The CSIS Economics Program is tracking commitments, approvals, and disbursements by major international financial institutions (IFIs) to meet the massive financing needs generated by the Covid-19 pandemic and its economic fallout. These IFIs include the International Monetary Fund (IMF), World Bank, and regional development banks. We also include select regional financing arrangements (RFAs), which, together with the IFIs, central bank bilateral swap lines, and individual countries’ foreign reserve holdings, comprise the Global Financial Safety Net (GFSN).

Updated data as of June 19 show several key trends:

We estimate IFIs have approved $117 billion in Covid-19-related support since January 27. The IMF has approved $77.1 billion, including emergency assistance and precautionary lines of credit, while the multilateral development banks (MDBs) combined have approved a total of $39.3 billion. Among the MDBs, the World Bank has approved $13.0 billion, followed by the European Investment Bank, which has approved $7.7 billion, and the Asian Development Bank, which has approved $7.2 billion.

We estimate IFIs have disbursed $68 billion, or roughly 58 percent of the amount approved. While IMF approvals exceed the MDBs, we estimate MDBs have disbursed slightly more funding due to the precautionary nature of a large portion of IMF support via flexible credit line (FCL) arrangements with Colombia, Chile, and Peru. The Fund developed the FCL as part of the 2009 lending reforms to help countries with strong economic fundamentals mitigate external shocks and support market confidence.

RFAs have not been a significant source of funding on a global scale to date. Of the five RFAs in our dataset, only the Arab Monetary Fund has approved and disbursed financial support to four of its member countries in response to the current crisis. The European Stability Mechanism (ESM) and the Latin American Reserve Fund have both announced institutional commitments to support their members, but European countries are reportedly reluctant to use ESM financing. The Chiang Mai Initiative Multilateralization Agreement and Eurasian Fund for Stabilization and Development have not announced any Covid-19-related programs, despite their representation in a meeting with IMF managing director Kristalina Georgieva to coordinate responses on April 21.

