Shreyans Bhaskar and Amaani Bashir

Indian states have generally recorded budget deficits in recent decades, with both development and non-development expenditures rising as India’s population has exponentially grown. In particular, public spending has risen on provision of goods and services as well as on debt servicing. Public spending is not only a function of demographic size, but also demographic structure, as public spending on social and medical services and transfer payments is generally higher in countries with a disproportionately higher share of younger or older people, who are not part of the labour force and often require additional budgetary support from the state. Research in Asian countries indicates a negative relationship between demographic transition and government budget balances through higher government expenditure.

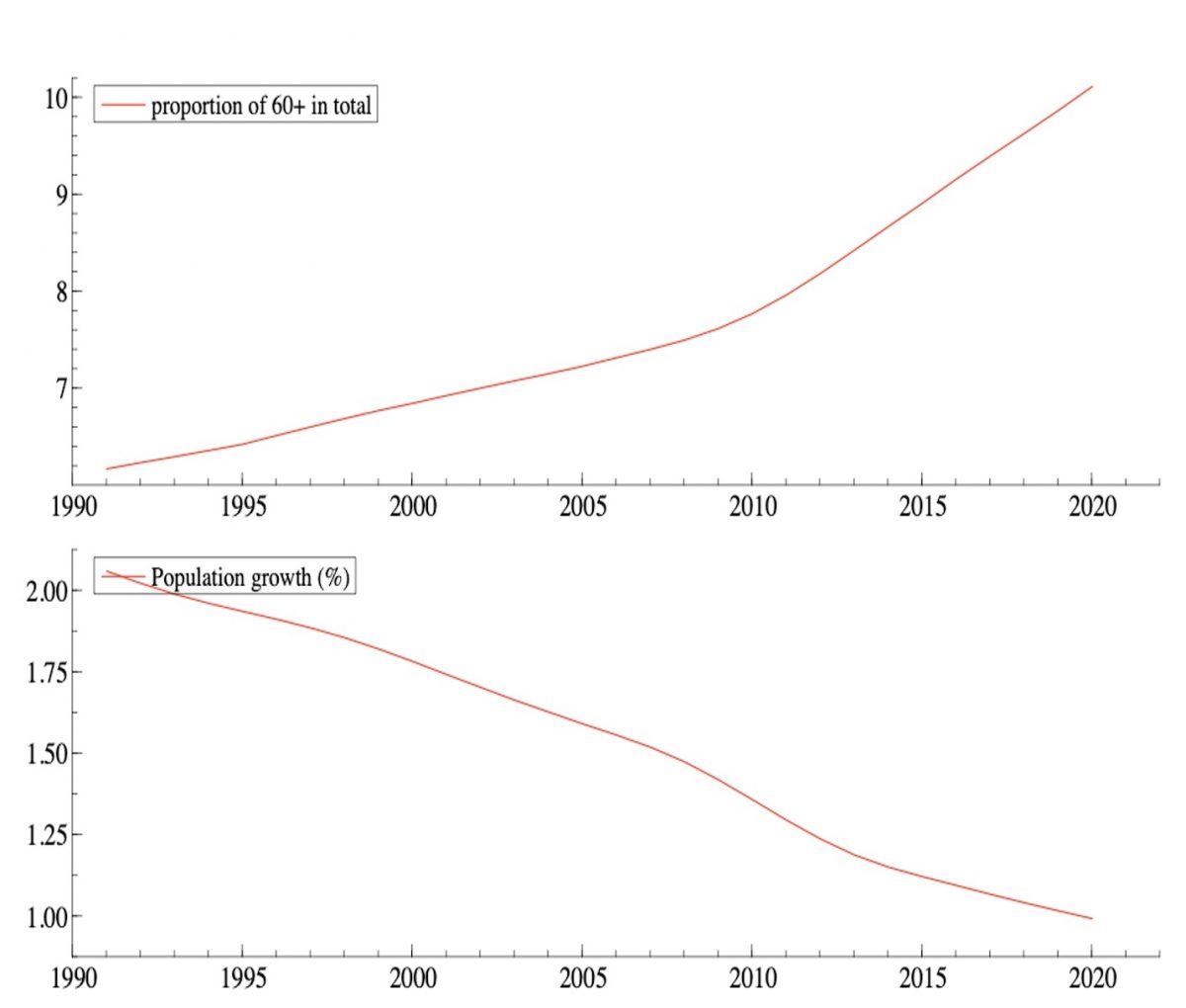

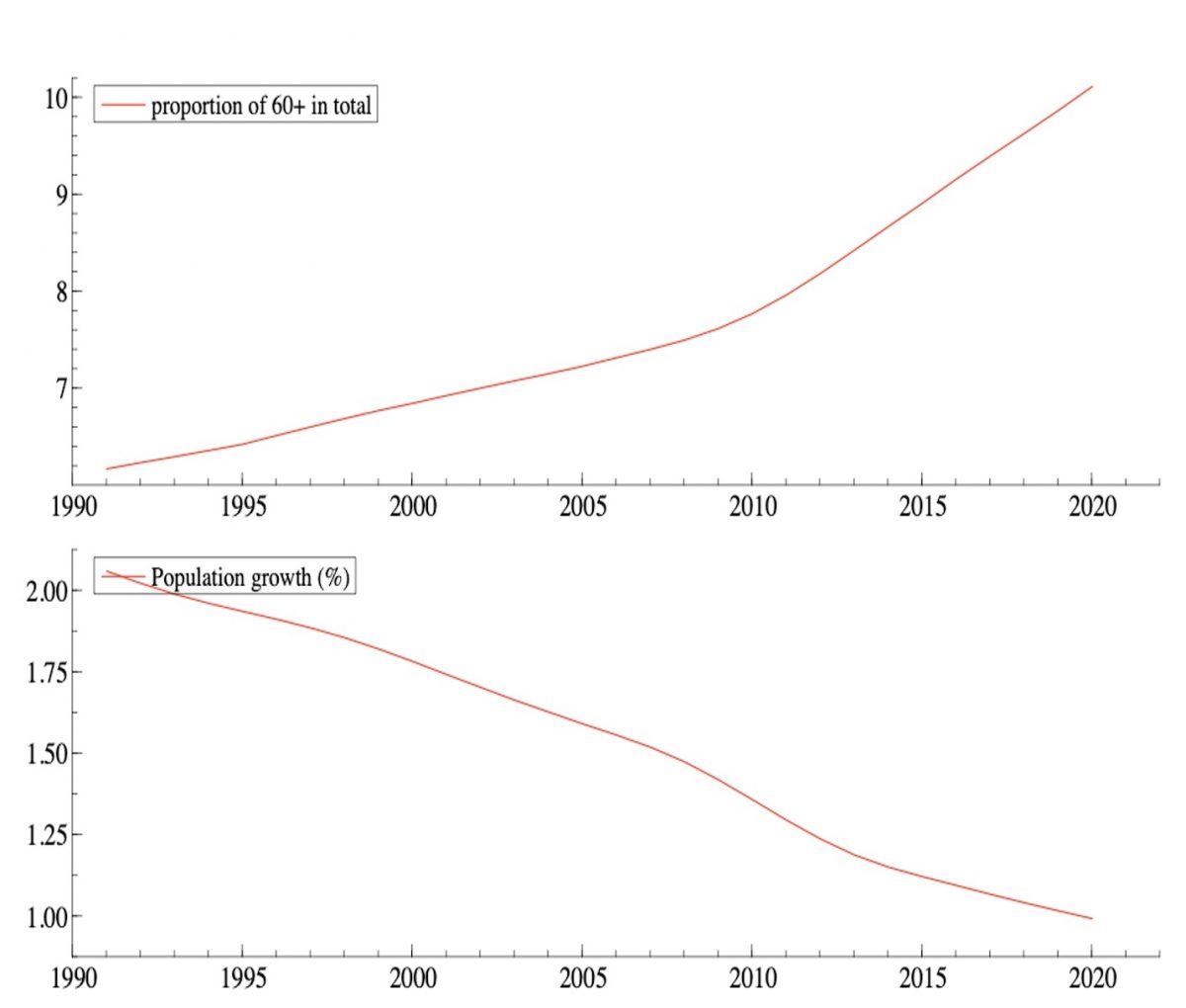

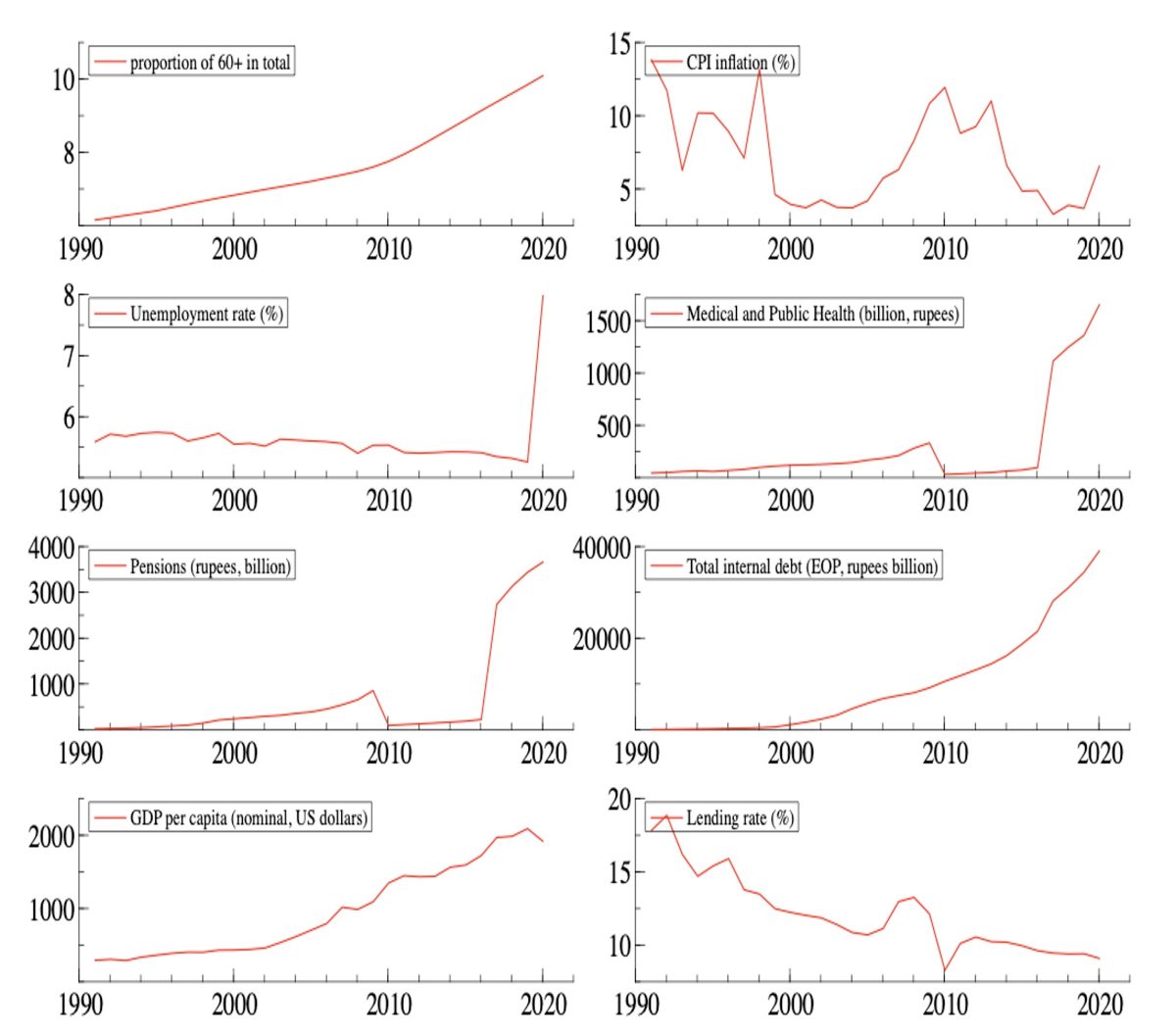

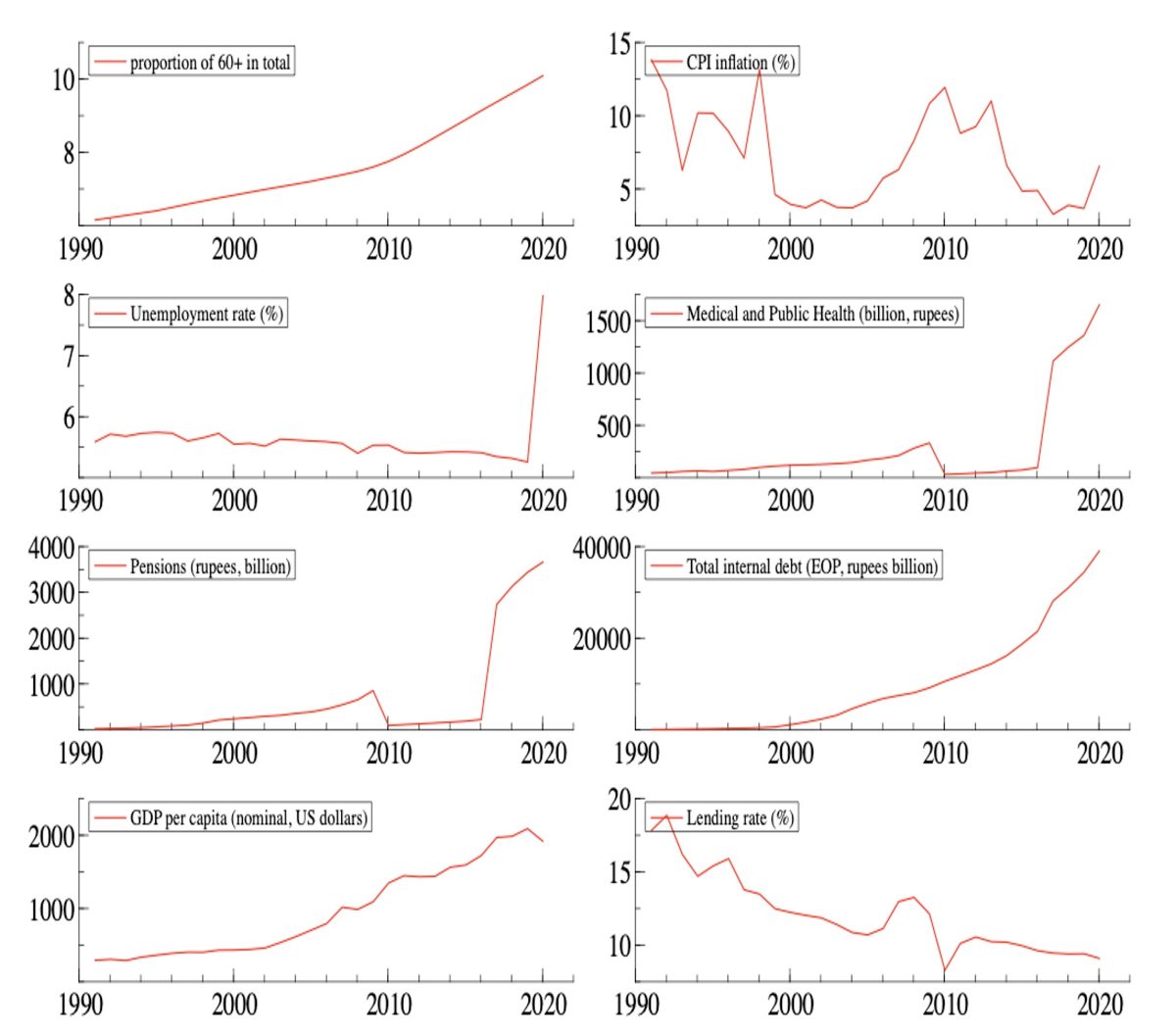

Indian states have generally recorded budget deficits in recent decades, with both development and non-development expenditures rising as India’s population has exponentially grown. In particular, public spending has risen on provision of goods and services as well as on debt servicing. Public spending is not only a function of demographic size, but also demographic structure, as public spending on social and medical services