Nathaniel Sher

Two global shocks—the Russia-Ukraine war and the U.S. Federal Reserve’s interest-rate hiking cycle—explain the recent momentum behind RMB internationalization. Beijing is promoting the RMB to insulate itself from U.S. sanctions, reduce exposure to foreign exchange rate fluctuations and ultimately gain the prestige of a great power with a great currency. Nevertheless, in the near term, the Chinese Community Party (CCP) is more interested in de-dollarization than RMB internationalization. The government remains highly attuned to the risks associated with capital-account liberalization, including capital flight and exchange-rate volatility. For this reason, Beijing is elevating the RMB in a gradualistic fashion: first promoting the RMB as a medium of exchange for cross-border trade settlement and, then gradually expanding capital-account convertibility to facilitate the long-run development of the RMB as a reserve currency. In short, RMB internationalization remains a work in progress.

Promote RMB Internationalization in an Orderly Manner

Over the past decade, the path of RMB internationalization has been neither steady, nor orderly. The first wave of RMB internationalization began during the global financial crisis, when the U.S. credit crunch created a global dollar shortage. Starting in 2009, the People’s Bank of China (PBOC) began extending currency swap lines to the central banks of China’s major trading partners, thereby reducing the risk of liquidity shortfalls. In 2011, Chinese regulators announced a pilot program to allow Qualified Foreign Institutional Investors (RQFII) to invest in domestic securities (People’s Daily, December 19, 2011). In 2015, the PBOC allowed full access to the interbank bond market for long-term investors. These reforms ultimately led to the Renminbi’s inclusion in the International Monetary Fund’s Special Drawing Rights (SDR) basket in 2016 (PBOC, September 2022).

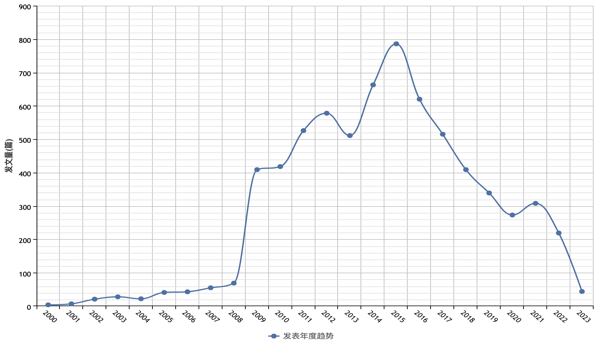

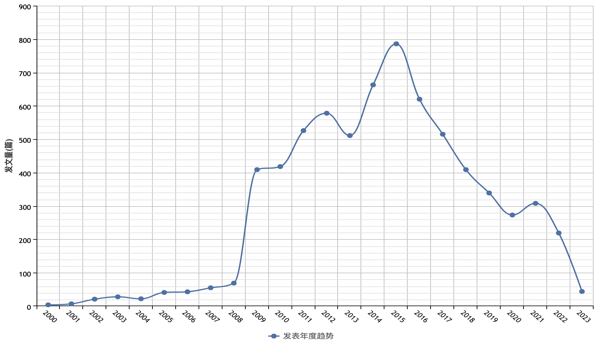

Events leading up to the 19th Party Congress in 2017, however, diminished the government’s confidence in RMB internationalization. China’s yuan devaluation episode in 2015, which necessitated renewed capital controls for domestic investors, highlighted the risks of capital account liberalization (South China Morning Post [SCMP], September 13, 2015). Xi’s 19th Party Congress work report then completely omitted any reference to “RMB internationalization” (Xinhua, October 27, 2017). A keyword search on CNKI illustrates that usage of the term “Renminbi internationalization” in Chinese journals, periodicals, and books peaked in 2015, falling precipitously thereafter (Figure 1). Nonetheless, at the 20th Party Congress last October, Xi Jinping reintroduced the phrase “promote RMB internationalization in an orderly manner” (有序推人民币国际化) into the Party’s lexicon (Sina, October 25, 2022). Figure 1. Frequency of journal articles, periodicals, and books in the CNKI database mentioning “renminbi internationalization” (人民币国际化). 2000–2023

Figure 1. Frequency of journal articles, periodicals, and books in the CNKI database mentioning “renminbi internationalization” (人民币国际化). 2000–2023

Figure 1. Frequency of journal articles, periodicals, and books in the CNKI database mentioning “renminbi internationalization” (人民币国际化). 2000–2023

Figure 1. Frequency of journal articles, periodicals, and books in the CNKI database mentioning “renminbi internationalization” (人民币国际化). 2000–2023De-dollarization or RMB Internationalization?

