MOHAMED A. EL-ERIAN and MICHAEL SPENCE

India’s recent economic success, solid momentum, and promising prospects are making the country ever more influential both regionally and internationally. But the experience of other countries – most notably China over the last three decades – suggests that such rapid influence and robust progress can be tricky to manage. After all, an action that makes sense domestically may conflict with what other countries expect from a systemically important economy. By the same token, actions that make sense internationally could complicate domestic economic progress.

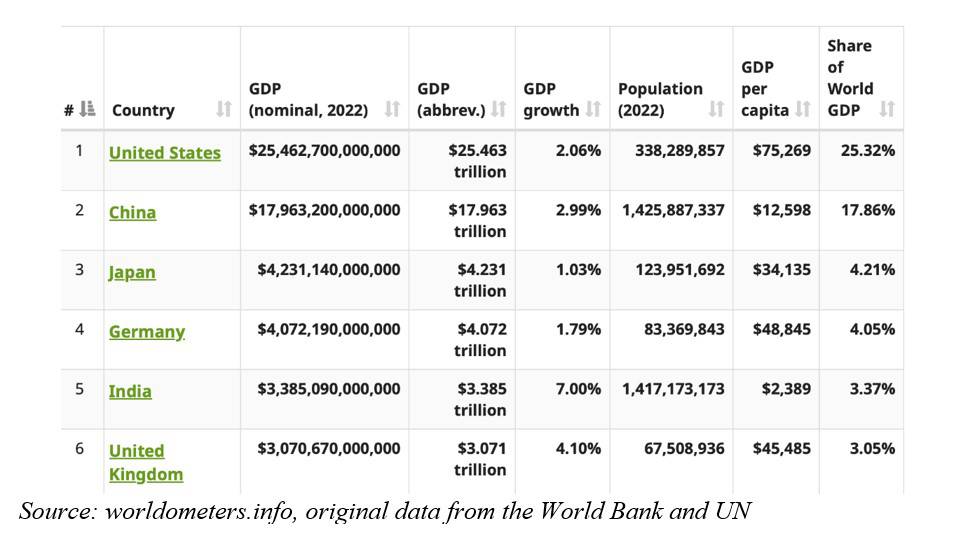

Like China, India’s systemic importance has become apparent earlier in its growth and development process than was the case with other emerging economies, primarily because it boasts the world’s largest population (over 1.4 billion). Its growing presence is easy to detect. It is the world’s fifth-largest economy, and with an annual growth rate 5-6 percentage points above that of Germany and Japan, it could well move into third place in about four years.

Relative per capita incomes paint a different picture, however. India’s per capita GDP, at $2,389, is still far below the level of high-income economies, and remains considerably lower than that of China. In terms of overall economic size and income levels, India is roughly where China was in 2007, nearly a generation ago.

Adjusting for differential price levels – the so-called purchasing-power-parity adjustment – lower and lower-middle-income countries tend to move up in relative size. With the PPP adjustment, India is already in third place, at about half the size of the US economy.

