Ben Cahill, Allegra Dawes

The aim of the bipartisan and international CSIS Ukraine Economic Reconstruction Commission is to produce a policy framework that will help attract private sector investments to support Ukraine’s future economic reconstruction. To support the commission, CSIS will convene a series of working groups to examine a range of issue-specific areas that are critical for reconstructing and modernization of the Ukrainian economy, including in agriculture, energy, and transportation and logistics, as well as addressing the impact of corruption on private sector investment.

Introduction

Russia’s invasion of Ukraine has had far-reaching impacts on the global energy system. In Ukraine, a very different energy crisis is unfolding as Russia has directly targeted Ukraine’s energy infrastructure with waves of missile attacks, leaving the power grid severely damaged. These attacks have led to rolling blackouts across the country, worsening the humanitarian crisis.

Rebuilding Ukraine’s energy system will be essential to enabling both broader reconstruction efforts and the return of economic activity. There are two principles that should guide efforts to rebuild Ukraine’s energy system: (1) ensuring energy security and independence, and (2) deepening the connection and economic relationship between Ukraine and the European Union. To accomplish both, Ukraine should develop its potential renewable energy resources. Renewable energy, including wind, solar, and biomass, are abundant in Ukraine. Developing these resources will support domestic power generation, thereby bolstering Ukraine’s energy security and independence. Ukraine has ample potential to become an energy exporter after the war, thereby supporting the European Union’s decarbonization and energy security goals.

As with broader reconstruction efforts, the renewables sector will need substantial financial support from both public and private partners. Creating a market that can attract capital and compete with other countries pursuing renewable energy will require improvements to Ukraine’s renewable policy framework. Expanding renewable energy generation will depend on significant grid modernization efforts and greater storage and export capacity to manage variable generation across the system.

To successfully unlock the potential within Ukraine’s renewable energy sector, several key questions should be addressed:How can renewable energy help meet Ukraine’s future energy needs?

What projects should be prioritized in the near and medium term to enable the effective integration of renewables in the power sector?

What role can international institutions and donors play?

Renewable Energy’s Potential in Ukraine’s Future Energy Mix

The reconstruction of Ukraine’s energy sector will initially focus on repairing the damage done to the power grid and other energy infrastructure (such as pipelines for district heating networks, thermal power plants, and transmission networks) to ensure energy access for citizens and enable building efforts. Once these initial steps are implemented, continuing efforts to expand renewable energy should be prioritized in reconstruction.

State of Renewable Energy in Ukraine Prior to the War

Ukraine has significant potential to expand energy generation from renewable resources including wind, solar, and biomass. The International Renewable Energy Agency (IRENA) conducted a survey of Ukraine’s renewable sector and potential in 2015. Ukraine’s total wind power potential is between 16 gigawatts (GW) and 24 GW, with 16 GW considered economically feasible. Prior to the war, companies had significant wind capacity additions planned, with 91 turbines added in 2021. The most promising regions for solar development are in the southern and southwestern regions of the country, where solar irradiance is highest. IRENA estimates a total of 4 GW of feasible solar development potential in Ukraine. Biomass could increasingly be used for heating purposes across the country thanks to Ukraine’s plentiful agricultural resources.

