Kati Suominen

Series Introduction

In 2018, 11 countries—Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam—came together to sign the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The agreement deepened the liberalization of trade in goods and services among the members and broke new ground addressing digital trade issues via a comprehensive e-commerce chapter. However, to date, little is known about the impact of the CPTPP in general and its e-commerce provisions in particular on trade, investment, and e-commerce in the CPTPP region.

This five-part series seeks to provide early insight into the CPTPP’s potential effects by looking at trade and investment flows in the CPTPP region in the past few years, exploring the views of firms in the CPTPP region on the agreement and especially its e-commerce chapter, and presenting preliminary findings on the CPTPP’s unique impacts relative to other factors that have shaped trade and e-commerce patterns in the region, such as other recent trade agreements, trade wars, and the Covid-19 crisis. Much more data and analysis will be needed to establish how the CPTPP is shaping its members’ trade flows; this series looks to raise fresh hypotheses for such future research by exploring early patterns.

Learning about the agreement and its potential impacts is timely for many groups, including: (1) countries, such as the United Kingdom, South Korea, and the Philippines, that have expressed interest in joining the CPTPP, (2) countries that have adopted CPTPP-like digital trade provisions in other trade agreements, (3) the many countries and regional groupings, such as the members of the African Continental Free Trade Area (AfCFTA), that are pursuing agreements related to e-commerce, and (4) the ongoing e-commerce negotiations in Geneva among the leading World Trade Organization (WTO) members.

This series will cover five topics:

Two Years into the Deal: What are CPTPP members’ trade and investment patterns?

The Impacts of the CPTPP’s E-commerce Chapter: What do businesses in CPTPP member economies think about the CPTPP’s e-commerce chapter, its impacts, and its enforcement?

Growing the Bloc: What would countries that aspire for CPTPP membership bring to the table, and how would they benefit, especially from the CPTPP’s e-commerce provisions?

Impacts on Trade: How has the agreement affected the trade of CPTPP members—can we tell?

Beyond the CPTPP: What are the lessons learned from CPTPP countries negotiating e-commerce-related provisions in trade agreements?

What Are CPTPP Members’ Trade and Investment Patterns Two Years into the Deal?

VIETNAM EXPANDS TRADE IN GOODS AND FDI, JAPAN AND SINGAPORE ARE BOLSTERING TRADE IN DIGITAL SERVICES, AND COVID SETS MEMBERS’ E-COMMERCE MARKETS SOARING.

In 2018, 11 countries—Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam—came together to sign the CPTPP, hailed at the time as the gold-standard deal that would uphold free trade in the Asia-Pacific region amid the U.S.-China trade wars. Seven members—Australia, Canada, Japan, Mexico, New Zealand, Singapore, and Vietnam—ratified the deal promptly. Yet shortly into its second year, the membership suffered supply chain disruptions and demand shocks due to Covid-19 as well as, on the upside, rapid acceleration of e-commerce, including across borders.

Exploration of recent trade and investment data during this turbulent time suggests that Vietnam especially, for which the CPTPP is a flagship trade deal, has made gains in goods exports and imports and tapped investment inflows, while tech superstars Japan and Singapore are on the way to increasing their trade in digitally deliverable services. Of extra-regional partners, China continues relentless growth as a source of imports for CPTPP members. This paper reviews CPTPP members’ trade and investment patterns in recent years to start exploring the agreements’ potential impacts, without at this point attributing trends to the CPTPP. Paper 4 in this series seeks to get at these causal patterns.

In particular, there are seven major developments:

1. The fluctuations of CPTPP members’ exports to the CPTPP region mirror their global exports, with Vietnam scoring new export gains.

In 2019, the first year of the CPTPP’s implementation, members’ trade in the CPTPP region dropped by 4 percent, with the exceptions of Australia (0.5 percent export growth) and Vietnam (7 percent growth), and signatories that had not ratified the deal, Brunei (27 percent growth) and Peru (24 percent growth) (Figure 1). Vietnam gained in manufactured exports to the CPTPP, especially to Japan. In 2020, amid Covid-19, all CPTPP members’ exports to the bloc declined, though Chile and Vietnam managed to grow their global exports by about 6 percent, with Vietnam benefiting from global demand for phones, electronics, and computers.1

CPTPP members’ intra-bloc export performance mirrors their overall export performance: from 2017 to 2020, the ups and downs of CPTPP members’ trade with each other have followed the patterns of their trade with the rest of the world. Australia, Brunei, Malaysia, and Vietnam expanded their exports both to CPTPP members and the world during this period, while Canada’s and Japan’s exports to CPTPP members and the world dropped. In general, CPTPP members’ intra-bloc export gains from 2017 to 2020 were nonexistent or lackluster, except for Vietnam (4 percent export growth into the CPTPP per annum) and Brunei (15 percent growth, albeit from a low base).