and transfer payments is generally higher in countries with a disproportionately higher share of younger or older people, who are not part of the labour force and often require additional budgetary support from the state. Research in Asian countries indicates a negative relationship between demographic transition and government budget balances through higher government expenditure.In India, the population remains young relative to the wider Asia region, but overall, the share of 60+ persons in the population has risen from 6.2% in 1991 to 10.1% by 2020[1]. Falling fertility rates and improving health outcomes could further accelerate this climb and indeed, there remain strong inter-state differentials in the demographic structure, with important policy implications. State governments in India play a crucial role in provision of social services and several states already have significant debt burdens. State governments are the key drivers of government schemes given India’s quasi-federal constitutional structure and are responsible for disbursement of welfare payments and social services in a way that the central government is not. Therefore, in this article, we try to understand the relationship between government budget and debt levels of Indian states, and the change in the proportion of the 60+ population. We also try to understand the changing trend in health and pension spending as the population has aged.

Demographic projections in India and evidence from Asian countries

India’s population structure has gradually evolved over the years. A fall in the total fertility rate from 4.83 in 1980, to just 2.18 by 2020 is combined with an increase in the life expectancy, which has risen from 53.8 years to 69.9 in the same period. The median age of the country is growing, rising from 19.3 in 1970 to 28.4 in 2020, and is projected to be 35 by 2040[2]. This is further accentuated by strong interstate differences, particularly between Southern and Northern states. As per the 2011 census data, the states of Bihar and Uttar Pradesh had a median age of 20 years each, while Kerala had a median age of 31 years. Divergent fertility rates indicate that this gap will persist in coming years, with the latest family survey data showing that Bihar had a TFR of 3, compared with 1.8 for Kerala.

As many emerging economies in Asia have grown rapidly in recent decades, they reaped the benefits of young populations who have become more economically active, exploiting the ‘demographic dividend’. However, as countries move past this, they move to a new stage of the demographic transition, characterised by an ageing population. This is caused by a) lower mortality rates and b) fertility rates, leading to lower proportions of ‘economically active’ citizens. While there are different definitions of ‘economically active’, this usually includes a reduction in potential GDP and domestic savings. There may also be lower consumption and investment which can hamper growth and productivity outcomes in an economy.