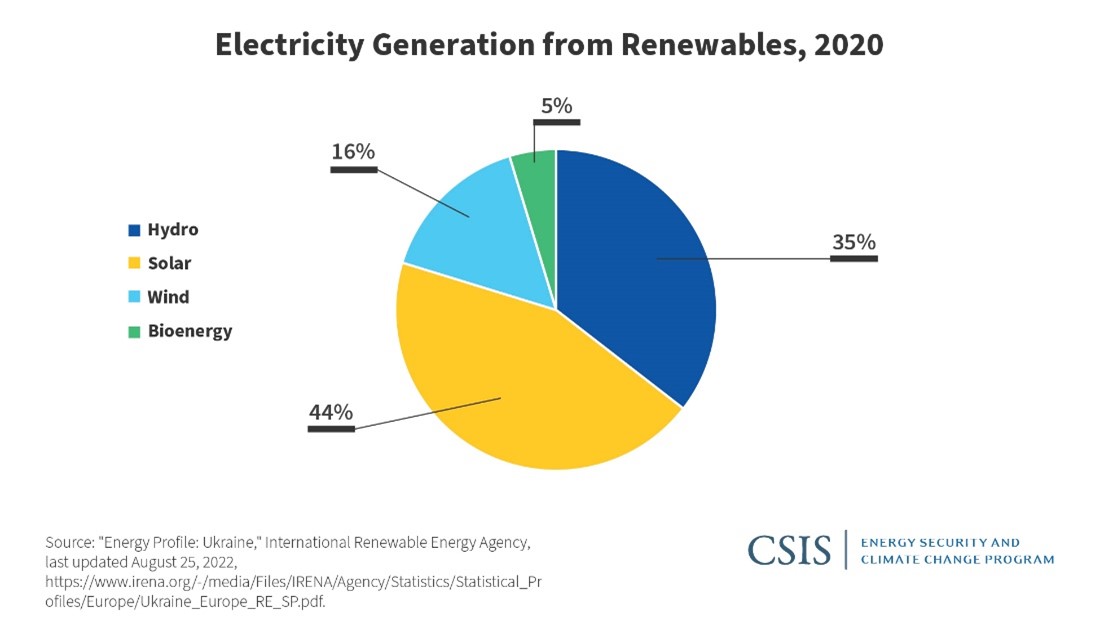

Prior to the war, Ukraine had seen substantial increases in renewable capacity and private sector investment. The Ukrainian government set a goal of sourcing 25 percent of its total energy mix from renewables by 2035. In 2009, renewables accounted for around 3 percent of Ukraine’s electricity generation mix; by the end of 2020, this share had increased to 12.4 percent. The figure below shows the mix of renewables in electricity generation in 2020, with the highest contributions from hydro and solar power. Hydropower plant capacity has remained relatively stable over the past 10 years, with all major hydropower plants belonging to the state-owned company UkrHydroenergo. The renewable increase has been driven by wind and solar additions with some biomass production coming online in more recent years.

The rapid expansion of renewable energy sources (RES) was driven by the adoption of a feed-in tariff (FIT) in 2009. The policy led to a surge of private sector investment, as the FIT in Ukraine was one of the highest across Europe. Under the FIT policy, energy produced from renewable sources could be sold to the guaranteed buyer, a state-owned enterprise created when Ukraine liberalized its electricity market. The guaranteed buyer would then sell the purchased electricity at market prices (lower than the tariff). The policy proved to be unsustainable, with the guaranteed buyer unable to meet payment obligations to renewable energy generators starting in 2019. While Ukraine had begun to reform the policy surrounding renewables prior to the war, significant steps will need to be taken in postwar reconstruction to attract and sustain investments in the sector.

The Postwar Landscape

Ukraine has outlined plans that would significantly ramp up renewable generation capacity in the reconstruction effort. The Ukraine National Recovery Plan, presented in July at the Lugano conference, includes around $130 billion in spending (equivalent to 65 percent of Ukraine’s GDP in 2021) to achieve energy independence and develop green energy over two reconstruction phases (2023–2025 and 2026–2032). Renewable energy is emphasized in the second phase, with a target of an adding 5 to 10 GW of solar and wind capacity ($15 billion), localizing RES equipment production ($2 billion), building 30+ GW of RES for hydrogen production ($38 billion), and constructing smart grids ($5 to 10 billion). The scale of these targets is ambitious to say the least.

Unfortunately, the highest potential for renewable energy is concentrated in regions that have been or are currently under Russian control. Developing renewables, particularly wind and solar, depends on Ukraine successfully recapturing these territories. The level of destruction across these regions could impede any new investment or development, as enabling infrastructure such as roads and grid networks may need to be rebuilt. Current installations may also have been damaged. Around 66 percent of solar and wind installations are in five regions: Odesa, Zaporizhzhia, Mykolaiv, Kherson, and Dnipro. These sites may require additional maintenance and repair as Ukraine retakes territory.

Significantly expanding generation capacity will occur in the later stages of reconstruction, but projects and initiatives in earlier stages will contribute to expanding green energy. Prior to the war, the rapid increase in renewable generation capacity caused grid imbalances and a growing need for balancing capacity and storage. The Ukrainian government had estimated that the grid would require around 2 GW of new peak-generation capacity and about 500 megawatts (MW) of energy storage capacity by 2025. Initial projects in grid-scale battery storage had seen significant private sector and international involvement prior to the war. DTEK, the largest private investor in Ukrainian renewables, completed a 1 MW storage project in the city of Energodar at the beginning of 2022, with the support of Honeywell and SunGrid. Creating further partnerships between Ukrainian renewable and grid companies and U.S. and other international companies can further the country’s reconstruction plan.

Expanding renewable energy will also depend on the interconnection and export capacity between the Ukrainian and EU electricity grids. Integrating the Ukrainian grid with Europe’s will be an ongoing effort both during and after the war. Following emergency synchronization of the two networks at the beginning of the war, Ukrenergo (the Ukrainian grid operator) and ENTSO-E connected their grids, but interconnection levels remain low. In the Ukraine Recovery Plan, the country hopes to reach a transfer capacity between Ukraine and Europe of 3.6 GW by 2030 and 6.2 GW by 2040. Expanding interconnection will depend on rehabilitating the Rzeszow-Khmelnytskyi line between Ukraine and Poland and upgrading segments of the Ukrainian grid to meet European energy regulations.

Rolling out renewable generation will enable Ukraine to support the European Union’s climate ambitions through green electricity exports. Before the latest disruptions in the nuclear energy sector, some 55 percent of power generation in Ukraine came from nuclear. Renewables can potentially displace coal and natural gas in the sector. Full integration with the European grid will require progress on both regulations and technology, underscoring the importance of clear steps forward throughout the war and initial reconstruction.

Enabling Renewable Energy: The Role of International Institutions and Private Sector Investors

Ukraine’s vision of a secure and green energy mix will require significant investment across the energy sector. But missed payments to energy producers under the FIT and revisions to the renewable energy policy environment had eroded investor confidence in the sector prior to the war. Ukraine will also be competing with many other countries aiming to expand renewable energy. Development finance institutions (DFIs) and multilateral development banks (MBDs) can help overcome these challenges. Three broad initiatives can support renewable development and investment in the sector:Use existing relationships to support renewable development.