POISED FOR CONTINUED GROWTH

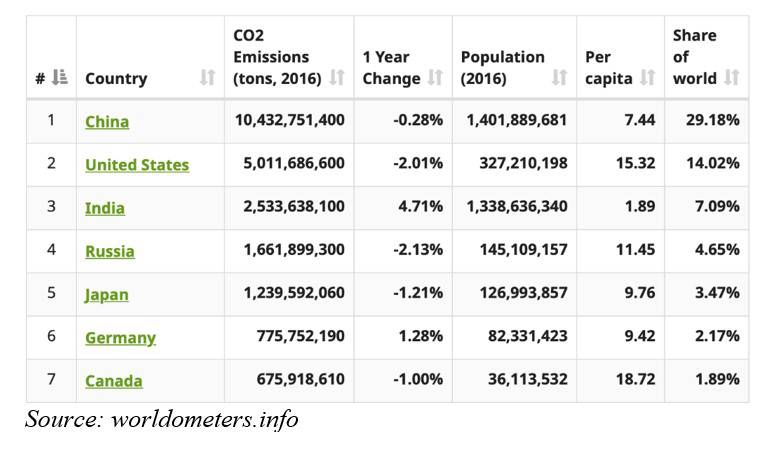

Carbon dioxide emissions, another dimension of global impact, paint a similar picture. India ranks behind only China and the United States in terms of overall CO2 emissions. But this, again, is a function of its large population; its per capita emissions are still quite low, at 1.89 metric tons, well below the global average of 4.66 metric tons.

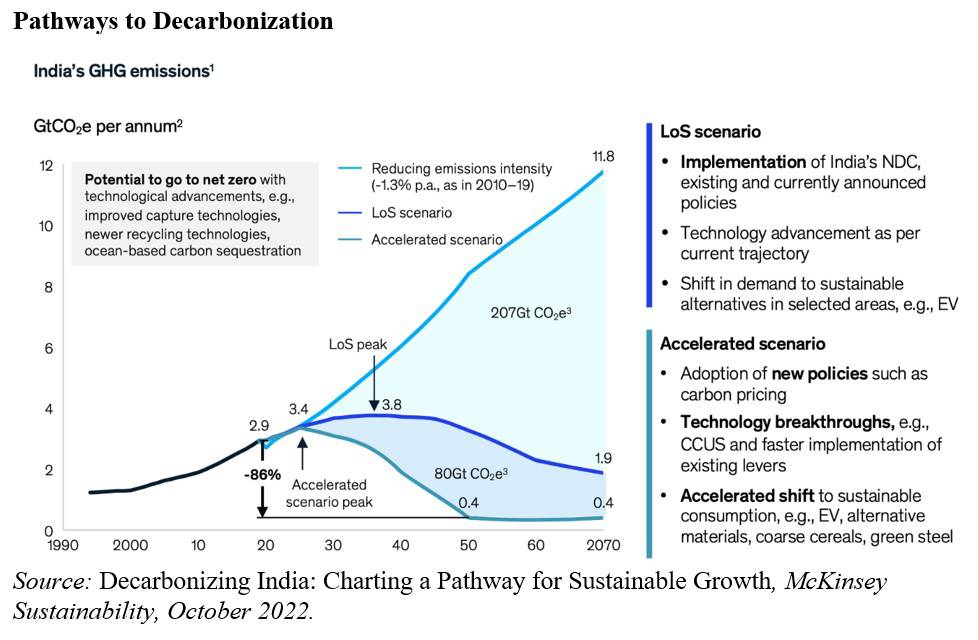

Moreover, India already has plans to reduce its emissions. The chart below, from a 2022 McKinsey Sustainability report, depicts alternate decarbonization pathways that it could take. The “line of sight” (LoS) scenario (the royal blue line) reflects the anticipated adoption of existing technologies, policies, and commitments that have already been implemented or announced, whereas the accelerated scenario captures further-reaching measures such as carbon pricing and carbon capture, utilization, and storage (CCUS).

But even the LoS scenario seems very aggressive to us. With overall CO2 emissions peaking in the mid-2030’s, and with 7% annual growth in the interim, it will be achieved only if the carbon intensity of the economy declines at an equally rapid pace. But over the past decade, McKinsey notes, India’s carbon intensity declined at a rate of 1.3% per year. If India manages to stay on the LoS path, its per capita CO2 emissions would peak at 2.71 metric tons – something that has never been done before. It will be difficult to stay on this path, and India will most likely face growing sustainability-related global pressure, as has been the case for China.