2. Brunei, Singapore, and Vietnam have been growing their imports from within the CPTPP—but also from the rest of the world

In 2019, most CPTPP members grew their imports, especially from Australia and Vietnam. Malaysia expanded imports from Chile and Mexico in particular, and Mexico did so from Malaysia and Vietnam (Figure 2). However, the CPTPP bloc as a whole only grew as a source of imports in 2019 for Mexico and Vietnam and very slightly for Canada and Brunei.

In 2020, Brunei, Singapore, and Vietnam grew their purchases from most of their CPTPP peers; Chile had double-digit import growth from Australia, Canada, and New Zealand; and Malaysia had double-digit import growth from Brunei, Canada, New Zealand, and Peru. However, these bilateral flows were from a low base and totaled only 1 percent of all CPTPP members’ imports from peers in the block. In the biggest CPTPP goods trade corridor, Singapore’s imports from Malaysia grew 7 percent, but the second-largest corridor, Japanese imports from Australia, dropped by 22 percent. Most CPTPP members’ imports of manufactured goods, especially from Japan and Mexico, dropped drastically in 2020 against a backdrop of a major plunge of CPTPP members’ imports from the United States and European Union and, in most cases, a decline of imports from China.

Overall, CPTPP members’ intra-bloc imports echo patterns in their imports from the world: from 2017 to 2020, countries that grew their goods imports from the CPTPP region—Brunei, Singapore, and Vietnam—also grew their goods imports from the rest of the world. Meanwhile, Chile and Malaysia’s imports from CPTPP members dropped quite drastically during the period.

Perhaps the overall subdued growth in intra-bloc trade versus total trade partly reflects members’ relatively low most-favored-nation (MFN) tariffs (Table 1). Even Mexico, which has a higher applied MFN rate, also has long-standing free trade agreements (FTAs) with mostly zero tariffs with several CPTPP members. Indeed, the CPTPP was built on the extensive network of bilateral and regional trade agreements among member economies. It could be expected to increase the trade flows of partners without extensive trade agreement networks—such as Vietnam, for which the CPTPP represented the first flagship FTA, with deep liberalization both for outbound and inbound trade. According to a 2019 World Bank estimate, Vietnam will have gained deep market access to CPTPP members and eliminated tariffs on them by 2030 (Figures 3 and 4). New Zealand and Singapore will also gain significant new access, Brunei will liberalize, and Japan and Singapore will bring down non-tariff barriers. Brunei and Vietnam are expected to score the greatest GDP growth gains, at 1.9 and 1.1 percent, respectively, by 2030.

In addition, like most trade deals, the CPTPP makes members adhere to open regionalism, essentially barring protectionist barriers against third parties. To the extent the CPTPP succeeds at bolstering economic growth and demand in the member economies, it should also result in trade creation with extra-regional partners.

3. Partly reflecting China’s rise in CPTPP members’ exports and imports, the CPTPP region is less relevant for most CPTPP members’ goods trade today than a decade ago.

Japan remains a very important export destination for all CPTPP members. Malaysia is a leading export market for Singapore, and Singapore in turn plays a significant role in Japanese and Malaysian exports. Overall, however, CPTPP members’ have become somewhat less important to each other as both export and import markets in recent years. Only Mexico, Peru, and Singapore have slightly increased imports from the CPTPP as a share of their total imports in 2020 compared to 2011 or 2017, and the CPTPP has only grown somewhat as an export destination for Brunei and Singapore. In contrast, China has grown as an export market and especially as a source of imports for most CPTPP members, except as an export market for Mexico, whose exports are still mostly destined for the United States (Figure 5). While the United States is still a very important source of imports for CPTPP markets, China is unquestionably rising in prominence in CPTPP members’ trade and has further cemented its role through the Regional Comprehensive Economic Partnership (RCEP), posing new geopolitical questions for the region and its traditional trading partners.

4. In services, the picture is somewhat different (though data ends in 2018): before the deal entered into effect, the largest CPTPP members grew their commercial services and particularly digitally deliverable services trade with each other, with Singapore and Japan leading the way.

