http://econintersect.com/pages/contributors/contributor.php?post=201511270658&utm_medium=email&utm_campaign=Daily+Global+Economic+Intersection+Newsletter+Feed&utm_content=Daily+Global+Economic+Intersection+Newsletter+Feed+CID_2700be1955f8af5835fc289ced29a16a&utm_source=newsletter&utm_term=Building+A+Smarter+Grid+Can+Smart+Grid+Technology+Change+The+Way+We+Use+Electricity

posted on 27 November 2015

from the Richmond Fed -- this post authored by Eamon O'Keefe

On the hottest days of summer, when many Americans turn down their thermostats and crank up their air conditioners, electric utilities have to boost production to meet high demand. The power plants they bring online often are more expensive to operate, yet electricity prices rarely change. Economists envision an electricity marketplace in which prices reflect the true cost of producing electricity so that consumers and producers are constantly adapting to real-world conditions.

When demand increases, prices would rise and demand would decrease accordingly. New "smart grid" technologies could make that vision a reality.

"The 'smart grid' encompasses a lot of different things," says Paul Joskow, president of the Alfred P. Sloan Foundation and professor emeritus of economics at the Massachusetts Institute of Technology. But in general, it covers a variety of technologies that include computerized metering, control, and sensors. When implemented in homes, power lines, electrical substations, and transformers, these technologies could facilitate better monitoring and management of electricity consumption and distribution throughout the grid. The goal is to build a grid that allows for two-way communication between electricity consumers and producers. In addition to time-varying rates that could lead to more efficient energy use, potential benefits of a smart grid include improving the grid's resilience and better accommodating renewable energy sources.

Utilities have begun rolling out components of the smart grid, and pilot programs for dynamic pricing have begun to pop up around the country. A host of companies are building new technologies for grid modernization; in the Fifth District, North Carolina's Research Triangle has become a hub for such innovation. Home to more than 50 smart grid companies and a number of supporting research institutions, Wake County, N.C., has dubbed itself the "smart grid capital of the world."

"It's a driver of the future," says Michael Haley, director of business recruitment and expansion for Wake County Economic Development. "It has a disruptive, exciting, changing nature to it."

But building the smart grid is expensive, and changing the way electricity is priced could have unintended consequences. Can smart grid technology live up to the expectations?

The History of the Grid

America's electrical grid began with Thomas Edison and his Pearl Street Station in New York City. Built in 1882, this energy system relied on a 100-volt coal-burning generator to power a few hundred lamps. As demand for electricity grew and the technology for electrical generation increasingly favored large producers, competition between small power companies gave way to larger consolidated firms that began to exercise monopoly power in the market. Federal regulations in the 1930s reformed these electric power holding companies by subjecting them to regulation by the Securities and Exchange Commission or to regulation by state utility commissions if they limited their operations to a single state. These moves ushered in the era of vertically integrated utilities operated as regulated monopolies. Regulated utility companies managed a large portion of the generation, distribution, and retail services in the electricity market for much of the remainder of the 20th century.

Amid growing enthusiasm for free markets in the late 1980s and into the 1990s, the United States began restructuring certain electricity markets to encourage market-based competition. In 1992, the Energy Policy Act allowed for greater competition in electricity generation by opening up access to the transmission system. This encouraged some states to change their regulatory structures to allow for competition in generation and retail services while maintaining strict regulation on transmission and distribution. Today, the electrical grids in these regions are managed by Regional Transmission Organizations (RTOs) or Independent System Operators (ISOs), which are independent from market participants.

The California electricity crisis of 2000-2001 slowed the move toward restructuring as the country observed spikes in electricity prices from market manipulation that followed partial deregulation in the state. RTOs and ISOs operate in California and much of the country east of the Rocky Mountains, with the exception of parts of the Southeast. The remaining states have maintained their vertically integrated monopolies, but even many of these areas now allow for more competition in generation by allowing independent power-generating companies to sell electricity under contract to distribution utilities.

