another large government-controlled chip company, Wuhan Hongxin Semiconductor Manufacturing Co (HSMC), founded in 2017, has benefitted greatly from $1.2 billion in financial support from the Wuhan Dongxihu district government to produce 7nm and 14nm chips[12]. However, the project was suspended in 2019 following a payment default and was abandoned in 2021.

3.2 Chip assembly policy successes

Notwithstanding failed companies and lots of money spent in other areas, Chinese companies have expanded rapidly in the assembly of chips (Figure 4). But this is, by far, the least-demanding phase in the semiconductor cycle in terms of capital expenditure and know-how. The largest Chinese player is JCET, third globally with a market share of 14 percent (Poitiers and Weil, 2021). JCET’s acquisition of Singapore-based packaging and testing firm STATS ChipPAC, instrumental in JCET’s success, was partly financed by the Big Fund in 2015, raising state control to between 20 percent and 35 percent (OECD, 2019).

3.3 Some strides in design, driven by the private sector

Possibly an even more significant is the strides taken by some Chinese private companies specialising in chip design. China’s global market share grew from 5 percent in 2010 to 15 percent in 2019[13]. But Mainland China remains behind Taiwan and far behind the US in global market share (Figure 4). Furthermore, China’s design sector has taken a hit since 2019 as it is has become exposed to US sanctions. HiSilicon, Huawei’s subsidiary and China’s biggest chip fab, has been under US sanctions since 2020, resulting in the cancellation of its fabrication contract with TSMC and leaving the firm unable to get its most cutting-edge designs produced. In the upstream part of the value chain, China also remains exposed to US trade restrictions and US firms remain market leaders in design software.

4 General conclusions on China’s industrial policy

Because of its strategic importance and capital-intensity, China has poured huge amounts of money into developing its semiconductor industry. The challenges posed by US export restrictions have been a further trigger for the rapid deployment of funds into the industry. The objective is clearly ambitious: reaching self-sufficiency through the rise of national champions in the different steps of semiconductor production – design, fabrication and assembly.

The objective has been achieved for the last part of cycle, assembly. This has however the least value added and is the least strategically important of the three phases. In terms of fabrication, producing standard chips, especially for memory cards, has become feasible in China but these are clearly not the highest-end chips. The availability of funds for Chinese companies to assemble – and in some cases produce – low-end chips and, in particular, memory cards, has resulted in overcapacity and the collapse of prices. Furthermore, export restrictions on software design or manufacturing equipment, imposed by the US and some like-minded countries (such as the Netherlands), are making it even harder than it already was for China to move up the ladder.

All in all, and taking into account the massive financial support, estimated at $150 billion, China’s industrial policy of developing an advanced chip industry has so far yielded mixed results, at best. External reliance on semiconductors, especially high-end chips, continues unabated, even after the acquisition of foreign firms and building of fabrication plants. One reason for this could be the increasingly limited role of the private sector in the context in which state funding has increased state control over the sector. In addition, companies receiving such large amounts of funds have not been able to absorb them, and have become over-leveraged, leading to defaults in the case of several large companies.

This development is not unusual in highly-competitive sectors where money cannot buy upgrades. Indeed, the semiconductor sector is characterised by a high level of specialisation and concentration, with the US having leverage over several of the key bottlenecks in the production process. Along with the US export controls it faces, China is limited in its ability to secure production of high-end chips by shortages of talent. China has not succeeded in achieving its very specific objectives and timeline for becoming self-reliant and bypassing technological barriers.

But more time will be needed for a full appraisal of the outcomes of China’s massive investments in the semiconductor industry. China began supporting its semiconductors sector in 2014, giving less than a decade for which a preliminary evaluation can be done. So far, China’s ambitious chip industrial policy has certainly grown its domestic high-tech ecosystem and secured some market presence in the first steps of the value chain. But it remains short of its overblown goals of mastering the most high-tech segments.

The current state of the market reflects these realities. In design, the US is dominant and leverages export restrictions. China has not managed to become self-reliant, although strides have been made, possibly thanks to the greater role of the private sector. In the fabrication segment, China remains confined to mature technologies. In assembly, which is both less competitive and less strategic, China has managed to increase its global market share. For the Chinese government, the US sanctions regime in the chips sector represented an opportunity for an alignment of interests between private and public entities[14], as both aim to shed reliance on the US (Duchâtel, 2021). However, China has not managed to overcome the bottlenecks and monopolies of companies such as ASML and TSMC. These high-tech bottlenecks are set to endure in the medium to long term, making full supply-chain decoupling impossible. This will be especially the case with new sanctions hitting the sector, in the form of bans on exports to Russia by the largest semiconductor producers globally, except those in China (Marcus et al, 2022).