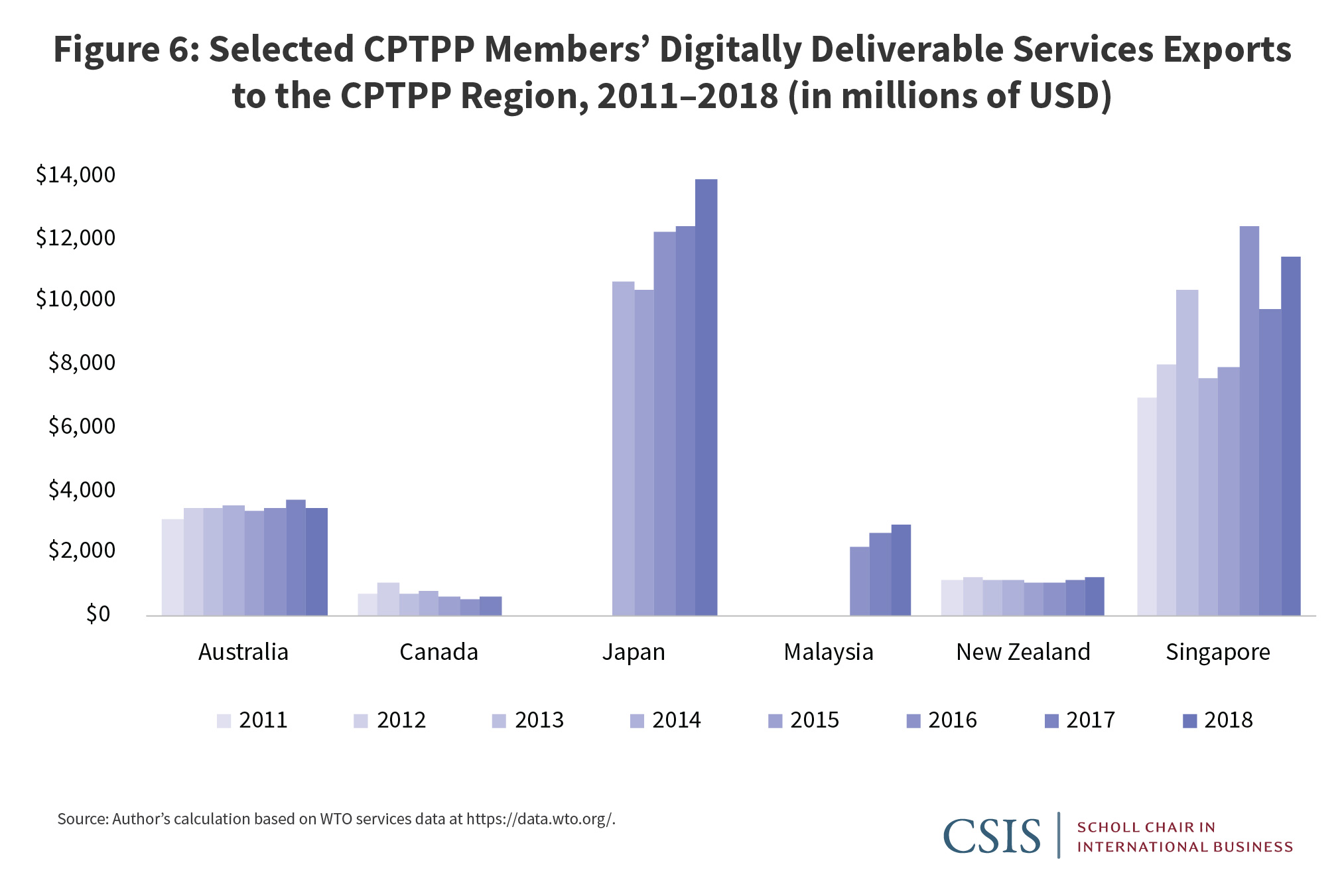

The CPTPP liberalizes trade in services and cements free cross-border data transfer and trade in digital goods, which could be expected to fuel trade in digitally deliverable services. This has been an area of robust growth for CPTPP members’ bilateral flows—at least through 2018, the end of currently available data on bilateral services, and the year the CPTPP was signed. That year, Australia, Japan, New Zealand, and especially Singapore expanded their services exports to the CPTPP region, albeit against the backdrop of very robust growth in services exports to other parts of the world. Japan, Malaysia, New Zealand, and Singapore especially boosted their exports of digitally deliverable services (e.g., computing, professional, and engineering services that can be delivered online) to fellow CPTPP members (Figure 6). Malaysia has also had strong, 16 percent growth in its digitally deliverable services to the CPTPP region. Data that will come in during 2022-23 will provide more insight into patterns after the CPTPP was signed.

