by Yukon Huang and Jeremy Smith

Invoking Mao Zedong’s 1938 essay on “protracted war”, Chinese President Xi Jinping is preparing his country for an external environment that is expected to harden both politically and economically in the coming years. Internationally, Xi confronts a trade war with the United States, a political push to uproot manufacturing supply chains and decouple from China, and a bleak overall outlook for global trade due to the coronavirus pandemic.

Xi’s remedy, first introduced at a Chinese Communist Party Politburo meeting in May, lies in the new “dual circulation” strategy. Though the concept remains decidedly vague, it emphasises giving greater play to domestic growth drivers, or “internal circulation”, while shifting away from the economy’s traditional bent towards export orientation. In this view, China should lean more heavily on domestic demand, given the diminishing role of trade in the economy over the past decade and a half.

Exports have been falling almost continuously as a share of China’s gross domestic product – from a peak of 35 per cent in 2006 to 17 per cent in 2019. This rise and fall is similarly true of imports.

The decline is the result of three structural forces that shaped China as it moved from a low- to upper-middle income economy: graduating from labour-intensive products; onshoring of higher value activities; and rebalancing from investment to consumption and from manufacturing to services.

Taken together, the competitive pressures and opportunities from trade are likely to continue to play a major role in shaping China’s growth process.

Women walk through a clothes store in a shopping centre in Beijing. China has been trying to boost domestic demand as it seeks to move away from export-led economic growth. Photo: EPA-EFE

First, Chinese producers have become less cost-competitive in labour-intensive manufacturing industries. According to data from the World Trade Organisation, China has ceded 8 percentage points in global market share in the clothing sector between 2014 and 2019, primarily to lower-cost neighbours like Bangladesh, Vietnam and Cambodia.

From 2008 to 2018, average annual manufacturing wages in Chinese private enterprises grew more than threefold – illustrating why US-China Business Council members

cited the costs of producing in China, not trade tensions, as the top reason for relocating production.

Second, as China graduates from these industries, it is simultaneously moving higher value-added portions of the supply chain back home. In prior decades, China was attractive to foreign investors principally as a low-cost base for product assembly and re-export to external markets.

This processing trade, which boomed in the years following China’s 2001 accession to the WTO, relied on imports of electronic parts and components from Japan, South Korea and Taiwan.

As Chinese manufacturers acquired technological know-how, however, they were increasingly able to produce more higher-value components at home, causing processing exports to slip to 5 per cent of China’s GDP by 2019, down from 19 per cent in 2006.