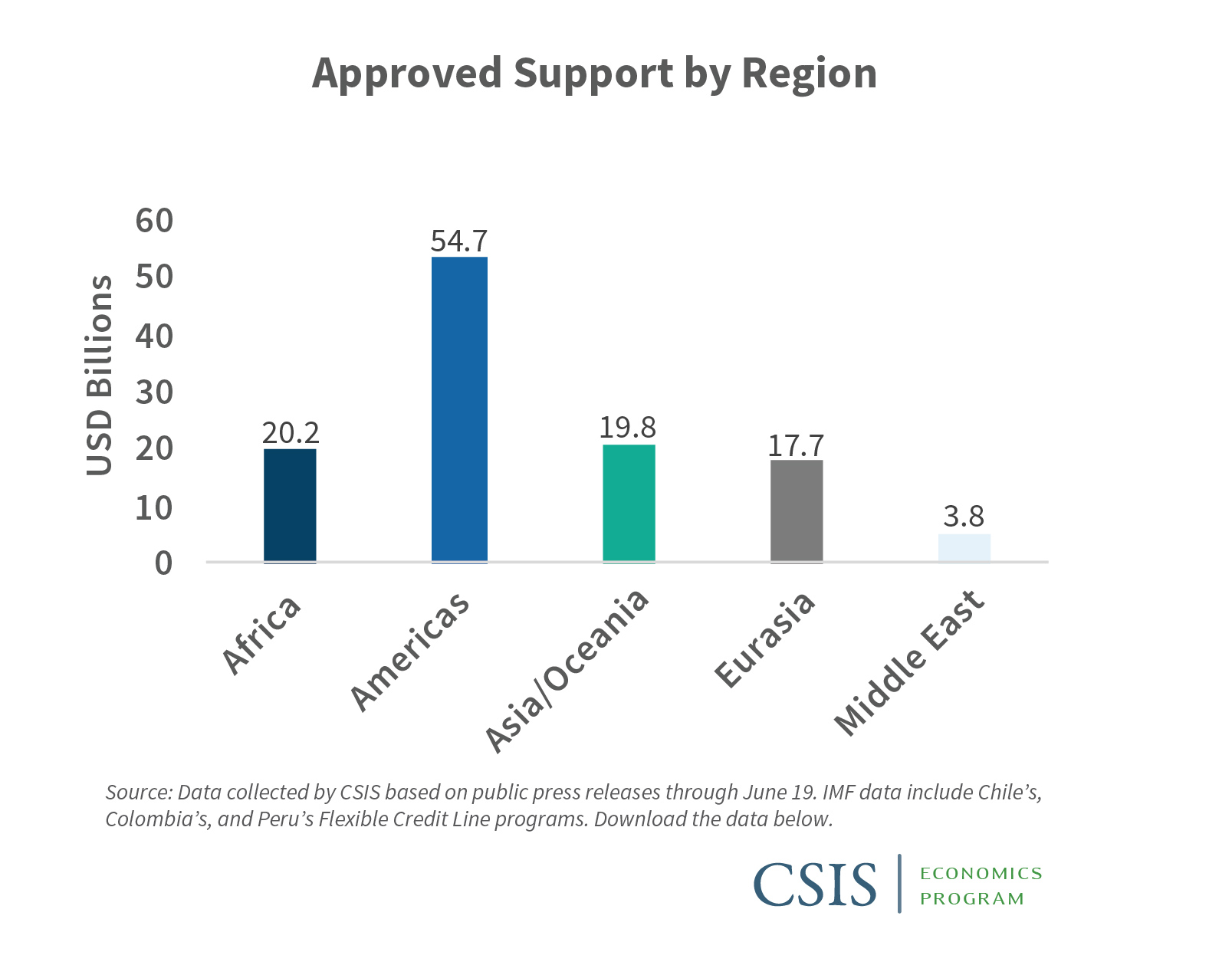

Regionally, the Americas have been the largest recipient of IFI approvals, but Africa and Asia/Oceania have received more disbursements. IFIs have approved $54.7 billion in funding for the Americas, reflecting the three IMF precautionary FCLs; $20.2 billion for Africa; $19.8 billion for Asia/Oceania; $17.7 billion for Eurasia; and $3.8 billion for the Middle East ($0.8 billion of announced IFI support is not targeted at a specific region).

New MDBs have approved notable support. The Asian Infrastructure Investment Bank (AIIB) and the New Development Bank, or BRICS Bank, have committed $10 billon each to respond to Covid-19. As of June 19, the AIIB has announced eight programs totaling $3.3 billion, six of which are co-financed with other regional MDBs, and the BRICS Bank has announced $1 billion loans for China and India.

As of June 19, several countries most hard-hit by Covid-19 had not received IFI support. Brazil, Mexico, and Russia, all of which are facing severe Covid-19 outbreaks, have not called upon IFI resources to date. This likely reflects generally accommodative market conditions, which have allowed many emerging market countries to raise funding on global capital markets, as well as the presence of central bank swap lines, which can help alleviate funding pressure in eligible countries.

This analysis is based on publicly available information; any corrections and/or clarifications will be included in future updates. Our dataset of IFI responses is available for download here, and our initial May 21 analysis on IFI responses is available here.

MDBs include the African Development Bank (AfDB), Asian Development Bank (AsDB), Asian Infrastructure Investment Bank (AIIB), European Bank for Reconstruction and Development (EBRD), European Investment Bank (EIB), Inter-American Development Bank (IADB), Development Bank of Latin America (CAF), New Development Bank (BRICS Bank), and the World Bank (WB). RFAs include the Arab Monetary Fund (AMF), Chiang Mai Initiative Multilateralization (CMIM), Eurasian Fund for Stabilization and Development (EFSD), European Stability Mechanism (ESM), and Latin American Reserve Fund (FLAR). Totals for the IMF include debt relief for 25 of its poorest members approved by the Executive Board on April 13, 2020.

Totals do not include financing through the European Commission’s SURE initiative, which provides funding to European Union Member States of up to €100 billion ($108 billion) by covering part of the costs related to the creation or extension of national short-time work schemes.

Stephanie Segal is a senior fellow with the Economics Program at the Center for Strategic and International Studies (CSIS) in Washington, D.C. Dylan Gerstel is a research assistant with the CSIS Economics Program. Olivia Negus, CSIS Economics Program research intern, assisted with the data collection for this analysis.

No comments:

Post a Comment