Kjeld van Wieringen

With the EU preparing a ‘chips act’ to reinforce its semiconductor sector, what are the challenges that will need to be addressed – and what are the potential consequences of failing to act?

In response to previous chip shortages, the proposed European chips act aims to mobilise €43 billion in 'policy-driven investment' to reinforce the EU's semiconductor capabilities by 2030. At the same time, equivalent strategies in the US, China, South Korea and Japan likewise aim at ramping up investment in their own chip sectors. What must the EU do to keep up, and what are the best- and worst-case scenarios for European semiconductor futures?

Answers to this question were provided through a survey, a workshop and interviews with over a dozen European semiconductor policy experts deeply involved with advising policymakers on these issues. Their expectations, hopes, fears and geopolitical insights will shape the potential continuity, rise, decline or collapse of EU semiconductor capabilities and supply security by 2030, as well as indicate the key challenges that will determine which of these scenarios may become reality. These findings were originally prepared for and recently published by ESPAS, the EU's shared foresight cooperation framework, in a paper titled 'Global Semiconductor Trends and the Future of EU Chip Capabilities'.

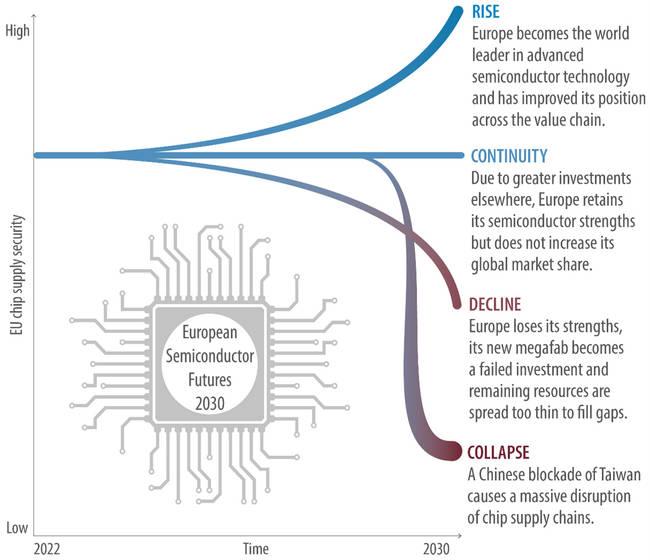

Figure 1: Potential EU semiconductor futures for 2030

CreditEPRS design with scenarios from survey, workshop and exchanges with semiconductor policy experts

CreditEPRS design with scenarios from survey, workshop and exchanges with semiconductor policy expertsIn the expected Continuity scenario for 2030, Europe’s share of global chip production would remain at a similar level to now due to greater investments elsewhere. This means European semiconductor capacities would still double together with the global chip sector growth projection for this decade, but not quadruple as intended by the chips act. Europe would also gain a small manufacturing capacity for leading-edge chips, strengthen its global market position in advanced semiconductor technologies and remain a global leader in equipment, (chemical) inputs, automotive chips and research for innovative chip design and applications.

In the hoped-for Rise scenario for 2030, Europe would be the world leader in R&D for cutting-edge semiconductor technologies and would dominate chip innovation in new fields such as 6G; AI; cloud-, quantum- and edge computing; and self-driving cars. Europe would lead the equipment and design segments and further increase its global market share in chemical input production. Through its unparalleled technological IP development as a world-class innovation hub, Europe would create new markets for microelectronics. Europe would also have led the way in fostering semiconductor partnerships across the world, thereby successfully mitigating some of its critical foreign semiconductor dependencies. Europe would foster, attract and retain local and global talent and skilled workers for its semiconductor production and design ecosystem through favourable conditions and educational opportunities. Private investments would provide the capital needed to fund expanding innovation by Europe’s centres of excellence and scale-ups among SMEs and start-ups. Europe would also have managed to attract leading foreign chip manufacturers to invest in it, thus seeing the emergence of green and state-of-the-art chip megafabs in Europe. At least some production capacity would be available on European territory at every part of the semiconductor value chain. EU chip revenue would account for over 20% of the world's semiconductor value chains.