Another major change in the electricity market has been the growth of renewable energy. These sources accounted for 13 percent of total U.S. production in 2014 compared with roughly 9 percent in 2004, and the U.S. Energy Information Administration (EIA) estimates that renewable energy will account for 18 percent of total electricity generation by 2040. Renewable energy is highly variable: Unlike a traditional power plant that can be turned on and off as demand changes, wind and solar power generation can fluctuate widely as environmental conditions change. Renewable energy also has contributed to the decentralization of power generation as distributed energy, the term for generating power at one's home, continues to gain popularity in the form of rooftop solar panels. These developments pose challenges to America's aging electricity grid infrastructure, which was not built to accommodate these changes in supply.

The Smart Grid and Pricing

To economists, prices are the fundamental guide to decisionmaking in the economy. When prices go up, economic theory says consumers will respond by demanding less. But the price mechanism is distorted in much of the electricity market because prices fail to reflect the true marginal cost of producing electricity at any given time.

Most consumers are billed a flat rate, or in some instances, "increasing block pricing," in which prices rise on a tiered basis over the course of the billing cycle as a customer uses more energy. But during periods of high demand, such as hot summer afternoons when many households run energy-intensive appliances like air conditioners, base load capacity is inadequate to meet demand. When this happens, utility companies have to bring more costly power plants online. These "peaker" power plants usually run on natural gas, diesel, or jet fuel and, because of their high variable cost, are often more expensive to run than base-load power plants that operate all the time. During these peak demand periods, the marginal cost of electricity is much higher than at other times, but consumers still pay the same price. Because consumers don't pay the true cost of generating electricity, they aren't incentivized to use less energy during peak times.

Economists have been exploring ways to price electricity more efficiently for at least 50 years, but until recently, these attempts have been met with limited success. With the arrival of more sophisticated and cheaper smart grid technology, however, utilities can now know the demand profiles of each customer in nearly real time. Coupled with advances in computing power, this has allowed utilities to develop time-varying pricing schemes that reflect changes in supply and demand. "There are 8,766 hours in a year, and if you read the meter every 10 minutes, that's over 50,000 data points per household per year. That's a lot of data to analyze and match with the billing factors," Joskow says. "You couldn't do it for millions and millions of customers 20 years ago, but now you can."

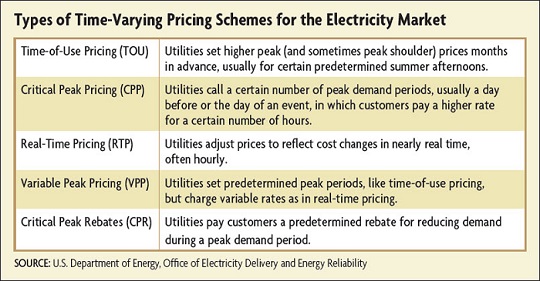

The most basic time-varying pricing scheme, time-of-use pricing, involves setting time periods, months in advance, during which utilities will charge a higher peak price and a lower off-peak price (and sometimes a moderate peak shoulder price). A more dynamic pricing scheme, called critical peak pricing, allows utilities to designate a certain number of days per year as peak periods right before the event occurs and then charge a higher price for a few hours. Because utility companies can't know what days will truly be peak period situations until shortly before they occur, critical peak pricing ideally helps power companies charge higher peak prices just on those days that warrant them. In the most dynamic pricing model, real-time pricing, prices are adjusted hourly to reflect the true marginal cost of generation.

A fourth pricing program, called peak time rebates, involves paying consumers for reducing their demand during a peak usage period. For example, Baltimore Gas and Electric has an optional "Smart Energy Rewards" program that pays consumers $1.25 for every kilowatt hour saved during a peak period compared with one's typical usage during those times. But Severin Borenstein, an economist at the Haas School of Business at the University of California, Berkeley and director emeritus of the University of California Energy Institute, notes that peak time rebates may distort incentives because of the baseline used to calculate the reduction in usage. If customers' baselines are calculated based on their usage during other peak periods, they could have an incentive to increase consumption in order to make their baseline higher than it normally would be.

How Do Consumers Respond?

Studies have found real-time pricing to be more effective than time-of-use pricing at changing people's behavior. "But realistically for most customers, it's a pretty foreign concept, and it's something that most of them are not very excited about doing because there is a lot of volatility," Borenstein says. "There are ways to hedge that volatility, but when you're to the point of saying 'hedging' to residential customers, you've lost 95 percent of them." Critical peak pricing, although less granular than real-time pricing, may be easier for customers to understand and could be an effective transition to more dynamic electricity pricing.