5 Lessons for the EU

The EU shares China’s ambition of increasing its chip production capacities, especially in the cutting-edge segments. This had led to a rethinking of EU industrial policy, making it more active, at least for this critical sector. The EU Chips Act, proposed in February 2022 by the European Commission with a promise to mobilise more than €43 billion in funding, aims to reduce semiconductor supply shortages and reverse years of decline in semiconductor investment in the EU. In particular, the proposed EU Chips Act is expected to boost Europe’s share of global chip production capacity to 20 percent from the current 10 percent of the global chips value chain. Meanwhile, the US finalised in August 2022 the CHIPS and Science Act, with $52.7 billion of funding to increase the production of chips in the US.

These EU and US initiatives can be considered commensurate to China’s two Big Funds (which provide the equivalent of $60 billion), although more financial help has been offered by local government funds in China. However, the starting points are different. The US leads the design part of the chip value chain, which has the most value added. Europe has some design firms, but much fewer than the US. Europe also has important technology – especially on lithography for the fabrication phase – and has a relatively strong position in some R&D areas.

A few lessons for Europe can be taken from China’s experience of using industrial policy to become self-sufficient in chips. First and foremost, the Chinese government’s eight-year long efforts to reach self-sufficiency in chip production have not been successful, even after pouring in a huge amount of funds. Upgrading production is challenging no matter the amounts of available capital. This is also confirmed by the struggles faced by both Intel[15] and Samsung[16] in producing the latest generation of chips, after trailing TSMC which remains on the cutting-edge. China’s unsuccessful attempts so far can be explained by its very low starting point in the highest-value parts of the chip supply chain. This might not necessarily be the case in the EU, though it is of course hard to tell. In other words, subsidising the fabrication of chips does not guarantee success.

Second, China has suffered from US containment, especially in relation to export bans on designs of semiconductors. This, again, will probably not be the case for EU chip companies, but they could still be caught out if the aim is to export EU chips to China, because US sanctions in this respect are bound to affect the European chip industry too.

Even without US containment or sanctions, as is the case for China, it is not clear how the EU can make good use of the funds that could be stimulated by the Chips Act if the focus is fabrication. The reason for this is the EU’s rather unclear comparative advantage. Thus, for the EU, focusing on the highest end of the value chain –design – seems like a better idea, with a special focus on R&D.

The EU does not really need to aim at semiconductor self-reliance, as it should be able to trust other sources of chip design and chip production, including the US, South Korea, Japan and Taiwan. Nevertheless, there is a major risk stemming from the very high concentration in the fabrication of advanced semiconductors in Taiwan (about 80 percent of total for 7nm and below). The EU could seek alliances with other producers in case of a major geopolitical event in the Taiwan Strait.

In any event, China’s experiences should be taken into account to avoid flooding the sector with funds that do not help develop a high-end European semiconductor ecosystem, but only create over-capacity at the lower end of the chip value chain. The Chinese experiences of defaults of semiconductor companies, after large amounts of funds were injected, also confirm that the most capital- and technology-intensive phase of production, fabrication, is where losses happen most often. Yet policymakers, in China, and more recently the US, continue to channel the most investment into this most risky step of the supply chain.

The Chinese experience also leads us to make a number of specific recommendations:If a decision is taken to subsidise production, it should at least be targeted to the highest value-added segment of the semiconductor cycle.

Cooperation with other countries beyond the EU can help reduce the costs. Avoiding excess investment is also important, considering that the sector is not only highly intensive in terms of capital, but also in terms of energy and water.

China’s increasing importance in assembly also calls for diversification strategies for the US and the EU for this final phase of the cycle. Otherwise, the EU and US will continue to be dependent on China as the provider of the final product in the semiconductor cycle.

Dependence on Taiwan for the fabrication of advanced semiconductors needs to be addressed given the geopolitical risks involved and the potential for natural disasters, such as earthquakes. This alone calls for the deployment of public funds, and/or the pursuit of strategic alliances, to reduce potential shortages and bottlenecks.

No comments:

Post a Comment