In the feared Decline scenario for 2030, the EU’s position in the global semiconductor value chain would become weaker and more insecure due to a loss of strengths, a failure to fill gaps, waste of resources and sporadic disruption of access to foreign-produced chips. A growing lack of EU semiconductor manufacturing and design capacity would have caused an emigration of talent from Europe. R&D would slow down and knowledge would drain out of Europe as certain key research facilities opted to relocate abroad. A lack of talent, high manufacturing costs and choking regulations would have motivated key Western chip manufacturers and start-ups to invest and establish facilities in the US and Asia instead. A new partially EU-funded semiconductor megafab would have failed to meet expectations and become economically unviable due to serious technical problems, environmental issues and a lack of demand for its chips. The many dispersed injections of remaining funds to fill a myriad of gaps would be spread too thin to enable individual start-ups and initiatives to take off. Europe would lose market shares in production segments previously considered its strengths, including in the manufacturing of equipment, input materials and automotive chips. With its centres of excellence weakened, Europe would now risk falling behind in every part of the semiconductor value chain.

In the alarming Collapse scenario for 2030, a six-month Chinese naval and air blockade of Taiwan would cut the world off from Taiwanese chip exports. The blockade would be the result of a military stand-off between the US and China following years of growing tensions in the Taiwan Strait. China would have prepared for the event through semiconductor stockpiling, in addition to greatly expanding its domestic trailing-edge chip production in the preceding decade. While threatening sanctions against China, with its stockpiles dwindling, the EU would be forced to continue importing Chinese chips to keep European industries running. The global high-end electronics sector would be the hardest hit, as it is the most reliant on the cutting-edge chips still produced mainly by Taiwan's TSMC. Severe shortages and delays would also occur in the automotive and other industries that require less advanced trailing-edge chips, of which Taiwan also produces a large share. The blockade would eventually be lifted after UN-mediated negotiations between China and the US, but not before causing a severe global recession. As tensions lingered, the risk of another significant disruption occurring in the following decade would remain, thus spurring a vast wave of government-led semiconductor reshoring and import substitution efforts across the world.

If Europe is to be successful, it needs to work to improve its attractiveness as a semiconductor investment destination in competition with other regions

Europe's ability to deal with certain challenges will make or break the future of the EU chip sector, and determine which of the scenarios above may become reality. Many of the key factors that semiconductor policy experts indicated would shape the level of success of the EU's semiconductor sector by 2030 related to investment. If Europe is to be successful, it needs to work to improve its attractiveness as a semiconductor investment destination in competition with other regions. Investments would also need to be geared towards reinforcing existing European semiconductor strengths in equipment manufacturing and design. Gaps in EU chip capabilities would also need to be addressed as much as possible within the available means, without spreading resources too thinly. Another key challenge is to ensure a sufficient level of investment in R&D capacity, and to provide venture capital for innovative SMEs and start-ups. To avoid inefficiencies related to the duplication of efforts between countries, coordination of semiconductor investments among member states would also need to be enhanced. A final key investment challenge concerns identifying the right semiconductor market trends to put money into.

A second group of challenges concerns input and demand. One issue is how to achieve a qualified workforce and sufficient talent pool to further develop Europe's semiconductor sector. A quadrupling of EU chip manufacturing would also require a fourfold increase in training and academic enrolment in microelectronics; such talent needs to be attracted and retained. Semiconductor input manufacturing needs raw materials, and the challenge of securing access to them is complicated by China’s relative dominance in their supply. A demand-side challenge concerns how to involve and further develop end-user industries to inform policies and build local demand for cutting-edge chips. Another issue is how to avoid semiconductor investments causing overcapacity in chip production, which would result in falling prices and a lack of return on European chip investments.

A final group of challenges relates to external and environmental factors. To reinforce its chip sector, for instance, Europe will need to identify useful international partnerships with key actors like the US, Taiwan, Japan and Singapore to cooperate on semiconductor investment, research and supply security. Another challenge here is how to properly protect Europe’s intellectual property while still remaining open to collaboration with third countries. Another key overarching challenge will be raising the EU's level of preparedness and semiconductor supply security in the face of possible future external shocks related to US–China geopolitical tensions, natural disasters, pandemics and other potential external disruptions. Finally, ensuring that semiconductor sector development is environmentally sustainable and an enabler for the green transition presents an important additional challenge.

The ability of European policymakers and semiconductor stakeholders to jointly address these challenges will in large part determine the future strength and resilience of Europe's chip sector and supply security, and decide which of the discussed scenarios becomes reality.

No comments:

Post a Comment