U.S. Secretary of State Michael Pompeo began the week in London, where he celebrated a win against China.

Standing next to U.K. Foreign Secretary Dominic Raab, Pompeo applauded Britain’s decision to ban Huawei's 5G gear and declared he wanted to build a “coalition” that understands the “threat” China poses.

The next day the U.S. ordered China to close its consulate in Houston, a move Beijing blasted as “unprecedented escalation.” Asked about the closure at his next stop in Denmark, Pompeo responded that Washington would act to protect American interests.

The secretary of state was then in California at the presidential library of Richard Nixon, whose 1972 trip to China is credited with opening relations. In a speech there, Pompeo cast competition with China as a struggle between right and wrong, hearkening to language from the Cold War.

It has become increasingly clear the hawks in President Donald Trump's administration are in ascendance when it comes to China. Chief among those pushing policy toward its most antagonistic in decades is Pompeo.

The risk is that as Washington takes a more hostile posture it will bolster the more hawkish officials in Beijing who argue that China should also be more aggressive. A cycle of tit-for-tat escalation would serve neither country's interests.

Beijing has already pledged to respond to the closure of its Houston consulate with firm countermeasures. Many, including former Australian Prime Minister Kevin Rudd, believe that means the U.S. will likely be told to close one its five consulates in China.

But Hu Xijin, editor of the nationalistic-leaning Global Times newspaper, suggested in a post on Chinese social media that Beijing might move to inflict more pain on the U.S. than just closing one of its consulates. That could include reducing the number of American diplomats allowed to work in Hong Kong, he postulated.

How China decides to respond will say much about whether the hawks are ascendant in Beijing, as they are in Washington.

Cyber Attacks

In explaining the order to close the Chinese consulate in Houston, the U.S. cited the need to "protect American intellectual property and American's private information." And while the State Department made no reference to any specific case, its explanation came hours after the U.S. Justice Department released an indictment accusing two Chinese nationals of committing cyber attacks on Beijing's behalf. The duo of college classmates is accused of engaging in criminal hacking to steal trade secrets and intellectual property for their own personal profit and of working to further the goals of China's Ministry of State Security. While the U.S. has issued indictments against Chinese hackers in the past, this was the first time that Washington has accused Beijing of providing safe haven to criminals in exchange for assisting the state. It also highlights a notably more aggressive American stance when it comes to technology theft, which has also included seeking the arrest of Chinese students at U.S. universities for alleged military ties.

Resurgent Infections

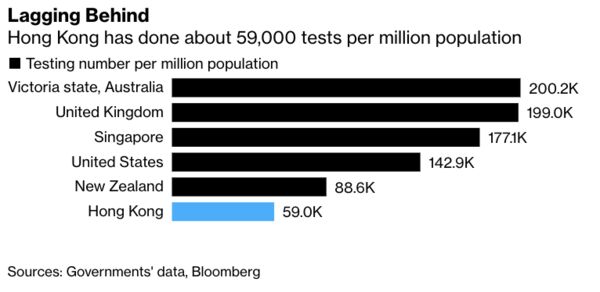

Hong Kong was widely lauded for the deftness with which it handled earlier waves of Covid-19 infections. The city quickly shut schools, closed government offices and enforced social distancing measures. But now it seems those earlier successes have returned to haunt it. The city has recorded about 600 infections in the past seven days. Worryingly, authorities haven’t been able to identify the source for many of those cases. Many experts have pointed to the effectiveness of Hong Kong's previous measures when explaining this resurgence, noting that residents may have been lulled into a sense of false security and prematurely let their guard down. The city also failed to use that intervening period to better prepare. Hong Kong’s ability to quickly test its population, for example, now trails many other jurisdictions.

Financial Decoupling

One of the most sought-after Chinese IPOs in years isn’t going to New York. Ant Group, China’s largest electronic payments company and the crown jewel of Alibaba’s sprawling empire, will instead sell shares for the first time on exchanges in Hong Kong and Shanghai. That adds to a wave of Chinese companies that have listed shares closer to home in the past 12 months. NetEase and JD.com, both already listed in the U.S., executed secondary listings in Hong Kong this year. Alibaba, which owns a third of Ant, did the same in late 2019. Ongoing tensions between Washington and Beijing, including the threat of forced de-listings, has left many Chinese companies feeling that their stock is undervalued on America's exchanges. Further deterioration in ties will only exacerbate that perception. There are exceptions, though. Chinese fintech firm Lufax, for example, is hoping to raise at least $3 billion in an IPO in the U.S. as soon as this year. But even Lufax notes that its plans could change depending on how tensions go.

Bad Options

Tiktok has been a fantastic success for Bytedance, the Beijing-based company that built the video app into one of the most promising franchises on the internet. It has become increasingly clear, however, that Chinese ownership of Tiktok will also be a hindrance to its future growth. President Trump, who said this month he's considering banning the app, has the power to cripple the company. His administration could, for example, put Bytedance on the U.S. entity list, which would compel American companies such as Apple and Google to drop TikTok from their app stores. That's why founder Zhang Yiming is being forced into a difficult decision. One option that's been suggested is selling TikTok to a group of venture capital firms, thereby making it into an American company independent of Bytedance. Another less likely option that's been floated could even see Zhang himself move to the U.S, running operations from California and making all of Bytedance an American company.

No comments:

Post a Comment