Stratfor, 18 December 2015

Summary

As with many aspects of modern banking, the word “bankrupt” has its roots in Renaissance Italy. The original banks were Florentine merchants who would sit in the open street behind benches (bancas in Italian) upon which their money would be stacked. If trading went against them and their capital was reduced to nothing, their bench would be said to be broken, or banca rotta. It is fitting then that, 500 years later, the European country with the most worrying debt problem is Italy.

Analysis

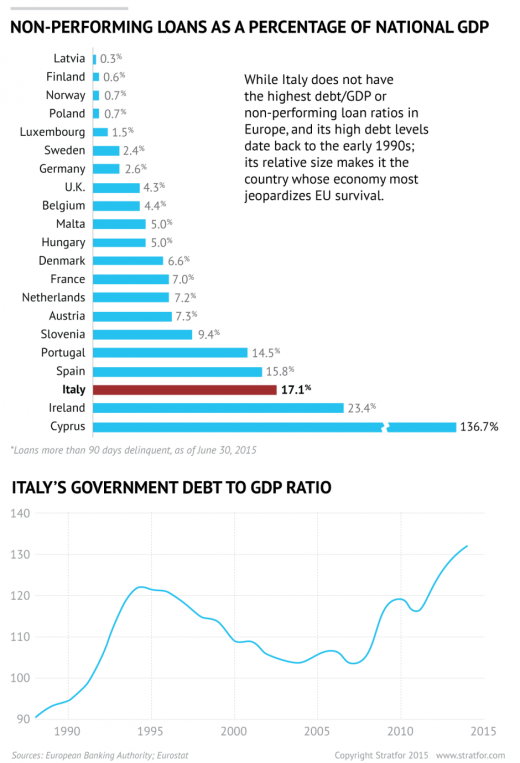

This may be surprising to some, since Italy does not top the tables as worst offender by any of the usual metrics. It does not have the highest levels of debt to gross domestic product in Europe: That dubious honor belongs to Greece, whose debt to GDP ratio rests more than 40 points higher than Italy’s 132%. Nor are Italian banks afflicted with the highest quantities of nonperforming loans as a percentage of GDP. Cyprus wins that contest easily; at a staggering 137%, it relegates Ireland (23%) to a distant second place and far exceeds Italy at 17%.

But though Italy is not the worst offender, its size still makes it the most potentially problematic. Italy has the third largest economy in the eurozone after Germany and France, and it is 1.5 times bigger than fourth-ranked Spain. So even without having the highest ratios, in actual numbers Italy has the biggest debt mountain: 2.3 trillion euros (roughly $2.4 trillion) of government debt compared with Greece’s 392 billion euros. Thus the three recent Greek bailouts, though giant in relation to the Greek economy, were just a sliver of the European economy as a whole, and in their wake the eurozone carried on more or less unaffected. The same would not be true of Italy. A bailout would be a massive undertaking that would greatly stretch the union’s finances.

Of course, this is not an altogether new phenomenon. Italy’s debt to GDP ratio has been over 100% since the early 1990s, and GDP growth since then has been fairly stagnant. But the fact that Italy’s debt has been large for a long time does not mean it is not dangerous. It was the threat of Italy defaulting that drove much of the market panic during the sovereign debt crisis in 2011 and 2012, when weakness in Europe’s banks had prompted bailouts from their national governments, calling into question the solvency of the governments themselves.

Europe’s governments did not resolve the debt crisis by directly dealing with Italy’s debt problem. (In 2012, Italy’s debt was still only 123% of GDP, 9 points lower than now.) Nonetheless, the policies they put in place helped Italy stabilize its finances. Panicking markets were quieted by European Central Bank President Mario Draghi’s promise to do “whatever it takes” to save the euro — a promise that ultimately led to an ECB bond-buying program that drastically reduces Italy’s debt-servicing costs.

Quantitative easing, then, has temporarily put off one of Italy’s problems: growing government debt. With the ECB buying Italian bonds, interest rates on the government’s debt have fallen from 6% in 2012, to 4% in 2014 and now down to 1.5% as we enter 2016. It has cushioned Italy from market panics, because it now has one large guaranteed buyer of its bonds in any crisis. That, along with the low oil prices that have been largely responsible for an uptick in growth across the Continent, has allowed Italy’s government to spend more freely this year — a welcome state of affairs for Italian Prime Minister Matteo Renzi.

Renzi, who originally came to power not by election but through an intra-party confrontation, has spent much of the last two years attempting to reshape the Italian electoral and governing apparatus so that he first can call an election (by May 2018, but possibly before) that will give him the legitimacy of a popular vote. He can then govern Italy without many of the obstacles and hazards that have hindered his post-war predecessors.

Having undertaken these reforms, Renzi now appears to be intent on winning votes at home. Against the European Commission’s wishes he has pushed through measures popular with middle-class voters such as property tax cuts, and used the migrant crises and Paris attacks to justify even more spending on areas such as security and culture. These policies undermine Italy’s overall fiscal position of course, but quantitative easing hides the effects, while Italy enters 2016 projecting GDP growth of 1.6%, which would be its highest rate since 2010.

