MICHAEL SPENCE

MILAN – Much economic commentary nowadays focuses on “divergence”: while broad equity-market indices are at or near all-time highs, much of the wider economy struggles to recover from one of the most severe downturns ever. Whereas the Russell 2000 is still down 5.4% year to date, the S&P 500 and the Russell 3000 have fully recovered to their pre-pandemic levels, and the Nasdaq, which tilts toward digital and technology companies, is up some 26%.

Many have concluded that the market is unmoored from economic reality. But, viewed another way, today’s equity markets may be partly reflecting powerful underlying trends amplified by the “pandemic economy.” Equity prices and market indices are measures of value creation for the owners of capital, which is not the same thing as value creation in the economy more broadly, where labor and tangible and intangible capital all play a role.

Moreover, markets reflect the future expected real returns to capital. When it comes to measuring the present value of labor income, there simply is no comparable forward-looking index. In principal, then, if there is a significant anticipated economic rebound, the outlooks for capital and labor income could be similar, but only capital’s expected future would be reflected in the present.

But there is more to the story. Market valuations are increasingly based on intangible assets, not least the ownership and control of data, which confers its own means of value creation and monetization. According to one recent study of the S&P 500, stocks in companies with high levels of intangible capital per employee have recorded the biggest gains this year, and the less intangible capital per employee companies have, the worse their stocks have performed.

In other words, incremental value creation in markets and employment are diverging. And while this was true even before the pandemic, the trend has now accelerated. There are at least two reasons for this. One is the rapid adoption of digital technologies as part of the response to lockdown measures. The second is that many labor-intensive sectors (which normally add value mainly with labor and tangible capital) have been partly or totally shut down as a result of lockdowns, social distancing, and consumer risk aversion.

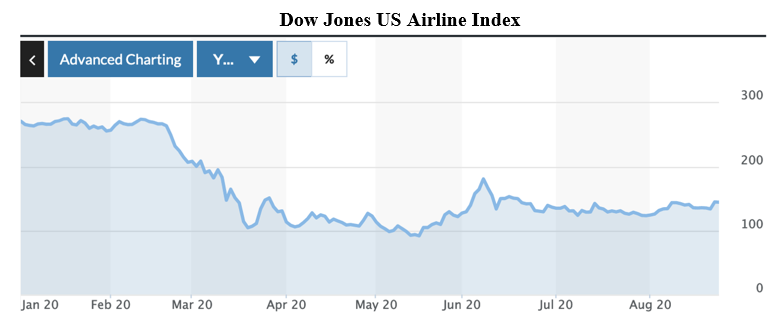

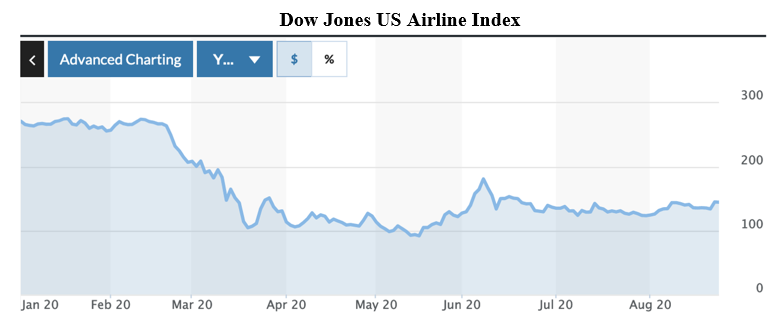

For example, the Dow Jones US Airline Index clearly took a large hit and has yet to recover. In normal times, this sector generates value mainly with tangible capital, labor, and fuel (though there are significant digital elements to its business, too).

To be sure, general market valuations have been supported by the US Federal Reserve and other major central banks’ interest-rate policies. In the current context, highly accommodative monetary policies are principally aimed at creating space for governments to use debt to finance large fiscal programs in response to the COVID-19 shock.

But while ultra-low interest rates may provide some general support for today’s market valuations, they do not account for the stark differences across sectors. After all, the part of the economy not represented by publicly traded stocks is also suffering (though there are, of course, private companies in digital sectors whose valuations and returns are similar to, or even higher than, the upper end of the intangible-capital spectrum in public markets).

The Green Recovery

Join our virtual sustainability event, September 16-17, for a series of in-depth discussions on the path to a green recovery, with an emphasis on biodiversity, energy, public investments, and financial and corporate governance.

More broadly, lower-income households and many small businesses with thin, fragile balance sheets have been left with no effective shock absorbers, and many of the labor-intensive sectors that generate significant employment in normal times (including hotels, restaurants, and bars) have been partly shut down. To address these trends, sovereign balance sheets are being used as a shock absorber for large swaths of the economy.

But not all swaths. Because the current crisis is actually boosting the value of certain companies, it is worth asking who owns the bulk of their stock. It certainly isn’t the private households and businesses whose balance sheets are too weak to serve as shock absorbers. Today’s high-valuation companies are owned by individuals and institutions with balance sheets that are already substantial enough to provide a cushion of economic resilience.

When the post-pandemic phase comes into view, labor-intensive sectors with lower intangible capital per employee may enjoy a period of outperformance as they bounce back. Yet even in this scenario, the economy’s digital footprint is likely to expand, and the underlying trend favoring intangible capital and its owners will continue.

It is not surprising that intangible-capital-intensive sectors would have an advantage. For the most part, their cost structures are abnormally tilted toward fixed costs and low or negligible marginal costs. This makes some platforms massively scalable, which in turn confers significant power in terms of pricing and market access.

One could draw a few conclusions from these economic realities. For starters, the pandemic economy has accelerated the pre-pandemic trend favoring intangible-asset value creation through firms with relatively fewer employees. We can expect this trend to continue, albeit not at the heightened pandemic-induced pace. Traditional businesses will recover, but the disconnect between value creation across firms depending on intangibles per employee will persist and remain a major economic and social challenge.

The idea that markets and the economy are diverging reflects a narrow focus on particular indices. But no single index can offer a useful summary of overall market, let alone economic, conditions and trends. And in the pandemic economy, equity-market indices obscure even more than they otherwise would, owing to the large divergences in economic outcomes across sectors and for the people who work in them.

Finally, given the outsize contribution of digital intangible assets to value creation, it is hard to see a way to reverse the trend of rising wealth inequality. Because the balance sheets of those lower down the income and wealth ladder are largely devoid of assets with high intangible and digital content, the rewards of current economic and technological dynamics will pass them by.

No comments:

Post a Comment