FP Explainers

AI-driven GPU demand has pushed NVIDIA to become the first US chip maker to reach a valuation of $1 trillion. With this, NVIDIA will soon join the likes of Meta, Apple, Alphabet aka Google, Microsoft, and Amazon

Nvidia on Tuesday became the first chipmaking company to enter the elite $1 trillion club.

The past three trading sessions on Wall Street have seen Nvidia stock rise more than 31 per cent including a three per cent gain on Tuesday – though its market cap soon fell below that $1 trillion mark.

Apple, Alphabet, Microsoft and Amazon are all members of the $1 trillion club, while Meta is a former member.

But why is the share price of Nvidia, a company famed for making graphics processing units (GPUs) favoured by hardcore gamers, zooming?

Let’s take a closer look:

Experts say Nvidia is benefitting from the hype and craze surrounding Artificial Intelligence.

The stock’s value has tripled in less than eight months, reflecting the surge in interest in artificial intelligence following rapid advances in generative AI, which can engage in human-like conversation and craft everything from jokes to poetry.

According to CNBC, the company’s powerful chips are a favourite of researchers who use them to train and run advanced AI programmes.

“Training these programmes involves processing large amounts of data and performing complex mathematical computations. Nvidia’s GPUs excel in these tasks by efficiently handling parallel computations, which accelerates the training process,” the piece noted.

Another piece in CNBC stated that Nvidia’s GPUs a key component of OpenAI’s ChatGPT and Google’s Bard.

The Verge in a piece said that AI tools comprised the majority of recent Google I/O and Microsoft Build presentations, and noted Nvidia’s status as a ‘key supplier’ for such tech companies.

CNBC said all the tech giants have entered the AI race with budgets of tens of billions of dollars.

“A meaningful part of this spend will go to companies like Nvidia, which sell these chips supporting all this AI development,” the piece stated.

A piece in Indian Express stated that Nvidia has a lock on the market share for GPUs globally – a lead which is unlikely to wane in the near future.

The piece quoted experts as saying Nvidia is way ahead of its competitors due to its proprietary software.

It quoted Huang as saying, “You have to engineer all of the software and all of the libraries and all of the algorithms, integrate them into and optimise the frameworks, and optimise it for the architecture, not just one chip but the architecture of an entire data centre.”

The Verge also said that timing is playing a big part in Nvidia’s surge.

The frenzy surrounding ChatGPT had hit a peak when the company presented its latest report in February,

Company CEO Jensen Huang also pointed to the company’s data center growth, and the latest report showing a new record in data center revenue.

‘Most important company on planet’

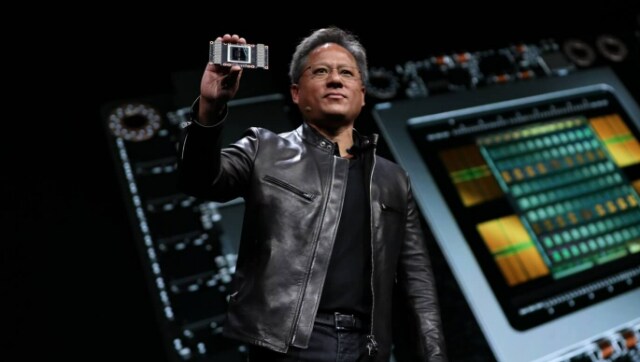

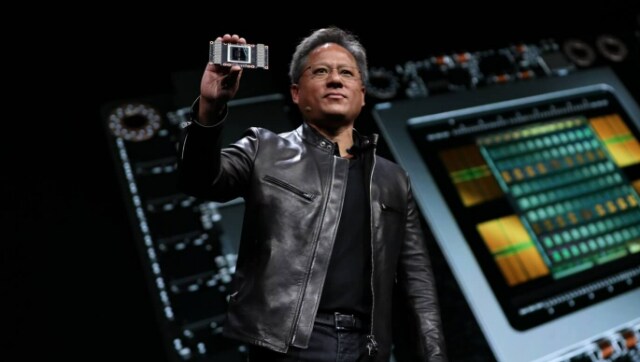

Nvidia has gained about 200 per cent since October, far outpacing any other member of the broad-market S&P 500 index. The rally has propelled its valuation past its peers, but some analysts say the AI boom means the stock should still be worth more. Nvidia’s CEO Jensen Huang

Nvidia’s CEO Jensen Huang

Nvidia’s CEO Jensen Huang

Nvidia’s CEO Jensen Huang“We view Nvidia as the most important company on the planet in an era that is rapidly changing towards one that will be emphasized by greater AI capabilities,” CFRA Research analyst Angelo Zino said.

The latest surge furthers a rally from last week, which was jump-started by a revenue forecast that surpassed the mean Wall Street estimate by more than 50 per cent, which some analysts called “unfathomable” and “cosmological.”

The highest price target values the company at about $1.6 trillion, on par with Google-parent Alphabet.

Nvidia’s forward price-to-earnings multiple (P/E), a common benchmark for valuing stocks, is 47.23. The figure is significantly above that of peers Qualcomm (QCOM.O) and Intel (INTC.O) and also tops the sector median of 18.09, according to Refinitiv data.

“While the company’s valuation looks lofty at the moment, we think Nvidia has the earnings firepower as the adoption of its AI GPU remains in the very early innings,” Kinngai Chan, senior research analyst at Summit Insights Group, said.

‘Shares are underpriced’

Big Tech companies have shifted focus to AI, hoping the technology will attract demand. The computers that power generative AI run on powerful chips called graphics processing units (GPUs) – of which 80 per cent are produced by Nvidia, according to analysts.

OpenAI-owned ChatGPT’s rapid success has prompted tech giants such as Alphabet and Microsoft to make the most of generative AI.

Nvidia, led by Huang, has pivoted to the data center market over the last few years after years as a powerhouse in videogame chips.

The company’s business rapidly expanded during the pandemic when gaming took off, cloud adoption surged and crypto enthusiasts turned to its chips for mining coins. Huang’s bet on AI is expected to fuel growth in the coming months.

Despite the sky-high valuation, analysts believe Nvidia’s AI chips business has room for growth as generative AI technology is still at a nascent stage with wide adoption expected in the years to come.

Last week alone, Nvidia’s shares rose about 25 per cent, sparking a rally in AI-related stocks and boosting other chipmakers. That helped the Philadelphia SE Semiconductor index (.SOX) close at its highest in over a year on Friday.

“Technical traders and AI mania have pushed Nvidia toward the $1 trillion cap and it is not inexpensive,” Argus Research analyst Jim Kelleher said.

With inputs from agencies

No comments:

Post a Comment