A Teetering Financial Sector

The more acute danger, then, is to be found not in Italy’s government debt levels but in its banking system. The country’s banking sector has long been weak and, unlike its Irish and Spanish counterparts, it has never experienced the restructuring and recapitalization that would have come with an EU bailout. Thus the underlying issues have been allowed to fester, with nonperforming loans continuing to grow as Italy’s unemployment levels have remained stubbornly high.

Again unlike Spain and Ireland, Italy has not been able to create a government-backed national “bad bank” where it can funnel these bad loans (in Spain and Ireland this happened as part of an EU bailout), which would free Italian banks of their burden. The European Union resisted attempts to create one even in November because of its reluctance to countenance any kind of state financing. Italian banks instead have to try and sell the bad loans on the open market to investors in distressed debt, who buy them at a discount from their original value because of their higher likelihood for default. The problem Italian banks face is that the less healthy the loans, the bigger the discount, and the higher the loss on the banks’ balance sheets from writing down the difference.

There is evidence that the market is interested in buying this Italian debt, but the prices offered are far below those sought by Italian sellers. Thus the process of selling off nonperforming loans has begun, but desperately slowly, with the total amount of impaired loans in the last month only dropping from 200 billion euros to 199 billion euros, having been climbing up until this year. The best hope for speeding up the process is for improving market conditions to make the loans a little safer, and thus worth more to investors. The government can help in this effort as well, since investors are partly reluctant to buy because of Italy’s convoluted insolvency legislation.

But new dangers are also arising, partly as a result of post-2012 measures enacted to break the so-called doom-loop between banks and governments. Along with quantitative easing policies, European policymakers also introduced a change to how EU members will aid their struggling banks, first seen in the restructuring of Cyprus’ financial sector in 2013. When a bank goes bust, the initial relief capital will no longer be put up by governments (and by extension, taxpayers) but first by the banks’ investors and depositors. The Italian parliament voted the measures through in July 2015, and as of January 2016 the first pain of a bailout will be felt by Italian banks’ shareholders, then by holders of their junior or unprotected bonds, then by those with more than 100,000 euros in their deposit accounts and finally by senior or protected bondholders. A special bailout fund raised with contributions from other Italian banks was also created.

The new rules may ease the burden on national governments, but they also mean there is a greater risk of bank runs. Depositors with more than 100,000 euros in their accounts now have good reason to withdraw their money from weaker banks at the first sign of trouble, transferring it either to stronger Italian banks or possibly even German ones. There was similar capital flow out of Greece in the midst of the crisis this year. Under the new regulations, a faltering Italian bank may ultimately require a bigger bailout than its shareholders, bondholders and the resolution fund are equipped to provide. And if depositors do see their funds claimed — and if fears of a bank run become real — Italy would have a banking crisis on its hands.

Even if Italy avoids this doomsday scenario, the new bail-in system — the term used to describe when stakeholders’ assets are used to shore up the banks — is already causing headaches. In November the government bailed in the shareholders and junior debt-holders in the resolution of four small banks that had been under the special administration of the Bank of Italy. It exposed another issue: Italian banks have spent much of the last five years selling their own junior bonds to their retail investors as safe products, meaning that the general Italian public is unusually over-exposed to the banks through this channel. Unsurprisingly there has been a stampede by the public to try and sell these bonds, especially following the suicide of a pensioner who had been stung by the bail-in of one of the four banks, and the lack of willing buyers has driven down the bonds’ value.

Consequently, there will now be less appetite for their junior debt, shutting down a useful funding mechanism. For now though, the biggest losers from this situation look to be the retail investors who were persuaded to buy these products. And there will be political repercussions. Renzi has been swift to try and compensate these losers with government money. However, such support will be hard to maintain from January onward, as the new regime includes restrictions against state aid.

Underlying Problems Persist

As of Jan. 1, Italy’s banking sector will be walking a tightrope. Under the new system, the shareholders, the resolution fund and the estimated 71 billion euros in outstanding subordinated debt should be enough to absorb the fallout of a smaller bank running into trouble. But if one of its larger banks, or several of its smaller banks go under, the country may run into severe difficulty. Italian regulators, and Renzi himself, will be hoping for a year with no major scandals like the one that afflicted Italy’s third largest bank, the Banca Monte de Paschi di Siena, in 2013, nor will they want a broader economic shock.

The good news for the Italian government is that, thanks to its free spending and favorable conditions, Italy is on course for timid growth in 2016, helping its businesses, in turn helping its banks reduce their nonperforming loans. In November, Fitch Ratings raised its outlook rating for Italian banks from negative to stable, reflecting this positivity. The next positive step might be consolidation in the Italian banking sector, which has been in store since the parliament passed a new liberalizing law at the start of 2015. Once Italy’s weaker small banks are attached to safer counterparts, there may be less risk of them running into trouble.

Still, even if Italy does get through 2016 without suffering a severe banking crisis, the future is not bright. The short-term factors keeping its spiraling government debt from becoming a major issue — quantitative easing, low oil prices —must come to an end at some point, re-exposing all of these problems. And while the banking sector’s situation may improve if banks can sell off nonperforming loans, these processes are all slow and unwieldy, and it would take an extended period of favorable conditions for the sector to return to anything like good health. Thus Italy’s debt is one of the largest threats facing the eurozone in the coming years, just as it has been since the 2011-2012 crisis first brought it into focus.

is republished with permission of Stratfor.

No comments:

Post a Comment