Due to Russia’s attacks on Ukraine’s energy infrastructure, many governments and DFIs are already deeply involved in the Ukrainian energy sector. For instance, the S. Agency for International Development (USAID) has headed efforts to provide emergency relief such as generators and fuel supplies and delivered essential equipment for grid repairs. The G7 established a working group focused on Ukrainian energy security to coordinate equipment deliveries and financial aid to the sector. The relationships between these institutions and Ukrainian energy companies (both state-owned and private) should act as the basis for further energy reconstruction activities. Creating a working group on the renewable energy sector could enable partnerships between Ukrainian and Western companies and better coordinate reconstruction efforts.

Establish a strong domestic policy framework.

Prior to the war, Ukraine’s FIT resulted in rapid expansion of renewable generation capacity. While the FIT helped expand renewable energy generation, by 2020, the accumulated debt of the guaranteed buyer to RES producers reached €500 million ($531 million). Several revisions to the FIT reduced the payment levels retroactively, hurting investor confidence. The risk of corruption in the sector has also been highlighted due to the significant involvement of several prominent businesspeople in the sector.

In 2019, Ukraine adopted Law 2712-VII, “on promotion of competitive conditions for producing electric power from alternative energy sources,” which introduced auctions as an additional policy support for the renewable sector. The proposal sought to address the overly burdensome FIT policy and to provide greater control over the amount of RES added annually to ensure grid stability. Renewable energy project bids, including by price offer (in euros per kilowatt hour) and project size (kilowatts), would be submitted through the ProZorro.Sales electronic system, with the winning bids selected by price offer. Auctions were to begin in 2020, but the program ran into delays under the Zelensky administration, and no auctions occurred before the war. After the war, transparency surrounding auctions will provide investors with a clear view of the timing and size of the annual auctions, helping to build trust in the sector.

In the first years of the reconstruction effort, it will be important to ensure the solvency of the FIT as well as clear communication between the guaranteed buyer and RES producers. FIT payments have paused during the war, and committing to timelines for FIT repayment and investor guarantees on pricing levels will improve investor confidence.

Leverage DFIs to streamline financing and enable public-private partnerships.

International funding has long been an important source of capital for Ukraine’s energy sector. To unlock private sector investment potential in the renewables sector, development banks will play an important role. MDBs can provide essential loan and risk insurance products to enable both short- and long-term investments. This involvement would build on experience in the country. The European Bank for Reconstruction and Development (EBRD) has played an important role in the renewable and broader energy sector in Ukraine. In 2009, the bank launched the Ukraine Sustainable Energy Lending Facility (USELF) to support hydro, biomass, wind, and solar projects. The program provides loan-based funding as well as technical consultants and training to enable project development. More recently, the EBRD offered €149 million ($158 million)to Ukrenergo to upgrade Ukraine’s power transmission system and further efforts for synchronization with the European grid. Lessons from these previous projects can be used to tailor interventions during reconstruction, including pairing funding instruments with opportunities for technical consultation and input. Institutions with expertise in the Ukrainian energy sector should partner with Ukrainian and international actors to target project funding and provide technical support where necessary.

U.S. development banks will also be important partners for investors in the renewable energy sector. USAID has developed significant experience in the Ukrainian power sector after leading U.S. efforts to provide aid during the war. Fostering partnerships with the United States and other Western countries to relieve immediate power sector damage can translate into effective partnerships for rebuilding. The U.S. International Development Finance Corporation (DFC) has also increased its activities in Ukraine and Eastern Europe; by October 2022, the organization had more than a dozen projects in the country, amounting to $700 million in value. The DFC can provide technical assistance grants and feasibility studies to accelerate project identification, planning, and funding. Political risk insurance can also help to reduce project risk for investors. The DFC offers political risk insurance that covers up to $1 billion in losses caused by political violence, including war, terrorism, and hostile actions by national or international forces. This support will likely be essential throughout reconstruction to attract investment and manage project risk.

Europe will play a significant role in the reconstruction of Ukraine as the country moves along the EU ascension process. Identifying areas for cooperation between U.S. agencies and finance instructions and their European counterparts will be important. These initial plans and relationships should be developed today.

Conclusion

Expanding renewable energy generation in Ukraine can bolster energy security and further Ukraine’s integration with the European Union. Rebuilding Ukraine’s energy system will be a time- and capital-intensive process. Attracting investment into the renewable sector will also require improvements to domestic policy surrounding renewables. While the war continues, international partners and Ukrainian leaders can identify projects that will strengthen the power grid through storage capacity expansion and interconnection with the European Union. The work being done to address the ongoing destruction of Ukraine’s grid can set the foundation for the longer-term reconstruction of the energy sector, while donor coordination and the expertise of different DFIs and MDBs will be invaluable for the renewable energy sector in Ukraine. Work on reforming and improving the renewable sector should begin today.

No comments:

Post a Comment