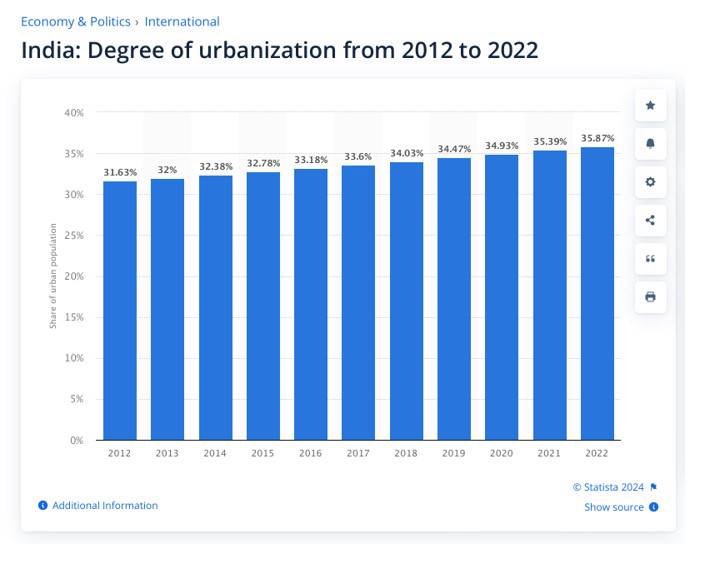

In the meantime, India’s urbanization, which is already moving at a steady, moderate pace, will likely pick up as more people pursue employment in industrial sectors.

China plays an important role in India’s recent growth story. Its high middle-income levels imply that it was destined eventually to shed labor-intensive manufacturing and assembly jobs. But that process has been accelerated by the rapid diversification of global supply chains, owing to various economic shocks and geopolitical developments. Most likely, there will be demand-side inducements for India to expand its tradable sector, with manufacturing for export providing employment opportunities for lower-income people in rural sectors.

Apple, for example, is expanding iPhone assembly in India, in collaboration with partners like the Taiwanese manufacturer Foxconn. India already accounts for 7% of iPhone production, and much of that is for export. That said, net foreign-direct-investment (FDI) flows into India declined sharply in the current fiscal year, and it remains to be seen whether there will be a wave of export-driven investment in manufacturing sectors.

Finally, India also already has a thriving digital and financial sector. With a large and growing domestic economy, it has a natural advantage in large-scale digital innovation, owing to the fact that such technologies tend to have relatively high fixed costs, but low variable costs.

As with manufacturing, recent developments in China bear on this issue. Owing to changes in China’s economic and governance model, along with its deteriorating relations with some advanced economies (most notably the US), external capital has been leaving, leading to an influx of capital into India. If not managed carefully, these inflows could complicate economic policymaking by impacting the currency and competitiveness.

CAUTIONARY TALES

With India expected to remain the world’s fastest-growing major economy, policymakers face the increasingly complex challenge of balancing external and internal interests, while still maintaining the country’s growth and development trajectory. Multinational corporations have also faced this dilemma when considering whether and how to change where they operate. Judging from the recent experience of Big Tech companies like Google and Meta, such changes can create many operational and reputational challenges.

Whether the lesson comes from China or Big Tech, India should heed it. Recent history shows that the necessary internal course corrections, as well as the ability to shape international perceptions, can come late or be insufficient. As a result, a country’s (or a company’s) secular transformation can end up being more complicated than it needs to be.

This is not just about India playing defense to manage the growing international expectations that come with increased regional and global influence. It is also about playing offense. The Indian economy is reaching the point where maintaining reliable access to international markets is not just valuable but also important as a development priority.

One of India’s major challenges is to avoid the error that both China and Big Tech made when they failed to recognize their newly acquired global influence and adapt accordingly. In China’s case, policymakers remained too narrowly focused on their domestic development agenda as the country was becoming more systemically important. By the time China woke up to the external realities associated with a growing global footprint, it was already getting serious pushback from other countries. These responses piled up and ultimately created major complications – including by exacerbating domestic challenges – which could now derail, or at least hamper, China’s impressive development journey.