But even with highly dynamic pricing, how likely are consumers to turn off their air conditioners when prices go up? Estimates vary for the elasticity of demand for electricity, but Borenstein estimates it could be as little as -0.025, meaning a 1 percent increase in price leads to only a 0.025 percent reduction in demand. But given that low value, he still demonstrated in a 2005 study that dynamic pricing could deliver at least 3 percent to 5 percent cost savings in electricity generation.

One reason for the low elasticity could be that consumers don't pay a lot of attention to their energy use. "Most people aren't going to spend their lives in their basements looking at their meters," Joskow says. But for consumers who don't want to track their usage closely, demand response could give them the option to have the utility reduce their demand for them. Southern California Edison, for example, offers a program called the "Summer Discount Plan" that provides residential customers with up to $200 in bill credits per year to give the company the ability to cycle off their home air-conditioning units.

Some customers have resisted smart metering technology due to concerns over privacy and the alleged health effects of radiation from wireless transmissions of digital smart meters. Opposition is also likely to come from consumers who use a large quantity of electricity during peak demand times and thus would see their electricity bills soar, or from those who simply don't like the idea of being forced onto a time-varying price scheme. It's also possible that confusion over dynamic pricing might lead to much higher bills for customers who fail to understand how time-varying pricing affects the amount they pay for electricity.

Borenstein and other economists have studied how consumers would respond if companies offered an option to remain on a flat-rate pricing model or transition to a time-varying one. He found that if the utility didn't use profits from one pool to subsidize the other, the flat rate pool would progressively become more expensive. This is because customers who don't strain the grid as much during peak hours would see the greatest benefit to switching to a dynamic pricing model, leaving only the highest peak-use customers in the flat-rate pool and causing the utility to raise the flat rate. In theory, this could encourage more people to reduce their energy use and switch to the dynamic pricing pool. "You get sort of a virtuous cycle," Borenstein says.

Dynamic pricing could have unintended consequences with regard to energy use. Economists note an interesting feature of dynamic pricing: During a majority of hours, customers would actually see a lower electricity price because peak periods don't occur all that often. Would consumers respond by increasing demand during off-peak hours? Borenstein thinks that although this might be the case, there would still be a small overall reduction in demand because turning off a light during a peak demand time wouldn't necessarily induce a customer to turn that same light on later when the price was lower. Still, it's possible that the overall effect of the smart grid could be to shift rather than reduce electricity demand.

Other Benefits

In addition to enabling more efficient pricing, the smart grid would bring other advantages. One of them would be better responses to power outages. Without smart grid technology, many power companies rely on customers to call in and report an outage. In contrast, two-way communication throughout the distribution system, including at substations, power lines, and transformers, would allow for "intelligent distribution": Switches would sense power outages immediately and reroute electricity to isolate affected sections of the grid. This "self-healing" network would be able to almost instantly reroute power so that most consumers would hardly know an outage has occurred. Such an improvement in grid resilience might help ameliorate the growing strain on the electrical grid from natural disasters and heavy storms. Such technology could have helped utilities respond more quickly to outages in 2003, when Hurricane Isabel touched down off the coast of North Carolina with 100 mph winds and wreaked havoc on the electrical grid in the affected region. An estimated 3.5 million people in the Fifth District lost power, and some didn't see their electricity restored for more than two weeks.

Smart grid technology could also help grid operators adapt to fluctuating supply from renewable energy sources. Dynamic pricing would encourage customers to reduce their demand when a dip in supply from renewable sources - when the sun isn't shining or the wind isn't blowing - strains the grid. In addition, adjustments to dips in supply could be enhanced by digital meters that communicate with household appliances to reduce demand during these times.

Making the Business Case

Utilities are asking themselves a number of questions about the smart grid. "How is this going to be better for our customers, how are we assured that it's going to be a reliable new technology, and is there a business case around it that we can actually implement?" asks Jason Handley, director of smart grid technology and operations for Duke Energy.