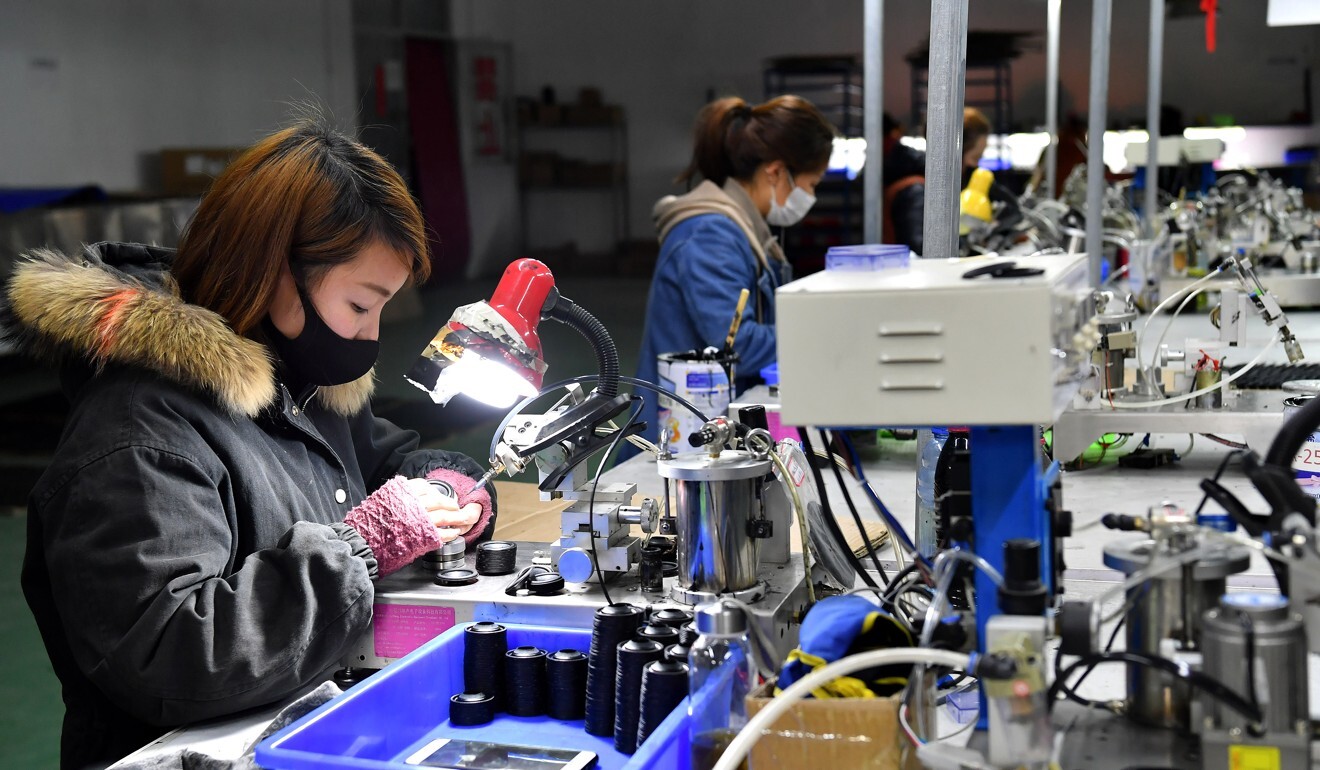

Workers make speaker components at a factory in Tongchuan city, in northwest China’s Shaanxi province. Photo: Xinhua

Third, China has been rebalancing gradually away from investment to consumption and from manufacturing to services as its economy matures. Growth in investment peaked a decade ago, driven by the construction boom which has now moderated. Total consumption increased from 49 per cent of GDP in 2010 to 55 per cent in 2018.

Investment is inherently more trade intensive than consumption, given the need for imported capital goods and raw materials. The service sector grew from 34 per cent of Chinese GDP in 1995 to 53 per cent in 2018, replacing industry as the major sector. Industrial activity is more trade intensive than services such as entertainment and education. Together, these structural shifts accentuated the decline in trade in relation to GDP.

From 2004 to 2014, China accounted for a commanding 18 per cent of world export growth, more than double the next largest contribution of 8 per cent by the United States. Graduation, onshoring and rebalancing gradually eroded China’s share, which fell dramatically to around 10 per cent from 2015-2019, and these processes will continue in the future.

Yet even after such a steep decline, incredibly, China still managed to contribute far more to overall export growth than any other economy – Germany’s 7 per cent share put it at a distant second.

The heyday of China’s export-led growth may have passed, but its continued impact may not be as bleak as some experts have suggested. In the short term, China’s external sector has paradoxically been quite strong. During the pandemic, China has benefited from surging demand for medical products and electronics that it is well positioned to provide.

These factors propelled China to a nearly 20 per cent global export market share in the second quarter – a major increase from a world-leading 13.1 per cent in 2019 – and surprisingly strong export figures in recent months. Meanwhile, import demand has been relatively weak, resulting in the investment bank UBS forecasting a trade surplus of 3.5 per cent of GDP for this year.

While such magnitudes cannot be sustained, exports still hold more potential for China than is widely believed, and general fears over trade decoupling and large-scale supply-chain restructuring are probably exaggerated: foreign multinationals remain committed to the Chinese market and China’s comprehensive manufacturing ecosystem cannot be easily replicated elsewhere.

Moreover, those now arguing for increasing consumption to drive China’s growth are mistaken. The concept of consumption-driven growth doesn’t exist in economic theory. Consumption is derived from growth; it does not drive growth.

The only true growth drivers are investment and productivity increases from technological innovation and deepening human capital. And, as highlighted by the World Bank Growth Commission, a strong external orientation is a key characteristic of developing economies that have succeeded in this regard.

No comments:

Post a Comment