SUCHET VIR SINGH

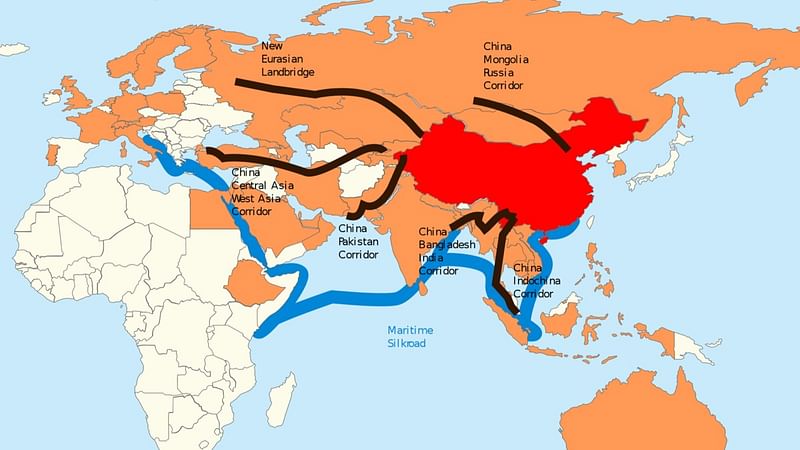

New Delhi: China’s investment and expenditure in foreign countries through its grand infrastructure development plan, the Belt and Road Initiative (BRI), has dipped by 11.77 per cent in the first half of 2022 year-on-year, data from China’s Ministry of Commerce (MOFCOM) shows.

Countries including Russia, Sri Lanka, and Egypt saw no investment from the BRI in the first half of 2022, while Pakistan saw a fall in funding by 56 per cent. Saudi Arabia became the single largest recipient, as assessed by a July 2022 report from Fudan University’s Green Finance and Development Center.

In the first half of 2021, MOFCOM data revealed that China’s BRI investments cumulatively stood at $84.2 billion, while for the same period in 2022, the figure has fallen to $74.74 billion.

Further, with the energy sector accounting for a majority of BRI investments, Saudi Arabia was the single largest recipient in the first half of 2022. The oil-rich kingdom received $5.5 billion in this period.

The report added that the BRI was launched in 2013 by President Xi Jinping, and since then, nearly $932 billion has been spent on it.

Investment data for the BRI is difficult to assess, as there remain multiple structures and vehicles through which the funds are disbursed. As the British think-tank Chatham House assessed, there is a “lack of transparency around its funding.” However, the 2022 data suggest that there are new priorities for the BRI.

‘Temporary blip to investments in Russia’

The lack of BRI investments in Russia this year could be a consequence of the war in Ukraine. With China wanting to avoid western sanctions, it has tactfully avoided new BRI engagements in Russia this year, Christoph Nedopil Wang — director of Fudan University’s Green Finance and Development Center — wrote in the Financial Times.

While China hasn’t invested through the BRI in Russia this year, it has been purchasing far greater volumes of oil from the country. In May this year, Russia became China’s largest source of oil, replacing Saudi Arabia. Both state-run refining companies Sinopec and Zhenhua Oil have been purchasing discounted barrels from Russia.

China has also criticised international sanctions against Russia, and abstained from votes related to the war at the United Nations, while accusing the United States of provoking Russia into war.

Further, China invested nearly $125 billion in Russia between 2000 and 2017, including investments via the BRI. The two states also have had currency swap mechanisms for bilateral trade since 2014.

Overall, the China-Russia partnership stands on a strong footing. Prior to his invasion of Ukraine , Russian President Vladimir Putin classified the strategic partnership between the two as one with “no limits”.

While BRI investments may be on a limited scale for now, this blip is only “temporary”, according to Nedopil. In the long run, they will continue to flow into Russia from China.

CPEC temporarily on backburner?

When the BRI was launched in 2013, the CPEC (China-Pakistan Economic Corridor) was its flagship and most ambitious project. Described by scholar Claude Rakisits in the journal World Affairs as the ‘jewel in its crown’, it was supposed to be a one-stop solution for Pakistan’s energy, infrastructure, and economy. However, nine years of the CPEC have been marred by delays and controversies.

In 2022, the Green Finance and Development Centre report highlighted that Chinese investment in the CPEC fell by 56 per cent. Further, China’s investments in Pakistan had been decreasing even before this year. In 2021, Pakistan received $76.9 million for the quarter that ended in September, compared to $154.9 million for the same quarter in 2020.

“Chinese investments into the CPEC have been slowing down for a few years now. There are a few reasons for this. First, the initial surge of funding came in the first phase of the CPEC, when projects were announced between 2013 and 2015,” Sushant Sareen, a senior fellow at the Delhi-based think tank Observer Research Foundation, told ThePrint.

The next phase of investments was supposed to kick off after the completion of projects from round one. However, the inability to complete these projects and the ballooning budgets hindered future investments, added Sareen.

Protests by residents of Balochistan against the flagship Gwadar port project, violence against Chinese operators, severe project delays, payment defaults, losses, and a slew of corruption scandals have derailed the CPEC.

“Essentially, Chinese companies seem to be losing the appetite to invest in Pakistan.” However, given the close strategic ties between China and Pakistan, the CPEC will continue to get investments, albeit slowly. Consider the project to be on the back burner temporarily, said Sareen.

Saudi Arabia — BRI’s new pivot?

China and Saudi Arabia elevated their ties to a comprehensive strategic partnership in 2016. In 2021, the kingdom was also the largest supplier of oil to China. The two countries also held joint military exercises in 2019. Given the growing salience of bilateral ties, the kingdom has slowly become an essential part of the BRI.

In the first half of 2022, Saudi Arabia was the single largest recipient of investment from China at $5.5 billion. About $4.6 billion of this $5.5 billion investment was marked for oil and gas projects in the Gulf state. Further, the Green Finance and Development Centre report added that oil and gas investments accounted for nearly 80 per cent of the BRI’s funding for energy projects.

Further, the energy investments have also made Saudi Arabia the fourth-highest partner of energy engagements with China since the BRI was launched in 2013.

Looking at the larger geopolitical picture, “Saudi Arabia’s relationship with the US is anything but warm. Sensing an opportunity to solidify its position in the region, Beijing has shifted the funding focus of BRI to ride the geopolitical trades,” a report in Asia Times explained.

For China, the BRI is a tool to increase its presence and prominence. And — beyond the economics of energy — the pivot to Saudi Arabia is just that, said Sareen.

No comments:

Post a Comment