Two major shocks have driven Beijing’s renewed interest in RMB internationalization: the Russia-Ukraine conflict and the U.S. Federal Reserve’s recent run of interest-rate increases. While Chinese officials have long disliked their vulnerability to U.S. sanctions, the war in Ukraine crystallized Beijing’s concerns. The sanctions imposed on Moscow in February 2022 highlighted the growing risk of China’s reliance on dollar-denominated settlements and Western payments infrastructure. Chinese experts closely studied how the United States was able to freeze $300 billion worth of Russian reserves, prevent dollar-based trade in key sectors, and eject Russian financial institutions from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) (Sina, February 28, 2022). In February, the PRC Foreign Ministry released a report entitled “U.S. Hegemony and Its Perils,” claiming that “‘the United States of America’ has turned itself into ‘the United States of Sanctions.’” (PRC Ministry of Foreign Affairs [FMPRC], February 20).

In order to insulate itself from future sanctions, the Chinese government is not only promoting greater usage of the RMB in international trade, but also accelerating the construction of an alternative payments infrastructure, the Cross-Border Interbank Payment System (CIPS). According to the PBOC, by the end of 2021, 1,259 foreign and domestic institutions were linked with CIPS, a six-fold increase since its launch in 2015 (PBOC, September 2022). China views the development of an indigenous payments system as necessary because even transactions conducted via SWIFT that are denominated in RMB can be detected by the United States, which jointly oversees SWIFT’s traffic data (SWIFT). Although CIPS functions primarily as an RMB clearinghouse and the bulk of its transactions are still communicated via SWIFT, CIPS role as an interbank messaging system could grow going forward (CSIS, May 2022). The use of CIPS as an interbank messaging system will not automatically render Chinese entities immune from U.S. sanctions or secondary sanctions, but it will make it more difficult for the U.S. Treasury Department to detect cases of sanctions evasion.

Second, the volatility of U.S. monetary policy has accelerated Beijing’s push to promote the RMB. Chinese policymakers have long lamented the fact that the policies of the U.S. Federal Reserve have an outsized impact on the global economy. In 2009, amid the global financial crisis, former PBOC governor Zhou Xiaochuan famously called for an international reserve currency “disconnected from economic conditions and sovereign interests of any single country” (BIS, March 23, 2009). Over the last three years, U.S. monetary policy has been particularly volatile. The yield on the 10-year U.S. Treasury bond rose from a low of 0.5 percent in 2020 to a high of 4.3 percent in 2022, following the fastest pace of Federal Funds rate increases since the 1980s (Caixin, April 22).

Amid this backdrop, Chinese commentators have grown increasingly frustrated with U.S. dollar dominance. Huang Zhuo, Assistant Dean of Peking University’s National School of Development, recently argued that “every time the Fed’s quantitative easing policy is withdrawn, there are exchange-rate or financial crises in emerging market economies” (Aisixiang, July 16, 2022). Throughout 2022, the Global Times constantly criticized the Fed for “exporting its own crisis to the rest of the world” (Global Times, June 8, 2022). In 2021, however, before the Fed began hiking rates, the Global Times criticized the Fed for its “unlimited quantitative easing,” calling it “one of the most radical monetary experiments in history” (Global Times, April 6, 2021; Global Times, October 17, 2021).

Finally, from a strategic perspective, Beijing resents the United States’ power of “seigniorage” (铸币税), which allows it to run trade and fiscal deficits without facing difficulties financing its military (PRC Ministry of Foreign Affairs [FMPRC], February 20). Add to this the fact that the size of China’s economy would exceed that of the United States if the value of the U.S. dollar reflected its purchasing power instead of global demand for the dollar (World Bank, 2021). In short, Beijing’s objective to globalize the RMB is interlinked with its interest in de-dollarization.

Preventing and Defusing Risks

Despite the Chinese government’s interest in de-dollarization, there remain limits to RMB internationalization. The scars of the 2015 devaluation episode remain imprinted on the minds of Chinese officials, when over $300 billion in reserves were spent to stabilize the RMB exchange-rate (SCMP, 2021). For Xi Jinping, “preventing and defusing risks” (防范化解风险) has become an important feature of Chinese governance (Sina, October 25, 2022). In the lead-up to the 20th Party Congress, the PBOC reiterated that “no systemic risk” (不发生系统性风险) is the “bottom line” (底线) of RMB internationalization (Jingji Ribao, October 9, 2022).