Big Tech also did not anticipate the tipping point where the pursuit of its vision of exciting transformational innovations became a source of system-wide, global disruptions. Among the most vivid illustrations of this was Facebook’s failure to understand the potential for, and the need to counter, election interference in 2016. The scandals over how its platform was used during that febrile period triggered regulatory and political reactions that are yet to play out fully.

Compared to these two cases, India’s vulnerability on the issue of climate change is particularly notable. While its per capita emissions are still low, it is already the third-biggest polluter in the world, and its overall emissions most likely will continue to increase.

Meanwhile, its own multinationals are increasingly looking abroad for growth opportunities. The increased influx of foreign companies and other foreign investment flows will heighten the focus on domestic labor conditions, as will the larger volume of incoming FDI. India also is attracting more foreign portfolio capital, partly because more investors are growing worried about geopolitical tensions and the prospect of China’s economy becoming un-investable.

India’s impressive recent technological successes will also add to its global systemic importance. Its thriving digital economy has allowed it to offer a superior open architecture for digital finance, making it a prime example of a massive country where money can move quickly and cheaply. Moreover, India’s multilingual technical capabilities are especially suitable for greater exports to many other countries undergoing similar technology-driven development.

NO TIME TO WASTE

Given India’s growing systemic importance across so many dimensions, current and future generations alike would benefit from early steps to minimize the risks and maximize the opportunities presented by a larger global footprint. The to-do list is rather long, but it starts with two critical priorities, one domestic and one international.

On the domestic front, India is on the cusp of an even greater inflow of FDI and portfolio investors. Such capital has many benefits, of course, including job creation, technology transfer, and greater access to cheaper funding.

But as other countries’ experience shows, large inflows require rapid adaptation of policies and policymakers’ mindsets, as well as measures to overcome internal resistance from domestic incumbents. Otherwise, the benefits will be more than offset by the serious threat of macroeconomic instability, severe resource misallocation, excessive risk taking, and corruption.

Looking outward, India needs to foster much deeper cooperative interactions with key bilateral trading partners, regional institutions, and international platforms. Its status as a founder of the New Development Bank – established by the BRICS grouping (Brazil, Russia, India, China, and South Africa) in 2014 – does not preclude the need for closer ties with the Asian Development Bank, the World Trade Organization, the International Monetary Fund, and other global institutions.

While Indian policymakers naturally will focus on exciting domestic developments and accomplishments, they also must keep a close eye on how their country is influencing existing global alignments. The challenge is for India to make room for itself in as orderly a manner as possible.

Given its success and outlook, India can no longer claim to be an economically small developing country with few global spillovers. Its growing systemic importance will bring a larger set of risks and opportunities. India today is near where China and Big Tech were before they inadvertently triggered reactions that have complicated their growth strategies and undermined their reputations. India must lose no time in managing its growing footprint, so that its domestic priorities align with international realities.

When China was at a similar stage of economic development 16 years ago, it ran a current account surplus of 10% of GDP. With Chinese policymakers focused on the stock-market bubble in 2007, they ignored growing external concerns about mercantilism and “unfair” competition until it was too late. Now, the US and others have introduced tight trade, capital, and technology restrictions against China, most of which seem likely to remain in place indefinitely.

The lesson is that a purely reactive approach, with its inevitable delayed response, is much less effective than a balanced approach combining proactive and reactive elements. The current Indian government, under Prime Minister Narendra Modi, appears to understand this, and has been generally praised for how it has navigated today’s highly complex and tense global environment.

But there is more work to be done. India should seek to play a larger role in the world’s multilateral institutions, where it could be a strong voice for constructive reform. For understandable reasons, India has stayed away from China’s Belt and Road Initiative. But like it or not, China and India are both destined to be giants in the global economy. The nature of their relations will have an enormous effect on the future of global integration and cooperation. Working gradually toward a more constructive relationship that is consistent with its other geopolitical priorities (including vis-à-vis the US), should be an objective for India. It is also a key element in both countries’ ability to manage their expanding global footprints.

No comments:

Post a Comment