The case can be difficult to make. Duke Energy in North Carolina is still a vertically integrated utility, and therefore any changes to its rate structure have to be approved by the state's public service commission. If Duke Energy wants to roll out digital meters, it has to justify it based on projections of the company's ability to recover the cost through rate increases. But because Duke Energy has already eliminated the costly process of sending people to read each individual meter by installing automatic meter reading technology, in which signals from meters can be picked up from a vehicle, new smart grid technologies deliver relatively fewer gains.

There are other major roadblocks to implementing the smart grid, such as a lack of grid interoperability or the ability of the components of the smart grid to seamlessly communicate with one another. Today, smart grid technologies are often proprietary, meaning that they weren't built to communicate with technology from other companies. Handley says this lack of shared communication standards is one of the main challenges of rolling out the smart grid for many utilities.

There's also the fact that building a smart grid is very expensive. A 2011 report by the Electric Power Research Institute (EPRI) found that the 20-year net investment for rolling out the smart grid would be between $338 billion and $476 billion. But in the same report, researchers also estimated that the technology would deliver $1.2 trillion to $2 trillion in benefits from lower costs and enhanced reliability, among other aspects.

Some economists remain skeptical of such projections. Joskow thinks the estimates from the EPRI overvalue the reliability benefits from smart grid implementation. And "the payoff for residential is probably not that great in the short run," according to Borenstein. This is because a considerable amount of peak demand reduction could come from dynamic pricing programs with commercial and industrial customers, some of whom have already enrolled in such programs. Further peak reduction from these consumers could reduce a fair amount of peak demand without the costly step of rolling out smart grid technology to residential customers. But Borenstein also notes that in the long run, there may be more appliances and smart home devices that respond automatically, reducing the cost and hassle associated with dynamic pricing for residential customers.

Despite the economic challenges of smart grid implementation, utilities have ramped up their efforts nationwide. The U.S. EIA estimates that power companies have installed about 46 million smart meters for residential customers in the United States as of May 1, 2015. President Obama's 2009 stimulus package included $4.5 billion for grid modernization, and $8 billion has been invested in 99 smart grid projects nationwide with the help of combined government and private sector funds.

The stimulus funds fall far short of the total cost of implementing the smart grid, and it's not clear that utilities will be willing to make up the difference. Although better reliability would be a large benefit for the utilities, Luciano De Castro of the University of Iowa and Joisa Dutra of Fundação Getúlio Vargas contended in a 2013 paper that aspects of reliability have public good characteristics; that is, utilities may tend to underinvest in reliability because consumers often aren't willing to pay for improved reliability for other customers if they don't have to.

The smart grid has the potential to improve the reliability of the electrical grid, better integrate alternative energy, and facilitate pricing that reflects the marginal cost of generation. What remains uncertain is how consumers will respond to the promise of dynamic pricing and whether the benefits of the smart grid will outweigh its considerable cost.

Readings

Borenstein, Severin. "Effective and Equitable Adoption of Opt-In Residential Dynamic Electricity Pricing." National Bureau of Economic Research Working Paper No. 18037, May 2012. (Working paper version available online.)

Borenstein, Severin. "The Long-Run Efficiency of Real-Time Electricity Pricing." The Energy Journal, 2005, vol. 26, no. 3, pp. 93-116.

De Castro, Luciano, and Joisa Dutra. "Paying For the Smart Grid." Energy Economics, December 2013, vol. 40, no. S1, pp. S74-S84.

Electric Power Research Institute. "Estimating the Costs and Benefits of the Smart Grid: A Preliminary Estimate of the Investment Requirements and the Resultant Benefits of a Fully Functioning Smart Grid." March 2011.

Joskow, Paul L. "Creating a Smarter U.S. Electricity Grid." Journal of Economic Perspectives, Winter 2012, vol. 26, no. 1, pp. 29-48.

Joskow, Paul L., and Catherine D. Wolfram. "Dynamic Pricing of Electricity."American Economic Review, May 2012, vol. 102, no. 3, pp. 381-385. (Working paper version available online.)

Source

https://www.richmondfed.org/publications/research/econ_focus/2015/q2/feature1

No comments:

Post a Comment