Digitally deliverable services imports are also growing in the CPTPP region, mostly from Japan and Singapore, which are also each other’s leading digital trade partners. Australia, Canada, Japan, Malaysia, New Zealand, and Singapore grew their services imports from the CPTPP both in 2017 and 2018, and all of them also increased imports of digitally deliverable services from other CPTPP members, especially from Japan and Singapore. These two partners are also important to each other; their bilateral corridor makes up a whopping 57 percent of all CPTPP intra-bloc trade in digitally deliverable services.

At the same time, CPTPP members boosted purchases of digitally deliverable services from the rest of the world as well, and their services export and import markets were strikingly similar in 2018 to what they were in 2011. Overall, the growth of CPTPP members’ services trade with each other mimics the growth of their services trade with the rest of the world.

5. Domestic e-commerce has grown dramatically for CPTPP members during Covid-19; and cross-border e-commerce is still challenging, especially for smaller businesses.

In various estimates, business-to-consumer (B2C) e-commerce grew in 2020 by close to 25 percent in Malaysia, 30 percent in Vietnam, 32 percent in Mexico, and 40 percent in Peru. Behind these numbers are businesses that are digitizing and selling to shoppers online, a trend that can be expected to result in new trade gains. Business surveys repeatedly show that firms that are using e-commerce and marketplaces such as Amazon, Lazada, Shopee, and Rakuten are much more likely to export than offline sellers. To the extent that CPTPP members enforce their e-commerce provisions and ease border processes, the CPTPP region is poised for greater intra-block B2C e-commerce flows. Subsequent articles in this series will discuss the e-commerce explosion.

6. FDI flows to Vietnam, in particular, have withstood the Covid-19-induced global slump in FDI.

Like many trade agreements, the CPTPP provides staunch protections and national treatment to foreign investors, which could help boost FDI inflows, especially in export-driven sectors in developing member states. Whether or not boosted by the CPTPP in particular, Vietnam scored a 7 percent gain in FDI inflows in 2019, the highest growth in 10 years, led by South Korean and Chinese investors, and Malaysia’s FDI inflows grew by 3 percent in 2019, led by Japan (Figure 7). Peru also had strong inbound flows in 2019 into its mining sector. Covid-19, however, slammed the region’s FDIs just as it undercut global FDI inflows in 2020. Malaysia’s FDI inflows contracted, and Mexico and Vietnam’s flattened, though Vietnam did keep pulling in FDI nearly at 2019 rates, especially from China in its industrial zones.

