Brad W. Setser

I first started to write a balance of payments focused blog back in 2004.

Initially, I spent most of my time documenting the rapid rise in China’s surplus, the relentless rise in the surplus of the oil exporters, and the massive run up in global foreign exchange reserves—and showing that for all the talk (at the time) about exchange rate flexibility, most emerging markets were heavily intervening in the foreign exchange market.

I also sought, with only limited success, to figure out the vulnerabilities associated with that particular global system. The “balance of financial terror” ultimately held. China never stopped financing the United States. Yet by the summer of 2007, obvious stress had emerged inside the financial systems of advanced economies.

With hindsight, a world where demand for safe reserve assets far exceeded net Treasury issuance created enormous problems for financial intermediation. “Synthetic” safe issues proved to be a poor substitute for good old full faith and credit claims on the U.S. Treasury. It wasn’t the conventional wisdom at the time, but a world of large “uphill” capital flows likely could have lasted a bit longer if the United States had run larger fiscal deficits. That would have made the U.S. economy, and the global economy, less dependent on European banks to intermediate between the world’s sources of surplus savings and the borrowing need of U.S. households.

Resuming this blog provides a natural point for a bit of reflection.

But looking back makes sense for a second reason: the large payments imbalances of the global financial crisis era came back this year. And that raises the question of what new risks—political as well as economic—are starting to build inside the global financial system.

The U.S. current account deficit is now around 4 percent of U.S. GDP, and it is more likely to rise toward 5 percent of GDP over the next couple of years than to follow the IMF’s forecast of an orderly return to 3 percent of GDP.

The strong dollar affects trade with a lag, and it will keep the goods and services deficit up even as U.S. goods demand normalizes. And the brutal dynamics of the U.S. income balance is unavoidable. A 2 percent rise in the average interest rate the United States pays on its external debt implies a percentage point of GDP deterioration in the net interest balance for a country that has borrowed (after netting out fixed income assets) about 50 percent of its GDP from the world.

But it is equally important to note that United States isn’t the only G-7 country running a significant current account deficit either. The United Kingdom (UK), of course, still runs a quite substantial deficit. More importantly, the steep rise in energy prices along with China’s growing exports to Europe have pushed the euro area into a balance of payments deficit. Japan’s surplus—which stems from its offshore investment earnings these days—has disappeared as well.

Large deficits imply large offsetting surpluses.

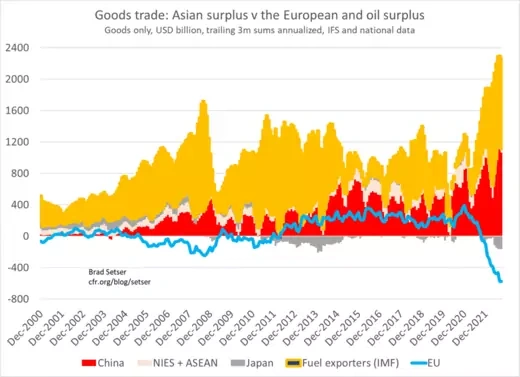

That shows up clearly in the raw trade data in chart above. There was an enormous swing in the trade surplus of the energy exporting economies and, surprisingly, China’s surplus also has continued to rise.

As a result of these shifts, the bulk of the world’s external surplus is now found in a few large economies that aren’t exactly known for their commitment to liberal democracy.

Russia’s surplus is set to top $250 billion.

Saudi Arabia’s surplus should top $200 billion.

The other monarchies in the Gulf should have a surplus comparable to that of the Saudis—if anything, it will be a bit bigger.

And China’s reported current account surplus should top $400 billion this year, and its true surplus could be bigger.* In many ways, the ongoing rise in China’s surplus is the most surprising fact here, as China is the world’s biggest oil importer.

Summed up, these autocratic countries surpluses should total about $1 trillion in 2022. That surplus could dip a bit in 2023 on the back of lower energy prices—though any fall in energy prices will also tend to increase China’s surplus.

To be sure, a few “friends” of the United States and the EU have sizable surpluses. Norway is running an absolutely massive surplus. Switzerland, technically neutral, retains a large surplus fueled by the tax avoidance strategies of large multinationals (Ireland is similarly running a large surplus these days). Singapore and Taiwan run absurdly large surpluses in good times and still quite large surpluses in bad times.

But the bulk of the global surplus is now found in countries run by autocratic governments that aren’t friends of the United States. Financial friend-shoring isn’t an option.

That is the deep irony of today’s supposedly deglobalizing world.

Many analysts hypothesize that trade will be balkanized as democracies trade with fellow democracies and autocracies trade with other autocracies ("friend-shoring"). Yet, put simply, that pattern of trade is inconsistent with today’s pattern of trade imbalances. The world’s big autocracies cannot simply trade with each other at a time when they collectively are running a record trade surplus. Adding up constraints are brutal.