The Party recognizes that maintaining control over exchange-rate and interest-rate policy is necessary to ensure China’s financial market stability and export competitiveness. Unlike many Western central banks whose mandates include price stability, full employment, and financial stability, the Law of the People’s Republic of China tasks the PBOC with maintaining “the stability of the value of the currency” to “promote economic growth” (PBOC, December 27, 2003). While PBOC Governor Yi Gang recently claimed that “the RMB exchange rate is determined by the market,” he also noted that Chinese citizens are not allowed to purchase more than $50,000 per year in foreign exchange (BIS April 20, 2023). Such capital controls act as a buffer against downward movements in the RMB. Meanwhile, the purchase of foreign assets by the PBOC and state-owned banks prevents upward pressures on the RMB (Reuters, September 29, 2022). In 2022, net purchases of U.S. assets by Chinese investors remained robust, despite reductions in the mark-to-market value of the PBOC’s dollar reserves (Sina, March 6). Allowing exchange-rate fluctuations within a controlled range enables the PBOC to balance the risk of capital flight with the priority of export competitiveness.

Serving the Real Economy

In addition to preventing risks, the Chinese government wants to ensure that RMB internationalization furthers its domestic economic goals. As the PBOC writes, RMB internationalization must “serve the real economy” (服务实体经济) (Jingji Ribao, October 9, 2022). For the Party, the “real economy” consists of those sectors that enhance China’s strategic capacity such as manufacturing, science and technology and infrastructure (Qiushi, November 1, 2020). Conversely, the growth of sectors like real estate, fintech and e-commerce tend to be viewed as offshoots of “excessive financialization” (过度金融化), contributing to the “disorderly expansion of capital” (资本无序扩张) (Guangming Daily, September 7, 2021; Renmin Ribao, March 15, 2022; China Daily, April 30, 2022). Some Chinese economists also worry that promoting the RMB as a reserve currency could lead to the negative economic outcomes seen in the United States such as the “hollowing out of American industry” (美国产业空心化) (Sina, April 11).

According to the PBOC, therefore, RMB internationalization should be promoted only insofar as it opens up new export markets for Chinese firms, lowers transaction costs and minimizes exchange-rate fluctuations (Jingji Ribao, October 9, 2022). The goal, however, is not to turn China into a global financial center. From the early stages of RMB internationalization, current-account convertibility preceded capital-account convertibility (Financial Street Meeting Room, 2014). This explains why many of Beijing’s recent efforts to promote the RMB include agreements to strengthen cross-border trade settlement, as in the case of Brazil and the SCO, rather than attempts to further liberalize China’s capital account.

A Renminbi Reserve Currency?

In the long-run, however, the promotion of RMB-denominated trade will be curtailed by China’s lack of capital-account liberalization. In order to incentivize foreign firms and financial institutions to trade and hold RMB, they must have access to liquid, interest-bearing investments such as bonds and equities, as well as instruments to hedge their exposure such as futures and interest-rate swaps. Otherwise, companies will be unlikely to hold RMB in amounts above what they need for the purchase of intermediate goods from China and foreign central banks will only need to accumulate RMB as insurance against the exchange-rate risk of their own countries’ bilateral trade with China. The depth and breadth of U.S. dollar trading, on the other hand, beyond its role in cross-border trade, explains why the currency still accounts for more than 90 percent of foreign exchange transactions (BIS, December 5, 2022). Recent reports indicate that some Russian firms have been unable to adequately hedge their RMB exchange-rate risk due to insufficient access to RMB futures (Asia Times, April 20).

Beijing’s focus on the real economy, coupled with the risks of capital-account liberalization, explain why the government has prioritized the RMB as a means of payment over and above its use as an international store of value. While the government wants to insulate itself from U.S. sanctions and monetary policy, it does not want to risk financial instability or undermine export competitiveness. The result is that, for now, de-dollarization is the key driver behind RMB internationalization. Even so, globalizing the RMB will likely remain a long-term project, regardless of the near-term risks. As Nobel laureate Robert Mundell once quipped, “great powers have great currencies” (IMF, September 2009). For China, RMB internationalization is “not only a symbol of China’s economic rejuvenation, but also an international responsibility for the great rejuvenation of the Chinese nation (Aisixiang, October 29, 2022).”

Nathaniel Sher is a senior research analyst at Carnegie China, where he researches China’s foreign policy and U.S.-China relations. His writings have appeared in Foreign Policy, Wired, The Wire China, and ChinaFile. Nathaniel completed master’s degrees from Tsinghua University and the University of Chicago. Follow him on Twitter @nathaniel_sher.

No comments:

Post a Comment