7. The CPTPP has succeeded at exporting its provisions to other trade deals.

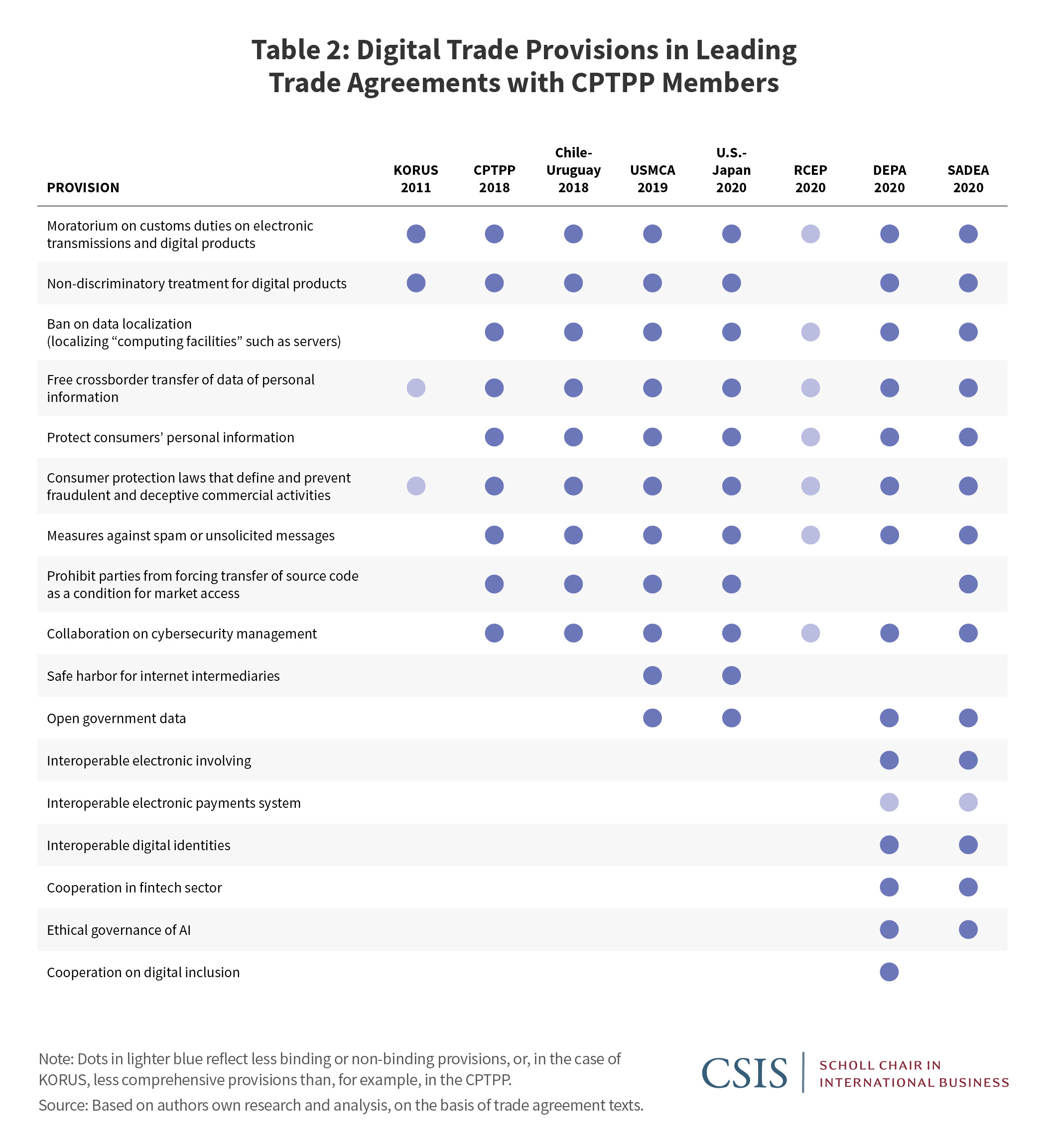

Perhaps where the CPTTP can be credited with solid impact is in exporting its e-commerce commitments to other trade deals. CPTPP members have signed further trade agreements that adopt very similar e-commerce provisions to those included in the CPTPP, including the 2017 Singapore-Australia Free Trade Agreement (SAFTA), the Chile-Uruguay FTA of 2018, and the Chile-Argentina FTA of 2019, which include practically carbon copies of the CPTPP’s e-commerce chapter (Table 2).

The CPTPP’s spirit also found its way to the 2020 Digital Economy Partnership Agreement (DEPA) between Singapore, Chile, and New Zealand, an important grouping of small economies that punch above their weight in global digital trade policymaking and that originated the CPTPP as the Trans-Pacific Partnership in 2005. In addition, Singapore and Australia formed the Singapore-Australia Digital Economy Agreement (SADEA) of 2020, which bolsters the existing digital trade provisions of SAFTA and echoes DEPA. The CPTPP’s digital trade provisions were originally crafted in large part by the United States and partly inspired by the U.S.-Korea FTA, and the provisions are mirrored in the United States-Mexico-Canada Agreement (USMCA), which includes even more robust rules on the governance of data transfer as well as internet intermediary liability protections.

The RCEP—signed in November 2020 between seven CPTPP signatories (Australia, Brunei, Japan, Malaysia, New Zealand, Singapore, and Vietnam) and Cambodia, China, Indonesia, Laos, Myanmar, the Philippines, South Korea, and Thailand—has a similar digital trade chapter as the CPTPP. However, the ecommerce chapter, including major commitments such as free cross-border data flows and ban on server localization are exempted from the agreements’ dispute settlement mechanism, meaning the RCEP’s e-commerce chapter effectively greenlights incompliance. For example, members can exempt themselves at will from the ban on data localization to protect their “essential security interests”, and this “shall not be disputed by other Parties.” The RCEP also has a generous grace period for less-developed countries to comply with data transfer rules.

Conclusion

Trade in the CPTPP region after the agreement entered into force has largely paralleled members’ trade flows with the rest of the world. Vietnam has grown its trade in goods as well as inbound investment, possibly a positive signal to other Southeast Asian countries that are considering CPTPP membership, such as the Philippines and Indonesia. Japan and Singapore have led the region’s trade in digitally deliverable services, also a key sector for the Philippines and the United Kingdom, another aspiring member. To be sure, these early patterns should be interpreted with care and should not be read as caused by the CPTPP. Further papers in this series explore the extent to which these and other patterns can be attributed to the CPTPP, as opposed to other factors.

No comments:

Post a Comment