In terms of fiscal balances, an ageing society can drive an imbalance through, a) a decline in tax revenues, b) an increase in government expenditures for aged populations through pensions, healthcare, social security etc. This can be a challenging policy dilemma as different cultural and social norms can determine the position of aged populations in a country, determining the economic resources available to them.

A study by the ADB found that across 178 countries over 18 years, health expenditure is a key expenditure for ageing populations. Their results find that health expenditure is negatively associated with the government balances. They also find that there is a positive relationship between the population aged over 64 and health expenditures. They finally find that demographic transitions have an indirect effect on fiscal balances via higher government expenditure.

Model

To determine the relationship between ageing and government balances in Indian states, we specify the following model. We are testing the effect of a change in the proportion of the population above 60 on the debt of the state, while also controlling for the effects of GDP growth, unemployment, inflation and interest rates. Mathematically, it is expressed as:

Of which, we have total internal debt as the dependent variable. Age structure (60+): We have calculated as our primary independent variable the % of 60+ in the total population structure. This data is sourced from the UN Population Division.

The log of GDP per capita is aimed at capturing the effects of wealth levels, while the log of nominal state GDP is required to control for the volume of fiscal strength available to states, and GDP growth and unemployment capture the state of the economy. Inflation and lending rate are other key measures of the state’s ability to spend and borrow, while inflation also captures the ability of citizens to make out of pocket spending.

In our consequent model, we want to capture the effects of demographics on various kinds of social spending. We find that there is a unit root in the pensions spending, and hence use the log of the first difference in our estimation. We use the following model:

We run different iterations of this model with different dependent variables viz. medical and health spending, family welfare spending, and social welfare spending.

Diagnostic testing

We have conducted diagnostic tests and diagnosed heteroskedasticity[3] using the white test which has been corrected with robust models as necessary. Heteroskedasticity is a statistical situation where the variance of the residuals of the model are not constant over a range of observations. In such a situation, econometric modelling can be invalid unless corrected.