In fact, the global pattern of surpluses and deficits today has some parallels with the pattern in 2007, the time of “peak” globalization. Both periods were marked by large, concurrent surpluses in emerging Asia—notably China—and the oil exporters, and deficits in the US, the UK and (much of) Europe.**

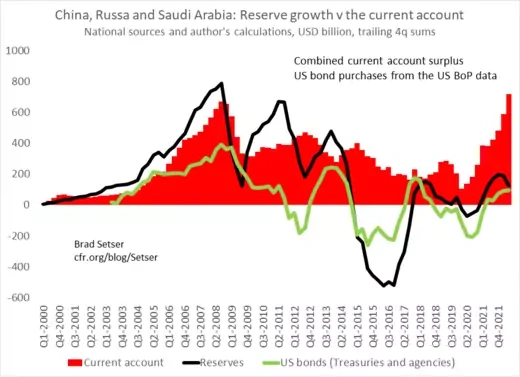

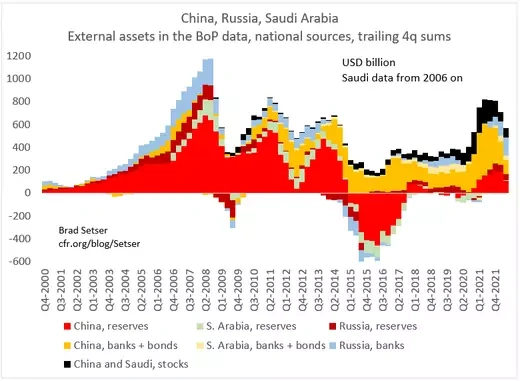

But there is an important difference between now and then: the big autocratic surplus countries are not adding to their formal foreign exchange reserves.

Russia of course cannot add to its reserves. The Central Bank of Russia is financially frozen. Russia surplus is piling up in European banks—apart from the bit that has made its way to Turkey (or Dubai).

Saudi Arabia has chosen not to add to its reserves. Mohammed Bin Salman has a taste for risk and wants to scale up Saudi Arabia’s sovereign wealth funds. The Saudi Arabian Monetary Agency's traditional portfolio is a bit boring.

And China, it seems, just isn’t adding (much) to its reserves. The data flow out of China is wildly confusing right now. The balance of payments data still shows a bit of reserve growth (surprisingly), but the small increase in the balance of payments data doesn't map to the stable foreign exchange reserve position shown on the PBOC’s balance sheet. The state banks seem to have shed a portion of their (substantial) foreign assets in the third quarter, at least in one data set. Nothing quite adds up, but there is no doubt that the pace of China's reserve growth now lags China's reported current account surplus. The withdrawal of foreign investors from the Chinese bond market has absorbed a portion of China’s trade surplus—and, it seems, China’s exporters also have been building up their offshore bank accounts.

The details here are important, but for another time. The broad point is simple: the bulk of China’s trade and current account surplus isn’t showing up in China’s formal reserves.

It makes for a strange world.

The big surpluses are back where they were before the global financial crisis.

But everything else is different.

The dollar is strong rather than weak.

China’s surplus stems as much from weak internal demand as from pure export strength.

The oil surplus comes more from lagging supply (and the prospect of a fall in Russian exports) than from booming demand.

Reserves globally are falling not rising. With the dollar’s current strength, many Asian economies (China excepted) have disgorged a portion of the large stockpiles.

Treasury issuance far exceeds central bank reserve demand.

By implication, private financial intermediaries somewhere around the world will need to absorb Treasury bonds. Just as financial intermediaries globally had to absorb U.S. “subprime” (household) risk prior to the global crisis, now they have to absorb U.S. interest rate risk.***

It is the only way everything adds up.

And the reality of a world where the big surpluses are in countries that don’t really want to be holding all that many dollars openly has opened up new opportunities for smaller financially troubled states to seek rescue financing from less traditional sources. Russia (through its state banks) has helped fund Turkey’s external deficit; the Saudis and the other Gulf monarchies are providing far more (net) financing to Egypt than the IMF; and Pakistan and the IMF are counting on China and Saudi Arabia not to pull funds out of the State Bank of Pakistan.

The geopolitics of global finance, so to speak, has gotten interesting.

And global flows, to be honest, have become much harder to track. I still intend to try.

*China’s customs (goods) surplus has increased by far more than its broader current account surplus. And the directly measured customs data could be a bit more accurate than China’s more massaged balance of payments data.

**Japan is in a worse trade position now than back in 2007, when energy deficit was held down by its nuclear plants and its coal use (coal was still cheap then). Oil imports and energy imports aren’t quite the same.

*** Technically, the U.S. financial system could absorb all of the Treasuries the U.S. needs to issue and the U.S. external deficit could be financed by selling other financial assets to the world (equity, corporate bonds, shares in money market funds, etc.). Right now the U.S. international capital flows data (the TIC data) still shows significant net inflows into the Treasury market from the rest of the world. However, the bulk of the flow is coming from financial centers, like the UK. Of course, the UK runs its own current account deficit; it registers in the U.S. data because large financial institutions in London act as global intermediaries.

No comments:

Post a Comment