We find the presence of a unit root[4] in the following variables: fiscal deficit, pension spending, medical and health spending, pensions, social services, and family welfare spending, using the augmented dickey fuller criterion. We use the first difference and re-test using the ADF criterion, and find the new series to be stationary, and valid for regression under OLS criterion.

Results

We first explore the relationship between internal debt and old age populations, finding that total internal debt increases by 0.83 % for a 1% increase in the old age population (significant at 1%). This indicates that governments have taken the burden of old age care, alleviating demand-constraints on younger households

In trying to disaggregate the drivers of government balances, we also regress the change in pension expenditure as a function of the old age population; we find that an increase in the proportion of the old age population by 1% has shown an increase in pension expenditure by 0.59% (significant at 1%) in the last 30 years in India.

There can be 2 main explanations for this relationship: a) the last 30 years have seen mass reforms in pension systems and social security expenditure from direct benefit to direct contribution systems. While this would lead to a lower fiscal burden for the government in the long-term, in the medium-term it would require fulfilling their direct benefit obligations to an ageing population which has led to large increases in pension expenditure. Secondly, even as the older age population is rising, a persistent fall in fertility rates is leading to a bulge in the working age population; this ‘demographic dividend’ in India has led to increased tax revenues for the governments which may have been channeled into more adequate pension provisions for the population.

Our findings indicate that there is a 1.09% change in state medical and public health expenditure for a 1% change in the old age proportion (significant at 1%), indicating that a majority of old dependency provisions take the form of health expenditures such as treatment for chronic or age-related illnesses. Decreases in old age mortality in India will no doubt increase this burden on fiscal balances over time.

An interesting finding from our analysis shows that social services expenditure as a whole (as part of development outlay expenditure in state budgets) have an inverse relationship with demographic ageing; indeed a 1% change in old age proportions coincides with a 1.26% change in social service expenditure. This is not a very surprising finding; India is still in the middle (albeit in the later stages) of its demographic dividend, indicating that there is a still a ‘youth’ bias in social services expenditure i.e. youth education, pediatric and natal health expenditure and employment-based schemes and security for example.

We also regress the log of the first difference of the budget deficit as the dependent variable and find no significant effects of population ageing upon the budget. Additional controls also fail to further strengthen the model, reflecting that in our data, there is not a strong effect.

Conclusion

As India emerges on the other end of its peak demographic dividend, old age dependency will likely impact household finances due to unavailability of affordable state-sponsored care and the small proportion of pension wealth in household wealth. These will have knock-on aggregate demand effects through constrained demand of younger households, which due to a mix of social and economic factors, allocate significant income to repaying intergenerational loans through ‘care consumption’; these will only increase as age expectancy increases. This will prove increasingly challenging as fungible financial asset holdings in Indian households, especially those approaching old age, are very low. State-sponsored old age provisions must be enhanced to lower old-age dependency on household finances and man(rather women)-power, allowing them to contribute to the economy through consumption and labour provision. Changing social trends of nuclear families and rural-urban migration may also leave old-age populations in existential insecurity, which should be duly addressed. Analysis like the one presented above should impart ‘caring spirits’ in boosting investment as a way to enhance productivity and future economic opportunities.

The policy implications of this are manifold. Firstly, the indication of a relationship between population ageing and an increasing fiscal strain implies that an increasing responsibility towards financing old age requirements will burden state balances in the future. It is pertinent that systems for reformation of old age healthcare and welfare be put in place now so they are well positioned to absorb the growth in old age ratios in the forthcoming decades as India progresses towards an ageing society, so as not to be burdened by the influx when the time comes.

States already grapple with immense pressures on their development expenditures in recent years have required state budgets to make difficult decisions. Given that healthcare is significantly affected by increasing old age proportions in our analysis, diverting even marginal finances to old age care schemes will go a long way in lessening household burdens. This will also have positive externalities such as enhancing labour-intensive, public-sector employment, especially for women contributing to demand-led growth through consumption. Pension systems like NSAP, which have weak replacement rates, must be propped up more by central contributions, and a stronger push for informal workers to subscribe to NPS should be considered, including co-contributions incentives. It is in our interest to act in a premeditated manner as opposed to grasping at straws when we face the waves of change.

Figure 1

Figure 2

Notes

No comments:

Post a Comment